Are Ethereum and Solana threatening the crypto market’s stability?

- Community is bearish on Solana and Ethereum, but experts are still very bullish on SOL.

- Crypto markets are still correcting, with most altcoins currently in the red.

The crypto market is still reeling from a strong case of the corrections, and altcoins are having it worse than all.

At press time, almost all the altcoins on the top 25 are in the red, having seen a slight decrease on daily charts. Is there a bearish storm on the horizon? Or are we still on for an altseason?

Solana and Ethereum inspire bearish sentiments

Two top altcoins have stood out among the crowd, seemingly dancing with the bears. Both coins have dropped from the critical support levels of $2,995 and $145.

At the time of writing, Ethereum [ETH] was worth $2,968 and Solana [SOL] was at $141.

Data from CoinGecko says that the community is mostly bearish on both tokens right now.

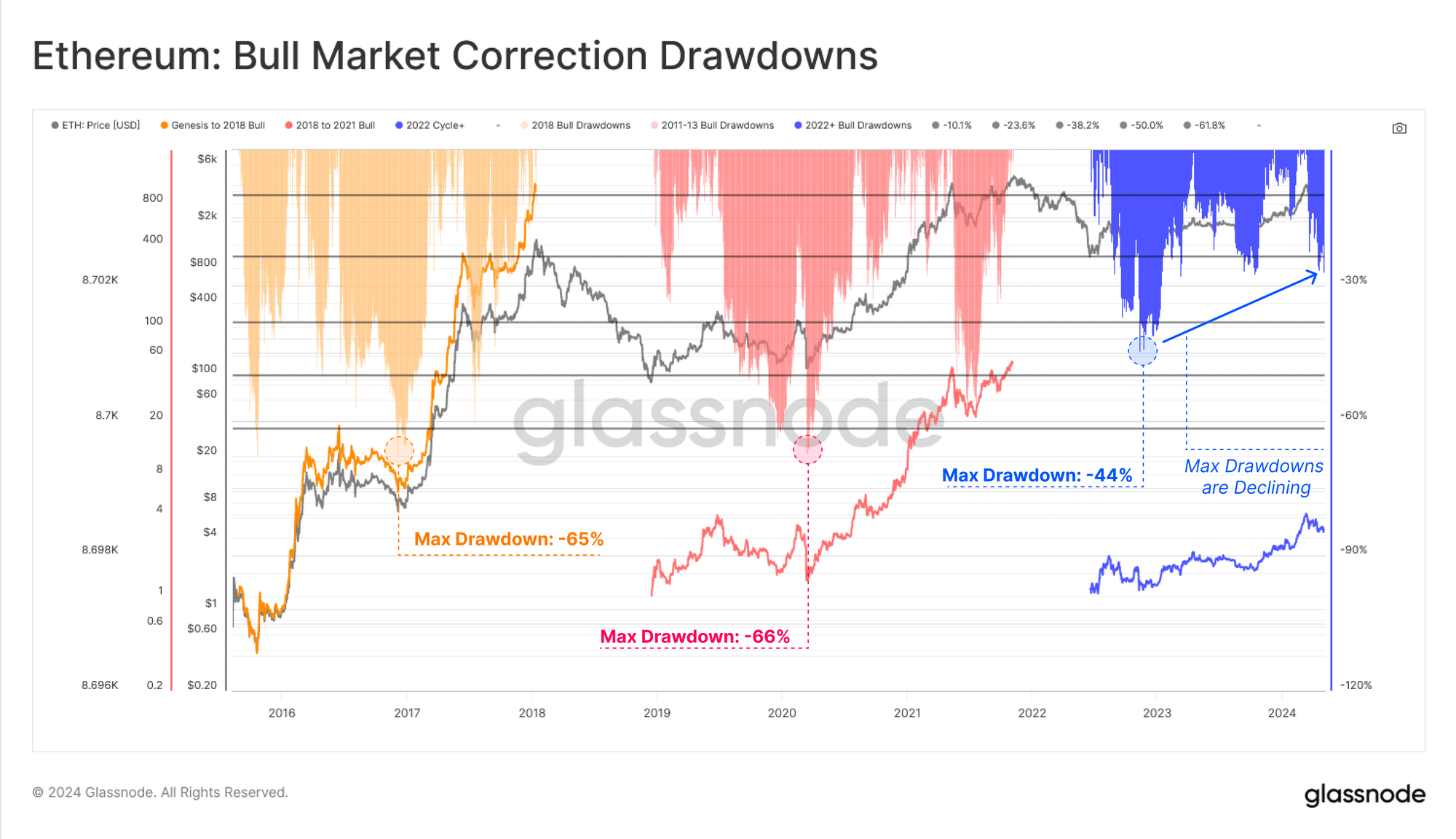

Just two days ago, Glassnode shared that Ethereum’s performance is much weaker than Bitcoin [BTC], despite the opposite being the case only a month prior.

This is a stark reversal from its previous position, where it had shown dominance over Bitcoin.

Ethereum’s price drop has been massive, with its deepest drawdown reaching 44% over the cycle, which is more than double that of Bitcoin’s 21%.

This highlights Ethereum’s struggles and underperformance relative to Bitcoin.

The Short-Term Holder Cost Basis for Ethereum, which typically offers support, shows that current prices are hovering very close to the cost basis of recent buyers.

Glassnode warns that this situation has created a precarious scenario where any further market dip could trigger a sell-off panic.

A silver lining

Despite the gloomy outlook, not all hope is lost. Solana, for instance, seems to have weathered what might have been its last major correction for this market cycle.

According to a well-followed crypto analyst known as Inmortal, the only support level Solana needed to defend is $120.

He is still expecting a rally, with his projections suggesting a climb to a new high of $320 some time later this year.

Furthermore, there are indicators that Solana might soon overtake Ethereum in terms of transaction fees.

Dan Smith, a senior research analyst at Blockworks, suggested that Solana could surpass Ethereum in transaction fees and capture maximal extractable value (MEV) as early as this month.

MEV represents the maximum profit that can be extracted from blockchain transactions through means like arbitrage.

On the 7th of May, Solana’s total economic value was reported at $2.8 million, nearing Ethereum’s $3.1 million. Elite figures like Arthur Hayes are also still highly bullish on SOL.

Interestingly, however, the community seems to be highly bullish on the broader altcoin market, especially AI tokens like Fetch.ai [FET].

Is your portfolio green? Check out the ETH Profit Calculator

Meme coins like Pepe [PEPE] and Bonk [BONK] are still seeing new holders every single day, suggesting that investors and traders are still very much expecting a bull run for 2024.

So, yes, the bears might have managed to snatch control. But it is likely to be temporary.