Base helps Uniswap cross major landmark – But why is UNI declining?

- Active traders on Uniswap grew in notable numbers because of Base’s influence.

- Both TVL decreased, with indicator suggesting a decline in UNI’s price.

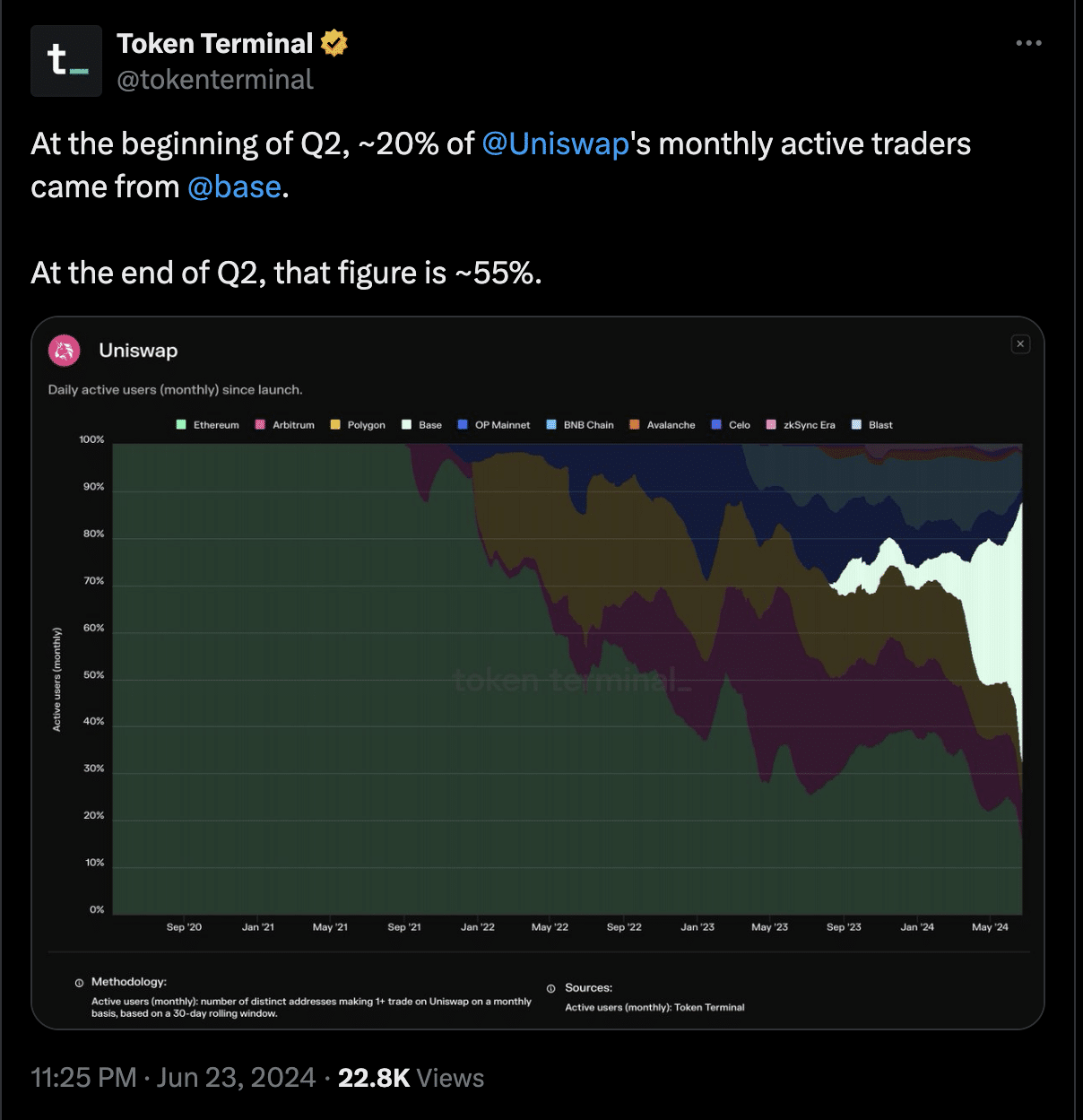

Base, the layer-2 blockchain has helped Uniswap [UNI] achieve a milestone for the second time in a row. According to Token Terminal, the growth in the number of monthly active users on the protocol could be attributed to Base.

