Why Polygon’s Q1 milestones had little impact on MATIC

- MATIC’s market cap surged by 31% in Q1, thanks to the bull market.

- Metric suggested that MATIC was overvalued, hinting at a price correction.

Polygon [MATIC] has been witnessing a massive surge in network usage over the last few weeks. In fact, one of its key metrics recently reached an all-time high.

In the meantime, Polygon’s Q1 report was released, pointing out its performance on multiple fronts.

Polygon reaches yet another milestone

Today In Polygon, a popular X (formerly Twitter) handle that posts updates related to the blockchain, recently posted a tweet highlighting a key development.

The tweet mentioned that Polygon PoS’s daily active addresses reached an all-time high as the number crossed 1.3 million.

Over the last few weeks, the blockchain’s active addresses have grown sharply and have been hitting new ATHs, which reflects a clear rise in usage and adoption.

However, it was surprising to note that despite the rise in daily active addresses, the blockchain’s number of transactions dropped last month.

A look at Polygon’s Q1 performance

Meanwhile, Coin98 Analytics, a data analytics platform, posted Polygon’s Q1 report, mentioning its performance on different fronts.

As per the tweet, in the first quarter of this year, MATIC’s trading volume increased by $6.1B quarter-on-quarter (QoQ).

Additionally, its number of holders also grew by 13.3% QoQ and 84.9% year-on-year (YoY). The reason behind the hike in accumulation could be because of its bullish price action.

In Q1, the token’s circulating market capitalization surged by over 31%.

However, things in terms of captured value did not look good. The blockchain’s fees touched $6.83 million in Q1, which was a 19% drop from the previous quarter.

This had a direct impact on its revenue, which touched $2.7 million, a whopping 45% drop from the previous quarter. Additionally, Polygon’s earnings plummeted by 33% in Q1 2024.

MATIC investors should also be cautious in Q2, as the token’s P/F ratio increased by 21%. A hike in the metric means that MATIC was overvalued, hinting at a possible price drop in the coming weeks.

What to expect from MATIC

According to CoinMarketCap, MATIC was down by more than 9% in the last seven days. At the time of writing, it was trading at $0.903 with a market cap of over $8.9 billion, making it the 17th largest crypto.

Read Polygon’s [MATIC] Price Prediction 2024-25

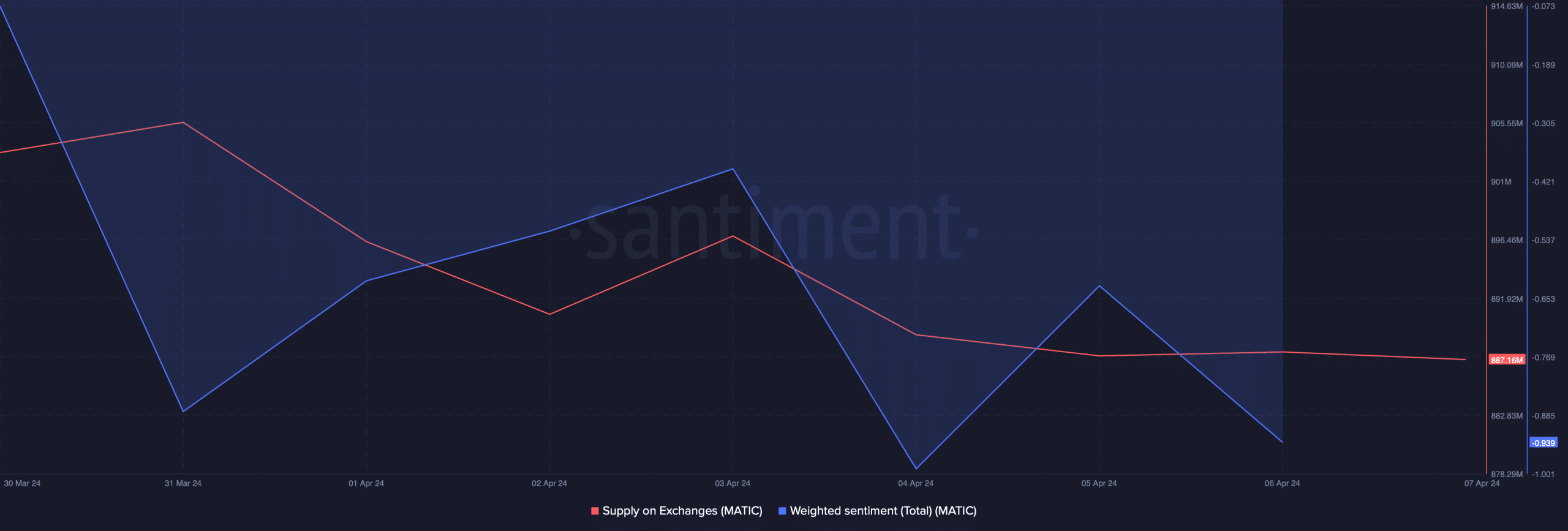

Bearish sentiment around the token also increased in the last week, which was evident from the drop in its Weighted Sentiment.

Nonetheless, investors still continued to accumulate MATIC, as its Supply on Exchanges declined.