Notcoin surges 84% in one week: Time to add NOT to your portfolio?

- NOT’s price has grown by over 80% in the past seven days.

- Technical indicators suggest that it is ready to climb further.

NOT, the token that powers Notcoin, the play-to-earn clicker gaming application on Telegram, is poised to extend its seven-day gains.

At press time, the altcoin exchanged hands at $0.02. According to CoinMarketCap data, its value has increased by 84% in the last week.

With key technical indicators confirming the increased demand for the altcoin, it may rally towards a new all-time high in the short term.

NOT bulls are not ready to relinquish dominance

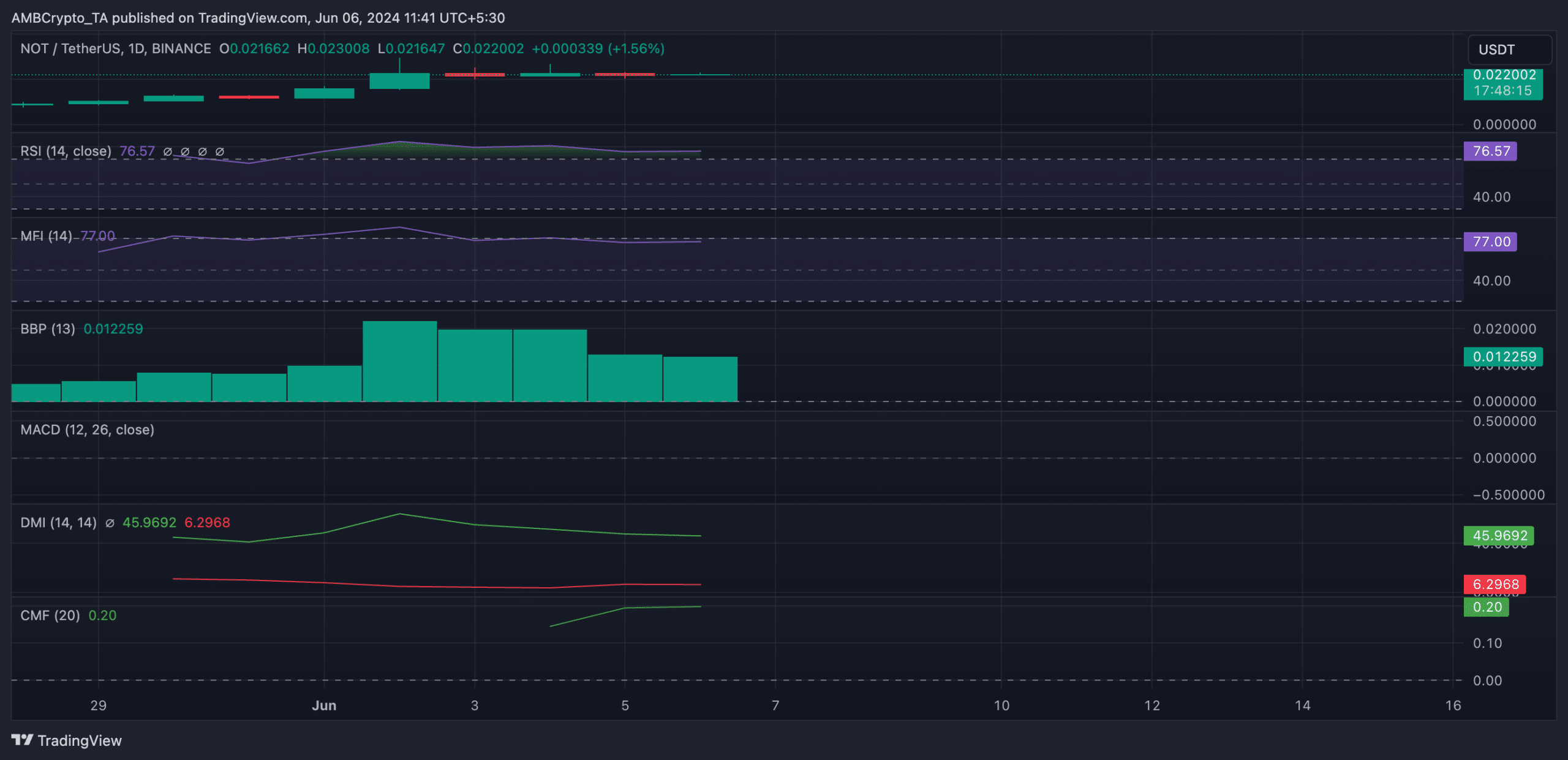

While there has been some profit-taking activity in the past few days, NOT’s momentum indicators remain significantly above their 50-neutral lines.

