Ethereum: The major reason why ETH cannot cross $4K easily

- Ethereum maintained its bullish market structure.

- The spot market and trading volume signaled short-term bearish pressure.

Ethereum [ETH] bounced 6% from its lows on the 29th of March, as Bitcoin [BTC] also bounced by 5.8% during this time. However, the bulls were not yet dominant, and traders going long should be cautious.

The technical indicators showed that selling pressure has been rising, and the short-term sentiment was also bearish. On the other hand, exchange reserves were falling and showed accumulation of the token.

The reaction from $3200 was positive, but will it be sustained?

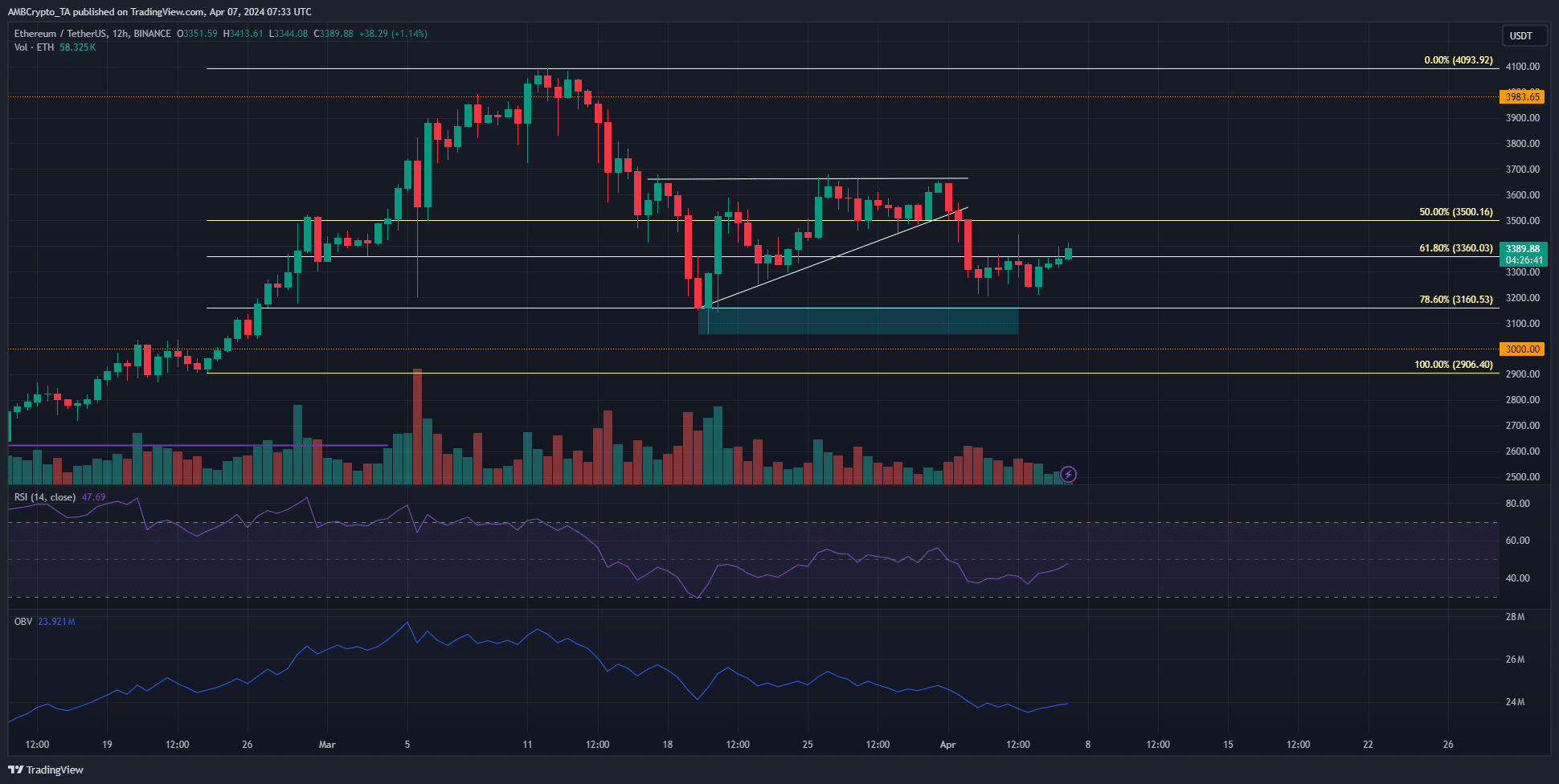

ETH climbed above the $3360 resistance but like many crypto assets, its trading volume has been quite low in the past ten days.

