Nearly half of Shiba Inu holders facing losses: What’s next for SHIB?

- SHIB resistance has held firm over the past few weeks.

- The current position could present buying opportunities.

The price trend of Shiba Inu [SHIB] has been disappointing over the last few weeks, with its value drifting further away from the previously established support levels.

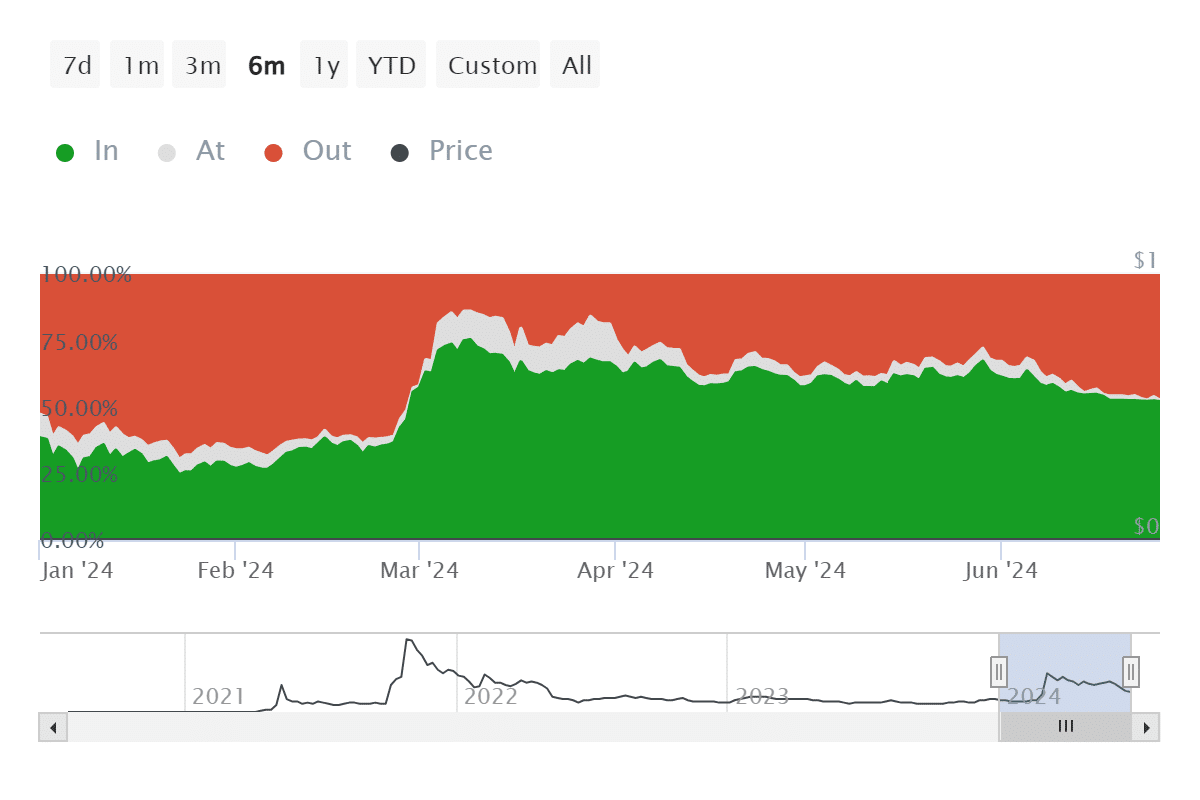

This decline has affected investor sentiment, as evidenced by the narrowing gap between the number of holders who are ‘in the money’ (profiting from their investment) and those ‘out of the money’ (experiencing a loss).

Shiba Inu oversold

Shiba Inu has experienced a steady decline since the beginning of the month, as shown by the daily time frame chart analysis from AMBCrypto.

The long moving average (blue line), which had served as a support level for months, has now turned into a resistance level due to the ongoing downward trend.

Similarly, the short moving average (yellow line) fluctuated between acting as support and resistance. However, it has now solidified its role as resistance and has remained in this position for several weeks.

As of this writing, SHIB was trading at around $0.000017, showing a slight increase. However, at the close of the previous trading session, it recorded a decline of over 3%.

The price movement of Shiba Inu in recent days has been characterized by sharp declines interspersed with minor uptrends.

Buying opportunity?

Furthermore, the Relative Strength Index (RSI), a momentum oscillator that measures the speed and change of price movements, indicated that Shiba Inu was in a strong bear trend.

The RSI is slightly below 30, suggesting that the asset is in an oversold state.

Being in such a state could signal a buying opportunity for traders, as it often precedes a possible reversal or a pause in the downward momentum.

Shiba in/out of the money tightens

The analysis of Shiba Inu’s In/Out of the Money metric on IntoTheBlock revealed that the disparity between profitable and unprofitable addresses is narrowing.

Currently, over 696,000 addresses, representing almost 52% of all holders, are ‘in the money.’ This meant they purchased SHIB at a price lower than the current market price.

Conversely, over 638,000 addresses, accounting for more than 47%, are ‘out of the money,’ having bought at higher prices than where SHIB is trading now.

Additionally, about 7,000 addresses, representing less than 1% of the total, have broken even.

Is your portfolio green? Check out the Shiba Inu Profit Calculator

Further detailed analysis showed that SHIB tokens purchased within the price range of $0.000018 to $0.000019 are currently holding the largest volume of tokens that are out of the money, with over 425 trillion tokens sitting in this bracket.

However, the price range between $0.000025 and $0.000030 contained the highest number of addresses that are out of the money, totaling over 147,000.