AVAX’s defense of $36 – Is a dip next for altcoin’s price?

- Avalanche has lackluster capital inflows and signaled bearish momentum in the one-day timeframe.

- The range formation’s mid-level support at $36 needs to be defended, but the bulls could fail at this task.

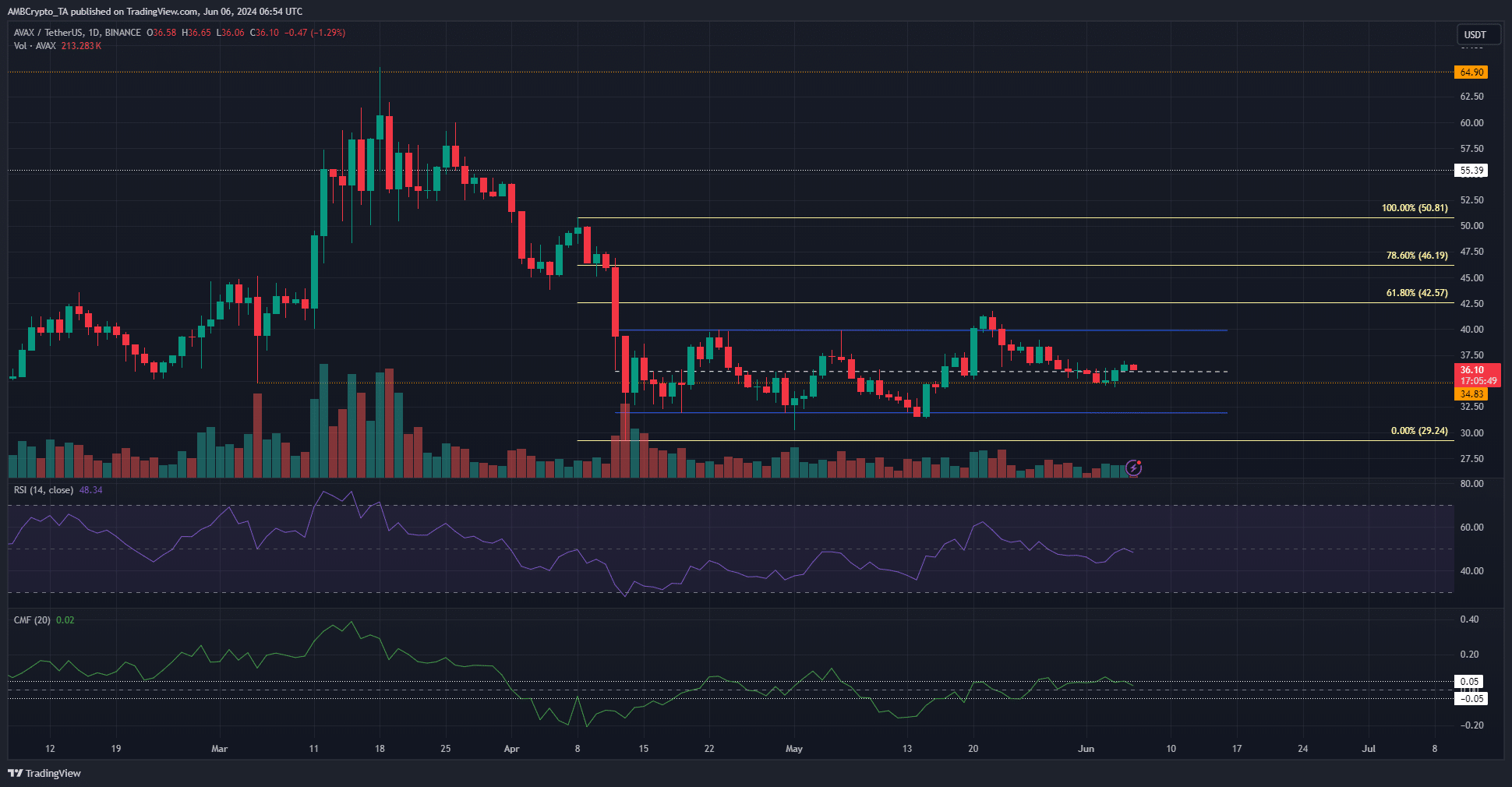

Avalanche [AVAX] continued to trade within the range formation that was highlighted in an earlier AMBCrypto report. The futures traders were not eager to go long, and the trading volume was subdued.

It was a similar case at press time. Not too much has changed. Even though Bitcoin [BTC] managed to climb past the $70k level, AVAX bears remained resolute. Here’s what traders can anticipate for the coming week.

Examining Monday’s range

The price action of 20th June, Monday, saw the high and low at $36.27 and $34.56 respectively. Sometimes, the week’s trading is confined within the Monday’s low and high, forming a short-term range.

While Avalanche traded within a two-month range, in the short-term, it has some bullish momentum. It climbed above the Monday’s high on Wednesday, and at press time the bulls were defending the mid-range level at $36 as support.

