Bitcoin’s May prediction – Is $70,000 a real certainty or is…

- Bitcoin’s slip below its STH Realized Price might capitulate the price to $53,000.

- Maintaining support at $69,178 may drive BTC to $92,237.

Bitcoin [BTC] is set to end the month with a negative price return for the first time since the year began. According to data from CoinMarketCap, Bitcoin’s price was $63,431 at press time. On average, this represents a 9.71% decrease in the last 30 days.

As May approaches, there have been questions if the coin would recover from this decline. While some analysts suggested respite, others painted a gloomy picture for BTC.

But hearsay and personal opinion won’t do the work. That is why AMBCrypto looked at some crucial metrics that could muck or nettle the coin price next month.

Beware! Conviction is not reality

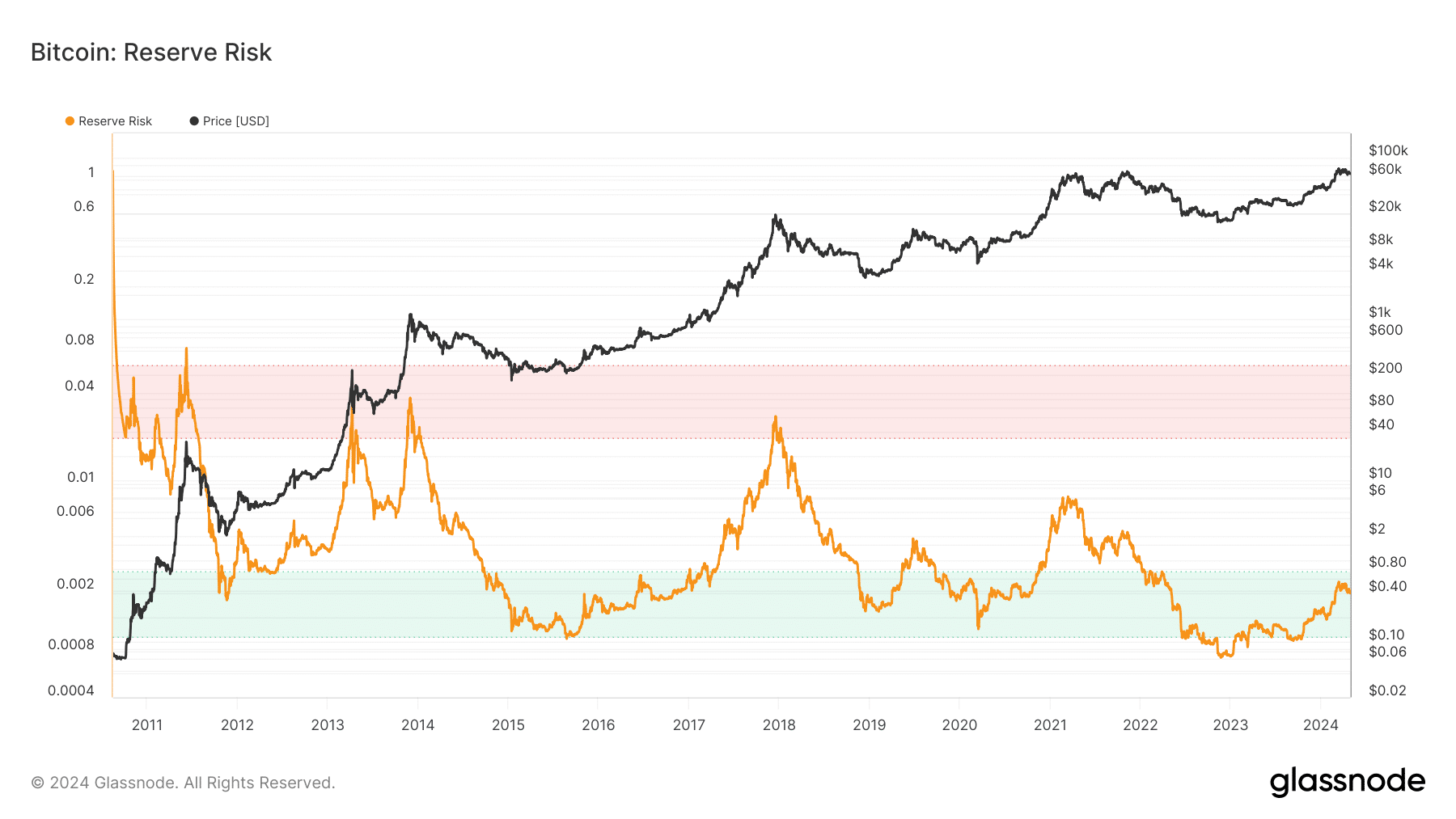

First on the list is the Reserve Risk. provided by on-chain analytic platform Glassnode. This metric measures the confidence of long-term investors relative to the price.

