As Bitcoin dominance drops, Chainlink exploits the market shift – How?

- LINK’s network activity increased along with its price.

- Most metrics indicated a continued price rise, but a few suggested otherwise.

Chainlink [LINK] has gained much traction of late as its price rallied substantially during the last week.

Interestingly, the token’s popularity rose while Bitcoin [BTC] dominance witnessed a slight drop in the recent past. Let’s take a closer look at what’s actually going on.

Decoding Chainlink’s state

IntoTheBlock recently posted a tweet highlighting quite a few interesting developments related to Chainlink.

The tweet first mentioned that there was a significant rise in LINK search trend data, reflecting newfound interest in the token.

The rise in popularity had a positive impact on the blockchain’s network activity, as its number of transactions started spiking.

To be precise, LINK recorded 5.82k transactions during the last day, which was near its monthly high.

However, it was interesting to note that the rise in transactions didn’t help attract more users, as there was not a major change in its new address graph.

But things looked good in terms of investors’ interest as accumulation increased. As per the tweet, there were mostly net withdrawals from exchanges, hinting at accumulation behavior.

Apart from that, whales were also stockpiling LINK, as its addresses holding over 0.1% of the supply show a net accumulation of 25 million LINK over the past month.

LINK is earning investors profits

The rise in accumulation actually helped the token begin a bull rally. According to CoinMarketCap, LINK was up by more than 20% in the last seven days.

At the time of writing, it was trading at $16.22 with a market capitalization of over $9.5 billion.

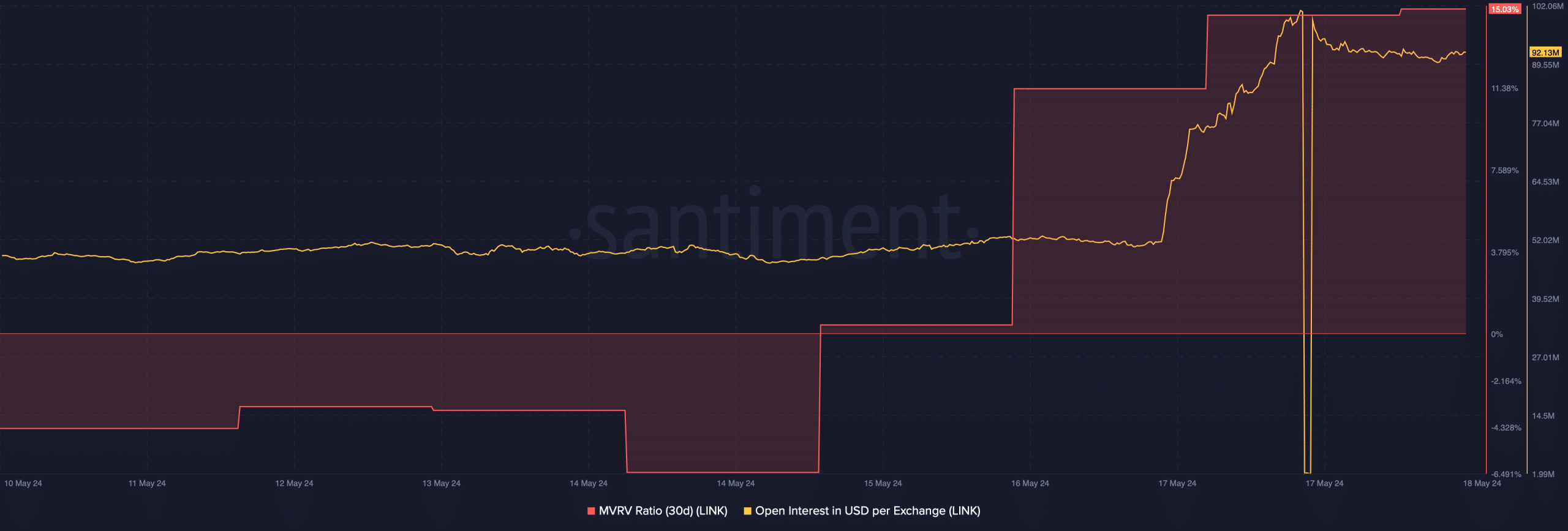

Thanks to that, LINK’s MVRV ratio registered a massive increase, suggesting that more investors were in profit. Its Open Interest also increased along with its price, hinting at a continued price rally.

Interestingly, Santiment recently posted a tweet highlighting that bullish sentiment around the token increased. In fact, Chainlink was witnessing the most bullish sentiment in over a year.

