Assessing 1INCH’s performance prior to token unlocks

- 1INCH scheduled another token unlock for 1 March.

- The token circulation decreased, but its founder says the DeFi ecosystem can hit 1 billion users.

The 1inch Network [1INCH] is part of a series of crypto projects expected to unlock several tokens on 1 March. This month, about 18 projects will take the same step. But out of the seven billed for the aforementioned date, 1INCH has the lowest number of tokens expected to be unlocked.

How much are 1,10,100, 1INCHs worth today?

According to Token Unlocks, 1INCH would unlock $100,000 worth of its tokens. Other projects who billed for the same event for the same include Hedera [HBAR] and Galxe [GAL] amongst others.

More stability for the inch?

The idea behind unlocking tokens is to bring more liquidity to an asset, increase the circulating supply, and stabilize the token price. Interestingly, the 1inch Network has had several unlocks in times past.

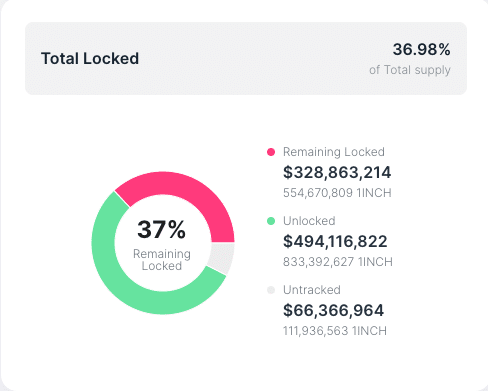

At the time of writing, Token Unlocks’ dashboard showed that $494.11 million 1INCH had been unlocked in total. However, there was still $328.86 million waiting to be released. These locked tokens represent 37% of the total 1INCH supply.

Further, information from the platform revealed that 64,286 1INCH, amounting to $38,115, were ready for the procedure.

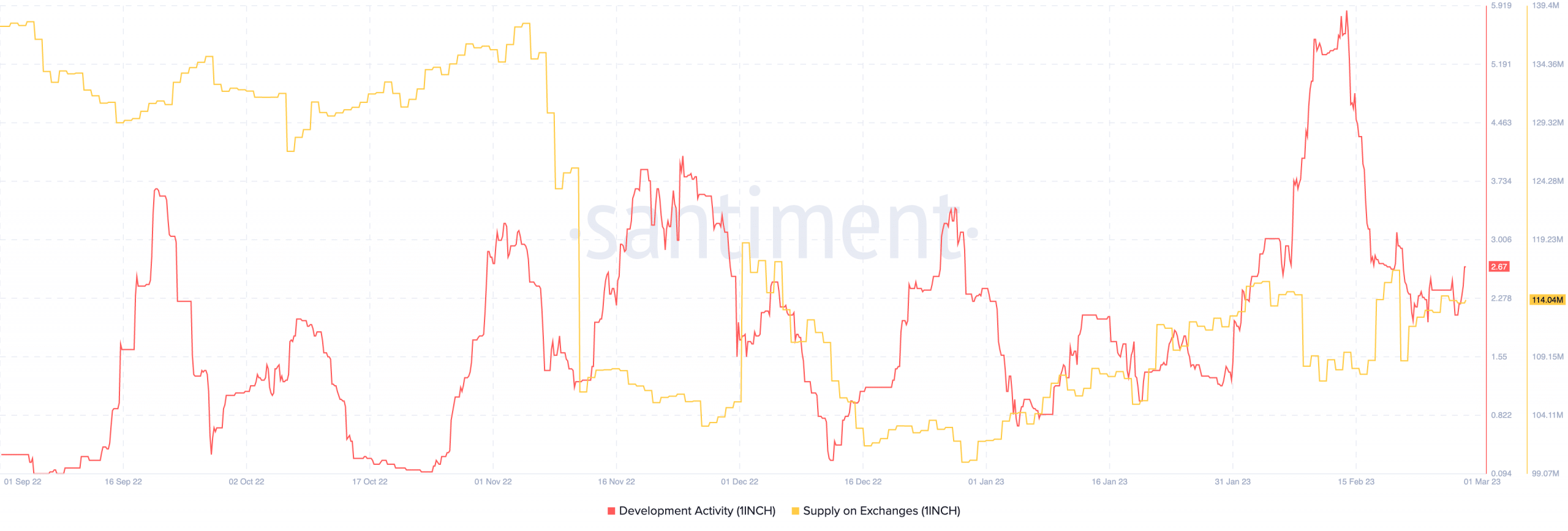

Moreso, Santiment’s data showed that 1INCH seemed committed to ensuring the smoothness of the process. This was because the development activity received from its decline on 28 February. The development activity measures a project’s resolve to see out reforms on its network. As of this writing, the metric had improved to 2.67.

