PEPE: Profit-taking sparks price fall? Investors in profit reach 92%

- The meme coin was down by more than 6% in the last 24 hours.

- Market indicators and metrics hinted at a further price decline.

Pepe [PEPE] had a major setback on the 18th of May as the meme coin price witnessed a steep decline. A check of its metrics pointed out a few possible reasons behind this bearish price action.

Let’s take a look at the entire picture.

Are PEPE investors taking profits?

CoinMarketCap’s data revealed that PEPE’s price started to decline sharply in the last few hours. Because of that, the meme coin’s daily price dropped by more than 6%.

At the time of writing, it was trading at $0.000009426 with a market capitalization of over $3.9 billion, making it the 27th largest crypto.

AMBCrypto’s look at IntoTheBlock’s data revealed a possible reason behind this. We found that over 92% of PEPE investors were in profit.

This might have motivated investors to sell their holdings, in turn pushing the meme coin’s price down.

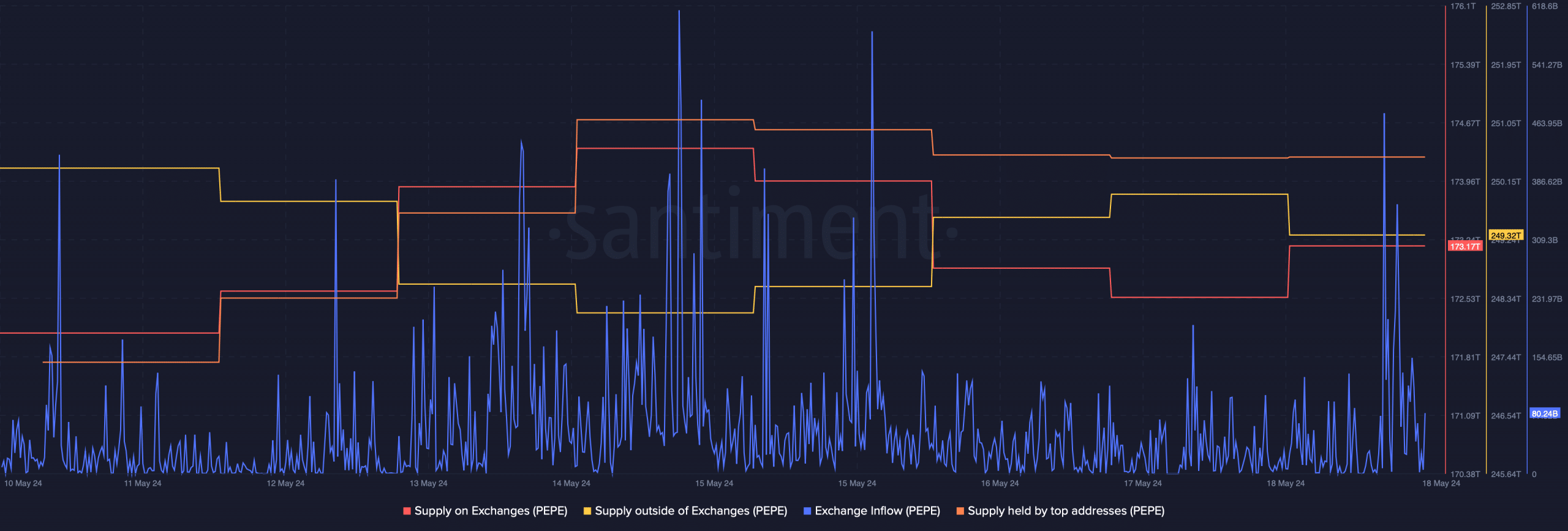

To see whether that was the case, AMBCrypto then analyzed Santiment’s data. As per our analysis, the meme coin’s exchange inflow spiked multiple times last week.

It was interesting to note that after a dip, the meme coin’s Supply on Exchanges started to increase. Meanwhile, its Supply outside of Exchanges started to decline on the 18th of May, signaling a sell-off.

