Can Cardano rebound from its April crash? Price chart suggests…

- Market sentiment around ADA continued to remain bearish.

- Apart from a bull pattern, a few of the metrics hinted at a price uptick

Cardano [ADA] disappointed investors over the last few months as the token fell victim to a major setback in April. However, there were chances for the trend to change in the coming days as a bullish pattern emerged on the token’s daily chart.

Cardano’s bloodbath

The month of April brought bad news for the token, as its price fell drastically on the 12th of that month. To be precise, the token shed more than 40% of its value during the crash.

Since then, the token hasn’t done enough to recover from that setback. AMBCrypto’s look at IntoTheBlock’s data revealed that more than 60% of investors were out of money, meaning that they were at a loss.

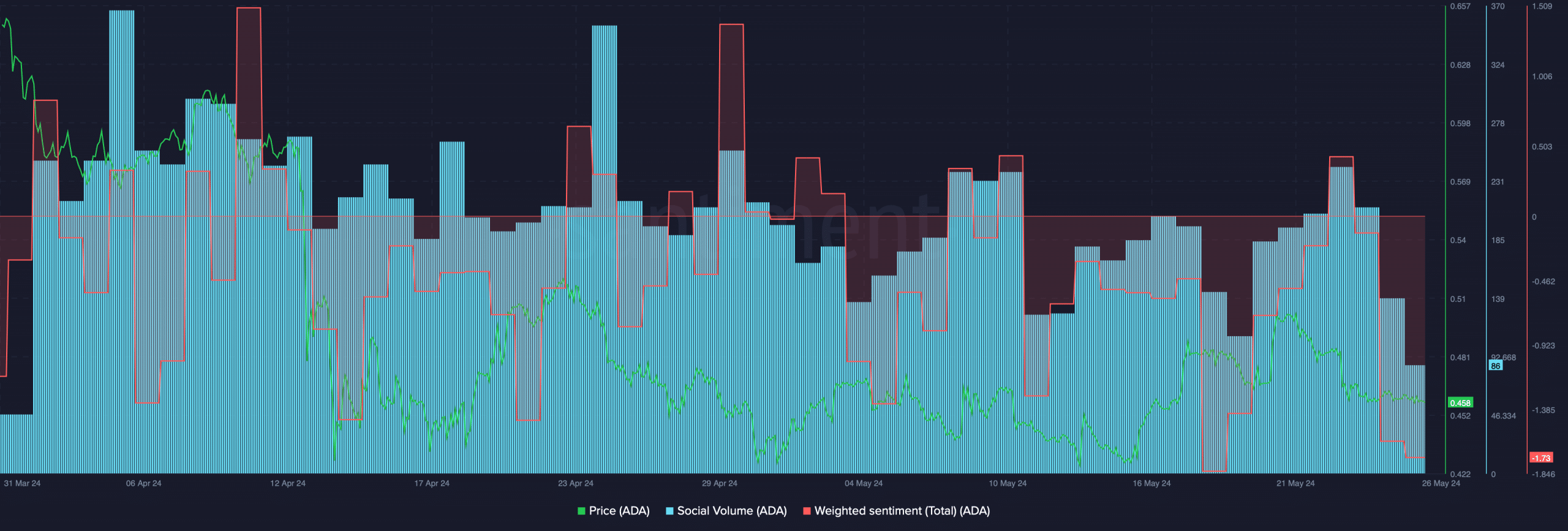

As its price crashed, people started to talk about ADA more, which was evident from the sharp rise in its social volume since April.

Its weighted sentiment mostly remained in the negative zone, suggesting that bearish sentiment around the token was dominant.