At the beginning of the year’s second quarter (Q2), Uniswap monthly active traders grew by 20%. At that time, Base had a big influence. With Q2 nearing its end, the metric had increased to 55%, all thanks to the chain again.

Base tokens have an influence, but all is not well

Uniswap was deployed on the network in August 2023. This made it easier for traders to interact with tokens built on the L2.

Recently, BRETT, a memecoin on Base, hit a new all-time high with a lot of volume going through decentralized exchanges.

Since Uniswap is the top DEX on Ethereum, it means that participation with BRETT and some other “Based” tokens influenced the hike.

However, it remains uncertain if Uniswap would continue to experience growth in this regard. This is because of the hawkish broader market conditions.

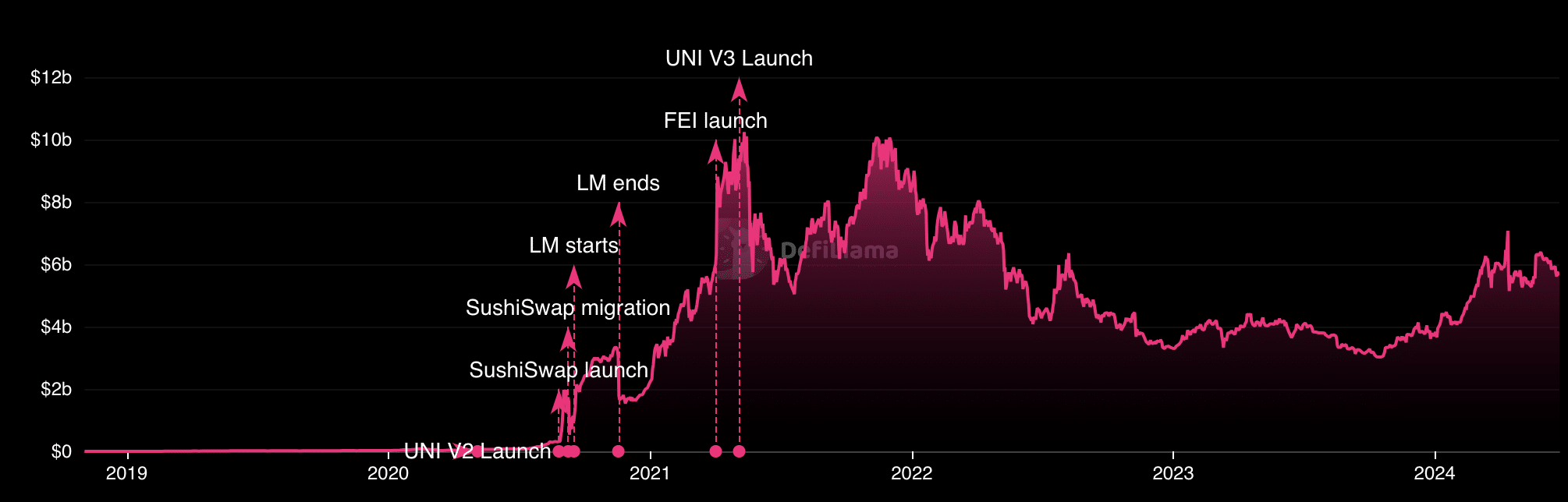

Despite the landmark, Uniswap’s Total Value Locked (TVL) has decreased by 11.68%. TVL measures the total value of assets locked or staked in a protocol.

The higher the TVL, the more trustworthy market participants trust a platform. Conversely, when the TVL decreases, it means participants have resolved to taking out liquidity initially deposited.