However, this momentum might die out quickly. The RSI on the daily chart was still below neutral 50, and the CMF showed an unconvincing capital inflow to the AVAX market. Short sellers could scour the lower timeframes for entries that suit their system, as the higher timeframe bias was bearish.

What clues do the liquidation levels yield?

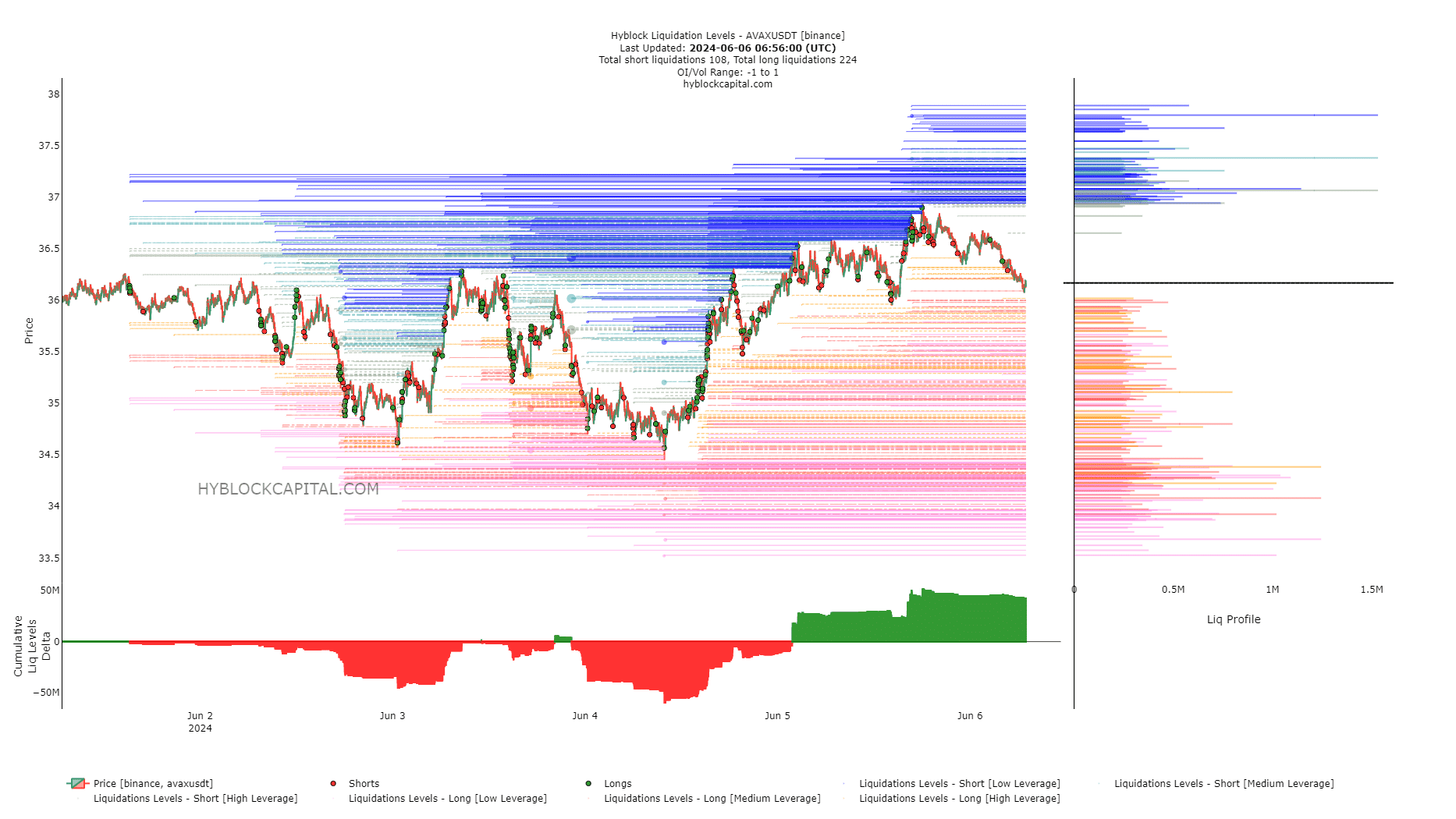

Source: Hyblock

The cumulative liq levels delta was positive, and high enough that it might warrant a liquidity hunt northward. The long liquidations outweigh the short ones, which meant a price bounce to liquidate these traders could occur.

Read Avalanche’s [AVAX] Price Prediction 2024-25

The cluster of liquidity at $37.06 might be a good short-term target. Scalp traders could use this bounce to enter short positions around the $37 level seeking a move toward $34.5 or lower.

Meanwhile, swing traders and investors can wait for a retest of the $30-$32 region to re-enter. Alternatively, a breakout past the range highs at $40 could be viable, but it would need to be a strong breakout which might not yield an immediate, comfortable pullback.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.