This is what Bitcoin needs to sustain its ATH in 2024

- Bitcoin needs the U.S. high yield rate to drop below 6% or 7% for a sustainable rally.

- Network activity is decreasing, and big investors are currently inactive.

Bitcoin [BTC] is still over $10k below its all-time highs reached earlier this year. The king crypto is struggling to hit even the $65k mark, and so far? It’s failing.

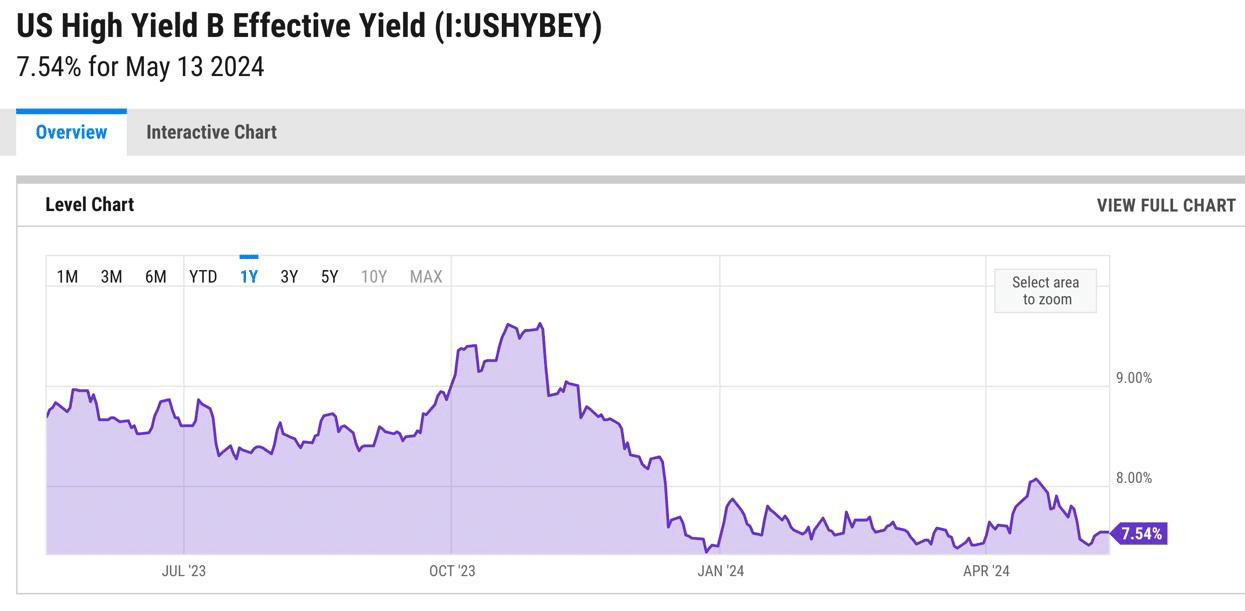

Popular financial analyst Timothy Peterson pointed out that the U.S. high yield rate is a key indicator for the market, emphasizing that it must fall below 6% or 7% for Bitcoin to sustain all-time highs effectively.

Economic indicators and Bitcoin’s price

The U.S. high yield rate stood at 7.54% at press time, which suggested a tight hold over potential financial growth and investments, including in the cryptocurrency market.

Historically, when the high yield rate drops, it often correlates with a rise in Bitcoin prices, as lower yields make alternative investments like Bitcoin more attractive.

This is because investors seek higher returns in a lower interest rate environment, which cryptocurrency can sometimes offer.

All in all, the U.S. economy means a lot to Bitcoin investors. The U.S. Treasury Department’s recent auction of 30-year bonds saw strong demand, leading to downward pressure on yields.

Coupled with the latest unemployment data, investors are desperately anticipating rate cuts this year, which could lower the high yield rates, potentially causing Bitcoin to reclaim its higher price levels.