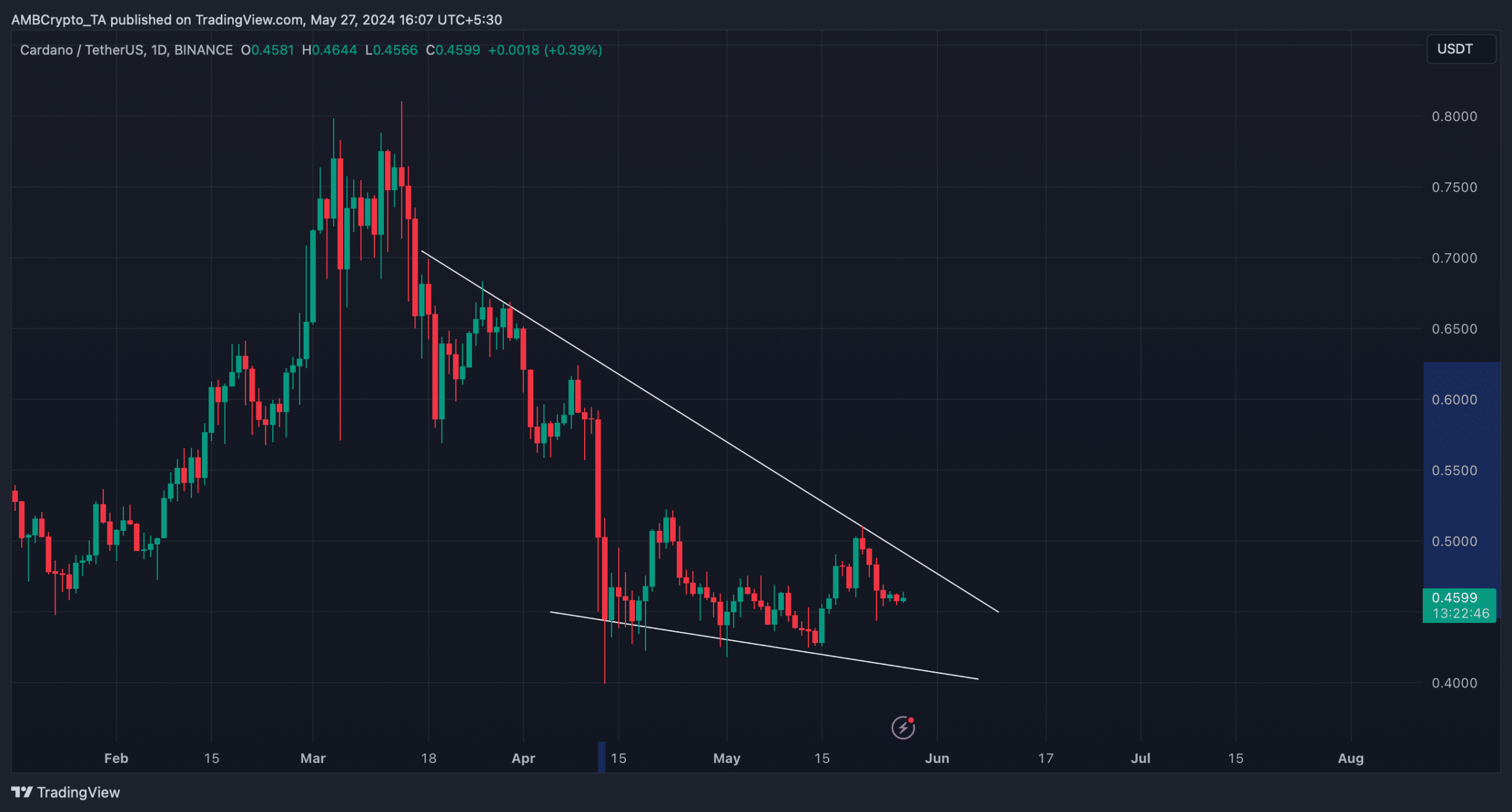

But the token’s daily chart gave hope for a recovery in the coming days as a bullish falling wedge pattern emerged on its daily chart. Since the price dropped, the token has consolidated inside the pattern.

At press time, it was close to making an exit from the pattern, which can result in a full-fledged recovery soon.

