Bitcoin and Nasdaq: Latest trend in market correlation

- Bitcoin and Nasdaq’s decoupling stopped as BTC’s value surged.

- BTC’s funding rate remained positive as it traded around $30,700.

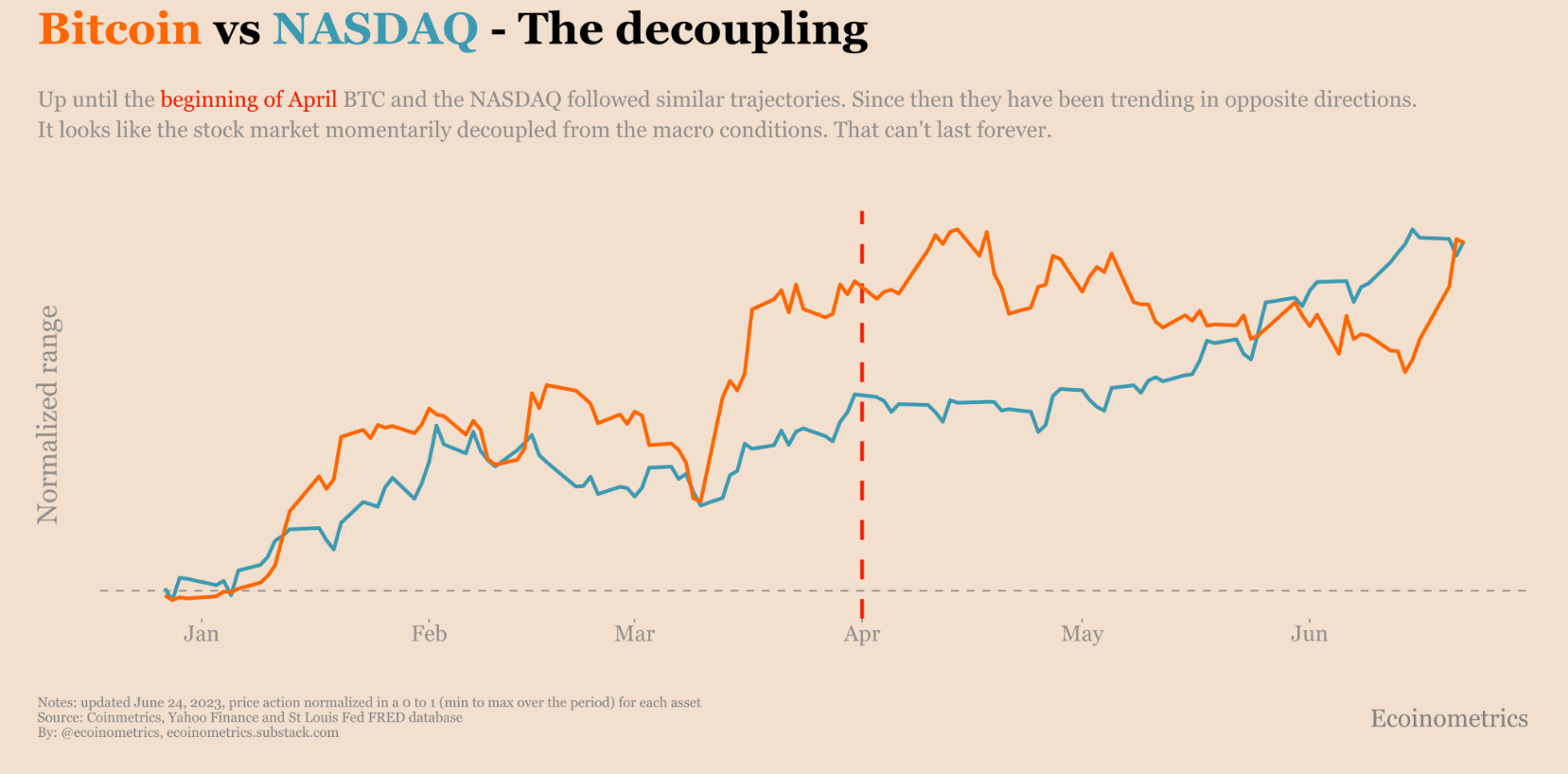

Intriguing data by Ecoinometrics revealed an emerging correlation between Bitcoin [BTC] and Nasdaq. This new pattern captivated observers, shedding light on BTC’s overall trajectory and sentiment among traders.

Read Bitcoin’s [BTC] Price Prediction 2023-24

Bitcoin, Nasdaq correlation

Bitcoin’s price correlation with traditional stocks has served as a valuable tool for investors in constructing their investment portfolios. Moreover, BTC has emerged as the benchmark against which traditional stocks are measured.

A recent analysis conducted by Ecoinometrics highlighted a noteworthy phenomenon: the price trends of BTC and Nasdaq have recently become intertwined.

The chart revealed a period of decoupling between BTC and Nasdaq from around April to June. Before this period, BTC and traditional stock prices exhibited a similar trajectory.

However, the present surge in BTC’s price, fueled by recent developments juxtaposed with the bearish sentiment plaguing stocks, has enabled BTC to bridge the gap and catch up to Nasdaq.

Surges and sentiments

The recent surge in applications for a Bitcoin ETF by various financial institutions has sparked a notable increase in the social buzz surrounding the king coin over the past few days.