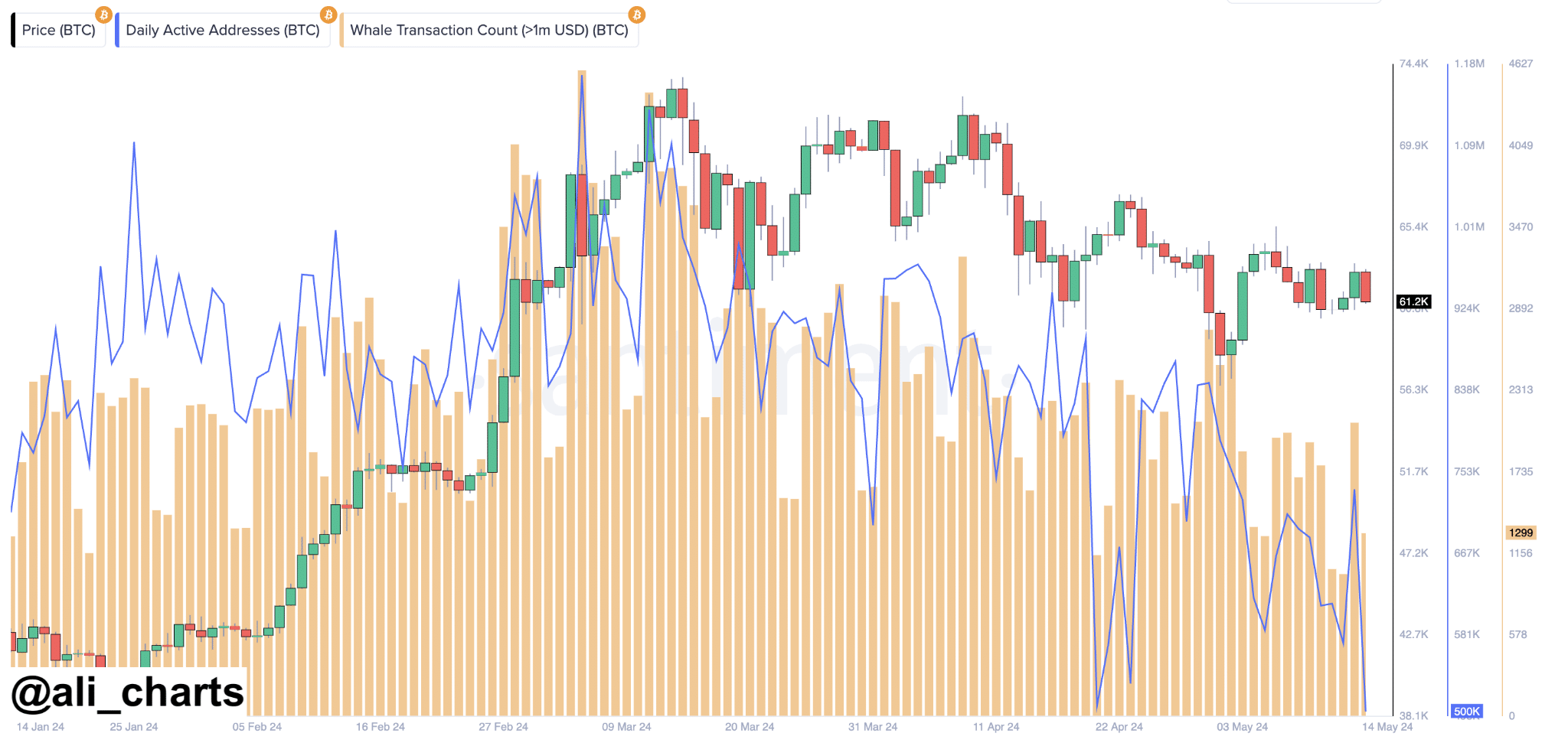

Taking a look at Bitcoin’s activity, we’re seeing some intriguing changes. According to recent data from Santiment, the Bitcoin network activity is on a decline.

This includes a decrease in the number of massive transactions, also known as whale movements.

The whales appear to be taking a step back, possibly waiting for more favorable market conditions before making large moves, hence making the market even more volatile.

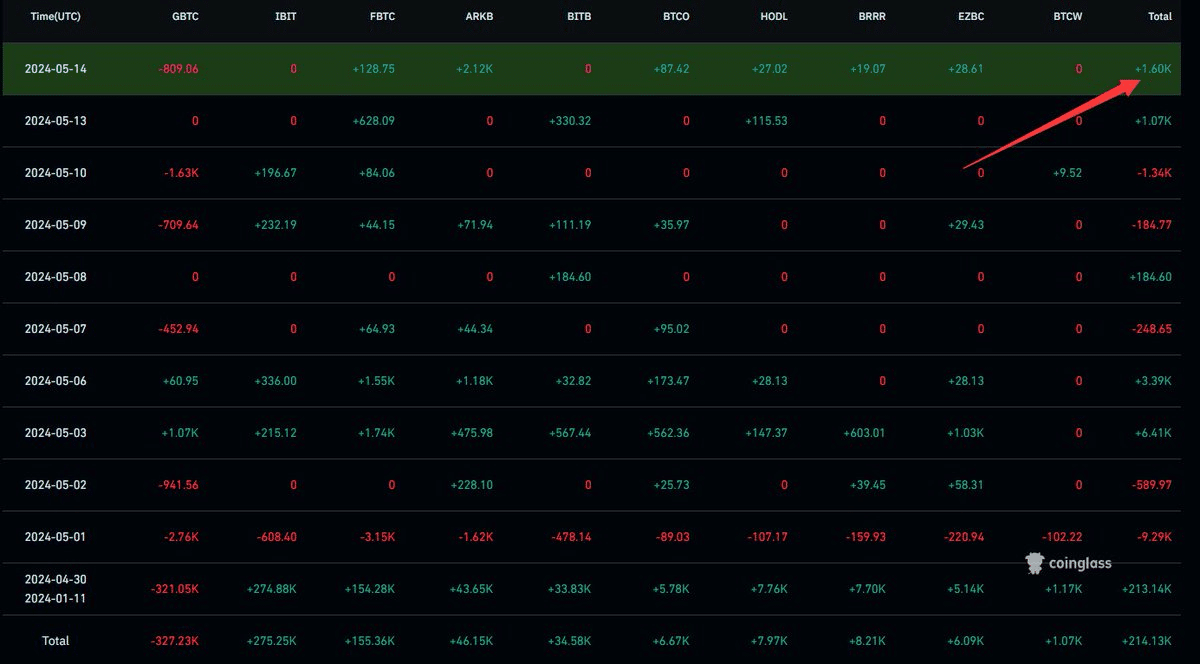

Meanwhile, Bitcoin ETFs are also showing some notable trends.

