Examining MATIC’s future as Polygon records new ATH in key area

- Polygon’s daily active addresses exceeded 1.4 million.

- MATIC’s price surged by more than 9% in the last 24 hours.

Polygon [MATIC] has been in the news for several weeks because of its high network activity. Things just got even better as a key metric hit an all-time high.

In the meantime, MATIC’s price gained bullish momentum as the market condition changed.

Polygon’s network activity is rising

Polygon has performed well in terms of network activity, as its daily active addresses have remained above the 1 million mark for multiple weeks.

The consistency resulted in the metric touching a new all-time high on the 1st of May.

According to a recent tweet from Today In Polygon, the blockchain’s daily active addresses touched 1.4 million.

AMBCrypto’s look at Artemis’ data revealed that the massive rise in active addresses had a positive impact on its daily transactions, as it also surged.

Though the blockchain’s network activity was up, things were not good in terms of captured value. AMBCrypto found that while active addresses rose, its fees dropped sharply.

Because of that, the blockchain’s revenue also declined.

Polygon’s performance on the DeFi front was also not on par, which was evident from the drop in its TVL.

MATIC bulls are here

MATIC bulls stepped up their game as the token’s price chart turned green. According to CoinMarketCap, MATIC was up by more than 9% in the last 24 hours.

At the time of writing, it was trading at $0.6944 with a market capitalization of over $6.8 billion. A possible reason behind this price pump could be a rise in buying pressure.

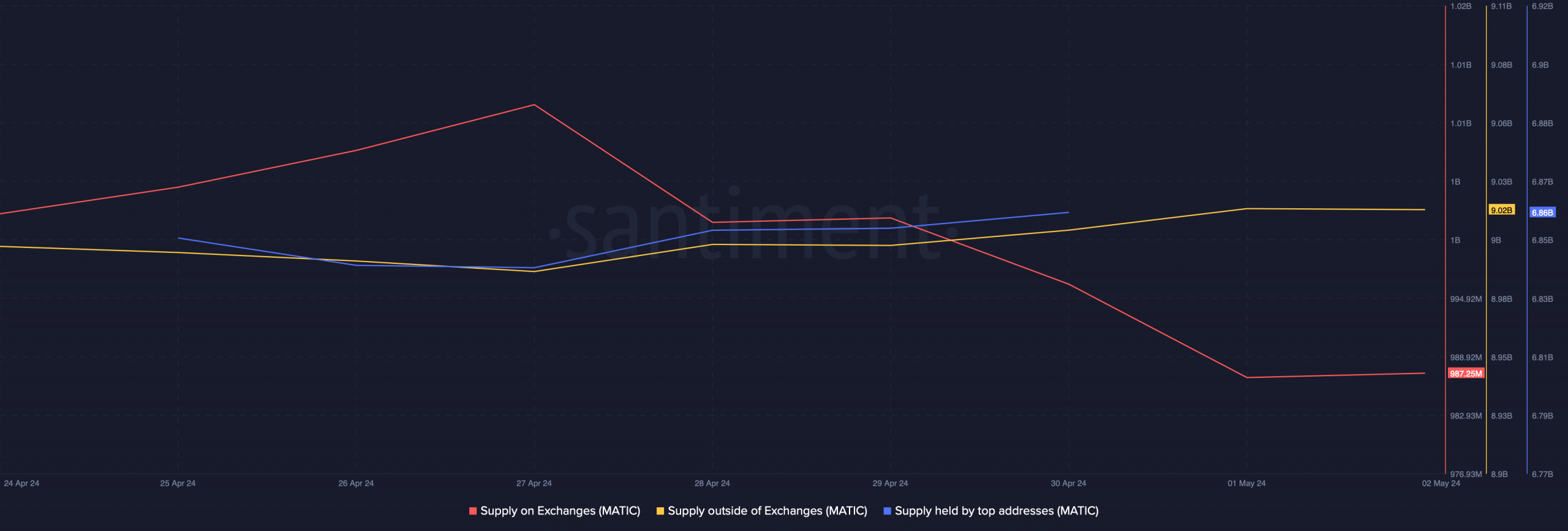

AMBCrypto’s analysis of Santiment’s data revealed that MATIC’s supply on exchanges dipped.

This happened at a time when its supply outside of exchanges increased, suggesting buying pressure on Polygon increased.

Whales’ confidence in MATIC also seemed to have improved, as the supply held by top addresses went up slightly.

To see whether Polygon will manage to sustain this new bull rally, AMBCrypto then planned to take a look at its daily chart.

