Bitcoin ATMs see a boom: Is this the catalyst BTC’s price needs?

- Bitcoin ATM installations surged significantly over the last few weeks.

- Inflows in BTC investment products across the globe grew.

Bitcoin’s [BTC] price fell significantly in the last few days, however, there could be reasons for investors to be optimistic about the king coin.

ATM installations on the rise

Bitcoin ATM installations were experiencing a resurgence after a dip in late 2022.

As of July 2024, there are now over 38,000 Bitcoin ATMs installed worldwide.

More Bitcoin ATMs mean easier entry points for new investors. With ATMs familiar and widely used, buying Bitcoin becomes less intimidating for those unfamiliar with cryptocurrency exchanges.

This broader accessibility can lead to a rise in demand, potentially halting or reversing the price slide.

Moreover, the growing number of ATMs suggested a maturing and potentially more stable crypto ecosystem. This can improve investor confidence, which is a crucial factor influencing price.

People are more likely to invest in an asset class perceived as legitimate and here to stay.

However, heightened inflows could help BTC grow.

A new report by CoinShares paints a positive picture for Bitcoin, revealing a total of $441 million in inflows last week. This is a significant turnaround after several weeks of outflows.

The report on the 8th of July dove into the details, highlighting a substantial inflow into Bitcoin. Investors poured $398 million into Bitcoin products, which translated to roughly $57,207 per Bitcoin.

According to CoinShares, this buying spree was likely triggered by a combination of factors, including the recent weakness in Bitcoin prices, activity from Mt. Gox, and selling pressure from the German government.

These events may have been interpreted by some investors as an attractive entry point.

Looking geographically, the inflows were primarily concentrated in the United States, which saw a whopping $384 million.

Other regions like Hong Kong ($32 million), Switzerland ($24 million), and Canada ($12 million) also witnessed inflows, while Germany bucked the trend with $23 million in outflows.

Read Bitcoin’s [BTC] Price Prediction 2024-25

How are addresses doing?

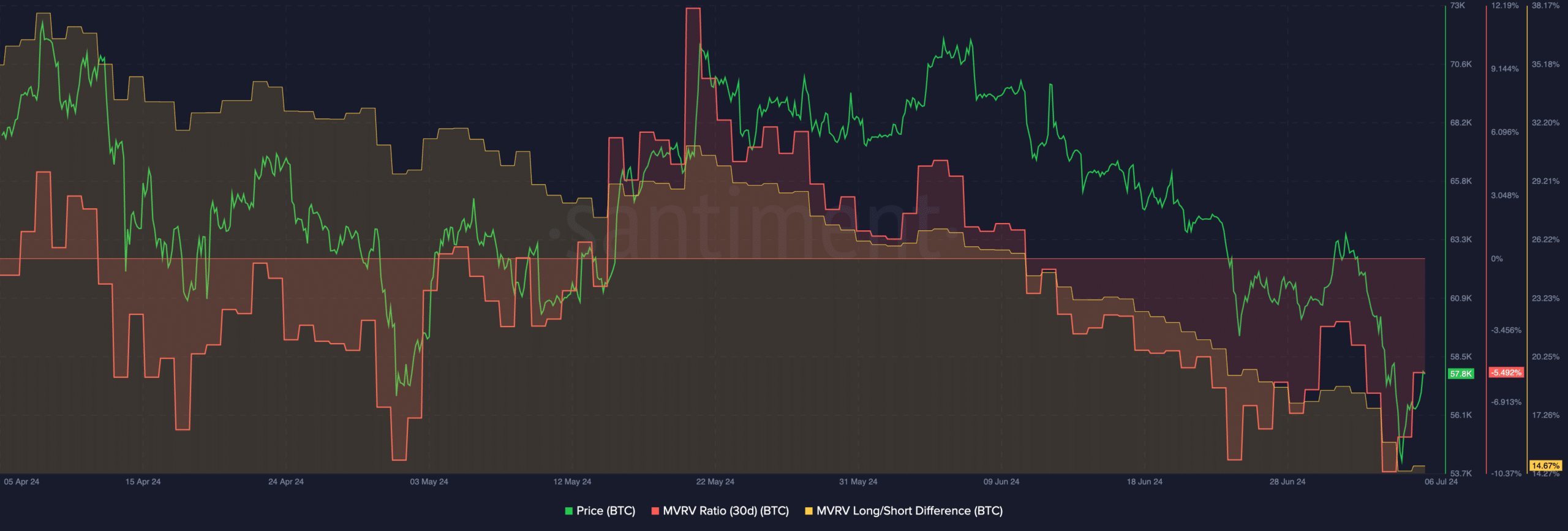

At press time, BTC was trading at $57,149.91 and its price had declined by 0.75% in the last 24 hours. Due to the declining price, the MVRV ratio for BTC fell.

This indicated that the number of profitable addresses holding BTC had declined significantly. This could reduce the incentive for these holders to sell their holdings in the future.