Is Cardano’s recovery possible?

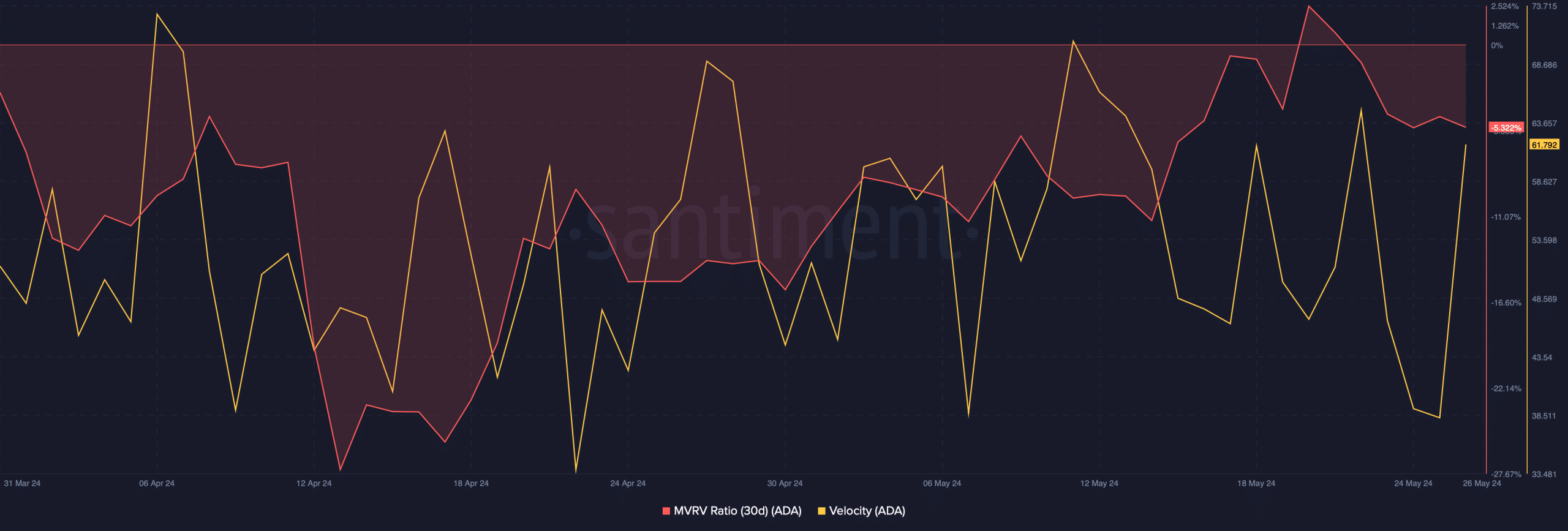

AMBCrypto then analyzed ADA’s on-chain metrics to see whether they supported the possibility of a recovery. We found that the token’s MVRV ratio dipped sharply after the price crash.

But over the next few weeks, the metric improved, hinting at a potential rally in the coming days. Additionally, ADA’s velocity also remained high.

This meant that ADA was more often used in transactions within a set timeframe.

