AVAX price prediction – What are the chances of further losses for traders?

- AVAX has traded within a range over the past six weeks

- Momentum and volume were in favor of the sellers at press time

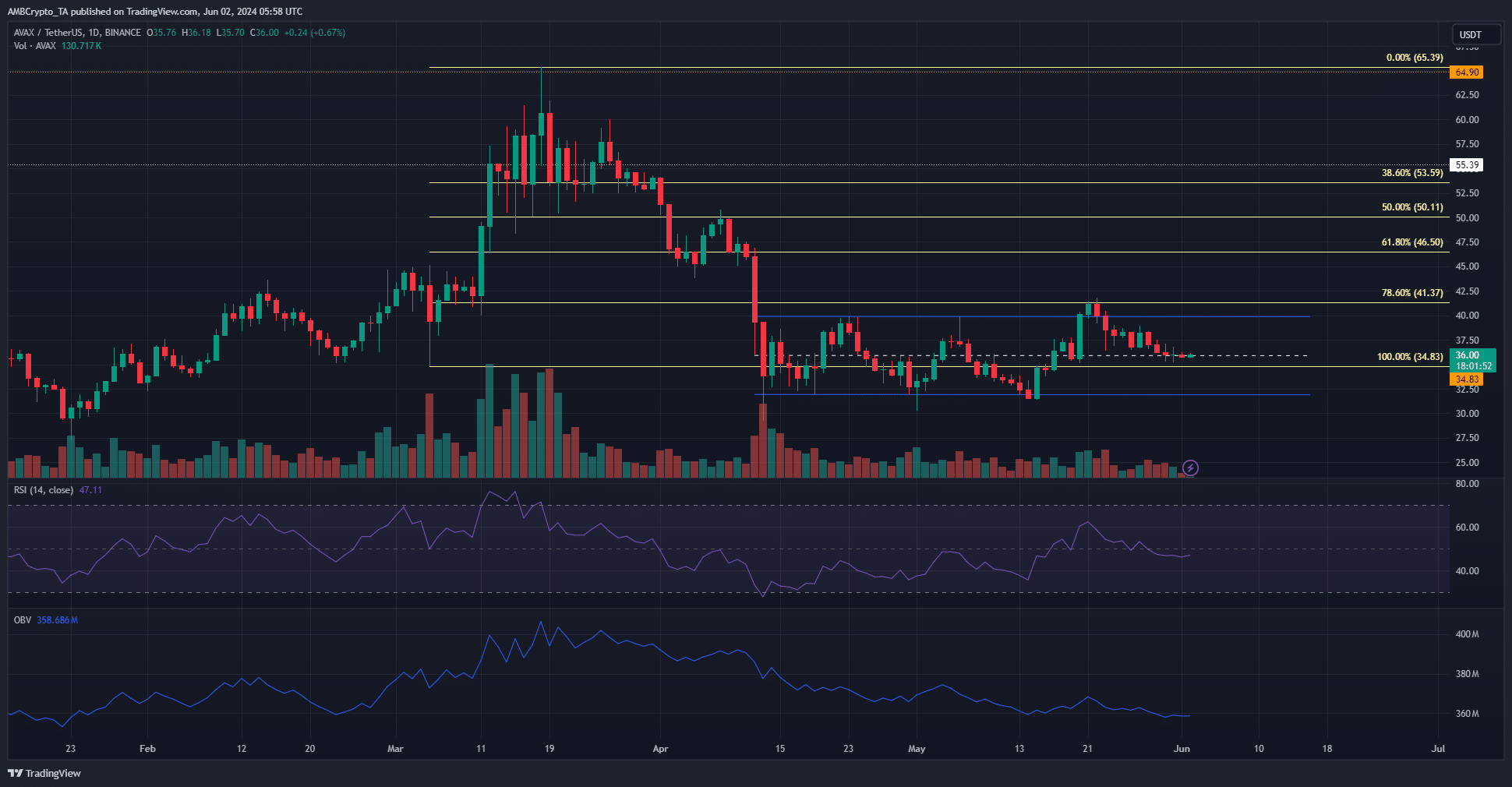

Avalanche [AVAX], at the time of writing, seemed to be in a consolidation phase, with a previous AMBCrypto report highlighting its lack of momentum and declining social media engagement too. Owing to the same, the altcoin was trading around its $36 support level.

In fact, the technical indicators didn’t suggest an AVAX rally could be coming soon. A move south towards $30 seemed more likely, given the selling pressure of the past six weeks.

Range formation still in play

Since mid-April, AVAX has traded within a range that stretched from $39.9 to $36.1. The dotted white line at $35.9 represented the mid-range level and it is a significant short-term level. The bulls were on the verge of ceding it to the bears, at press time.

The RSI on the daily chart has also fallen steadily over the past ten days. It slipped below neutral 50 to serve as an early warning that momentum has been shifting bearishly. Meanwhile, the OBV has been on a strong downtrend since mid-April too.