Moreover, after a sharp rise on the 14th of May, the meme coin’s supply held by top addresses dropped slightly.

This suggested that a few whales also sold their holdings, possibly causing the meme coin’s price to plummet.

PEPE’s troubles aren’t over

The dark days might continue for the meme coin, as few other metrics gave away a bearish notion.

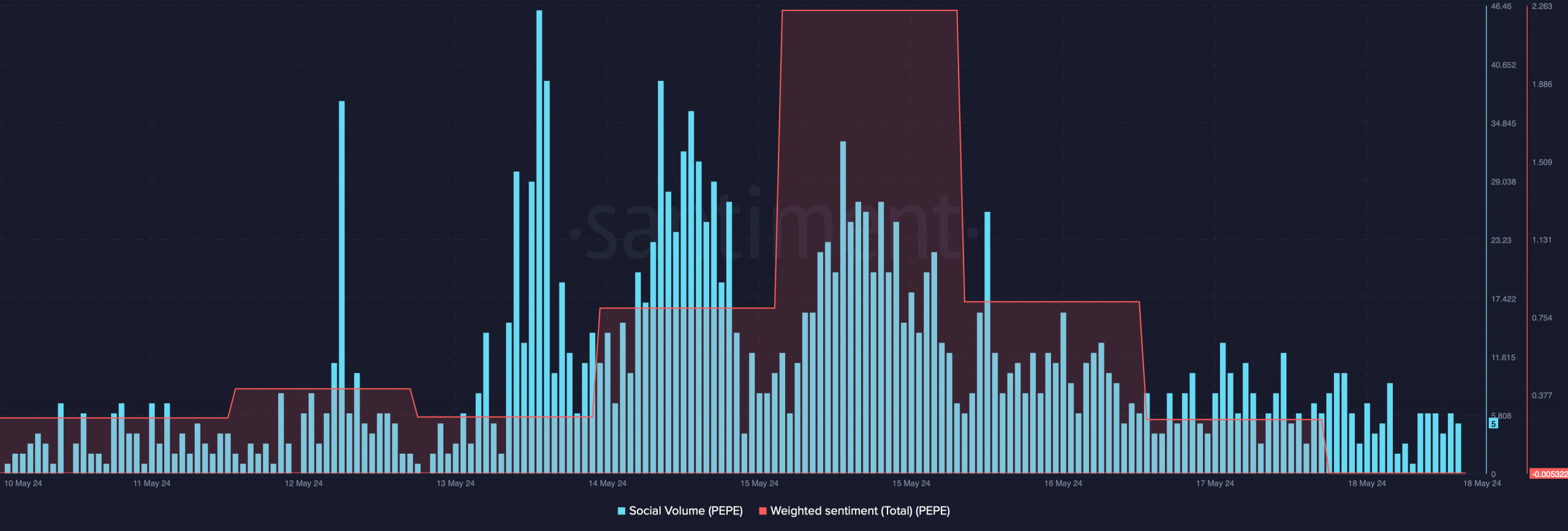

For instance, PEPE’s Social Volume declined sharply over the last week, reflecting a dip in the meme coin’s popularity. On top of that, its Weighted Sentiment also sank over the last few days.

So, bearish sentiment around the meme coin was high, indicating that investors were expecting its price to go down further.

