Aethir Ethereum launch sends ATH token soaring 100%, details here

- Aethir has launched its decentralized cloud computing network on the Ethereum mainnet.

- The value of its ATH token may plunge in the short term.

Aethir, a decentralized physical infrastructure network (DePIN) provider, launched its decentralized cloud computing network on the Ethereum [ETH] mainnet on 12th June.

The protocol allows users to rent high-performance computing resources needed for training artificial intelligence (AI) and rendering digital content.

This service is crucial for organizations that require significant computational power as it offers flexibility and scalability for their operations.

Aethir’s mainnet launch comes with a native token, ATH.

ATH is required for governance and security within the Aethir ecosystem, staking on the Ethereum network, and payment to compute providers through Arbitrum [ARB].

This mainnet launch comes seven months after its testnet launch on 7th November 2023 on Arbitrum, a layer-2 scaling solution for Ethereum.

In its announcement, Aethir confirmed that its user base exceeded 500,000 on its testnet, and it completed a $146 million node sale.

ATH pursues new lows

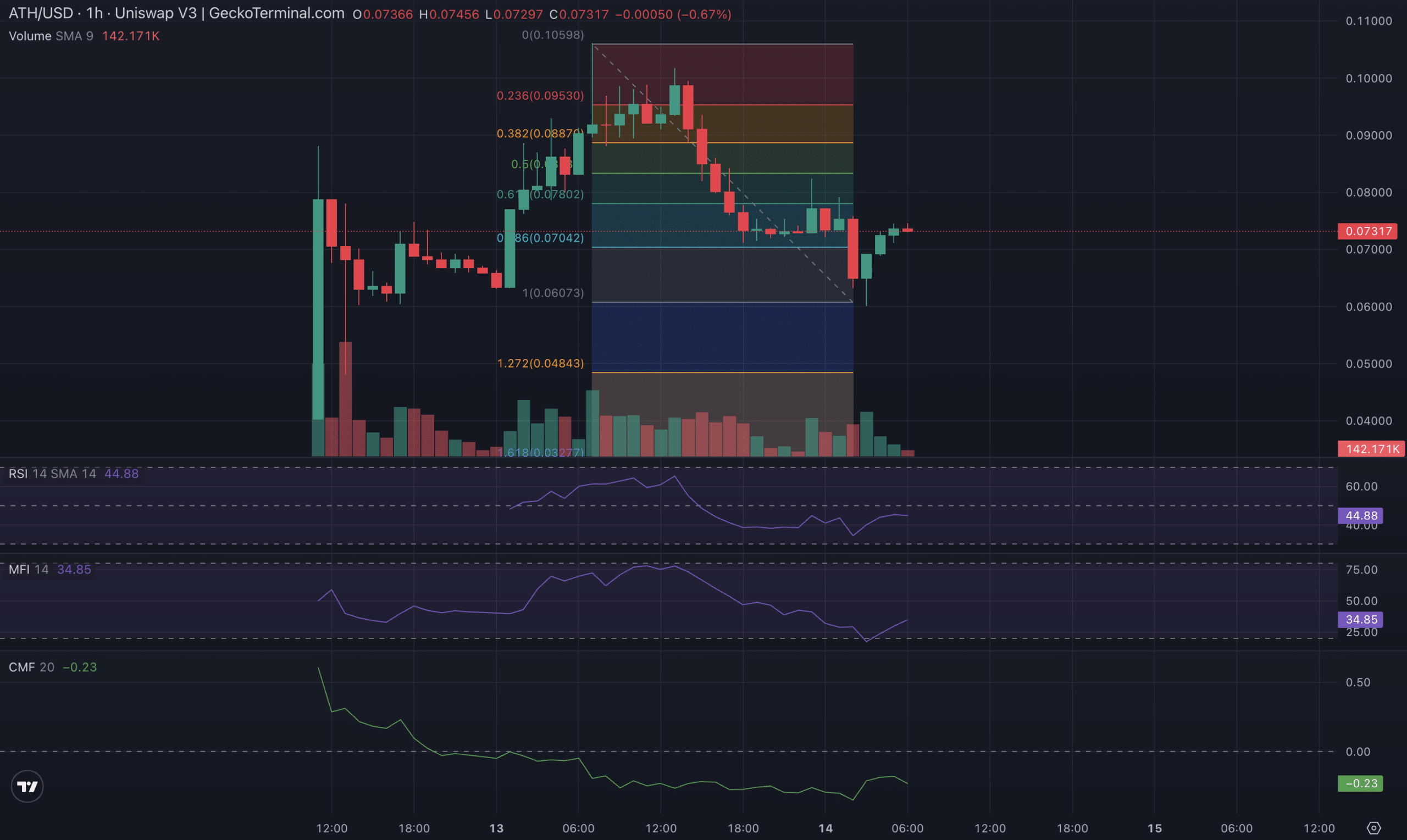

Following ATH’s launch, its price skyrocketed by almost 100% before correcting. At press time, ATH exchanged hands at $0.073. According to CoinGecko, its price has declined by 14% in the past 24 hours.

Its daily trading volume totaled $261 million during that period, rising by 38%. The opposite movements of ATH’s price and trading volume indicated the presence of significant bearish sentiment in the token’s market.

When an asset’s price declines while its trading volume surges within the same period, it signals a spike in selling pressure. This means that most token holders are looking to sell their positions, hence the downtrend in the asset’s value.

An assessment of ATH’s key technical indicators on an hourly chart confirmed the steady decline in the demand for the altcoin.

For example, its Relative Strength Index (RSI) and Money Flow Index (MFI) were 44.88 and 34.85 at press time.

These indicators measure an asset’s overbought and oversold conditions by tracking its price momentum and changes. At these values, ATH’s RSI and MFI suggest that market participants prefer to sell their holdings rather than accumulate new tokens.

This trend was confirmed by ATH’s Chaikin Money Flow (CMF), which measures the flow of money into and out of its market. As of this writing, this indicator’s value was -0.23.

A negative CMF value is a sign of market weakness. It signals liquidity exit from the market, a precursor to further price decline.

If ATH’s selling pressure continues to increase, its price might decline toward $0.048.

However, if the bulls re-emerge and token accumulation begins to climb, ATH’s value might rally toward $0.078.