This decline highlighted consistent selling pressure. Although the trend slowed down over the past two weeks, it still denoted bearish dominance and a lack of buying pressure. Until this factor can change, the downward pressure on AVAX will likely continue.

Speculative detachment contributes to AVAX’s woes

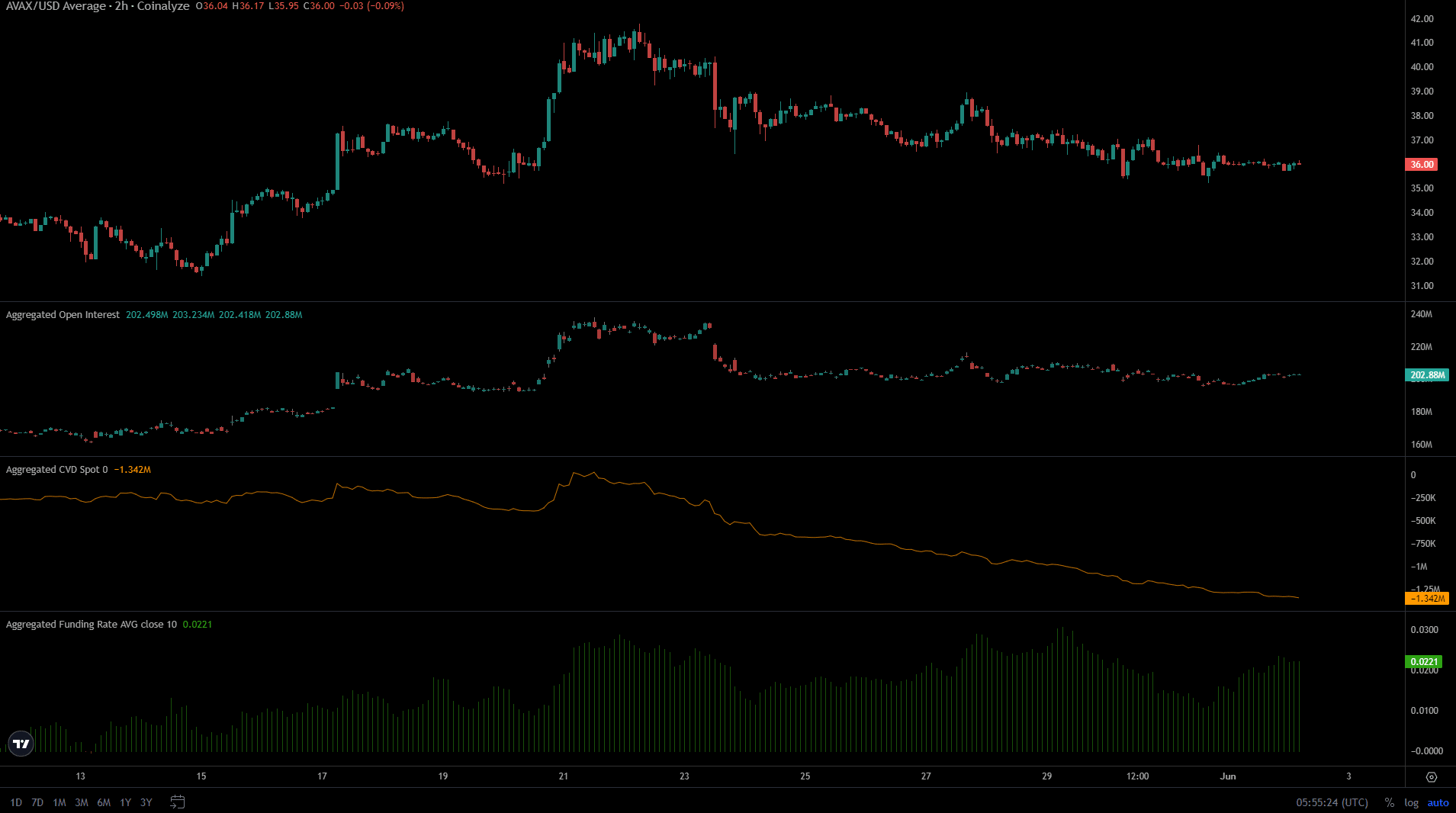

Source: Coinalyze

Since 23 May, the Open Interest has hovered around the $200 million-mark. Meanwhile, the price slowly trudged lower from $38 to $36. Futures traders did not look eager to bid the retest of the mid-range level – Indicating that further losses would be likely.

Read Avalanche’s [AVAX] Price Prediction 2024-25

Worth noting, however, that the funding rate has remained positive, with traders not shorting the asset en masse yet. Conversely, the spot CVD, like the OBV, was on a firm downtrend. Simply put, an AVAX recovery would be unlikely in the short-term given the selling pressure.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.