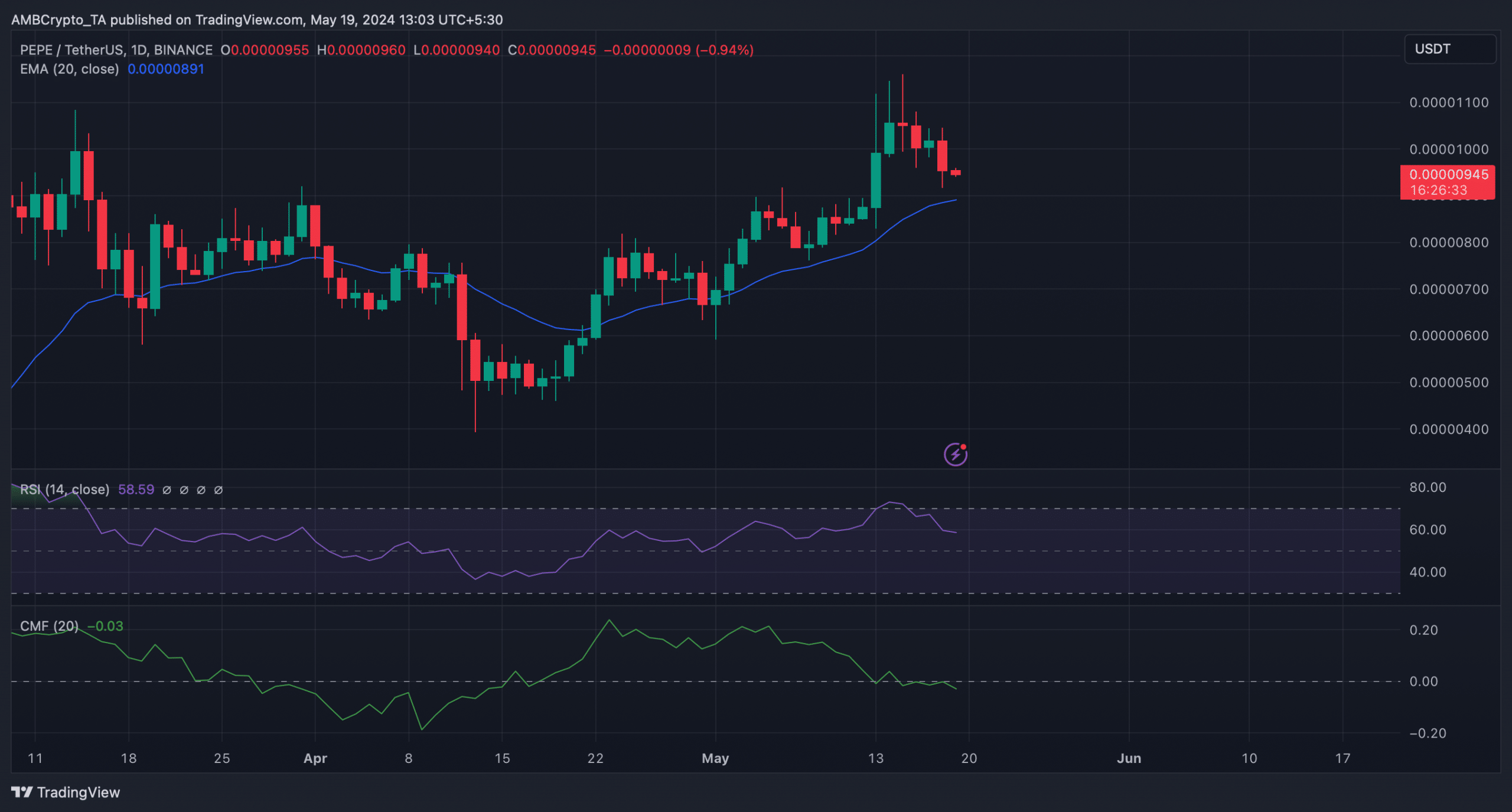

Like metrics, several market indicators also supported the bears. The meme coin’s Relative Strength Index (RSI) registered a decline. At press time, the RSI had a value of 58.7.

Likewise, the Chaikin Money Flow (CMF) also went down, indicating that the chances of the bearish price trend continuing were high.

Realistic or not, here’s PEPE’s market cap in BTC’s terms

As per our analysis, PEPE’s price was still well above its 20-day Exponential Moving Average (EMA).

Therefore, if the price decline continues, the meme coin’s value might drop to its 20-day EMA, which might act as a support.