Ethereum sets sights on $4K: Will THIS spark a new rally for ETH?

- ETH was up by more than 6% over the last seven days.

- A few of the metrics suggested that the bullish momentum might not last.

Ethereum [ETH] caught investors off guard as its price gained bullish momentum on the 17th of May.

While the token’s price moved up, it broke above a bullish pattern that could allow the king of altcoins to touch $4k in the coming days or weeks.

Ethereum eyes $4k again

CoinMarketCap’s data revealed that ETH investors enjoyed profits last week, as the token’s price had surged by more than 6%.

Things heated up in the last few hours as ETH’s value increased by over 2.6% over the last day. At the time of writing, ETH was trading at $3,108.31 with a market capitalization of over $373 billion.

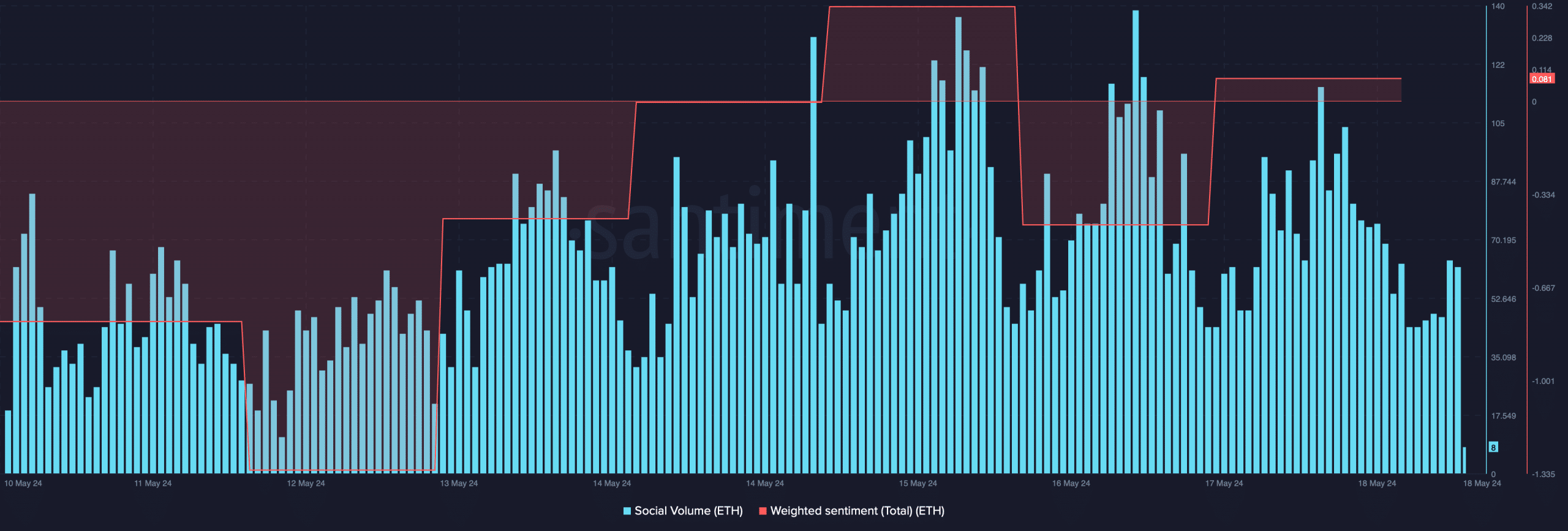

The bullish price action had a positive impact on the token’s social metrics, as its Social Volume remained high last week.

Its Weighted Sentiment also entered the positive zone, meaning the bullish sentiment around ETH became dominant in the market.

Thanks to the price uptick, ETH broke above a bullish pattern that hinted at a price rise towards $4k.

World Of Charts, a popular crypto analyst, recently posted a tweet highlighting that ETH broke out of a falling wedge pattern.

The pattern appeared on ETH’s chart during the beginning of March, and since then, ETH has consolidated inside it.

The tweet mentioned that the breakout could result in a 50% price rise, in turn allowing Ethereum to reclaim $4k once again.

What to expect in the short term?

AMBCrypto then analyzed ETH’s metrics to see whether they support the possibility of it touching $4k anytime soon.

Our analysis of CryptoQuant’s data revealed that ETH’s net deposit on exchanges was low compared to the last seven days’ average, signifying less selling pressure.

