Litecoin stays under $80: What’s stopping LTC’s rise?

- Litecoin exhibited bearish long-term signals, with a “death cross” of the MA50 below the MA200.

- Indicators like the Fear & Greed Index and RSI indicated a bullish turn.

Litecoin [LTC] has consistently flashed bearish signals over the past month, as though something is blocking the bulls from returning.

At press time, the altcoin has seen an increase of 2% in the past twenty-four hours, thanks to the latest U.S. CPI data. Is there a chance that the bulls are taking over?

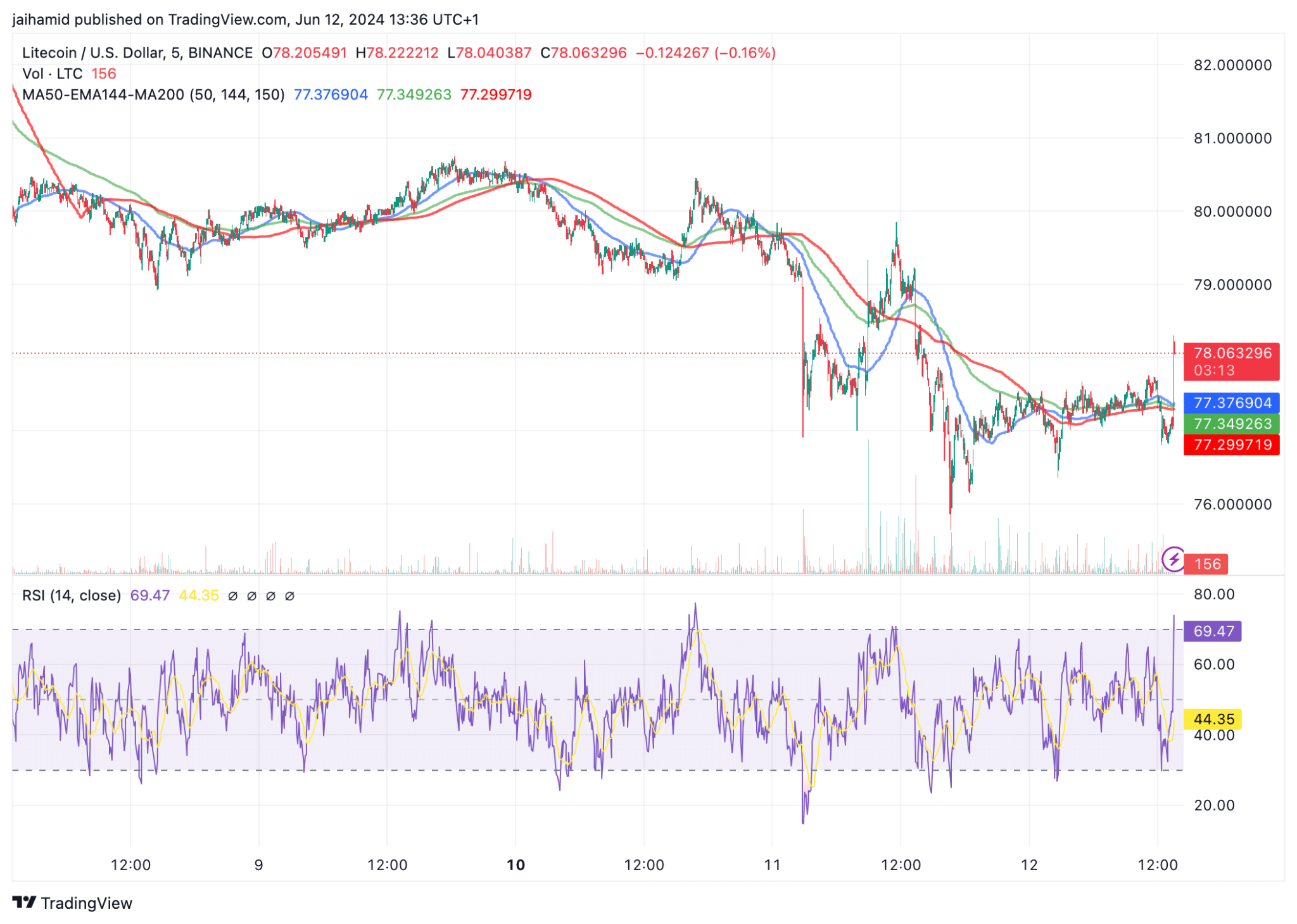

The LTC/USDT chart shows the 50-day moving average (MA50 — blue line) recently crossing below the 200-day moving average (MA200 — red line), a classic bearish signal known as the “death cross.”

