Bitcoin: ‘Quite confident’ whales with ‘most pull’ have this price prediction

- BTC whales that hold between 100 and 100,000 BTCs have accumulated significantly in the past three months

- Despite recent price troubles, bullish sentiment continues to grow

According to Santiment, Bitcoin [BTC] whale addresses holding between 100 and 100,000 coins have acquired a total of 319,310 BTCs (worth around $22 billion at current market prices) over the past three months.

?↗️ #Bitcoin's key stakeholders with 100-100K $BTC have ACCUMULATED a collective 319,310 $BTC (around 1.4% of the supply) in the past 3 months. Many of these coins came from 0-100 $BTC wallets, which have DUMPED 105,260 $BTC (-0.7% of supply) in 3 months. https://t.co/6KKFgZzrPz… pic.twitter.com/kXyQrOIRGA

— Santiment (@santimentfeed) April 5, 2024

According to the on-chain data provider, most of these coins have come from wallets holding between zero and 100 BTCs. This cohort of BTC investors distributed around 105,260 BTCs from their holdings over the 90-day period.

16,000 addresses held 100 and 100,000 BTCs at press time, controlling 57% of the coin’s circulating supply. On the other hand, BTC addresses that held between zero and 100 coins totalled 52 million. These addresses held 40% of BTC’s circulating supply, at the time of writing.

Bullish in the face of adversity

Here, it’s worth noting that Santiment went on to add that coin acquisition by its key holders over the past three months “is a bullish sign for Bitcoin and all of crypto, considering the wallets with the most pull to move markets are appearing quite confident in Bitcoin’s future value.”

Coin accumulation from this category of BTC investors has occurred despite its recent headwinds and the significant resistance faced at the $70,000-price level. In fact, BTC was trading at $68,026, at the time of writing, logging a 3% price decline over the last seven days.

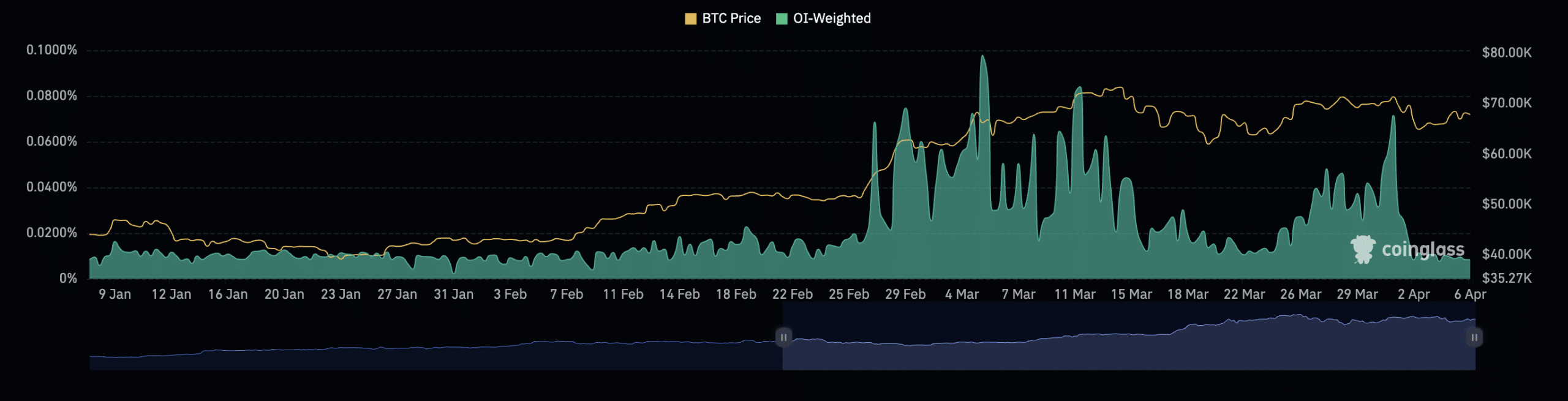

An assessment of the coin’s funding rates across cryptocurrency exchanges confirmed the market’s confidence that Bitcoin would break resistance and reclaim its all-time high of $73,750 soon.

Read Bitcoin’s [BTC] Price Prediction 2024-25

Funding rates are a mechanism used in perpetual futures contracts to ensure the contract price stays close to the spot price.

If an asset’s contract price is higher than its spot price, traders who hold long positions pay a fee to traders shorting the asset. Funding rates return positive values whenever this happens. When an asset’s funding rate is positive, more traders are holding long positions. This means that more traders are expecting the asset’s price to rise than there are traders anticipating a decline.

