Toncoin Flips Avalanche: Will Telegram Integration Fuel a Sustained Bull Run?

- TON hiked by over 4% in the last 24 hours

- Market indicators hinted at a trend reversal in the coming days

Toncoin [TON] once again created buzz in the crypto-community as it entered the top-10 by flipping Avalanche [AVAX] in the rankings. The primary driving force behind the price uptick was TON’s latest integration with Telegram, a popular messaging platform.

Toncoin re-enters the top-10 club

While most cryptos struggled to paint their daily charts green because of market conditions, TON somewhat decoupled from the rest of the market.

According to CoinMarketCap, Toncoin’s price appreciated by more than 4% in the last 24 hours alone, helping it earn a spot in the top-10 list. At the time of writing, TON was trading at $5.4 with a market capitalization of over $18.7 billion, making it the 10th largest crypto.

The good news was that the price uptick was accompanied by a 40% hike in trading volume, acting as a foundation for the surge.

Though there might be several factors at play, a major reason behind this bull rally could be Toncoin’s latest integration with Telegram. For initiators, Telegram rolled out TON payments for advertisers and crypto-payouts for content creators on the platform a few days ago.

Soon after Telegram made the announcement, the blockchain’s network activity spiked as it registered 156,000 active TON wallets, which looked promising.

Will Toncoin maintain this lead?

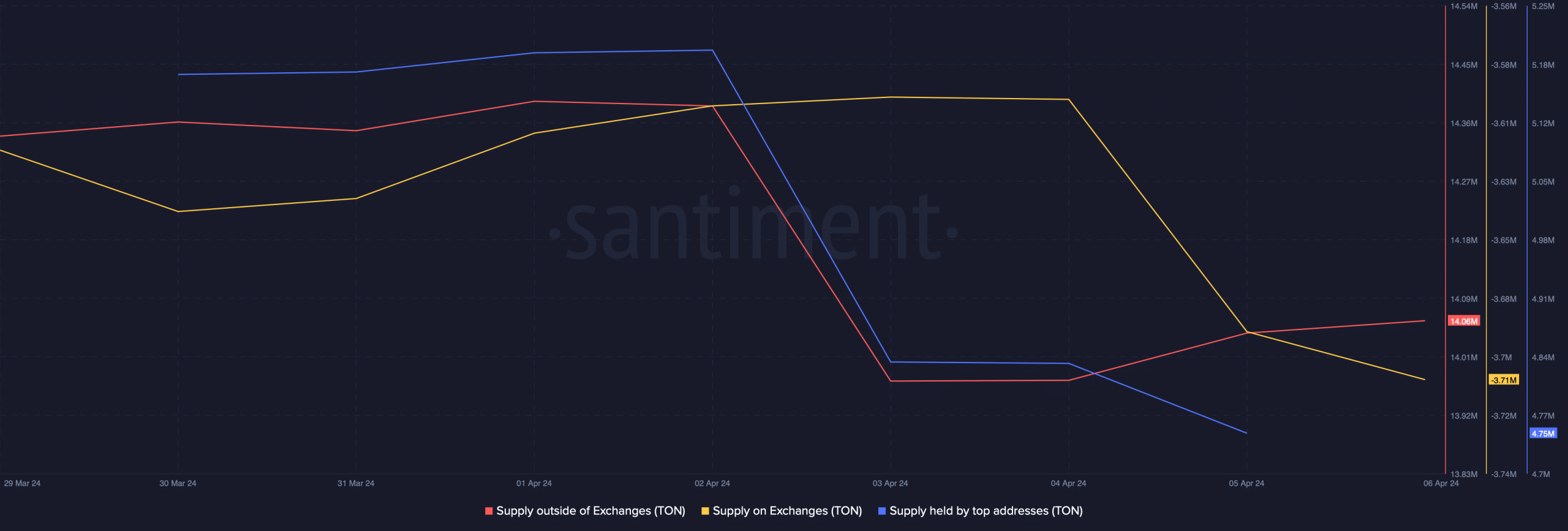

Since TON flipped AVAX to become the 10th largest crypto, AMBCrypto planned to check its metrics to see whether the token would manage to sustain this price uptrend. We found that after a decline, TON’s supply outside of exchanges hiked on 4 April. This happened while the token’s supply on exchanges dropped – A sign that buying pressure on Toncoin has been high.

