Cardano: Exploring the impact of rising short positions on ADA

- There is a hike in the demand for ADA short positions.

- This is due to the steady decline in the coin’s value.

Cardano’s [ADA] 20% price decline in the last month has led to a surge in the demand for short positions among its futures market participants.

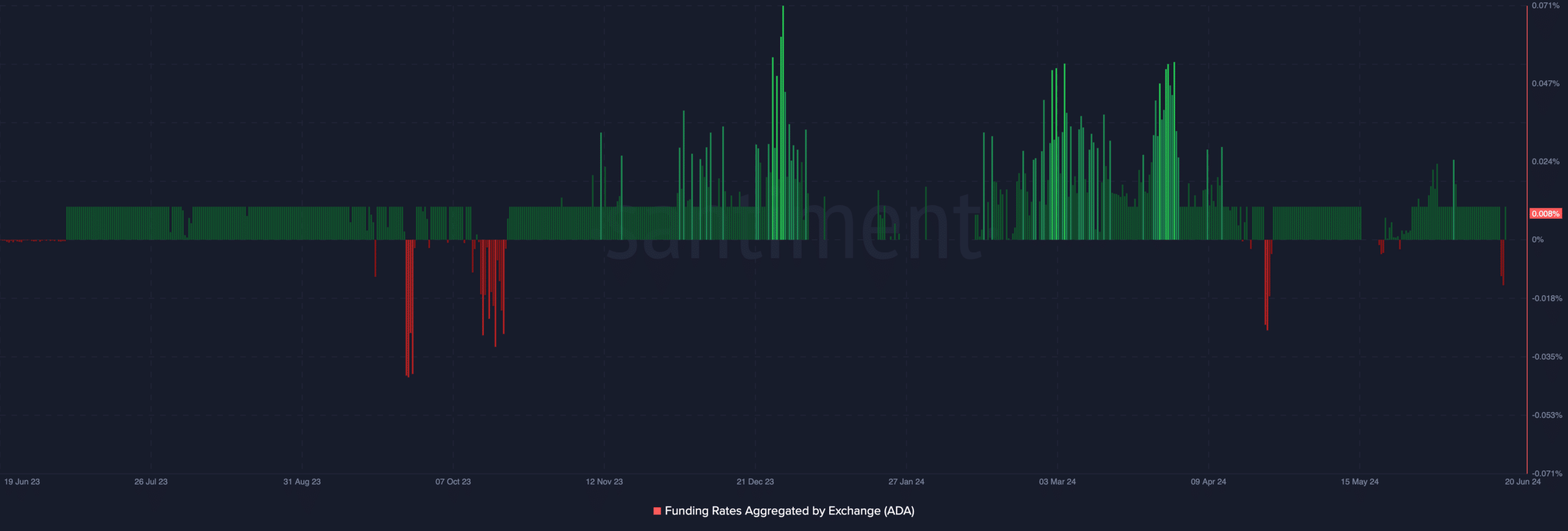

According to data from Santiment, on 19th June, ADA saw its most prominent shorting versus longing ratio since September 2023.

The coin closed that day with a funding rate of 0.0031%. Still negative at press time, ADA’s funding rate was 0.008%.

Funding rates are used in perpetual futures contracts to ensure the contract price stays close to the spot price.

When an asset’s funding rate is positive, its contract price is higher than its spot price, and more traders hold long positions.

Conversely, when an asset’s funding rate is negative, more traders are holding short positions. This means that more traders are expecting the asset’s price to fall than there are traders buying the asset with the expectation of selling at a higher price.

Long traders are victims

In a post on X, Santiment noted the surge in ADA’s short positions may come with a catch. According to the on-chain data provider,

“This is a good sign for patient bulls, as liquidated shorts can effectively act as ‘rocket fuel’ for continued price rises.”

However, this is yet to occur. So far, there have been more long liquidations than short ones as ADA’s price finds new lows.