Another positive metric was the Coinbase premium, as it indicated that buying sentiment was dominant among U.S. investors. However, not everything looked bullish for the king of altcoins.

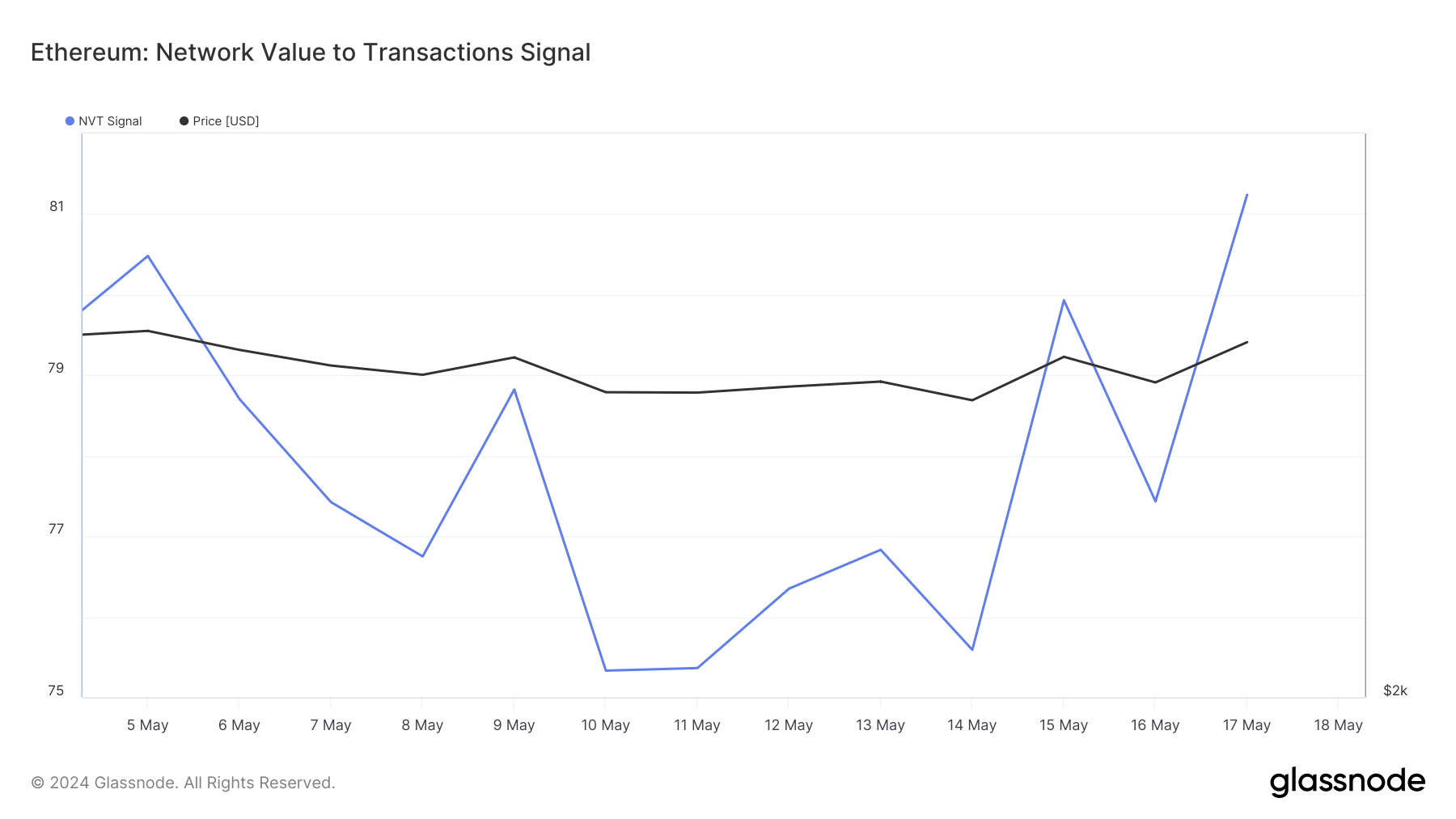

AMBCrypto’s look at Glassnode’s data revealed that ETH’s Network To Value (NVT) ratio registered a sharp uptick. A rise in the metric suggests that an asset is overvalued, hinting at a price decline.