However, these positive metrics didn’t help LINK sustain its bull rally, as the token’s price dropped by nearly 2% in the last 24 hours.

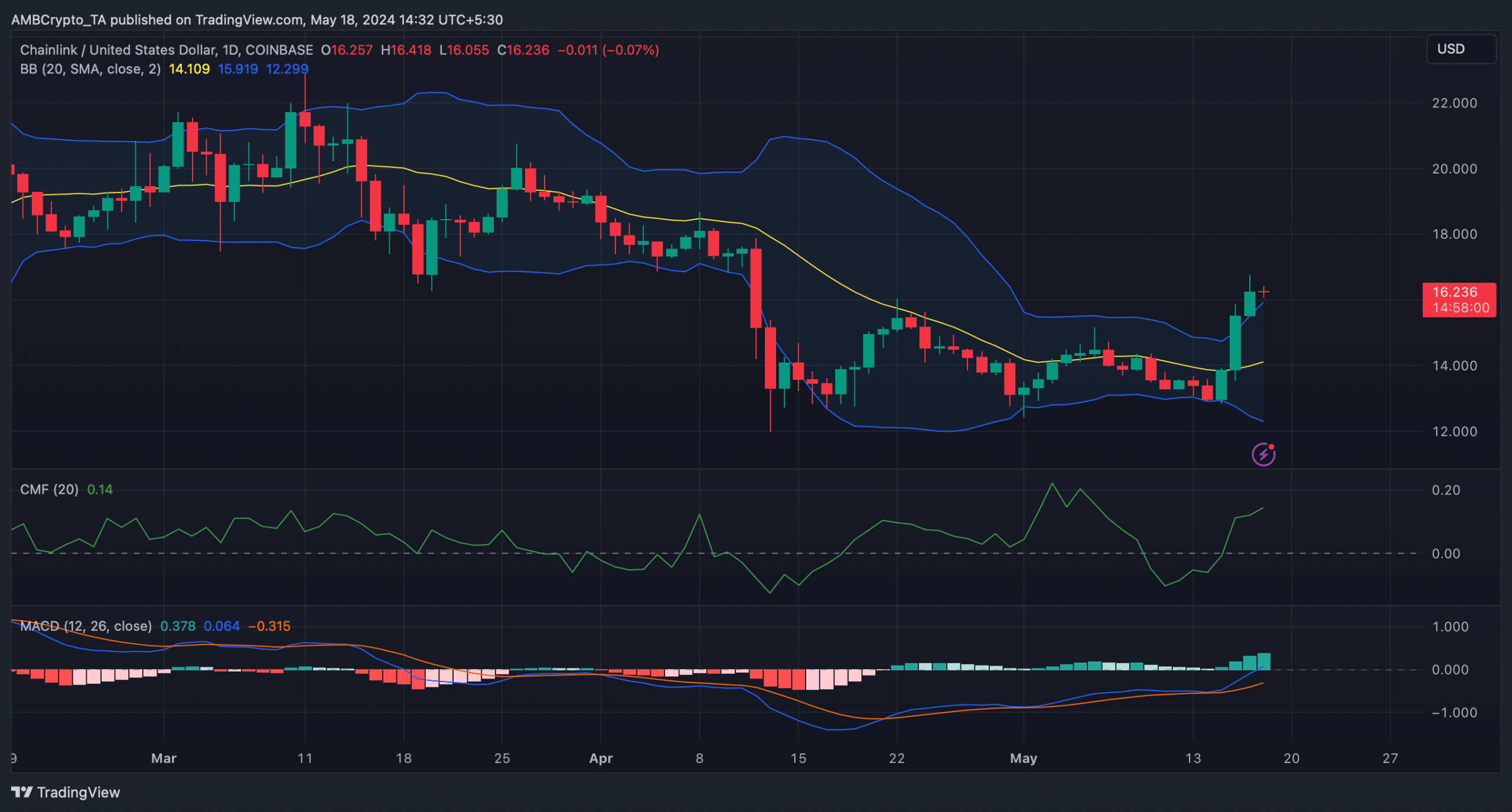

To see whether this was the end of LINK’s double-digit bull rally, AMBCrypto analyzed its daily chart. As per our analysis, the MACD remained in the buyers’ favor.

Is your portfolio green? Check out the LINK Profit Calculator

Moreover, the Chaikin Money Flow (CMF) registered a sharp uptick. This indicated that the latest price correction might be short-term and that LINK would resume its rally soon.

However, the token’s price had touched the upper limit of the Bollinger Bands, which looked concerning.