Cardano’s price to fall by more than 13%? These signals will tell you…

- ADA fell by 13% in the last 24 hours

- Technical indicators pointed to a further price decline in the making

Cardano [ADA] is in the news today after it revealed its March development highlights. However, that’s not the only reason it grabbed headlines. In fact, it also did so for all the wrong reasons after ADA saw red on the charts and dropped by 13% thanks to the market crash.

Cardano doing well on dev front

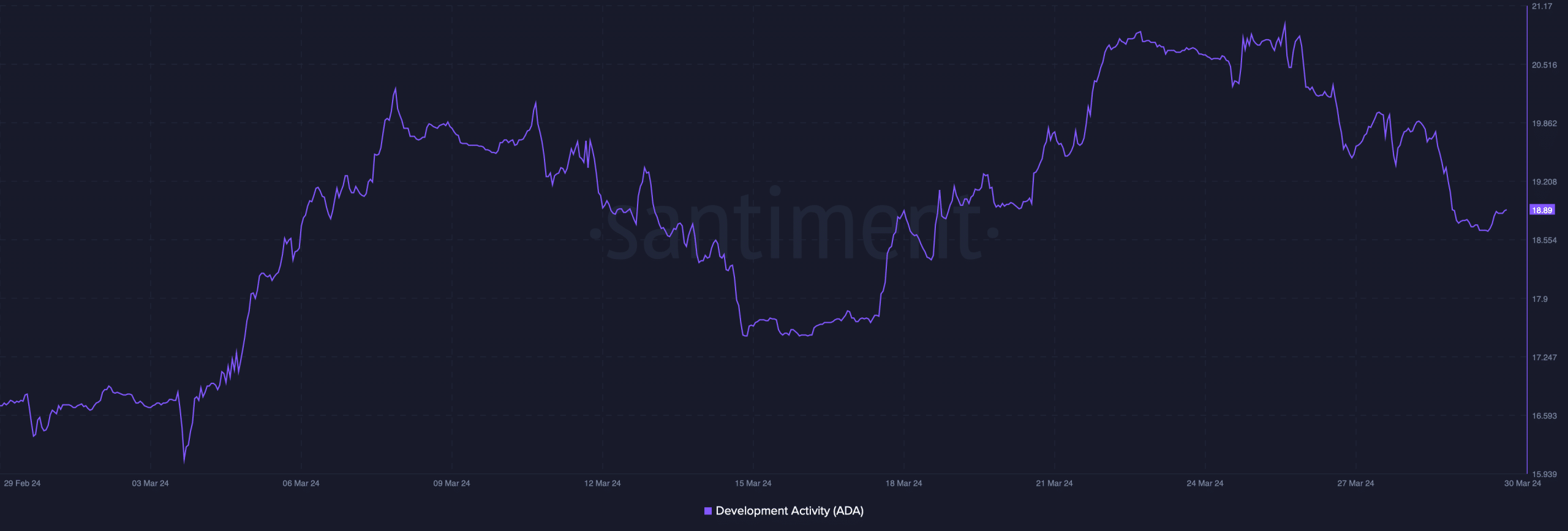

AMBCrypto’s assessment of Santiment’s data revealed that development work around Cardano has remained high. This was evidenced by its dev activity chart, with the same remaining steadily high in March.

Input Output, the developer of Cardano posted an X thread sharing the efforts made by developers during the last month of Q1. As per the same, the teams released Cardano node v.8.9.0, which introduced Genesis Lite bootstrap peers, re-certifying a bug to improve overall performance.

In order to improve scalability, the Mithril team also released Mithril distribution 2408.0, which included stake distribution improvements and others. Apart from this, the report also mentioned that ADA’s total number of transactions increased by 2.3 million over the month. Additionally, three new projects were launched in March on the Cardano blockchain.