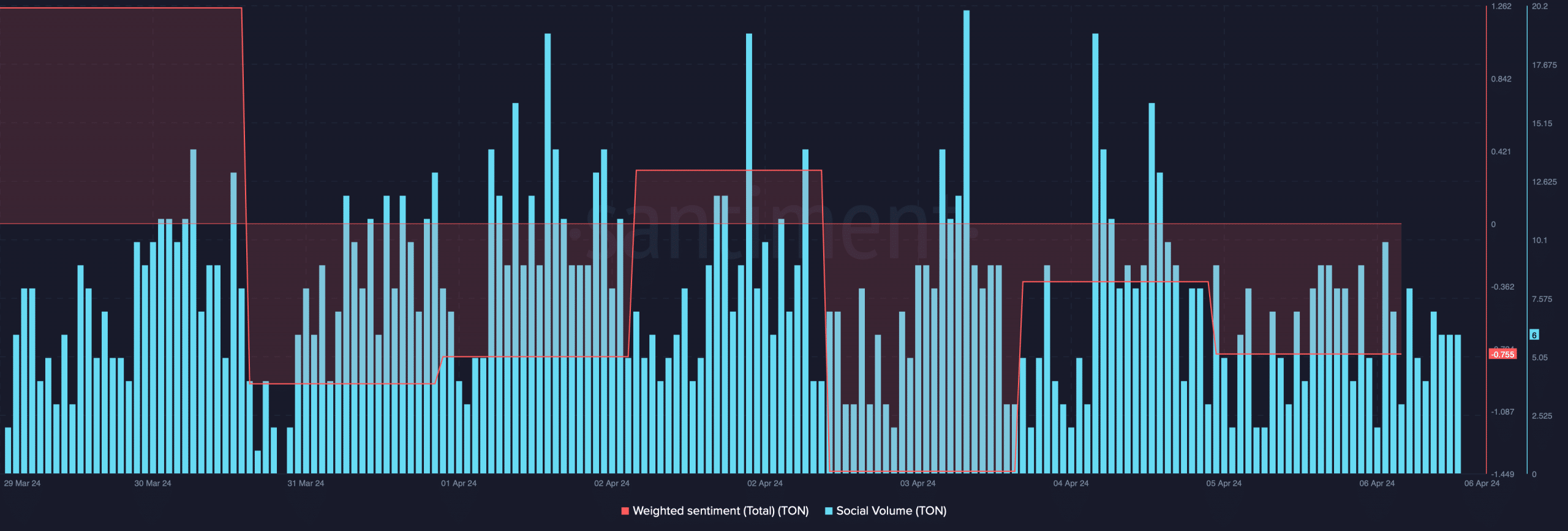

However, the whales weren’t confident enough in TON, which was evidenced by the drop in its supply held by top addresses. Interestingly, despite its latest price uptick, TON’s weighted sentiment remained in the negative zone, meaning that bearish sentiment was dominant.

Its social volume also plummeted over the last few days, reflecting a drop in TON’s popularity.

