Bitcoin miners pivot to AI: New revenue stream post-halving?

- Bitcoin miners are embracing AI as alternative revenues amidst a decline in mining income.

- Possible miner capitulations flash a BTC buy signal as spikes in Hash Ribbons persist.

More Bitcoin [BTC] miners, like Core Scientific, are massively diversifying into AI (artificial intelligence) to boost the revenue streams after April’s halving event.

April’s BTC halving event reduced miners’ block rewards from 6.25 BTC to 3.125 BTC, slashing their revenue by half.

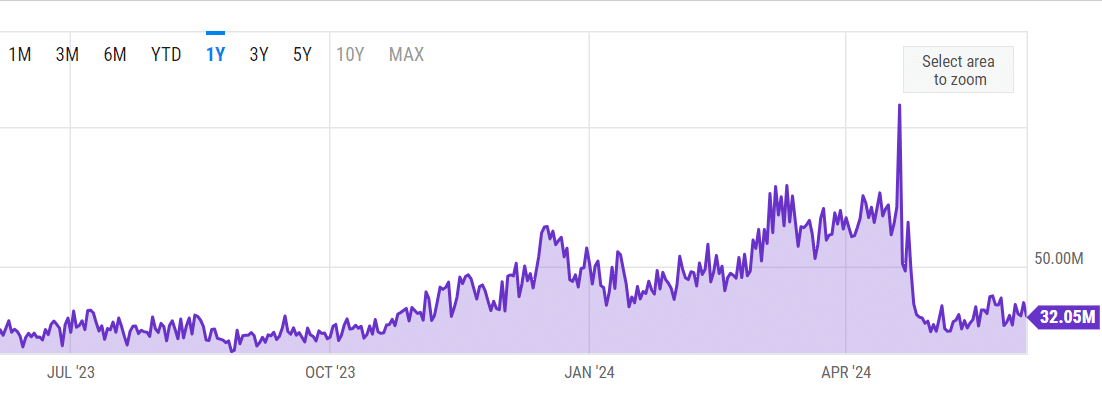

As of 5th June, Bitcoin Miner Revenue per day stood at $30.05 million. This was down over 70% from the record high of $107 million hit on April’s 2024 halving day, per YCharts.

AI to solve Bitcoin miners’ revenue problems?

However, according to a recent CNBC report, miners are now shifting their focus to AI computing for its higher rewards and increasing demand following the successful ChatGPT AI model from OpenAI.

Per the report, Bit Digital now gets 27% of its revenue from AI. Hut 8, another BTC miner, and Hive generated 6% and 4%, respectively, of their revenue from AI.

According to Core Scientific CEO Adam Sullivan, the shift to AI will help create,

‘Diversified business model and more predictable cash flows.’

The AI diversification could be a welcome relief given the reported miner capitulations.

Are some Bitcoin miners exiting?

In mid-May, an AMBCrypto report found that Bitcoin’s network hashrate dropped significantly, alongside possible miner capitulations amidst spikes in Bitcoin Hash Ribbons.

Hash Ribbons track short and long-term moving averages of Bitcoin’s hashrate. Spikes in the metric demonstrate low mining activity or exit of less efficient Bitcoin miners.

The Hash Ribbons signal has persisted, and crypto hedge fund Capriole Investments referred to the latest flash as a ‘tempting Bitocin buy signal.’

‘Hash Ribbons is back. Perhaps the best long-term Bitcoin buy signal there is, Hash Ribbons is now tempting us with the current Miner Capitulation, which started two weeks ago.’