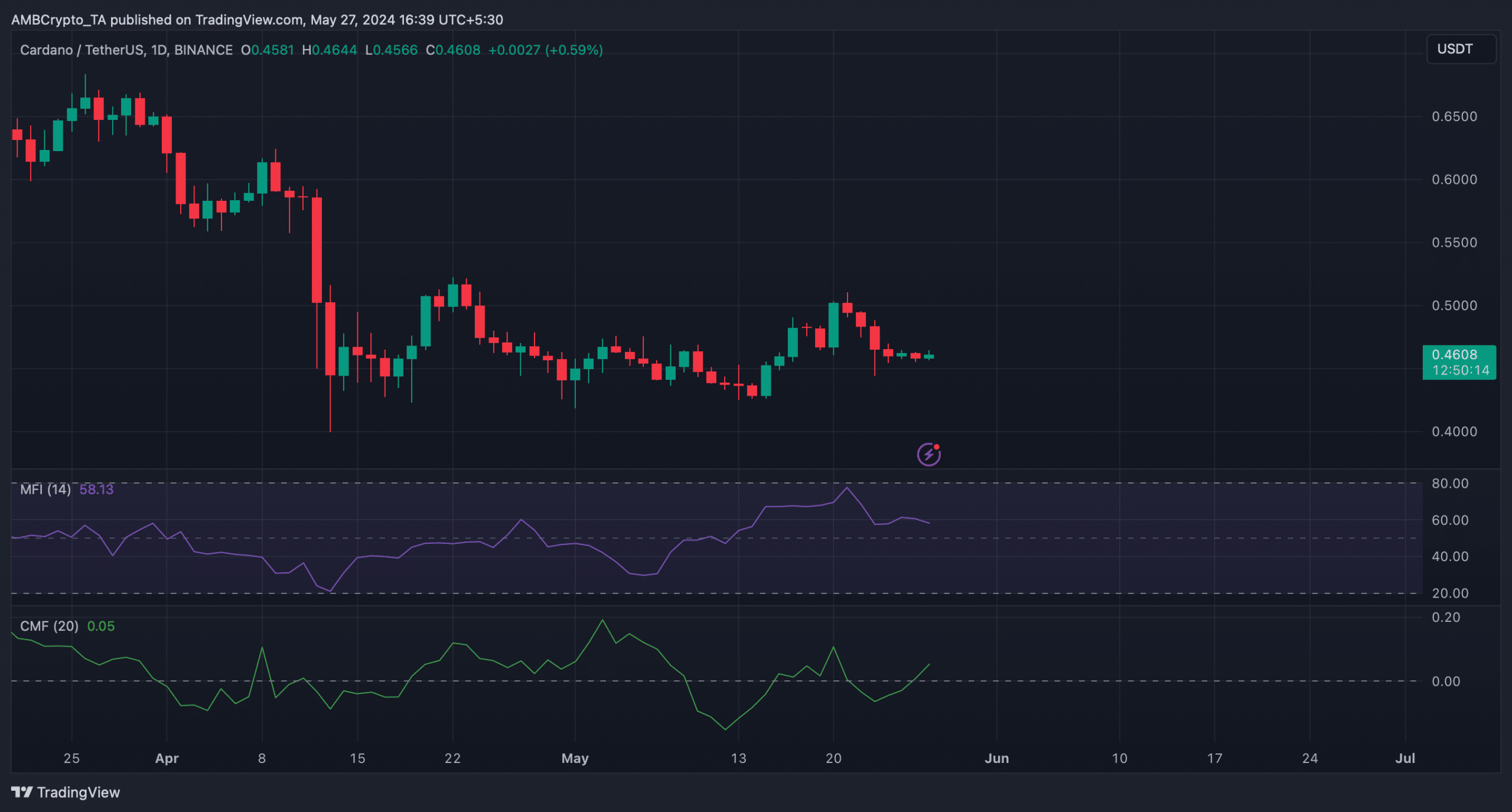

Since metrics looked bullish, AMBCrypto checked Cardano’s daily chart to see whether technical indicators also hinted at a bull rally. We found that the Chaikin Money Flow (CMF) registered a promising uptick.

This indicated that the chances of a price uptick were high. Nonetheless, the Relative Strength Index (RSI) followed the other route, which can restrict ADA from moving up.

If ADA’s price gains bullish momentum in the coming days, it would be crucial for the token to go above $0.467 as liquidation would rise sharply.

Realistic or not, here’s ADA’s market cap in BTC terms

A hike in liquidation often results in price corrections.

A successful breakout above the mark would allow ADA to touch $0.5, which would be the first step towards a complete recovery. At press time, ADA was trading at $0.4609 with a market capitalization of over $16 billion.