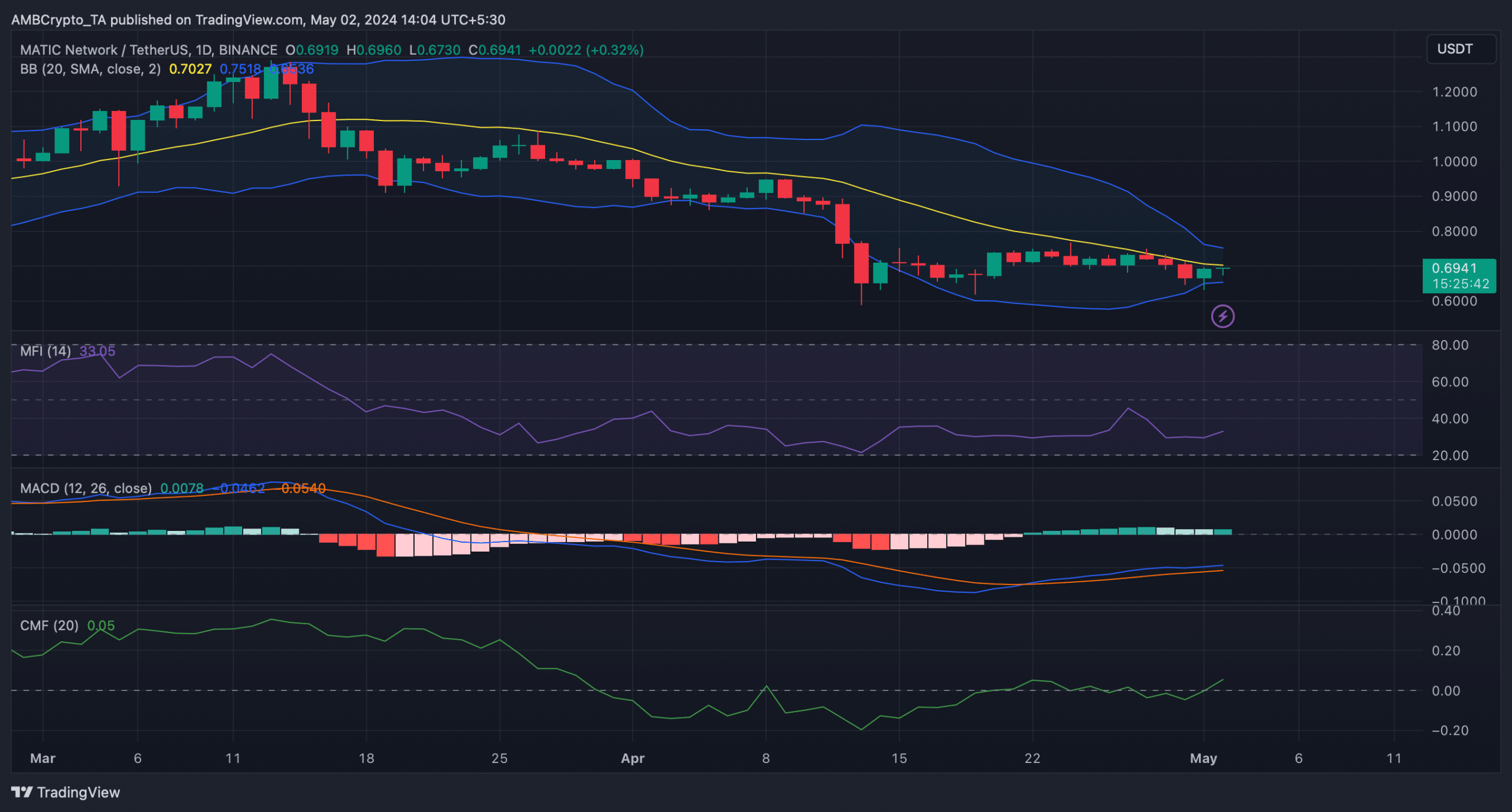

We found that MATIC’s Chaikin Money Flow (CMF) registered a sharp uptick and was headed further above the neutral mark. Similar to the CMF, the Money Flow Index (MFI) also went northward.

Read Polygon’s [MATIC] Price Prediction 2024-25

Moreover, the technical indicator MACD displayed a bullish upperhand in the market. These technical indicators clearly suggested that the chances of MATIC remaining bullish were high.

However, nothing can be said with certainty, as the Bollinger Bands pointed out that MATIC’s price was entering a less-volatile zone.