The last 24 hours alone saw a net inflow of approximately 1.60K BTC, which translates to about $100.50 million at press time prices, as per data from Coinglass.

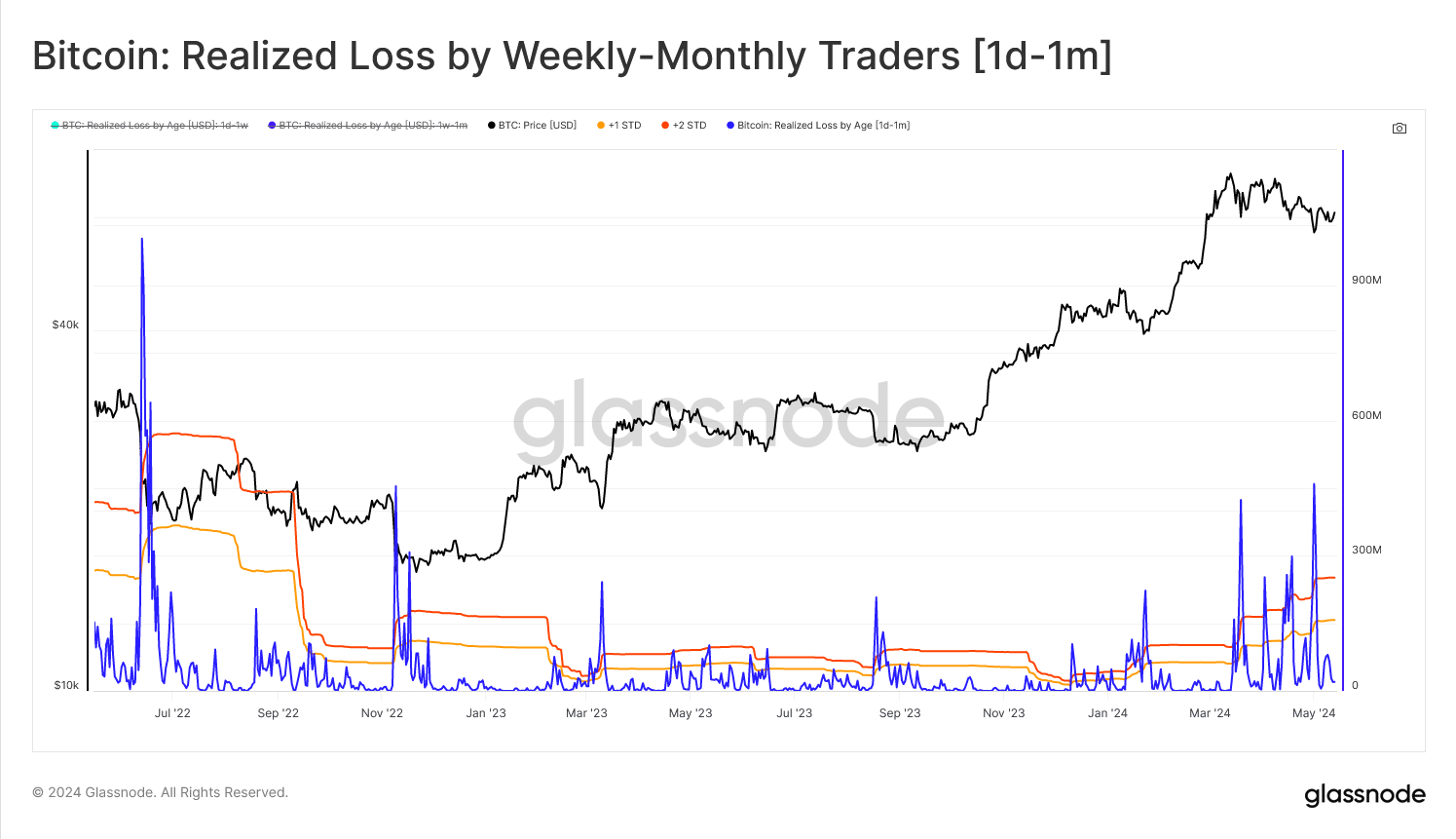

Glassnode’s new ‘Breakdown by Age’ metric gave us a deeper understanding of investor behavior during current market conditions.

In a bull market, it’s often the long-term investors who see the most profits, leaving the short-term holders to face losses.

These short-term losses can signal a turning point in the market. As you can see below, there was an upward trend at the start of 2024 when the market was bullish.

Read Bitcoin’s [BTC] Price Prediction 2024-25

Bitcoin’s price makes no move

Given the recent behavior, if Bitcoin maintains the support level around $62,700 today and market sentiment remains positive, it could attempt another push towards the $63,000 mark and higher.

However, if it breaks below the $62,700 support, there could be a further decline as traders might secure profits, leading to increased selling pressure.