This indicates that the long-term momentum has turned bearish. However, the exponential moving average (green line) still fluctuates above these, suggesting some levels of shorter-term volatility.

The RSI was at 61.78 at press time, which was neither in the overbought nor oversold territory.

This suggested that while there wasn’t extreme selling or buying pressure, the market was somewhat leaning towards bullish sentiment in the very short term.

The consistent bearish signals over the past month have likely eroded some investor confidence. A massive catalyst or broader market recovery would be necessary for the bulls to regain control.

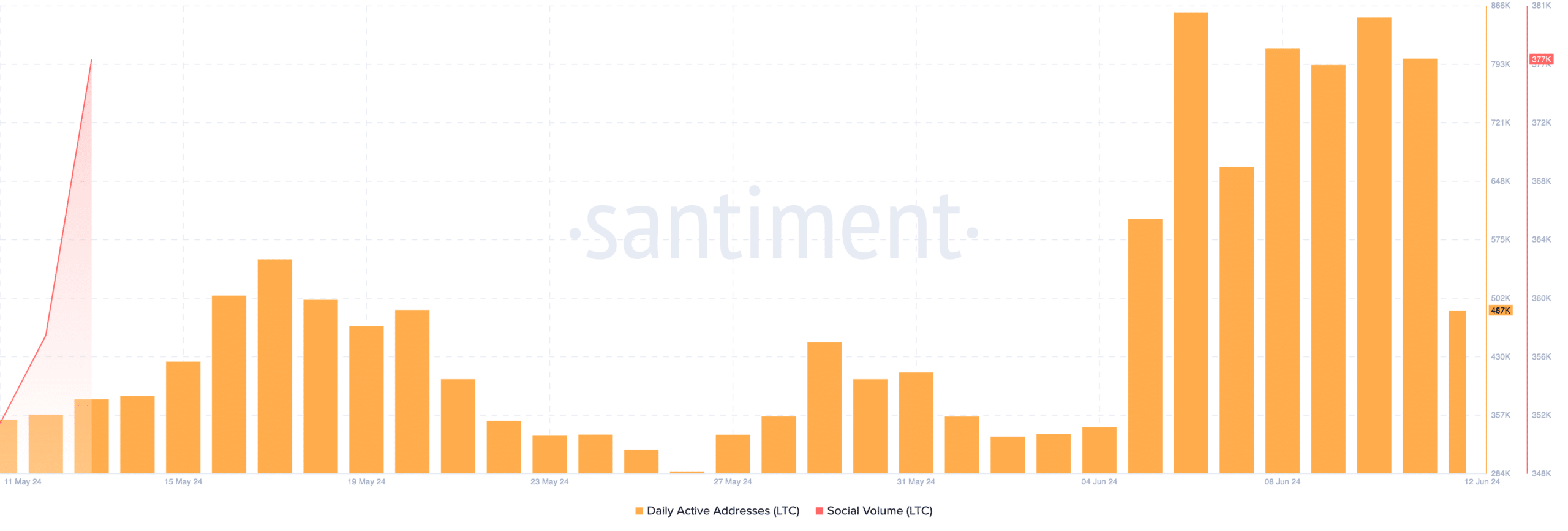

There was a notable trend of increasing Daily Active Addresses observed, reaching a recent peak along with the turnaround in price action. There is also an increase in social volume and dominance.

