XRP fails to test 6-year pattern, ‘overvalued’ concerns rise: More decline?

- XRP’s price dropped by more than 11% in the last 24 hours.

- A few market indicators suggested that the bearish trend might change.

Since the market crash, Ripple’s [XRP] price has been witnessing corrections and has yet to show any signs of recovery.

The worst is yet to come, as the token failed to test a long-term bull pattern, hinting at a further price decline.

XRP has obstacles to cross

According to CoinMarketCap, the token’s price had dropped by over 18% in the last seven days. In the past 24 hours alone, the token registered double-digit declines, and it plummeted by 11%.

At the time of writing, XRP was trading at $0.4844 with a market capitalization of over $26.7 billion.

In the meantime, XRP failed to test a 6-year-long symmetrical triangle pattern as its value dropped below $0.5.

Since the token couldn’t test the pattern, investors might witness the token’s value drop further in the coming days.

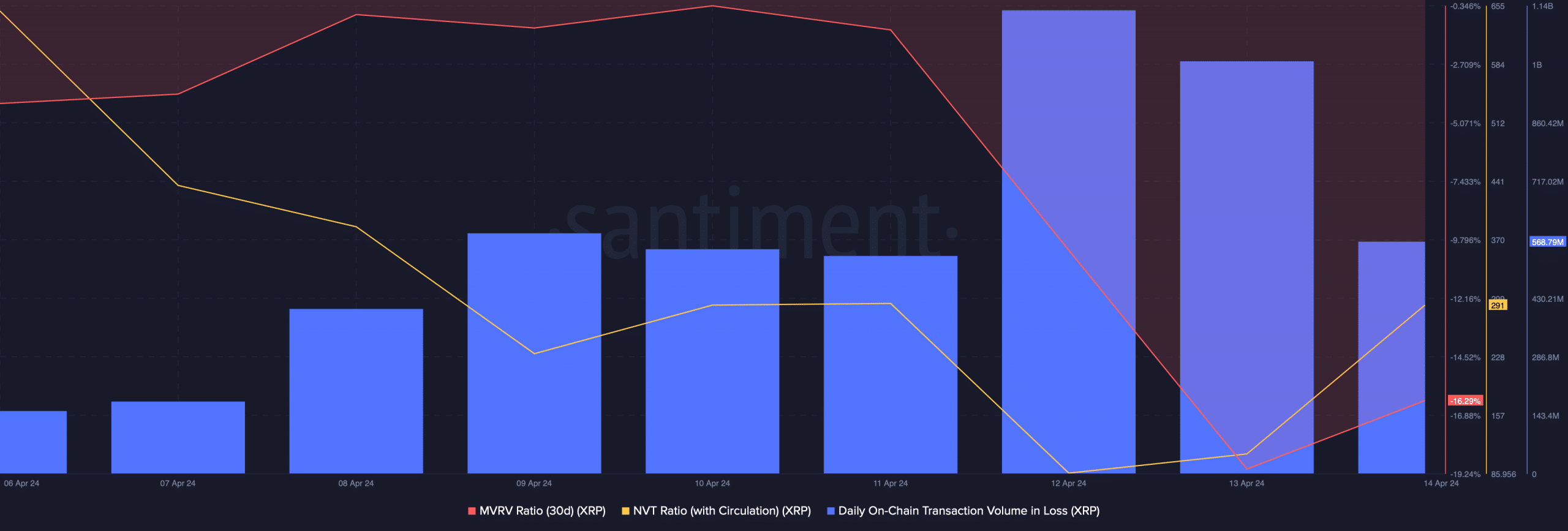

AMBCrypto’s analysis of Santiment’s data pointed out quite a few bearish metrics. For instance, the token’s MVRV ratio declined sharply last week.

After a dip, its NVT ratio also gained upward momentum, hinting that XRP was overvalued.

Additionally, the token’s daily on-chain transaction volume in losses spiked sharply in the last few days, which can be attributed to the market crash.

