Toncoin’s 5% rise sparks interest – Are bulls eyeing TON’s ATH?

- TON experienced a 5% price rise, with a surge in investors and renewed bullish momentum.

- A majority of TON holders were in profit, reinforcing the strong bullish sentiment.

Toncoin [TON] has seen a 5% increase in its price over the past day, signaling renewed bullish momentum.

This upward trend has sparked optimism among investors, who are eyeing potential new highs for the altcoin.

TON bulls make a comeback

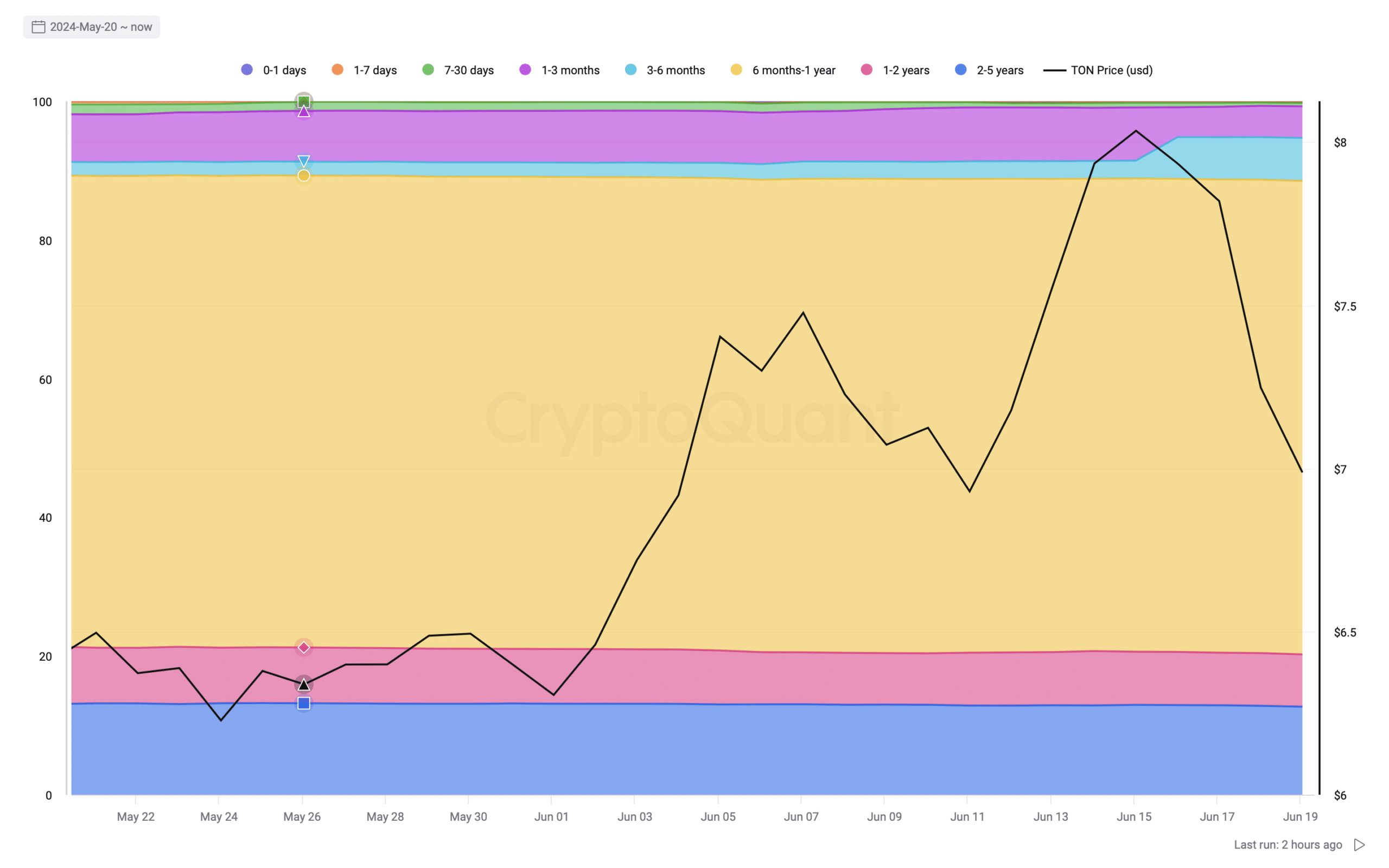

Looking at TON’s HODL waves, AMBCrypto noticed that its surge influenced the shorter duration bands (0-1 days, 1–7 days, 7–30 days) as newer, bullish investors entered the market.