But has the development affected created enough attention to affect actions taken on exchanges? Well, exchange inflow has increased significantly since 21 February such that it hit 114.04 million. This was an indication of possible selling pressure. However, the spike has not been reflected in 1INCH’s price, which gained 3.15% in the last 24 hours.

1INCH charges for 1 billion

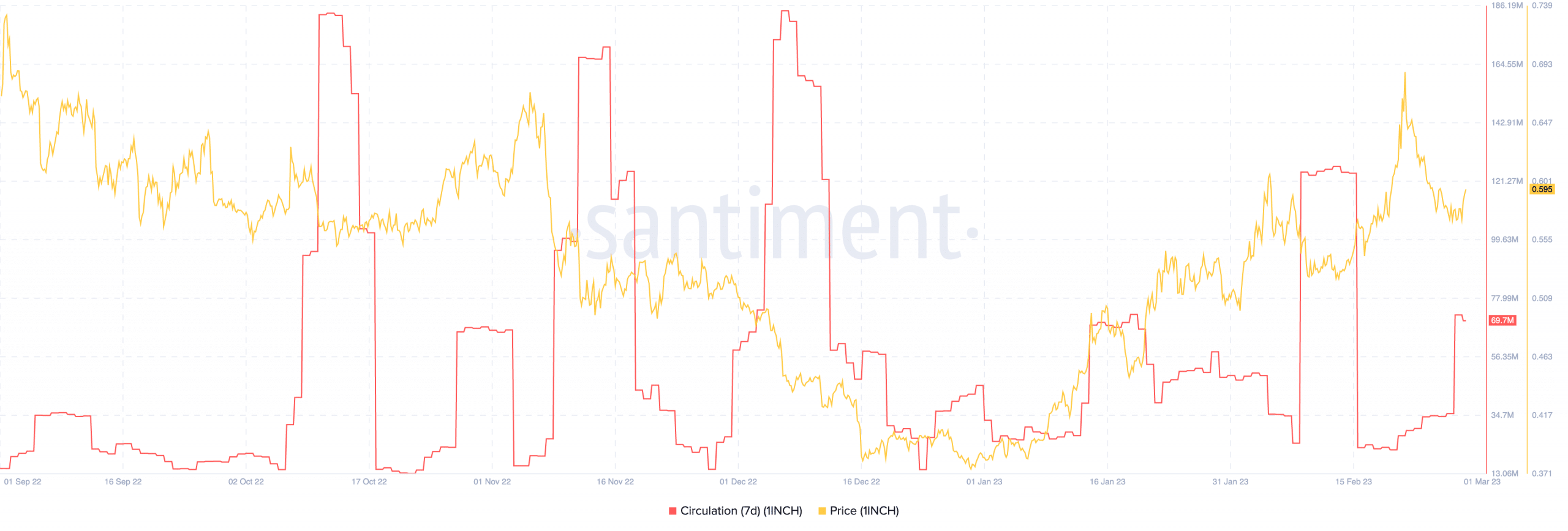

Although exchange inflow was high, 1INCH active deposits were not at a similarly impressive level. In terms of circulation, the on-chain analytic provider revealed that it has increased in the last seven days.

Read 1inch Network’s [1INCH] Price Prediction 2023-2024

This suggested that quite a number of unique 1INCH tokens were used within the period. However, the week-long hike was not a yardstick for what happened in the last 24 hours as circulation drowned.

Meanwhile, 1INCH co-founder Sergej Kunz, at a recent conference in Barcelona, said it was possible for DeFi to have 1 billion users. In a YouTube video uploaded on the project’s network, Kunz said that liquidity-based Decentralized Exchanges (DEXes) among other elements, could play a role in reaching the milestone.