Shiba Inu coin price prediction: Should you brace for another 20% drop?

- Shiba Inu continued to trend downward, losing a key support zone in the process

- The selling volume has been muted, giving bulls some hope of a recovery later on

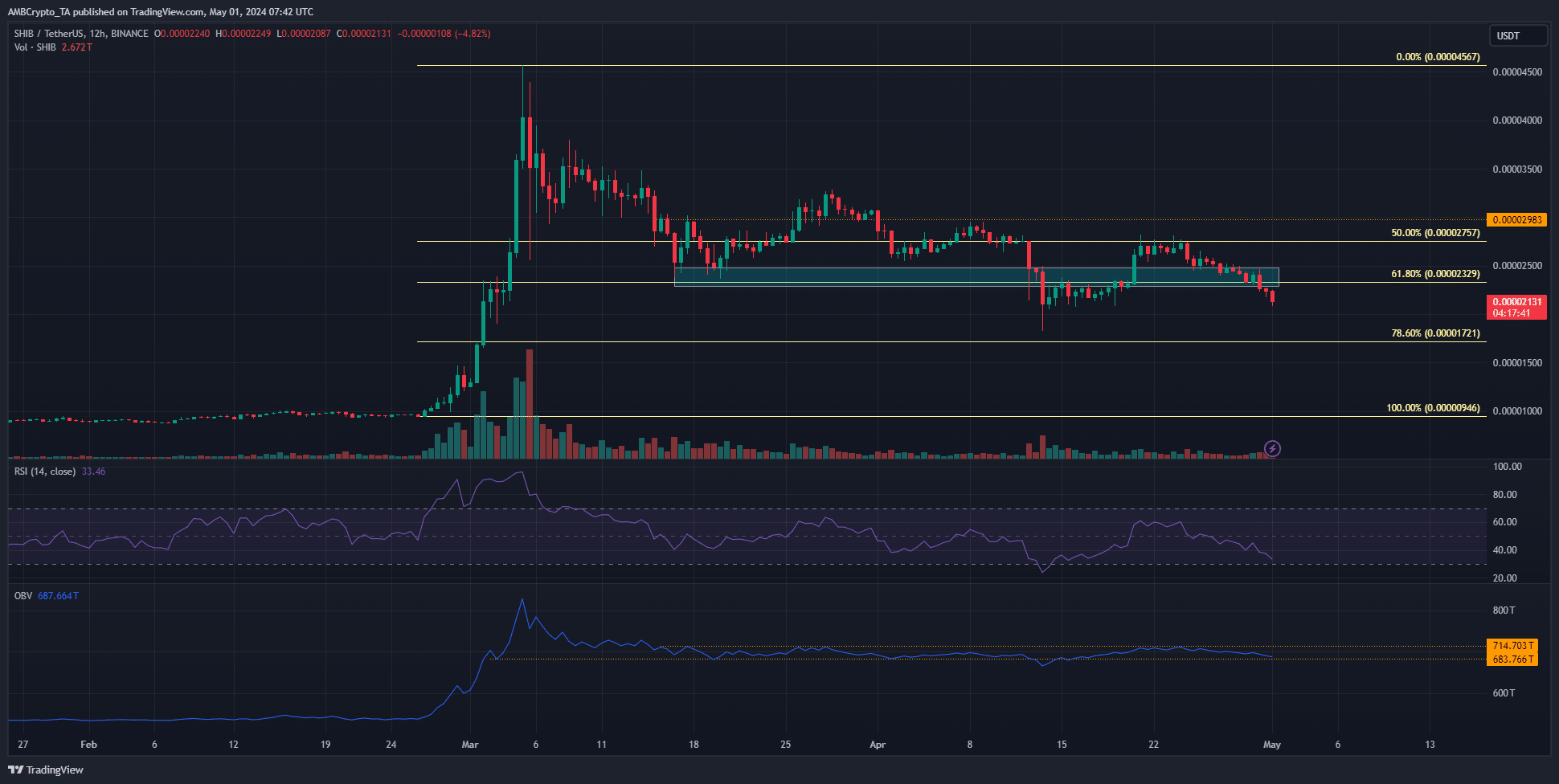

Shiba Inu [SHIB] fell below a key demand zone at the $0.000024 region. Selling pressure was prevalent despite a token outflow from exchanges.