Cardano is facing bears’ wrath

Cardano exited March with a slight decline in its price, compared to the beginning of the month, as its price fell to $0.64. April did not bring good news for investors either as the token’s price dropped by nearly 13% in 24 hours.

According to CoinMarketCap, at the time of writing, ADA was trading at $0.5071 with a market capitalization of over $18 billion, making it the 10th largest crypto. The possibility of ADA’s price going further down in April seemed likely, as most metrics flashed bearish signals.

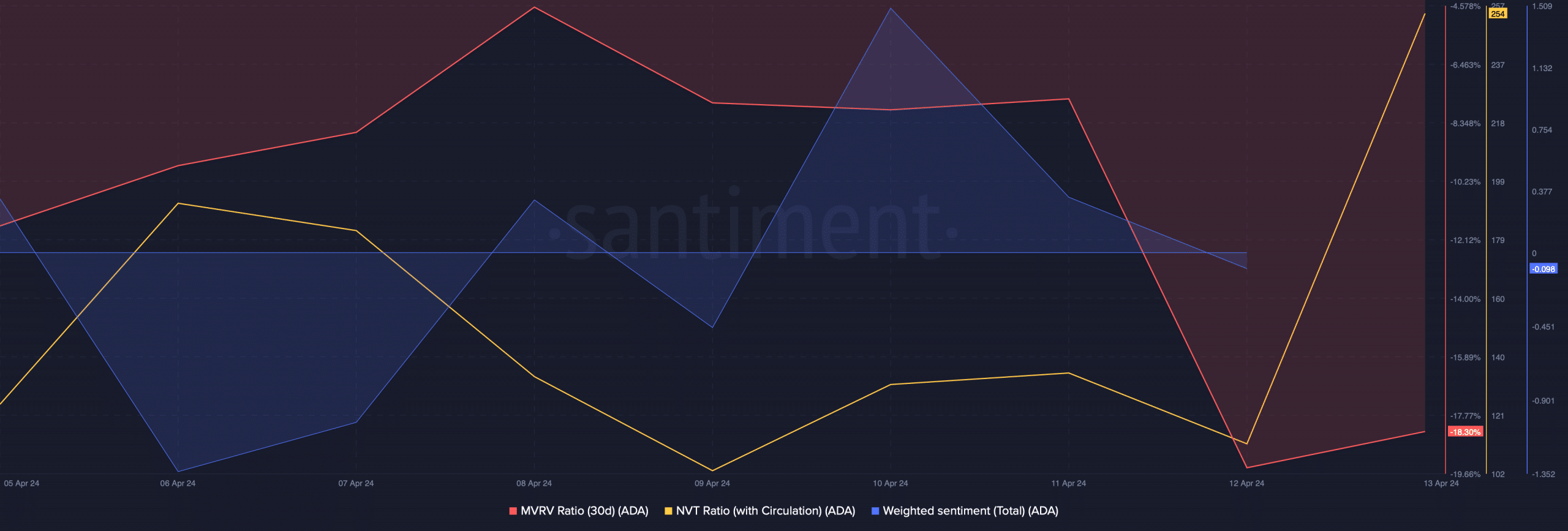

Our analysis of Santiment’s data revealed that Cardano’s MVRV ratio dropped sharply. At press time, it had a value of -18%. Sentiment around ADA also turned bearish, as is evident from the drop in its weighted sentiment on 12 April. Moreover, the token’s NVT ratio spiked sharply. A rise in the metric suggests that an asset is overvalued, hinting at a further price drop in the coming days.

