Ethereum – Examining if restaking is good for your holdings

- More than 12% of the staked ETH has been restaked

- ETH is now gradually emerging as a reliable yield-bearing asset

Ethereum [ETH] staking has become much more desirable since the concept of restaking was introduced.

A new paradigm for Ethereum staking

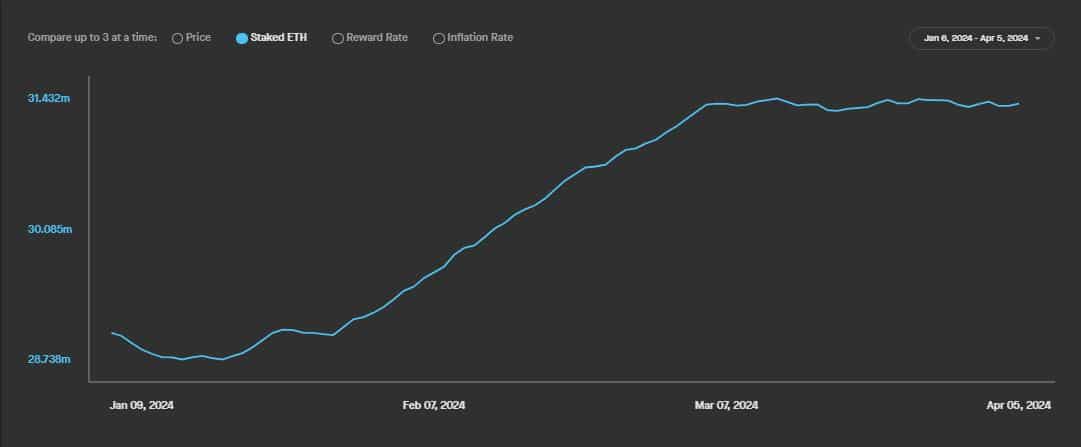

According to AMBCrypto’s analysis of Staking Rewards’ data, ETH locked on the network has risen by 9% over the last three months. In fact, its growth rate has gone parabolic since February began.

Interestingly, according to DeFiLlama, EigenLayer, the success story of the restaking narrative, noted a similar growth curve in its total value locked (TVL).

Additionally, Tom Wan, a research analyst at Web3 firm 21.co, revealed recently that over 12% of the staked Ether has already been restaked.

These findings have strengthened the assertion made previously about restaking providing an impetus to ETH staking.

Why are users leaning towards restaking?

EigenLayer has taken a giant leap in 2024, surpassing competitors to become the second-largest DeFi protocol in a very short period of time. The success lies in its unique offering – Restaking.

Restaking involves reusing staked ETH to extend security to other applications other than Ethereum. No prizes for guessing this allows stakers to earn extra rewards on their deposited holdings. As yields on conventional ETH staking continue to drop owing to an increase in participants, restaking is a viable option for users to boost their income.

How does ETH benefit?

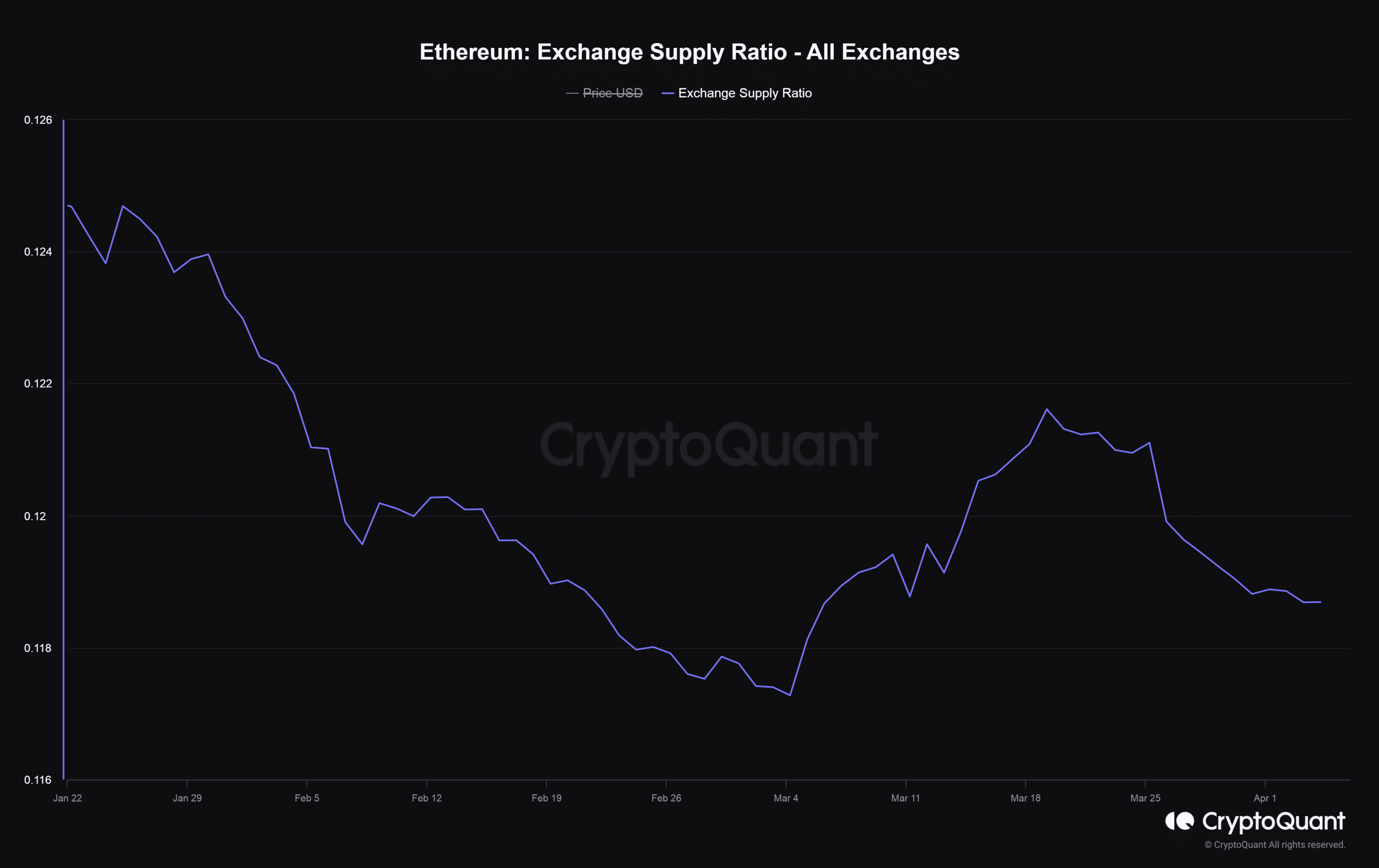

Overall, both staking and restaking underscore an important broader idea – ETH as a yield-bearing asset. With stable, guaranteed returns, users can start viewing it from a long-term prospective, rather than seeking short-term gains from its price fluctuations in the market.

Is your portfolio green? Check out the ETH Profit Calculator

Interestingly, the results can already be felt. Ethereum’s exchange supply ratio, for instance, plummeted to multi-year lows, according to AMBCrypto’s analysis of CryptoQuant data.

This could gradually lead to a scarcity in the market, which when matched by growing demand, could exert positive pressure on ETH’s price.