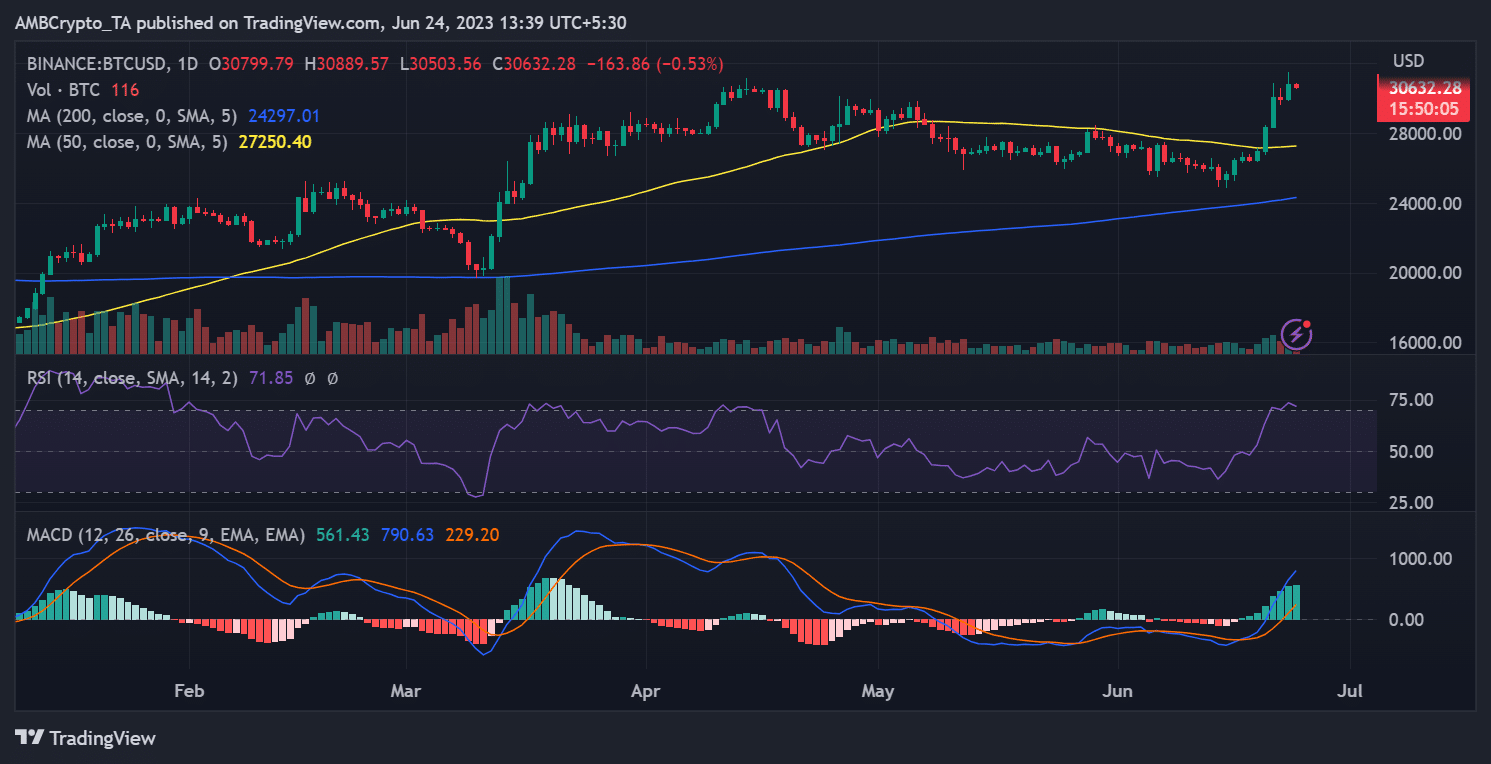

Upon analyzing the daily price trend, it became evident that BTC had experienced a significant uptick in value since the news broke.

As of this writing, BTC was trading at approximately $30,700, albeit with a slight decline in value. However, it concluded the previous trading session with a 3% increase.

The bull trend was unmistakably dominant, as exemplified by the Relative Strength Index (RSI) line residing in the overbought zone. Furthermore, the upward trajectory engendered a more positive sentiment among traders.

According to the Funding Rate chart provided by CoinGlass, BTC witnessed a surge in positive funding rates across most exchanges. As of this writing, the funding rate remained positive, indicating a collective wager on further price escalation beyond the current range.

With the entrance of different traditional financial institutions vying for BTC ETF licenses, the price of BTC is poised to continue its ascent until a correction phase materializes.

BTC’s 30-day MVRV

The ongoing price trend of BTC presented a favorable outlook for short-term holders who entered the market before the inception of this trend. According to Santiment’s 30-day Market Value to Realized Value (MVRV) metric, BTC had surpassed the zero mark.

How much are 1,10,100 BTCs worth today?

This indicated a noteworthy shift toward profitability. As of this writing, the MVRV stood at over 12%, signifying substantial gains for those holding positions within that timeframe.

Moreover, considering the press time state of the 30-day MVRV and BTC’s position within the overbought zone, it is reasonable to anticipate a potential correction.