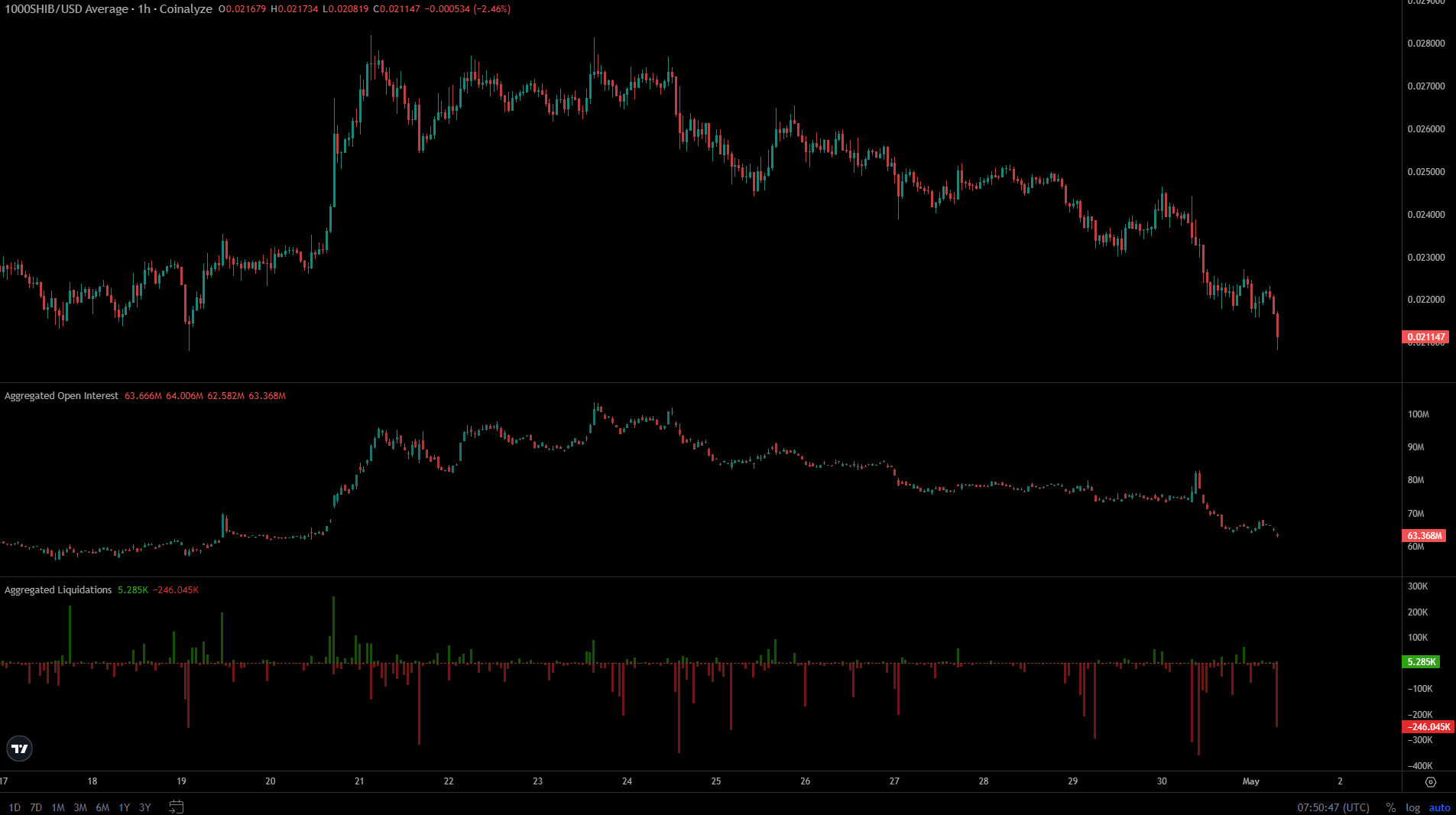

Liquidated long positions have also contributed to accelerating the recent losses.

A range formation was possible, but if Bitcoin [BTC] tumbled below $59k, the Shiba Inu coin price might retrace to the next Fibonacci support level.

The balance of buying and selling was surprising

The RSI on the 12-hour chart was at 33 and showed strong bearish momentum. It was a stone’s throw away from falling below 30 which would indicate oversold conditions. That by itself won’t guarantee a recovery.

The current trajectory of Bitcoin and the rest of the market could easily drag SHIB down by another 19%. The Fibonacci retracement levels (pale yellow) highlighted the next support level at $0.0000172.

In mid-April, the $0.0000212 level served as support. It might give another bounce upon this retest. While the price trended downward in April, the OBV maintained itself within a range.

This suggested that selling pressure wasn’t overwhelming.

Hence, so long as the OBV does not lose the lower support level, SHIB bulls can hope for a recovery from the two support levels highlighted.

The effect of liquidations on Shiba Inu coin price

Source: Coinalyze

Read Shiba Inu’s [SHIB] Price Prediction 2024-25

The Open Interest data showed it has been in a strong decline over the past ten days. Coupled with the price losses, it indicated firm bearish sentiment. Speculators were unwilling to bet on SHIB price gains.

The long liquidations also saw multiple spikes in the past 48 hours. This was a sign of forced market selling, which added to the downward pressure on Shiba Inu coin price.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.