Ethereum: Staking over trading? Read this, ETH holders!

- Increase in staked supply indicated a shift towards guaranteed, stable returns over risk-laden market trading.

- ETH retraced 6.5% in the last 24 hours, at risk of plunging further.

Interest in Ethereum [ETH] staking continued unscathed, as users saw more value in parking their assets with the smart contracts blockchain to earn passive revenue.

ETH staking continues to be hot

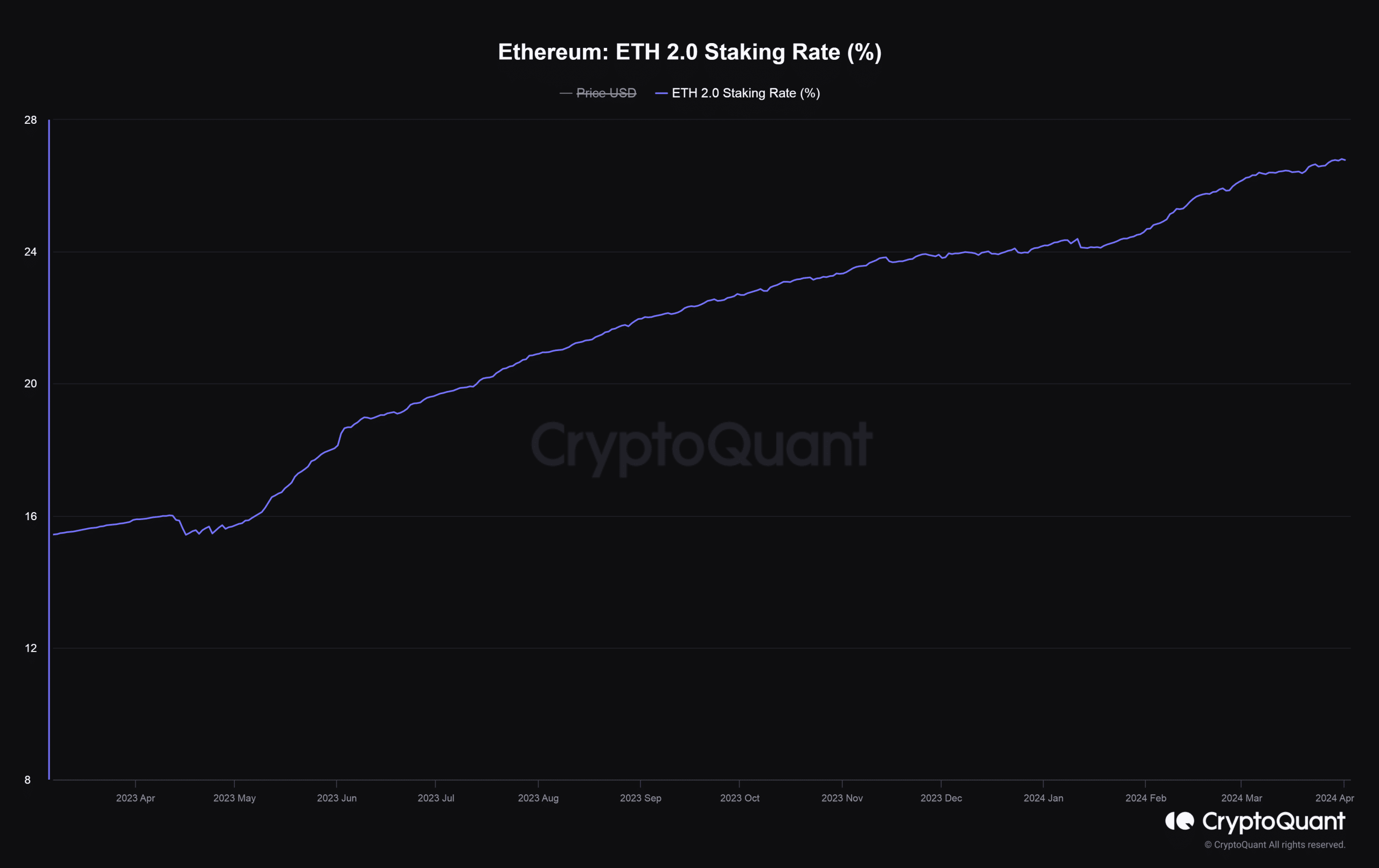

According to AMBCrypto’s analysis of CryptoQuant data, the staking participation rate was inching closer to 27% as of the 1st of April, meaning that 27% of ETH’s total circulation supply was deposited to secure the network. A year ago, the participation rate was just 15.89%.

Typically, the larger the ETH deposit, the more secured and decentralized the network tends to be.

Staked supply has increased significantly since the Shapella Upgrade last year, which permitted stakers to withdraw their assets. As the uncertainty around the process was removed, more users decided to lock their ETH into the network.