At press time, DeFiLlama showed that Uniswap’s TVL was $5.58 billion. This represented an 11.38% decrease in the last 30 days, indicating that market participants were unconvinced about the yield the protocol would bring.

UNI’s price to drop below $9?

For Base, the TVL was $1.55 billion, representing a 9.81% decrease within the last month. Should activity and liquidity on Base continue to fall, Uniswap might find it challenging to hold on to the growth.

However, if Base’s TVL begins to jump, the activity on the protocol might reach higher levels in Q3.

Furthermore, UNI’s price changed hands at $9.12— a 9.07% decline in the last 24 hours. However, it could be challenging for UNI to erase some of these losses, on-chain data showed.

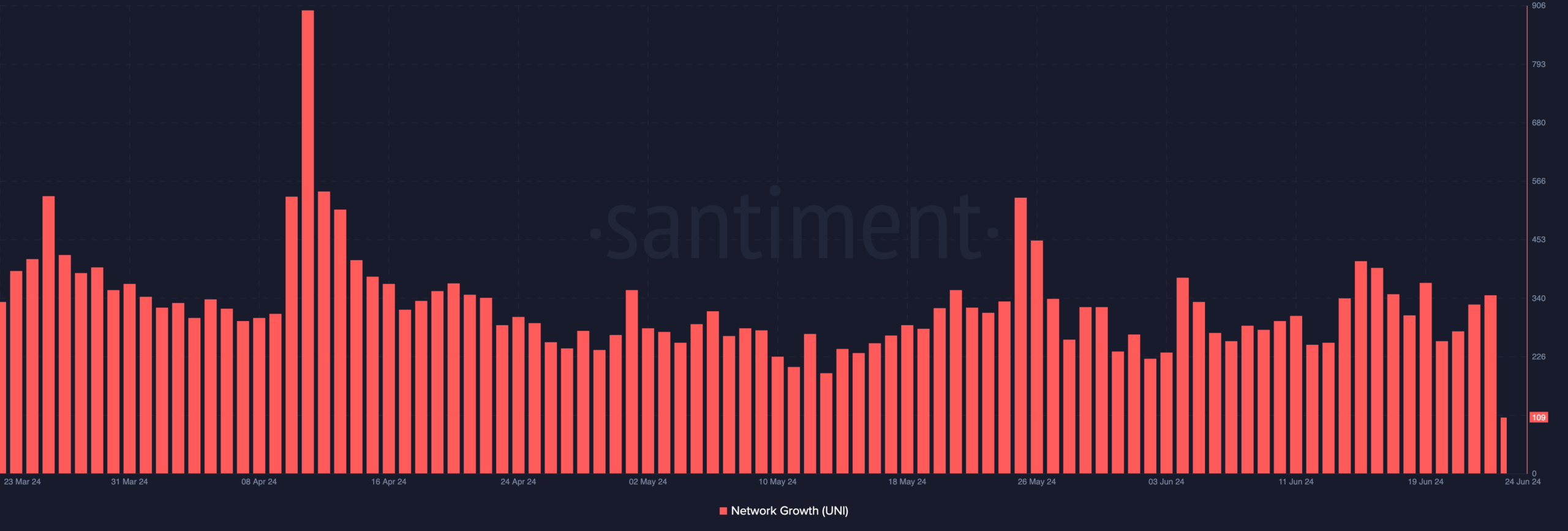

One metric sharing this sentiment is Network Growth. This metric tracks the number of new addresses making their first transaction on a network.

When it increases, it means a cryptocurrency is gaining adoption. On the other hand, a decline implies a lack of traction. As such, this leads to low demand.

Realistic or not, here’s UNI’s market cap in ETH terms

At press time, Uniswap’s Network Growth was down to 109. Should this metric continue to fall, then UNI’s price might do the same.

However, in the event that traction on Base improves, Uniswap and its governance token might record notable hikes.