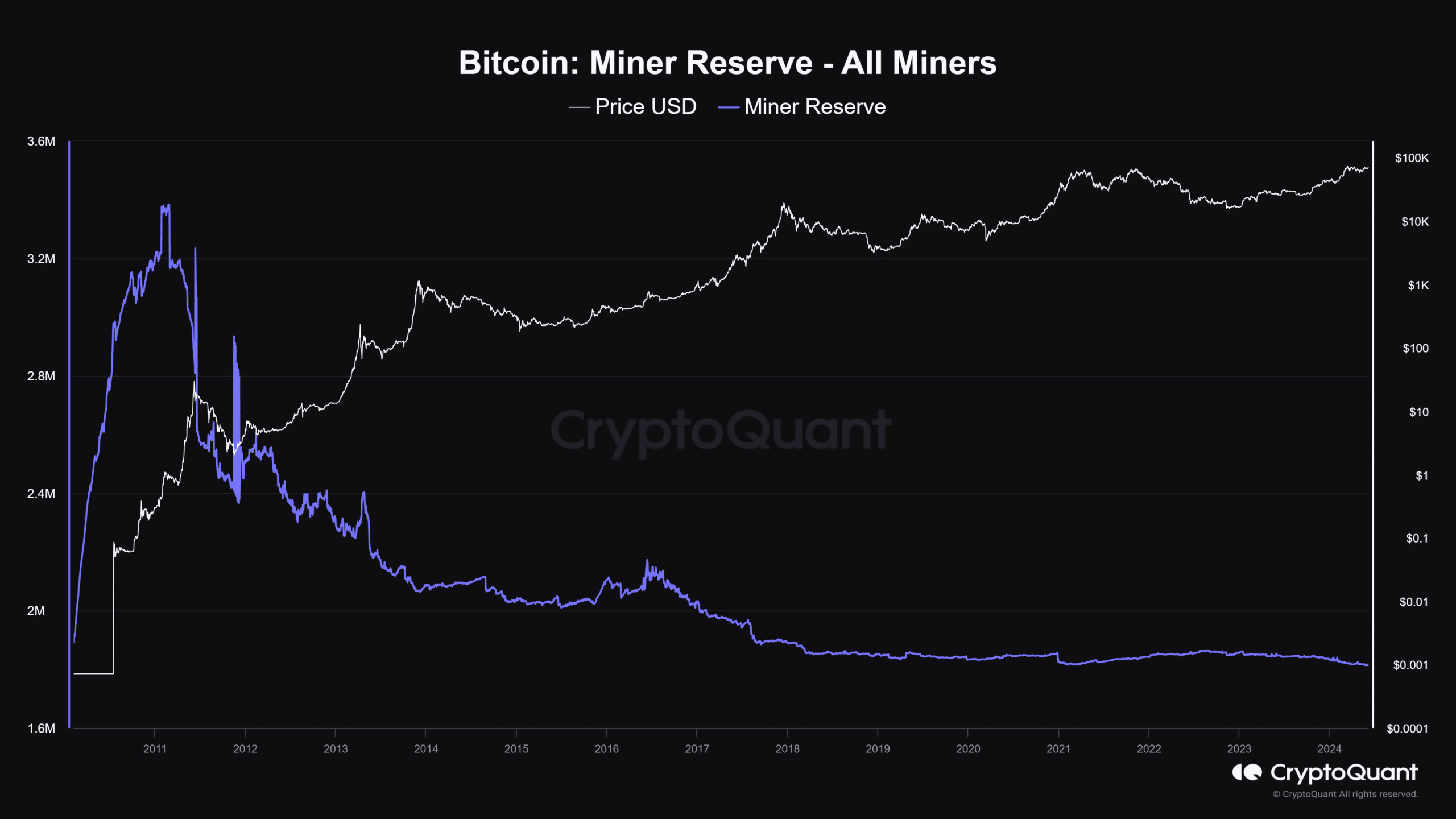

Additionally, the Bitcoin miner reserve hit its yearly low of 1.8 million BTC. The low level was last seen 14 years ago and suggested that miners were offloading their holdings, probably through OTC (over-the-counter) markets.

Perhaps another piece that corroborated the Hash Ribbons’ ‘buy signal’ was Willy Woo’s claim that institutional traders were ‘risk-on’ and have pivoted to buying. Should you copy professionals or wait for a range breakout to jump in?