Read Cardano’s [ADA] Price Prediction 2024-25

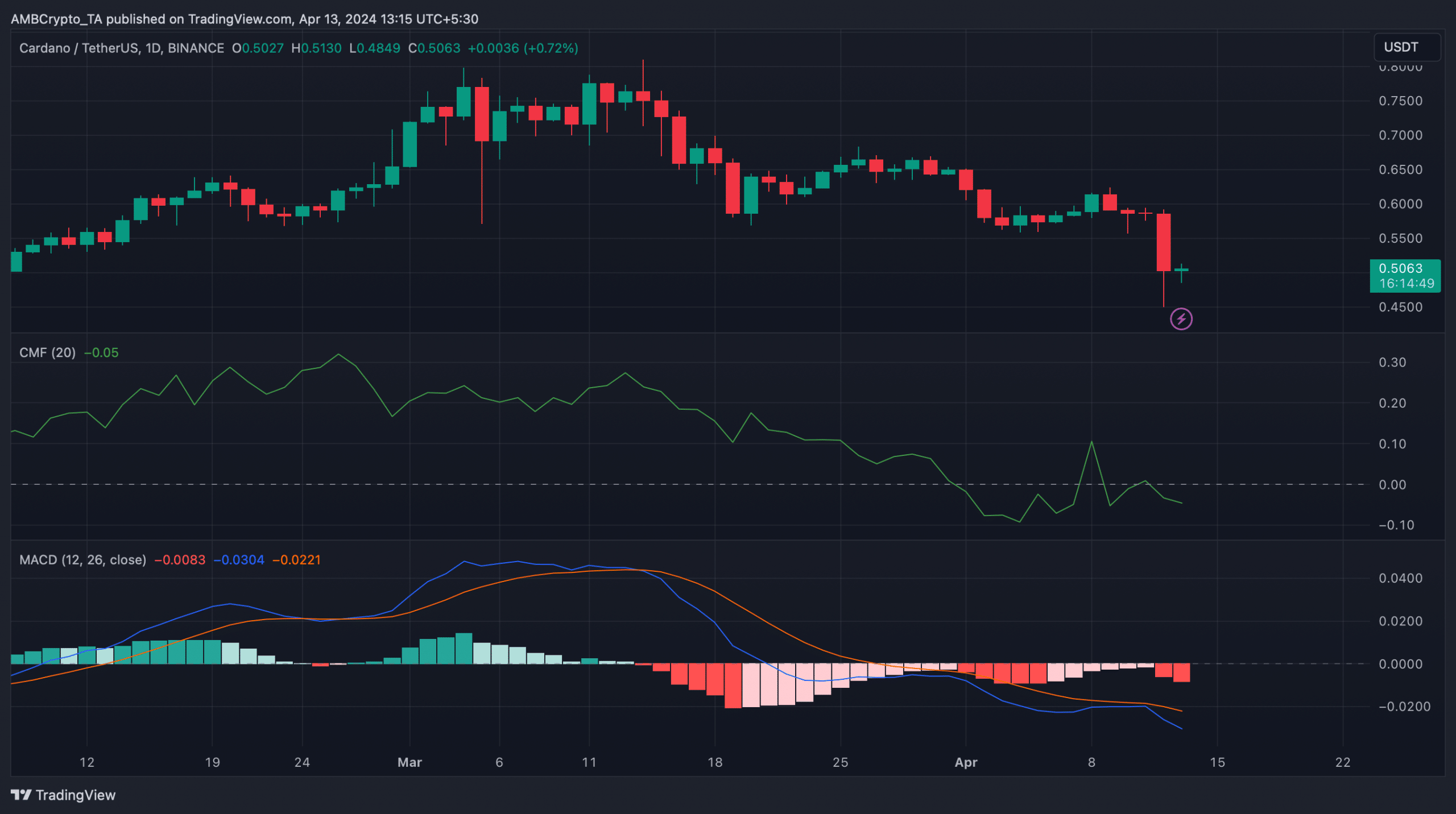

We then analyzed Cardano’s daily chart to see whether indicators also hinted at a further price decline. ADA’s MACD displayed a clear bearish upper hand in the market.

Additionally, the Chaikin Money Flow (CMF) registered a sharp downtick on 12 April. Both of these technical indicators supported the sellers and indicated that investors might witness ADA’s value drop in the coming days.