How Solana’s NFT market surpassed Ethereum’s – A 30-day snapshot

- Solana’s NFT buyers and sellers remained higher than those of Ethereum

- SOL’s price gained bullish momentum, but the trend might change

Solana [SOL] has once again dominated its competitors like Ethereum [ETH] in the NFT space over the past month. Now, while this seems optimistic at first glance, there might just be more to the story. Let’s have a look at how both of these NFT giants fared against each other.

Solana beats Ethereum

Coin98 recently shared a tweet underlining the latest datasets from the NFT ecosystem. According to the same, Solana is now ranked #1 on the list of blockchains in terms of the most NFTs created in the last 30 days. Apart from Solana, Polygon and Base also made it to the top three on the same list.

Here, what is also worth mentioning is that Ethereum took the 10th spot on the list. While 32 million NFTs were created on Solana, only 1 million NFTs were created on Ethereum. This gave SOL a whopping lead of 31 million.

AMBCrypto’s analysis of DappRadar’s data revealed that STEPN, SMB Gen2, and Mad Lads were the top NFT collections on Solana last month. Oddly enough, y00ts and DeGods, two projects that recently migrated to Solana, couldn’t make it to the top 5.

While the aforementioned datasets imply one thing, a look at the bigger picture might imply something different entirely. For instance, AMBCrypto’s analysis of CryptoSlam’s data revealed that while Solana’s monthly NFT sales volume was merely $99 million, Ethereum’s sales volume stood at $193 million.

Nonetheless, Solana’s number of NFT buyers and sellers remained significantly higher than that of Ethereum.

SOL turns bullish

While Solana’s performance in the NFT space remained positive, SOL’s price action once again turned bullish. According to CoinMarketCap, SOL’s price surged by over 2.5% in the last 24 hours. At the time of writing, the token was trading at $169.30 with a market capitalization of over $76 billion.

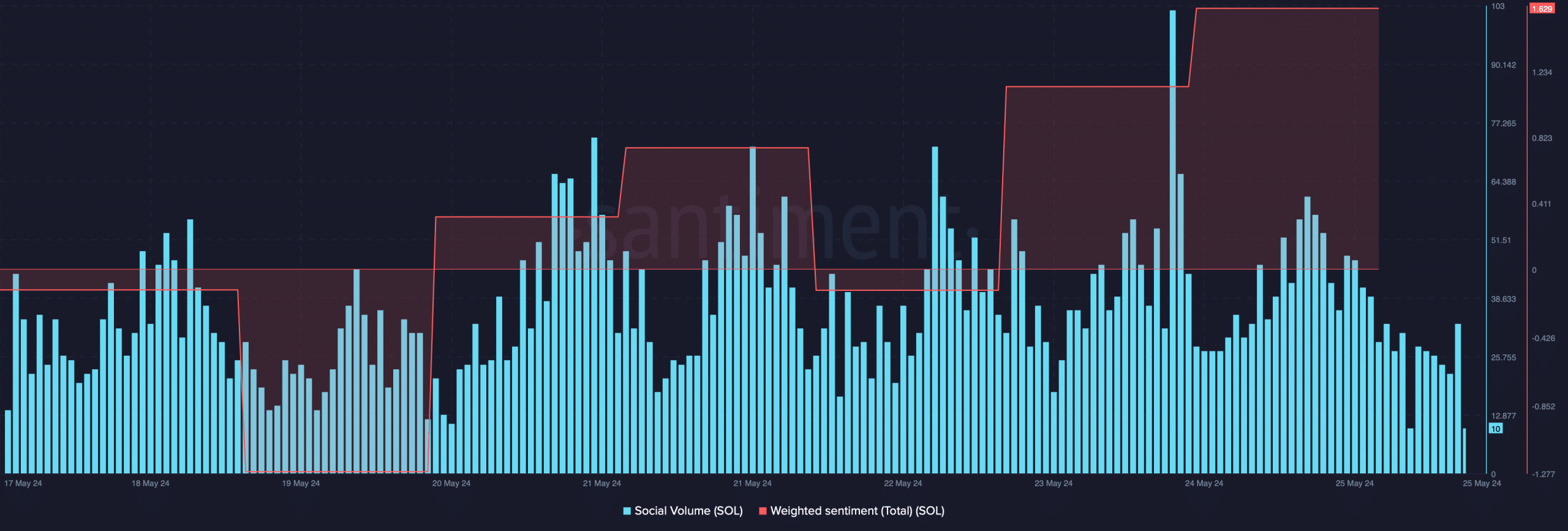

Thanks to the latest price uptick, the token’s weighted sentiment hiked too. This meant that bullish sentiment around the token was dominant in the market. Additionally, its social volume also appreciated on the charts, highlighting SOL’s popularity.

However, this trend might not last as a key derivatives market indicator flashed bearish signals at press time. Coinglass’ data revealed that Solana’s long/short ratio fell over the last 24 hours.

Read Solana’s [SOL] Price Prediction 2024-25

Here, a low ratio is a sign of bearish sentiment, where there is more interest in selling or shorting assets.