Ethereum vs. Bitcoin: How a key metric points to ETH as the winner

- Ethereum’s price increased by nearly 3% in the last seven days.

- Selling pressure on ETH continued to remain high.

While most cryptos’ prices were declining, Ethereum [ETH] decoupled from the market as it went the other way. In fact, the king of altcoins was outshining Bitcoin [BTC] on a key front, which hinted at a bull rally in the coming days.

Ethereum beats Bitcoin

CoinMarketCap’s data revealed that ETH bulls stepped up their game over the last seven days as the token’s price increased. The token’s daily chart also remained green as it moved up marginally.

At the time of writing, ETH was trading at $3,575.26 with a market capitalization of over $437 billion.

While that happened, Ki Young Ju, a popular crypto analyst, recently posted a tweet pointing out an interesting development.

As per the tweet, ETH’s MVRV ratio was rising, suggesting that ETH’s market was heating up relative to its on-chain fundamentals.

In fact, ETH managed to outperform Bitcoin in terms of MVRV ratio growth rate. The tweet also mentioned that, given the current ETF situation, this might be an ETH-only season.

It was also interesting to note that historically, when ETH surges, other alts tend to follow.

Is ETH ready for a bull rally?

Since the aforementioned dataset suggested that the chances of ETH showcasing a bullish performance were high, AMBCrypto planned to check its on-chain metrics.

As per our analysis of CryptoQuant’s data, ETH’s net deposit on exchanges was high compared to the last seven days’ average, meaning that selling pressure was high.

Additionally, its Coinbase premium was red, indicating that selling sentiment was dominant among US investors. Nonetheless, the Korea premium looked optimistic as it indicated that Korean investors were willing to buy ETH.

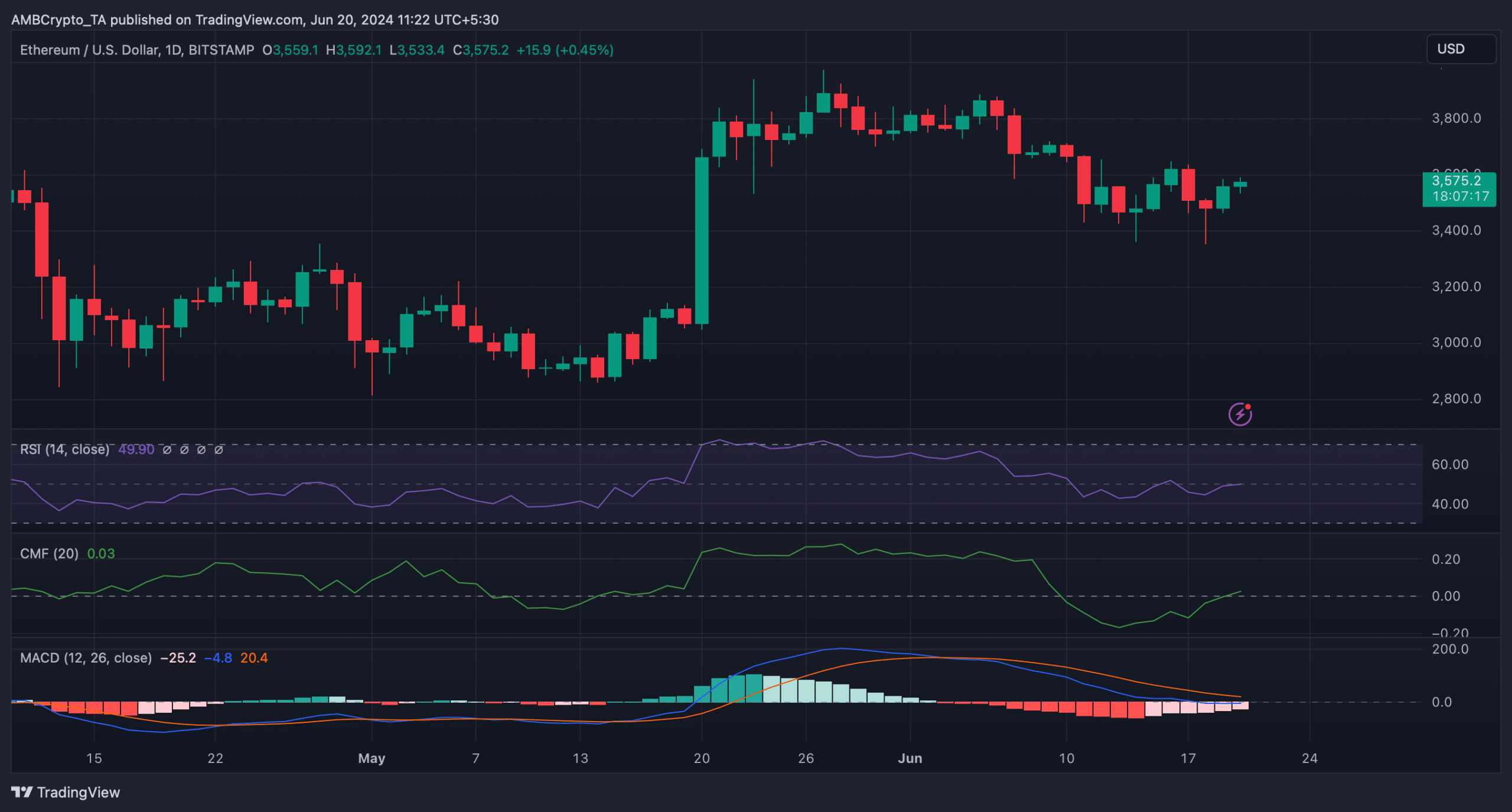

A few of the technical indicators also looked bullish on the king of altcoins. For instance, the MACD displayed the possibility of a bullish crossover.

The Relative Strength Index (RSI) registered an uptick and was resting at the neutral mark at press time.

Additionally, the Chaikin Money Flow (CMF) also moved northward, hinting at a price increase in the coming days.

AMBCrypto then checked Hyblock Capital’s data to look for possible targets for this week if ETH remains bullish.

Read Ethereum’s [ETH] Price Prediction 2024-2025

We found that ETH might first touch $3,660, as liquidation would rise sharply at that level. A rise in liquidation often results in short-term price corrections.

A successful breakout above that level might allow ETH to reach $3.8k. However, if the bears takeover, then investors might witness ETH drop to $3.28k this week.