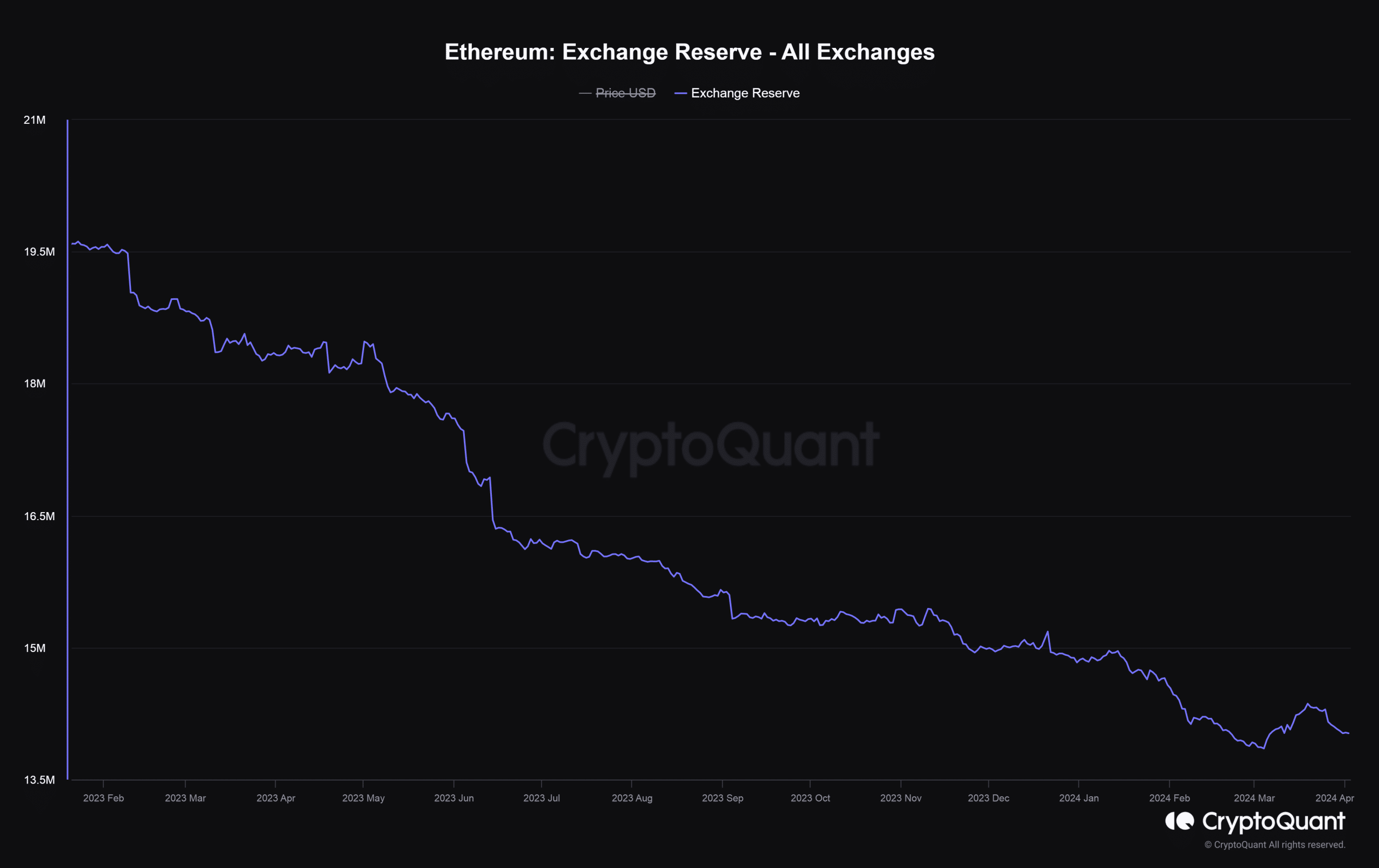

At the same time, ETH supply on exchange has plummeted to multi-year lows, accounting for just 11.6% of the total supply as of this writing.

What does this mean?

These trends revealed a clear shift in the Ethereum investment landscape – one towards guaranteed, stable returns over risk-laden market trading. They also signaled confidence in the long-term prospects of the Ethereum blockchain.

ETH was struggling on the price charts

While the future looked green, the present was in the red. ETH retraced 6.5% in the last 24 hours, as the broader market sank lower on Bitcoin spot ETF outflows and U.S. macroeconomic data.

As of this writing, the second-largest cryptocurrency was exchanging hands at $3,307, per CoinMarketCap.

Taking note of the developments, noted on-chain analyst Ali Martinez sounded an alarm, anticipating a further dip to $2,850.

Is your portfolio green? Check out the ETH Profit Calculator

ETH’s woes could be compounded by negative sentiment over its spot ETF prospects. Developments in recent weeks have led analysts lower the odds of approval significantly.

According to leading prediction markets platform Polymarket, there was just a 19% chance of approval as of this writing.