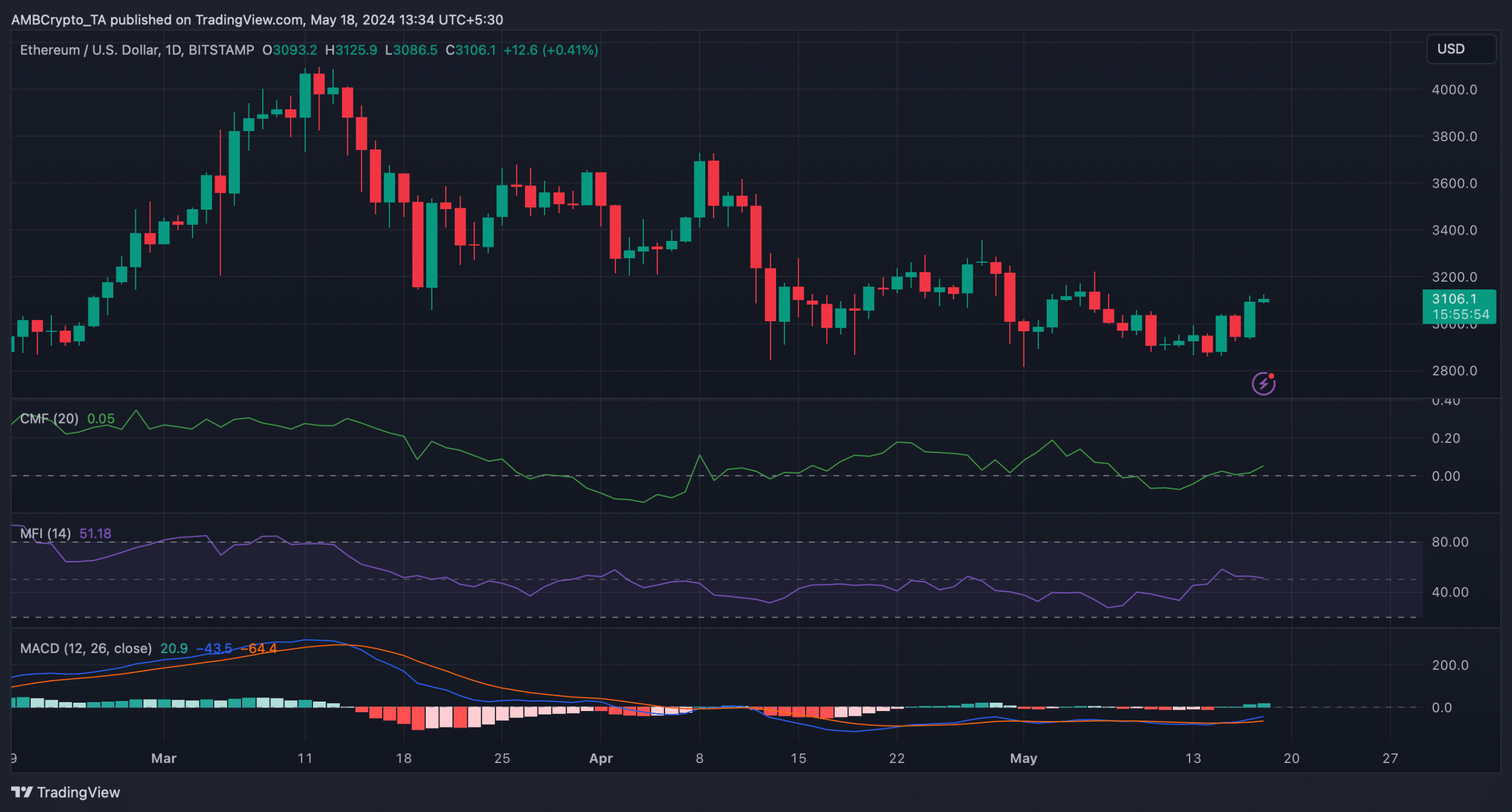

Ethereum’s Money Flow Index (MFI) also indicated a possible price correction as the indicator registered a decline. Nonetheless, the MACD displayed a bullish crossover.

The Chaikin Money Flow (CMF) also supported the bulls as it went northward.

Read Ethereum (ETH) Price Prediction 2024-25

To see what targets it might reach if its bull rally sustains, AMBCrypto analyzed Hyblock Capital’s data. We found that ETH’s liquidation would rise near the $3.2k zone.

A successful breakout above that would allow it to reach $3.5k in the coming days before it targets $4k. However, if ETH’s price turns bearish, then its value might plummet to $2.85k.