At press time, Coinglass data revealed that BTC’s funding rate was 0.0084%.

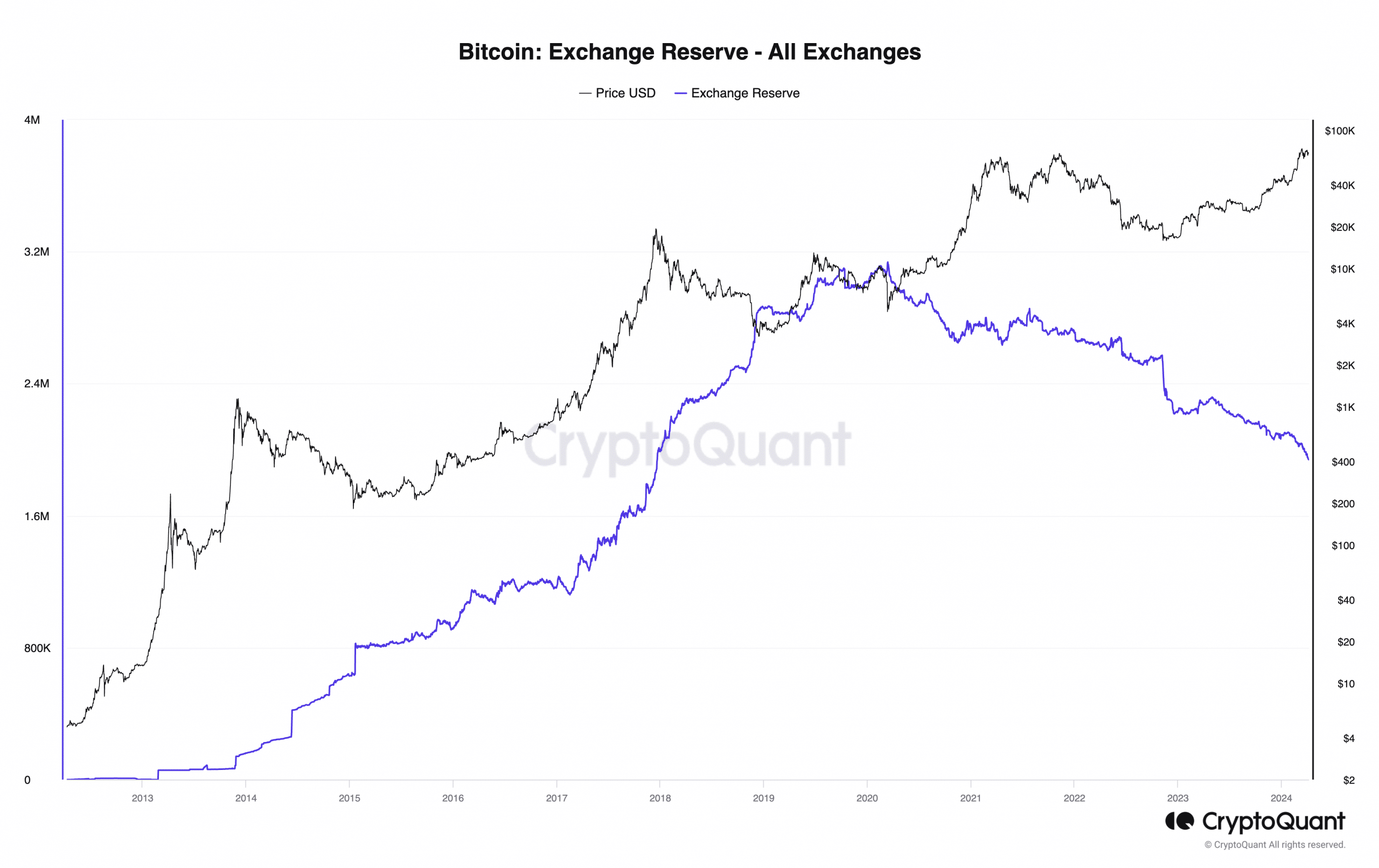

Although BTC witnessed significant profit-taking activity when it rallied to a new all-time high on 14 March, the year so far has been marked by a steady decline in the cryptocurrency’s exchange reserve.

With a reserve of 2 million coins, the total number of BTC held across exchanges has plummeted to its lowest since 2018. In fact, this year alone, the coin’s exchange reserve has fallen by over 30%, according to CryptoQuant’s data.

The steady decline in exchange reserves is a sign of decline in selling pressure. With Bitcoin facing significant resistance at $70,000, many holders remain confident that it will reclaim its all-time high.