Read Toncoin’s [TON] Price Prediction 2024-25

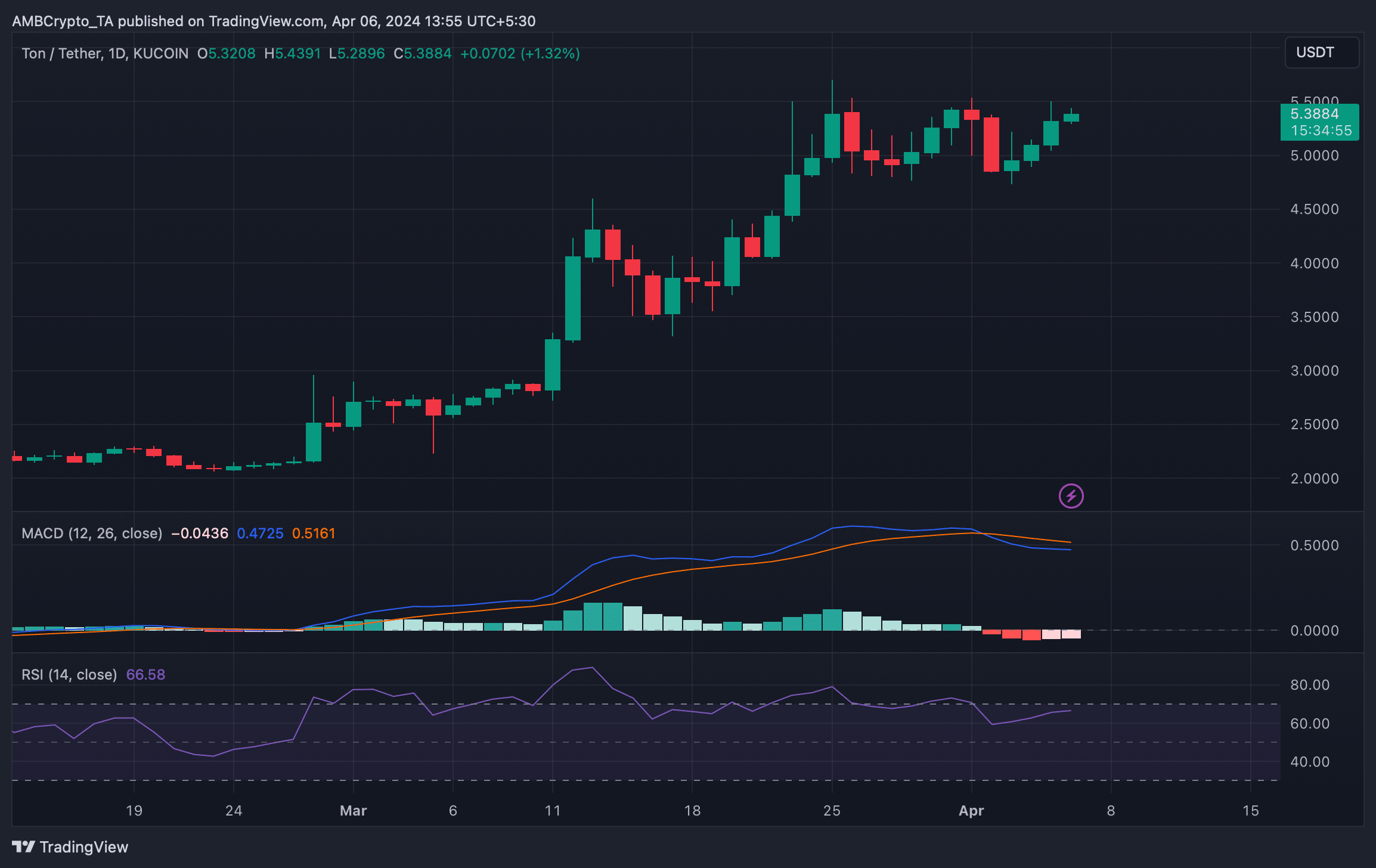

We then took a look at TON’s technical indicators to see what they had to suggest. We found that its Relative Strength Index (RSI) registered a sharp uptick, hinting at a sustained price hike.

However, if the graph enters the overbought zone, it might contribute to a rise in selling pressure, which can result in a price correction. In fact, the MACD had already turned in sellers’ favor as it projected a bearish advantage in the market.