If the price is high and confidence is low, it means Bitcoin might not offer a great risk to reward. On the other hand, a declining value and rising confidence suggest that the price could have a chance of appreciating.

At press time, the Reserve Risk was 0.002, indicating that holders were confident in the price of BTC. Also, since the price decrease in the last 30 days, it could be a signal to start accumulating before the next leg up.

Should accumulation increase, BTC might head toward $70,000, and this could put bears in an unfavorable spot. Another metric to look at is the Short Term Holder (STH) Realized Price.

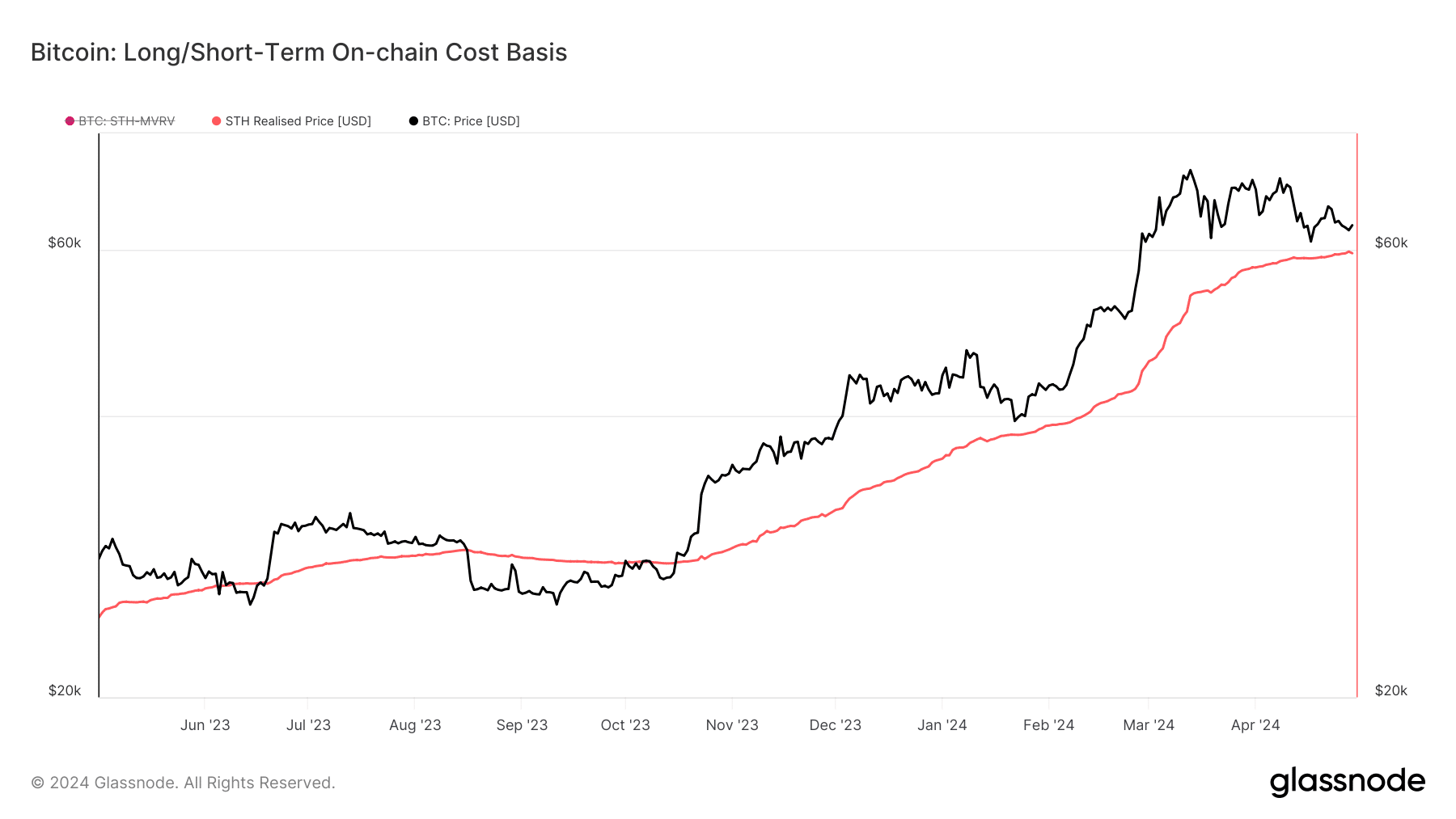

For context, the Realized Price is the average cost of purchasing BTC on-chain. If the spot price of Bitcoin falls below the STH Realized price, it could mean the coin has hit a local top.

Has the path to $92,237 begun?