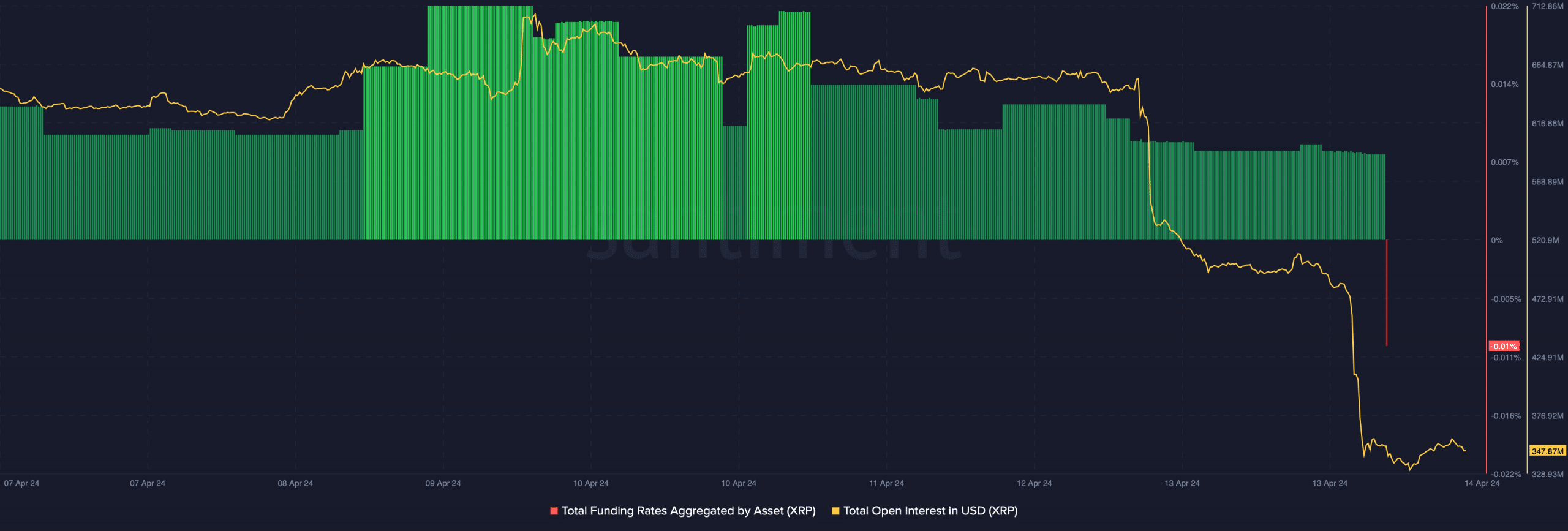

However, XRP’s derivatives metric looked bullish. Its Open Interest dropped sharply. This initiated a trend reversal that might happen soon, allowing the token to recover from its recent losses.

The Funding Rate also dropped. Usually, prices tend to move the other way than the Funding Rate, suggesting a possible price uptick in the coming days.

A further downtrend incoming?