Additionally, the OBV showed that the selling volume has been dominant since mid-March.

This was when we saw a rejection from $4100. The buyers have not yet recovered from this blow. The demand zone at $3200 and $3000 should, at least temporarily, halt the bears if prices drop there.

The RSI has meandered about the neutral 50 mark over the past two weeks and signaled no clear trend in progress.

Its move below neutral 50 earlier this month was an early sign that bears were gaining the upper hand.

Social Dominance took a tumble

Source: Santiment

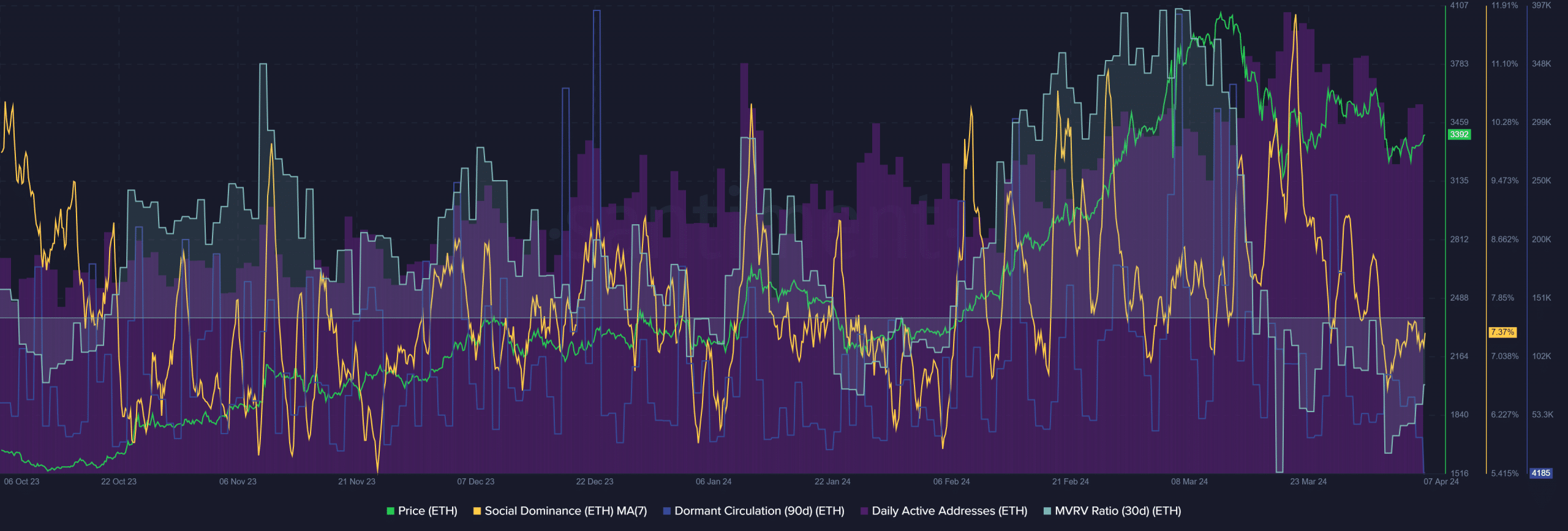

The 30-day MVRV ratio was negative and reflected an undervalued asset. Its dominance circulation saw a large spike on 26th March, but was relatively quiet since. Hence, another wave of selling was not yet upon us.

The Daily Active Addresses declined slightly since the mid-March highs, but it was still going strong compared to earlier this year.

The Social Dominance chart, which had been trending upward since February, plunged lower. This was a sign that social media engagement around Ethereum has waned considerably in recent weeks.