The majority of TON tokens have been held for longer durations, notably in the 1–2 years and 2-5 years categories.

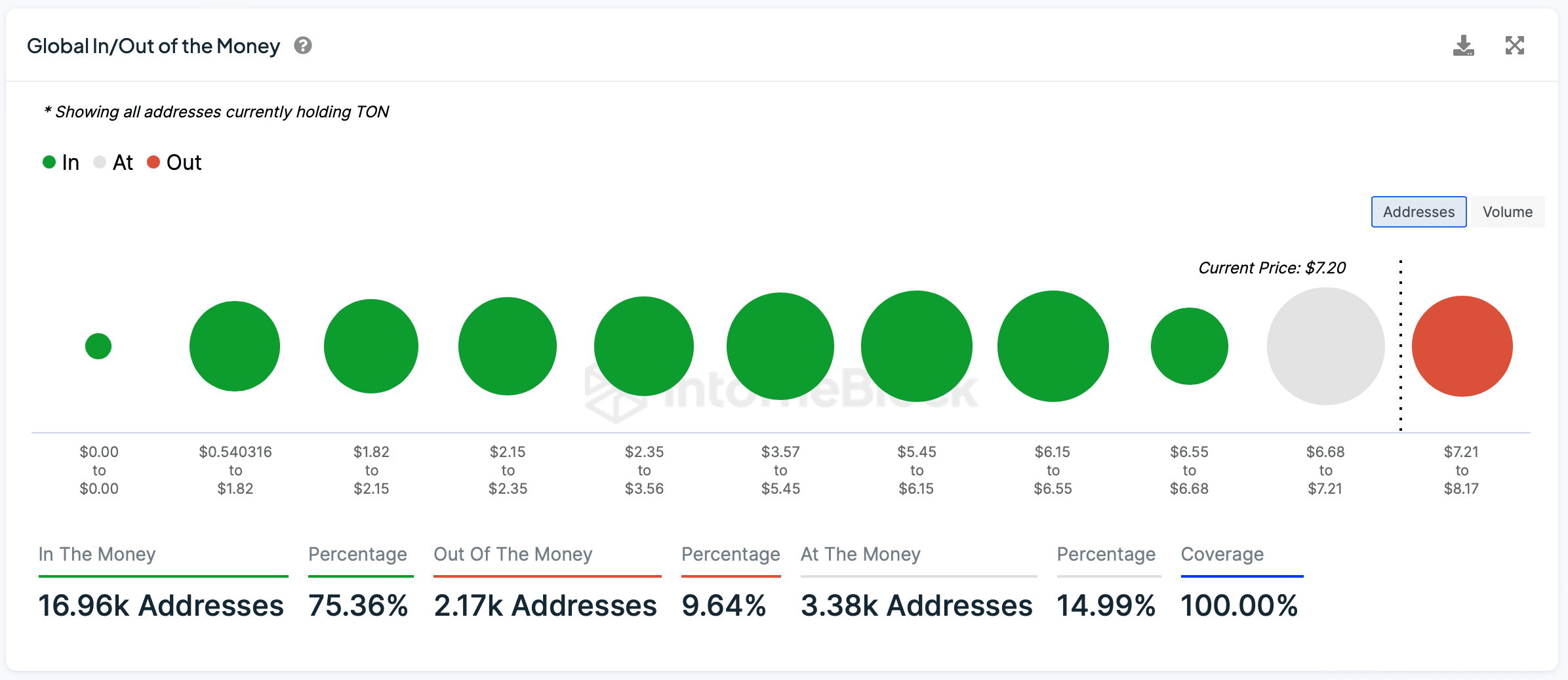

Most holders were “in the money,” at press time, meaning their holdings were worth more than the price at which they bought them. This strong majority in profit suggested a bullish sentiment among existing holders.