In fact, on 18th June, ADA long liquidations totaled $2.86 million, its single-day highest since 13 April, according to Coinglass data.

In an asset’s derivatives market, trades are liquidated when a trader’s position is forcefully closed due to insufficient funds to maintain it.

Long liquidations happen when an asset’s value drops unexpectedly, forcing traders with open positions in favor of a price rally to exit.

ADA sellers in control of the market

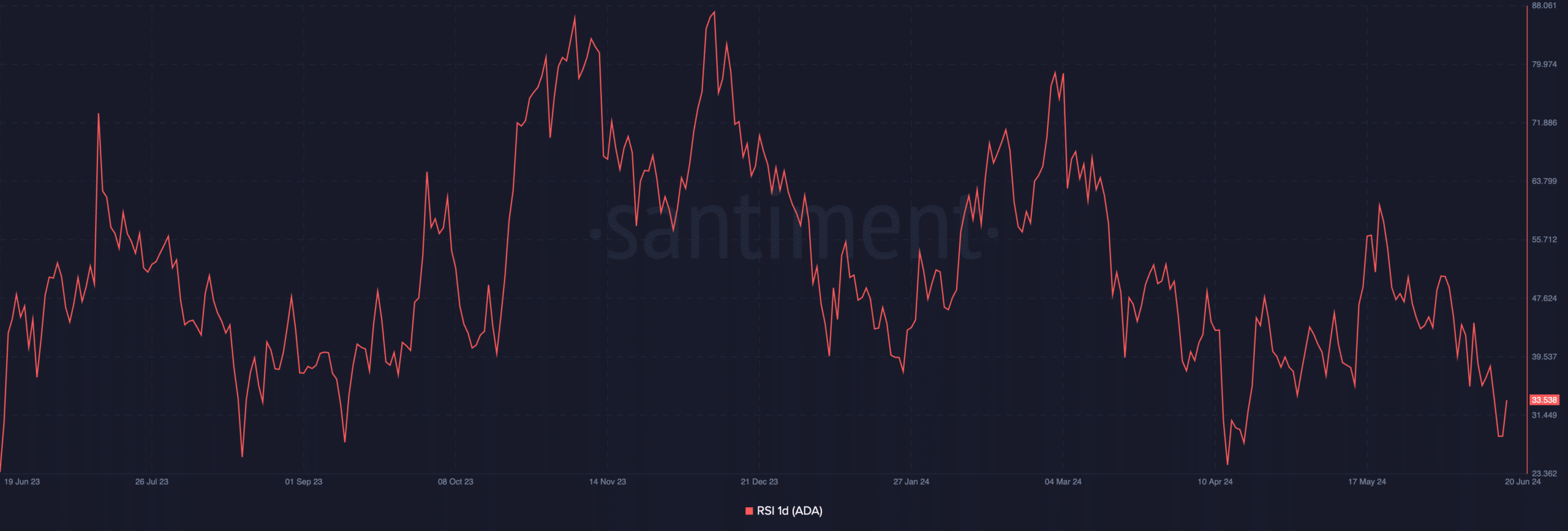

ADA’s price may continue to decline as demand for the altcoin continues to plummet. AMBCrypto assessed the coin’s Relative Strength Index (RSI) and spotted it at 33.53.

This key momentum indicator measures an asset’s overbought and oversold conditions by tracking its price changes.

It ranges from 0 to 100, with values above 70 indicating that the asset is overbought and likely due for a price correction. In contrast, values below 30 suggest that the asset is oversold and may soon experience a rebound.