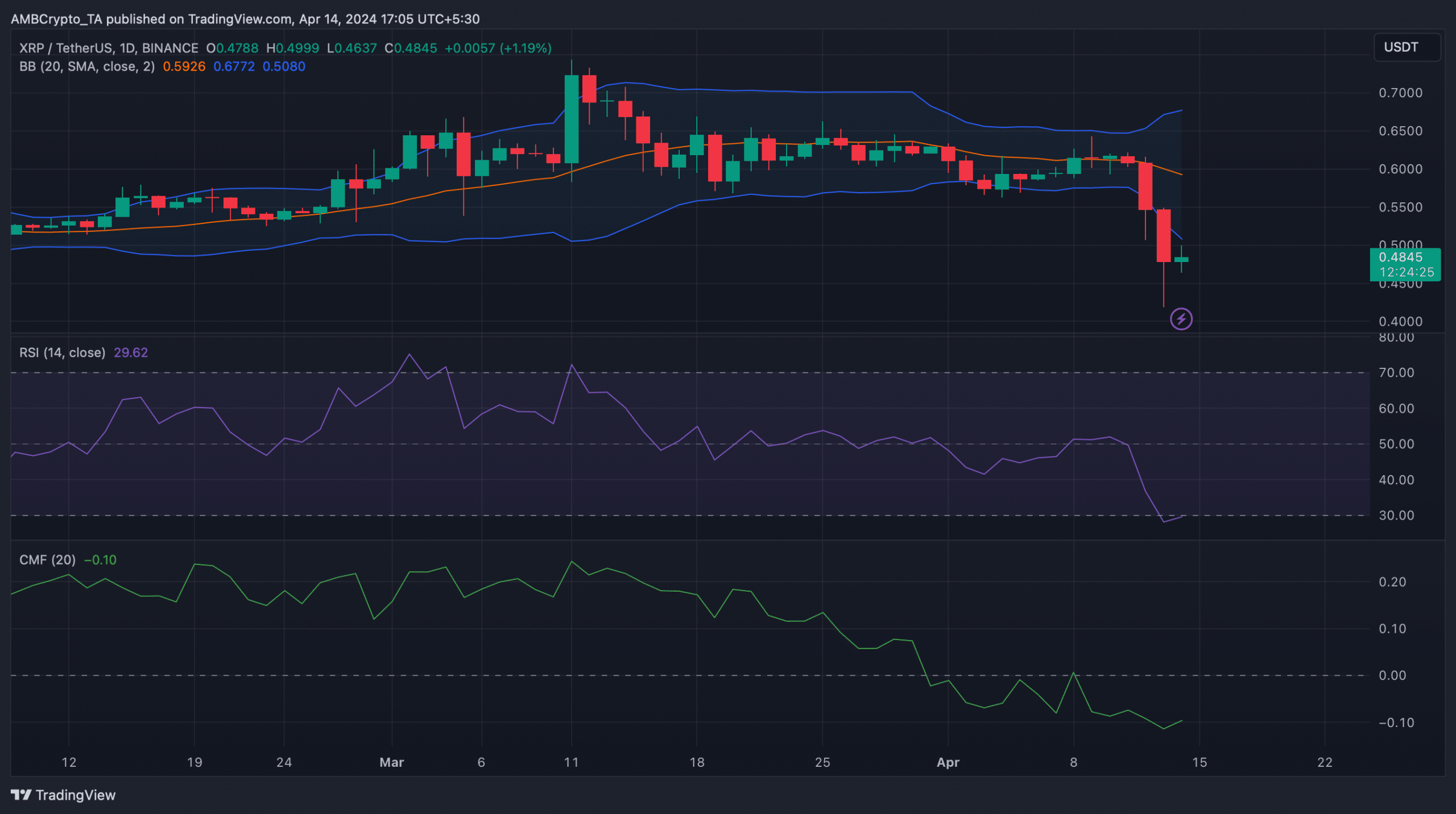

AMBCrypto then analyzed XRP’s daily chart to better understand which way it was headed. XRP’s price had touched the lower limit of the Bollinger Bands.

The token’s Relative Strength Index (RSI) entered the oversold zone, suggesting that buying pressure on the token might increase. The Chaikin Money Flow (CMF) also moved up slightly, indicating a price uptick.

Nonetheless, nothing can be said with the utmost certainty, as the global geopolitical scenario has turned unstable.

The ongoing conflict in the Middle East might have a negative impact on top crypto’s prices and keep them bearish over the coming weeks.

Read Ripple’s [XRP] Price Prediction 2024-25

AMBCrypto checked Hyblock Capital’s data to find the support levels XRP might plummet to if the downtrend continues. We found that the token has support near $0.46.

If the token tests this support, then a bull rally can be expected. However, if things go otherwise, XRP’s price might drop to $0.42.