However, the “At the Money” holders were at a breakeven point, and their decisions to sell or hold will be important in determining short-term price movements.

They may look to lock in profits or prevent losses with any major price fluctuations.

TON has low volatility

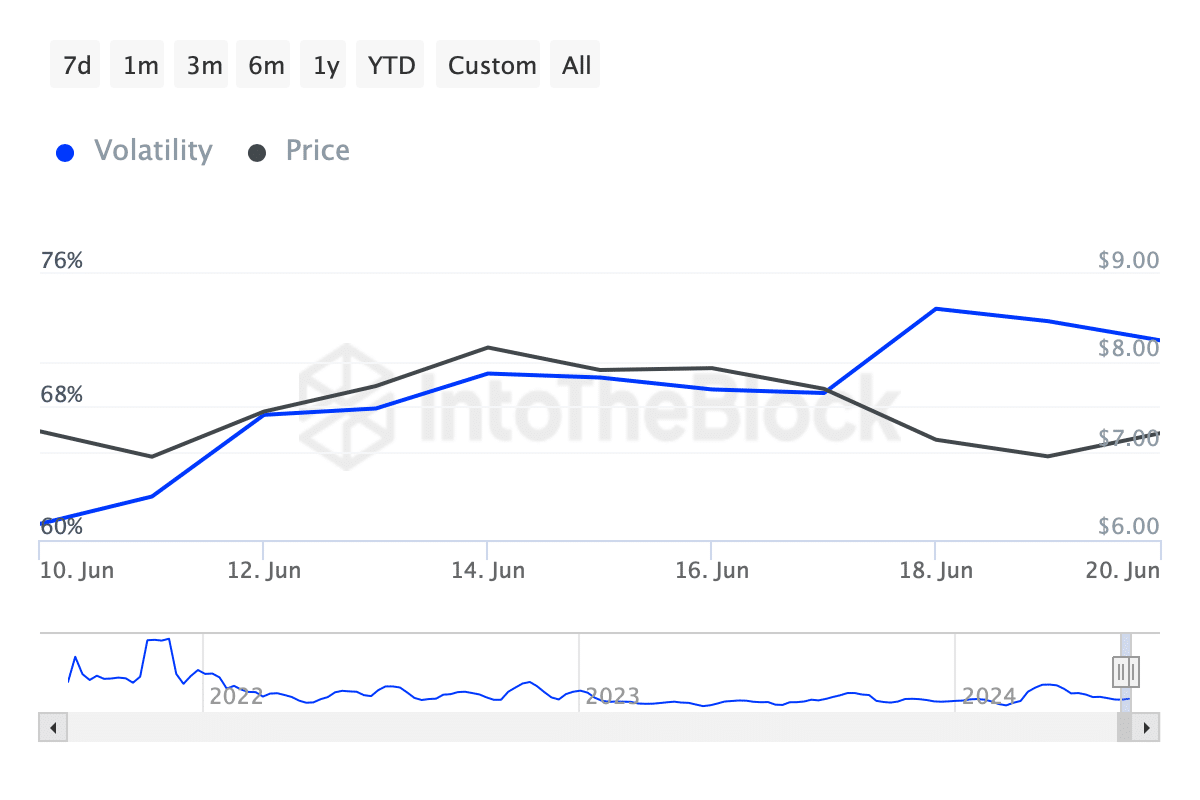

Toncoin’s volatility started at relatively low levels, around 60%, peaks near 68% as the price reached its highest level, and then notably declined as the price stabilized.

As volatility decreases, it may suggest a cooling-off period during which the bulls prepare for a massive surge. Inasmuch, TON’s declining NVT ratio could mean that it is a positive indicator of network health and utilization.

The decline also means that the market valuation is beginning to better reflect the underlying transactional activity, possibly leading to more stable price movements.