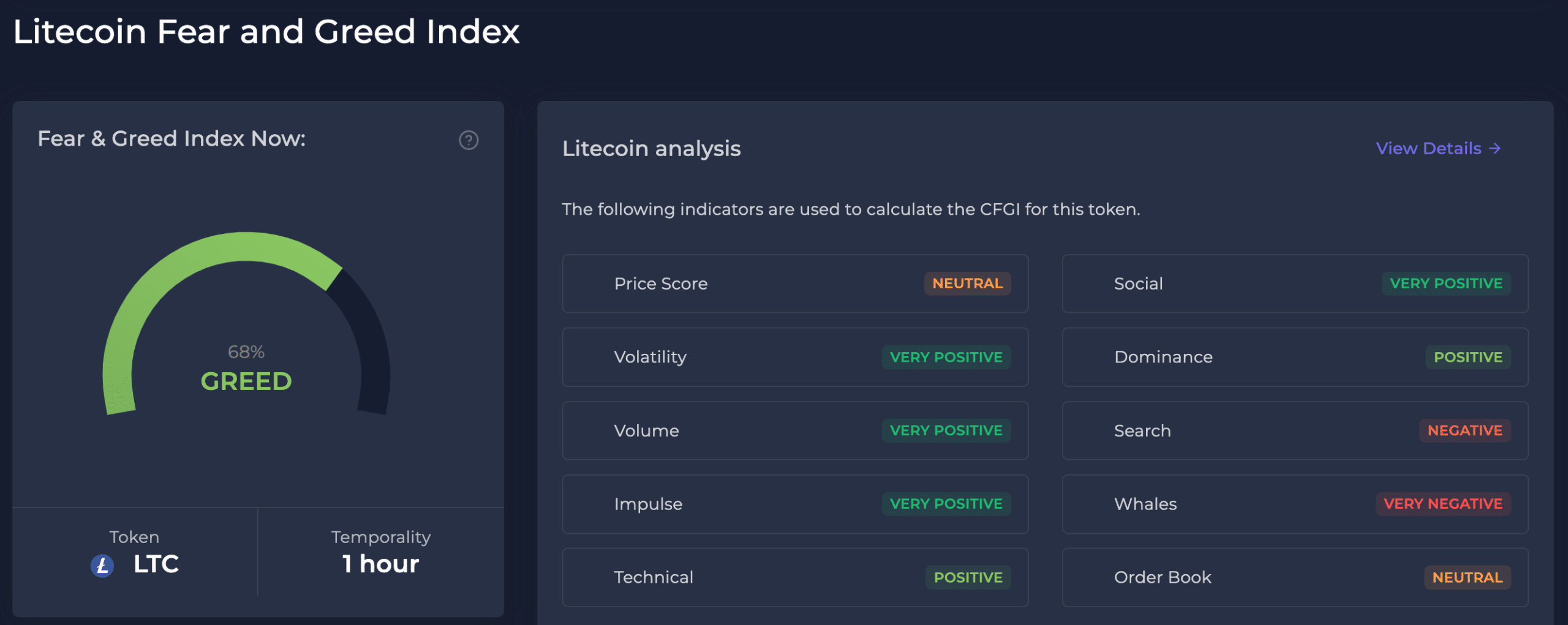

Litecoin’s Fear and Greed Index also showed positive signs, as it sat at a comfortable “Greed” zone with a score of 68% at press time.

This meant traders and investors alike were in an accumulation phase at the time of writing, which typically aligns with a rally.

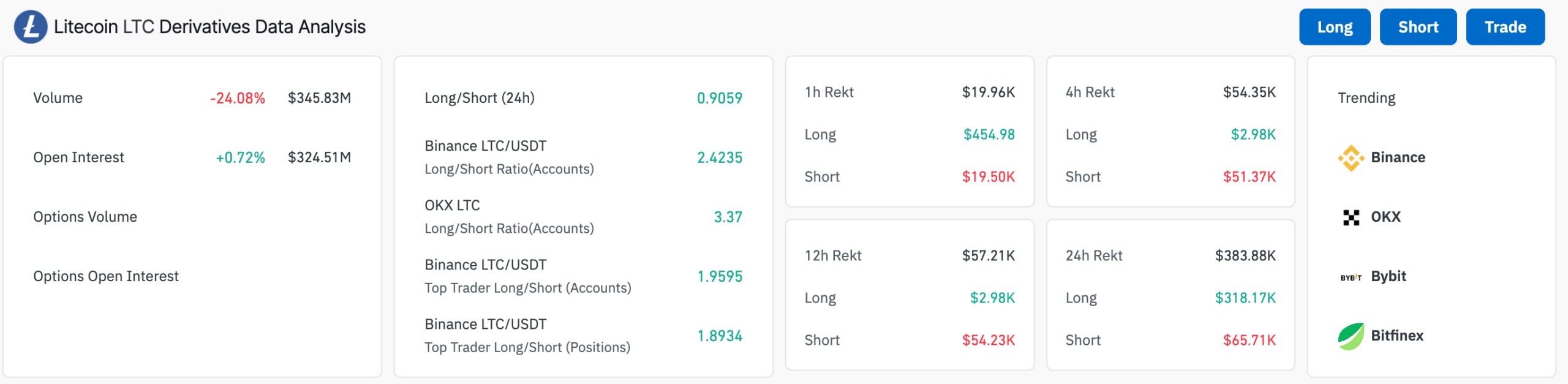

In the derivatives market, however, LTC was still mainly controlled by bears. The trading volume has seen a massive decline despite a modest increase in Open Interest.

Realistic or not, here’s LTC’s market cap in BTC terms

The overall long/short ratio was also bearish. But traders on Binance [BNB] and OKX remained bullish.

All in all, for LTC, while there was not overwhelming market participation, those involved were becoming slightly more bullish than bearish.