Source: Coinalyze

Read Ethereum’s [ETH] Price Prediction 2024-25

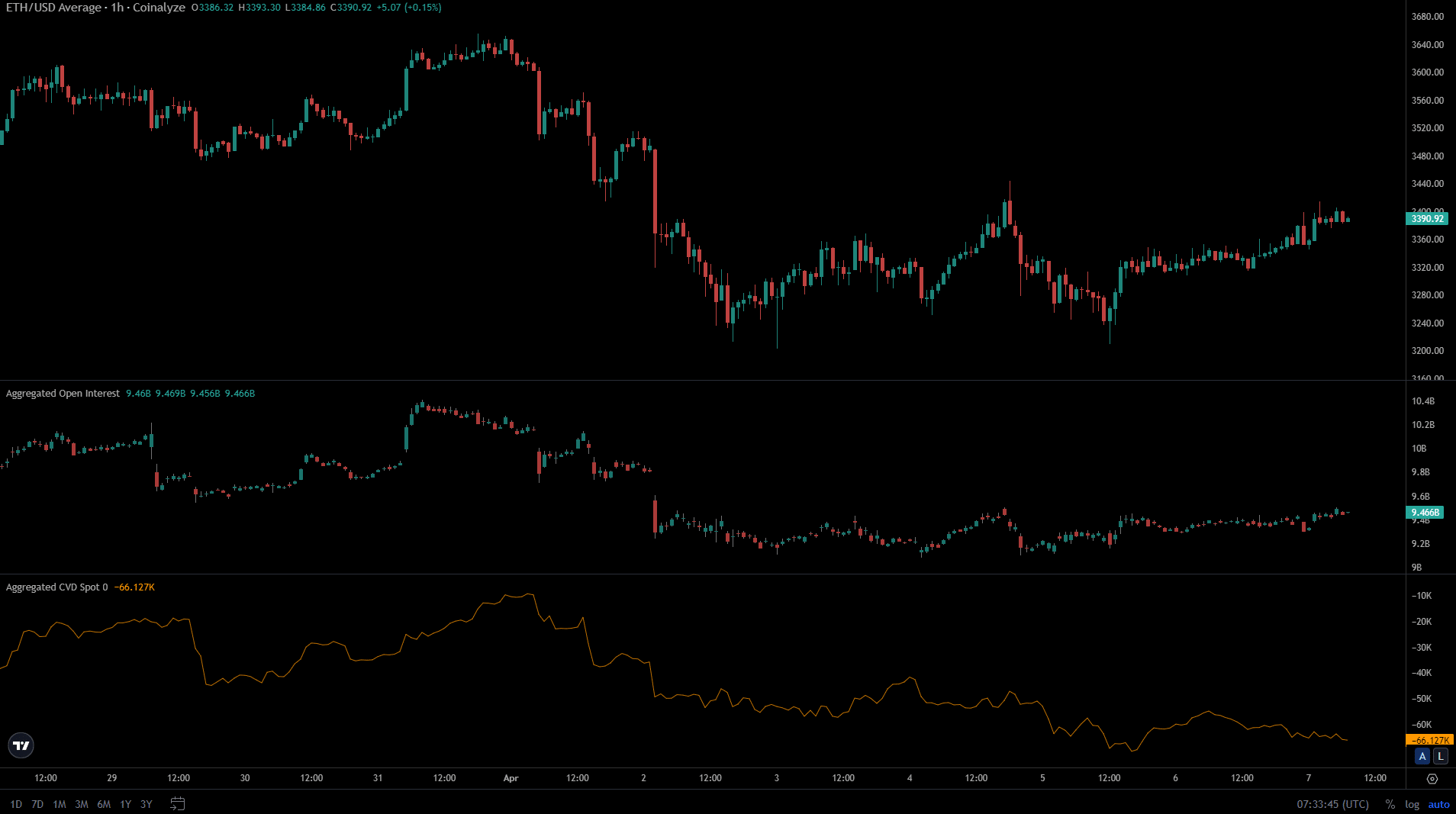

The spot CVD was also in a strong downtrend over the past week. It showed selling pressure in the spot markets, and indicated that traders could anticipate more losses.

The Open Interest climbed from $9.2 billion to $9.46 billion in the past 24 hours alongside the price. This indicated willingness from speculators, but overall the short-term bias remains bearish.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.