If BTC’s value stays above it, a further uptrend could be in the works. As of this writing, the STH Realized Price was $59,586. Should Bitcoin drop below this level, then the spot value might slip as low as $53,000.

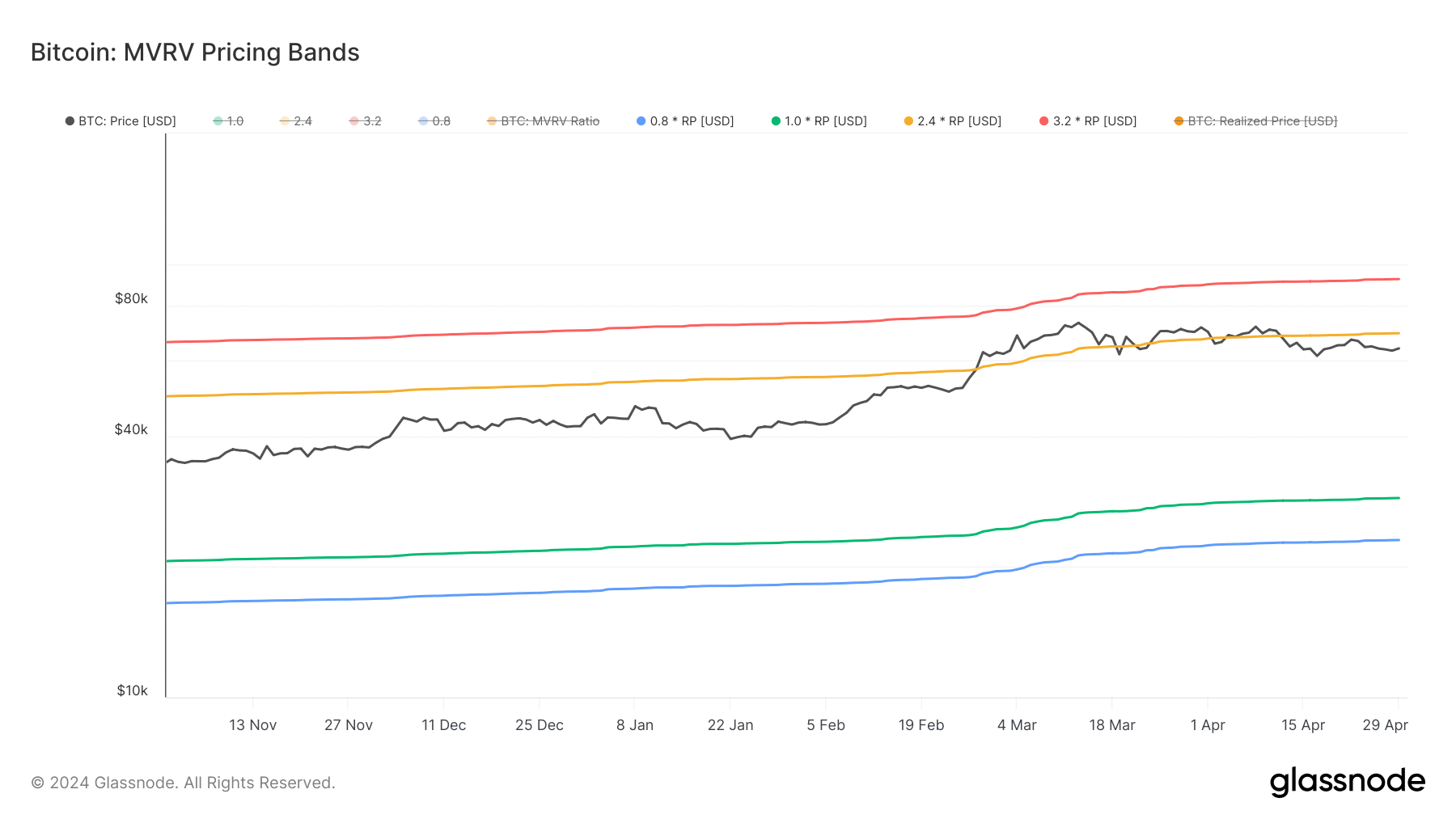

However, we can also evaluate the price Bitcoin needs to reach to avoid capitulation. This was why we assessed the MVRV Pricing Bands. MVRV stands for Market Value to Realized Value.

With the price model, investors can estimate possible cycle tops and bottoms. As of this writing, the MVRV Pricing Bands showed that a Realized Price of $69,178 could send the value to $92,237.

But that prediction could be for the long term. In the short term, bulls have to come to BTC’s rescue as selling pressure has been intense of late.

Read Bitcoin’s [BTC] Price Prediction 2024-2025

Should a surge in accumulation come in, then a drop below $59,586 might not happen.

Instead, the value of the coin might climb past $69,000, and this could validate a rise past $73,000 before the end of May.