Is your portfolio green? Check the TON Profit Calculator

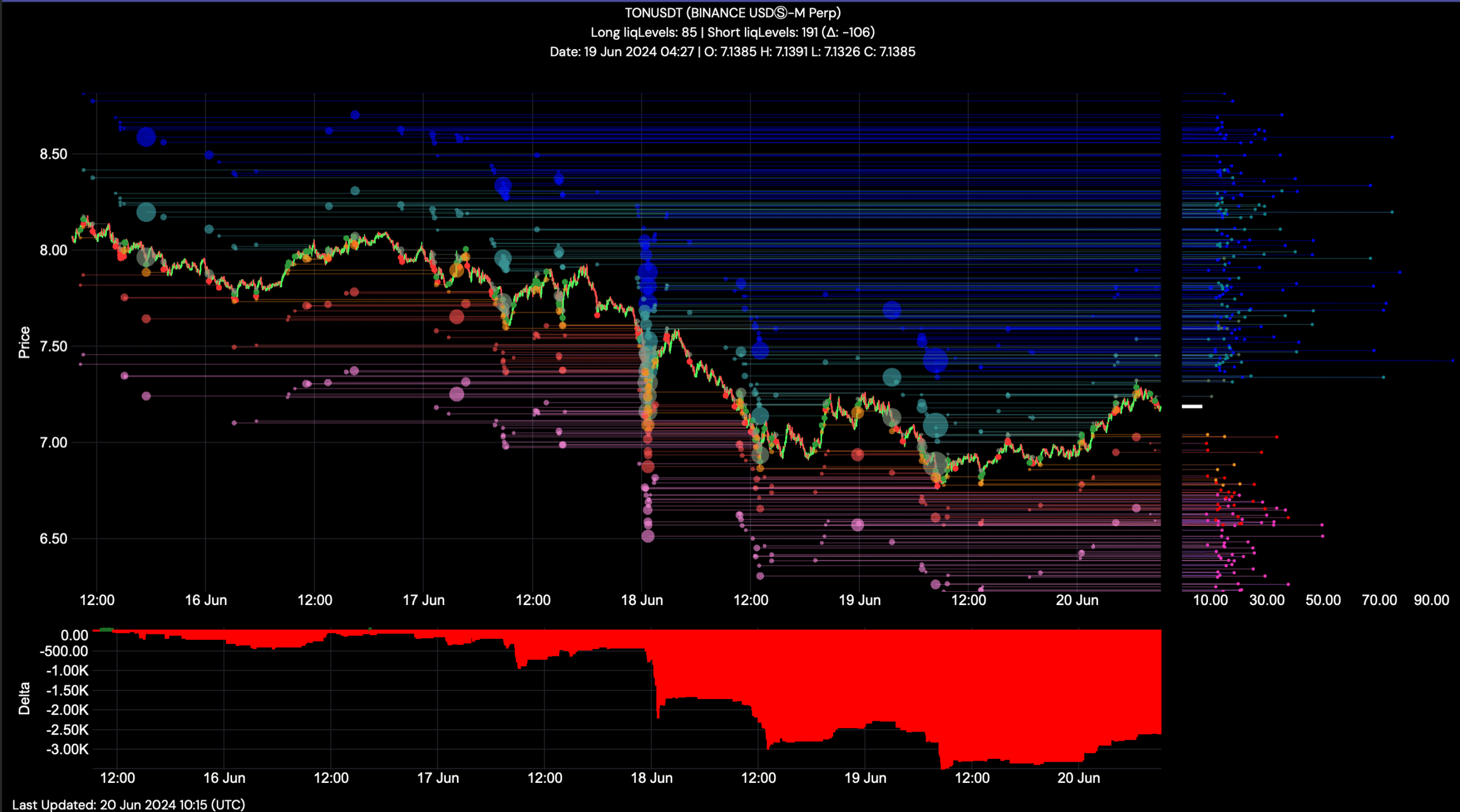

Over the past week, TON’s price has fluctuated between $6.50 and $8.50 with an overall bullish momentum. Notably, there’s a dense concentration of sell liquidity above the $8 mark, which might act as a resistance level.

The delta is predominantly negative, suggesting stronger selling pressure. However, the price did increase, meaning that buying pressure, although less in volume, is impactful enough to kick off a proper bull run.