At press time, the token’s Relative Strength Index (RSI) was 76.73, while its Money Flow Index was 77.

These indicators suggested that NOT buying activity remained significant and exceeded selling pressure.

However, it is key to note that at its value, NOT’s RSI signaled that the token was overbought and a potential price correction was imminent. When an asset is overbought, buyers’ exhaustion sets in, and its price witnesses a pullback.

Although there lies a risk of a slight correction in NOT’s price, the bulls remain firmly in market control. Readings from its Elder-Ray Index showed this. As of this writing, the indicator’s value was 0.012.

This indicator measures the relationship between the strength of NOT’s buyers and sellers in the market. When its value is positive, bull power dominates the market.

Further, its positive directional index (green), at 45.96, was above its negative index (red), at 6.2, as of this writing. This signaled that the altcoin was experiencing a stronger uptrend than a downward momentum, even though some traders had started selling.

In addition, NOT’s Chaikin Money Flow (CMF) at 0.20 showed that a significant amount of liquidity was flowing into the market.

A positive CMF is a sign of market strength. It connotes capital inflow as demand for an asset climbs, a bullish signal.

Realistic or not, here’s NOT’s market cap in SOL terms

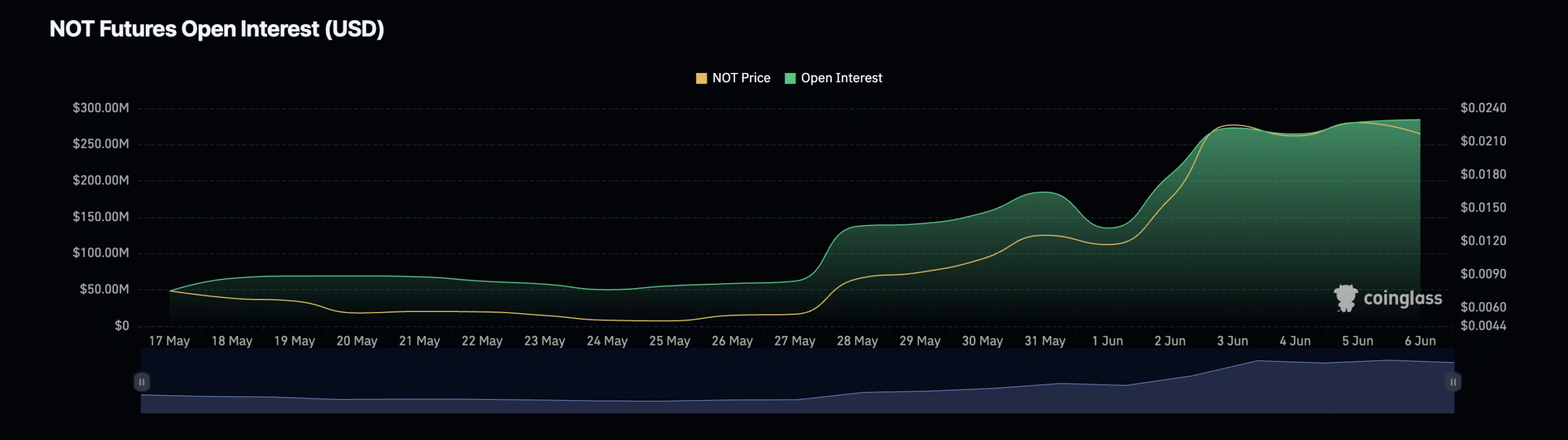

In NOT’s futures market, open interest has reached new highs. According to Coinglass data, at $284 million at press time, it was at an all-time high.

An asset’s futures open interest tracks the total number of outstanding futures contracts or positions that have not been closed or settled. When it rises this way, more market participants are opening new positions.