Is your portfolio green? Check the Cardano Profit Calculator

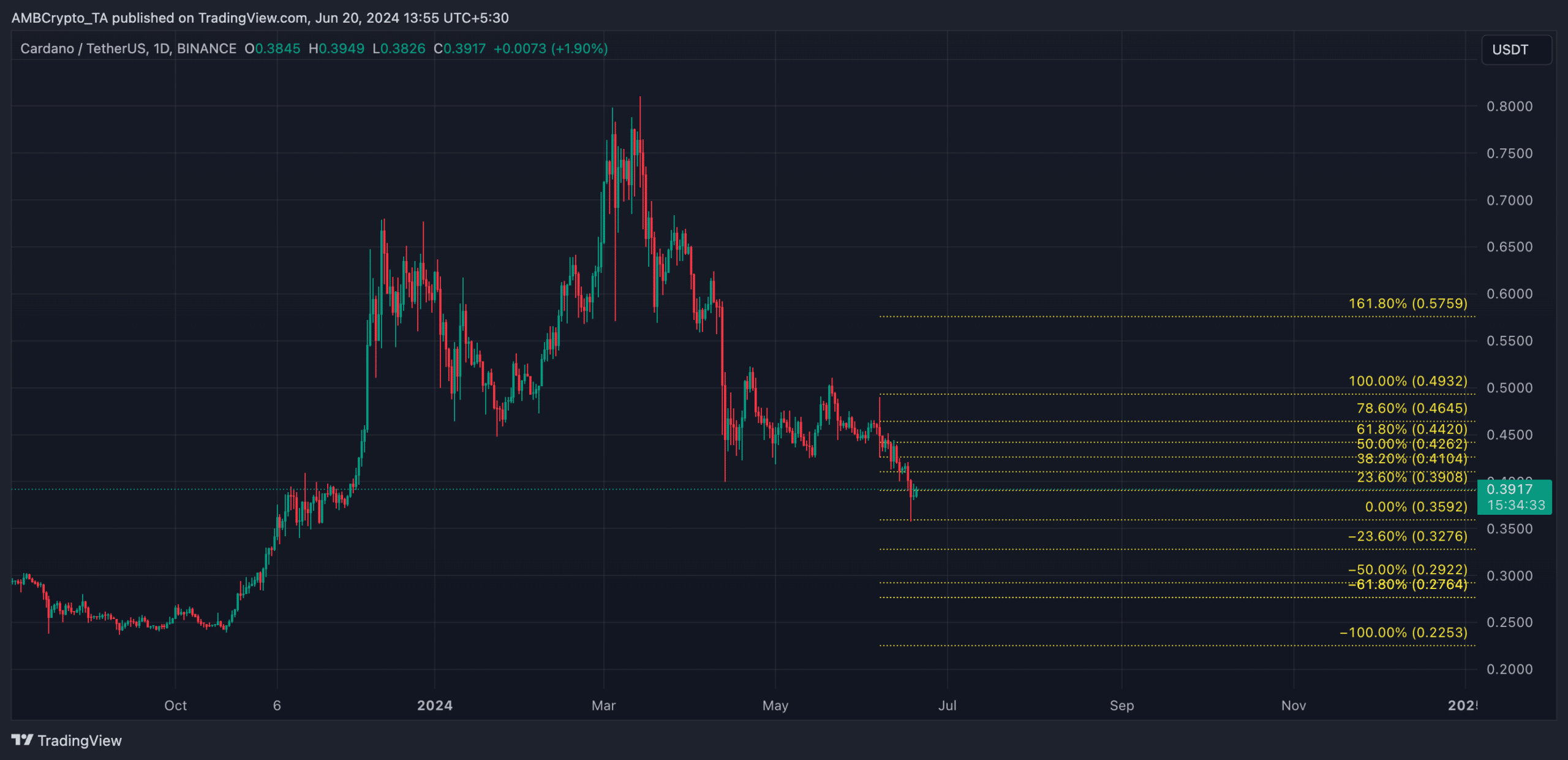

At 33.53, ADA’s RSI confirmed that selling pressure outpaced buying activity among market participants. If the downtrend persists, ADA may fall to exchange hands at 0.35.

This will be invalidated if bullish bias toward the coin skyrockets and demand climbs. Should this happen, the coin may rally to $0.41.