Bitcoin: Michael Saylor has THIS to say about BTC’s volatility

- Bitcoin may reach the $60,500 level if its daily candle closes above the $58,500 level.

- Veteran trader Peter Brandt suggests a buy signal in Bitcoin for the short term.

In the last few days, the overall cryptocurrency market has been very volatile and experiencing continuous ups and downs.

Amid this challenging situation, Michael Saylor, the founder and chairman of MicroStrategy, and the veteran trader Peter Brandt took bullish stances on Bitcoin [BTC].

Michael Saylor and Peter Brandt post on X

On 7th July, 2024, Michael Saylor made a post on X stating that

“Bitcoin is engineered to keep winning.”

This post from MicroStrategy’s chairman highlights that Bitcoin is designed to succeed and become more valuable over time despite anything happening in the market.

Along with the tweet, he also shared an image that showcased BTC’s performance over the year, comparing it to other asset classes including Gold and silver.

Separately, a prominent veteran trader Peter Brandt also made a post on X stating that he found a bullish pattern in BTC, which he called “Foot Shot.” He also added that this is a buy signal for the short term.

Both these tweets by industry giants gained massive attention from investors and traders in this challenging situation and might be influencing the emotions of the bulls.

Bitcoin technical analysis and key levels

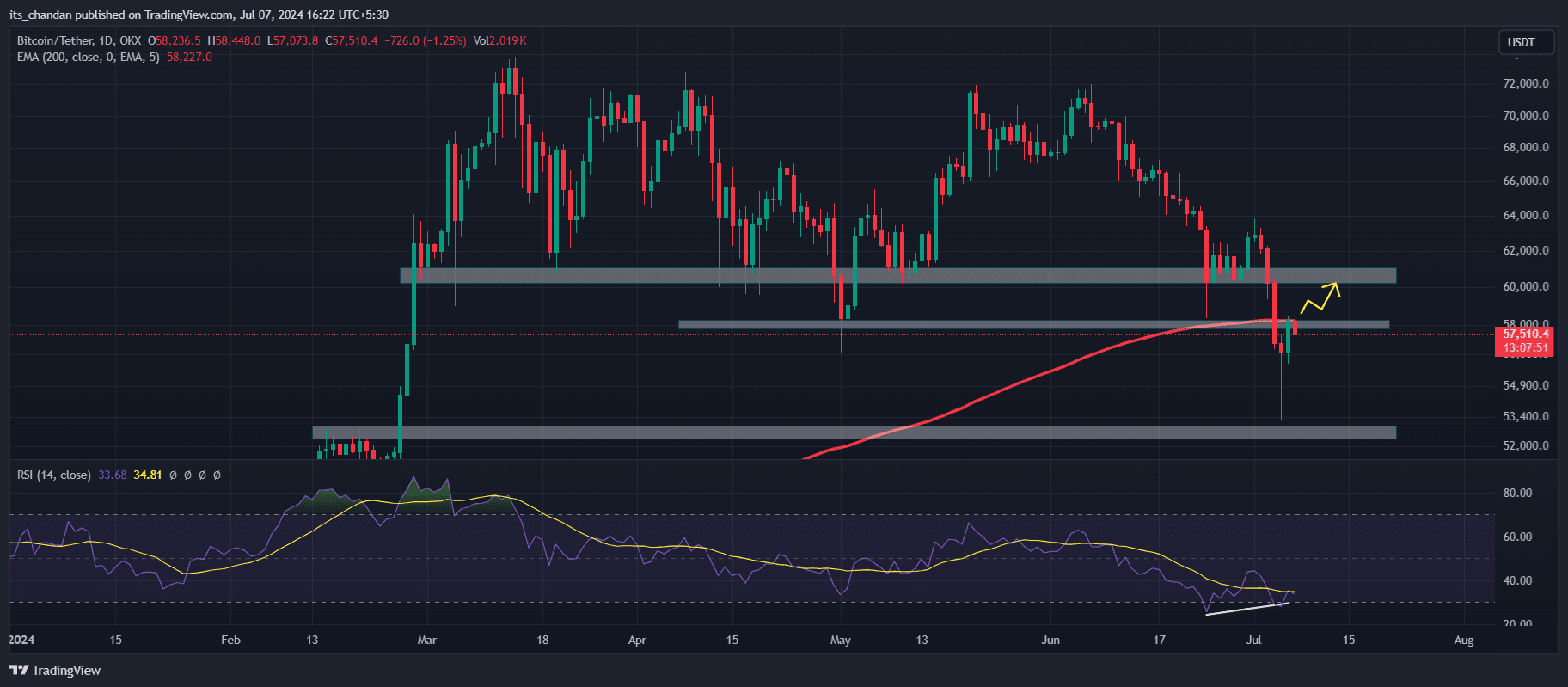

According to technical analysis, Bitcoin is currently looking bearish and facing resistance from the 200 Exponential Moving Average (EMA) near the $58,000 level.

This 200 EMA may create a hurdle for BTC until it gives a candle closing above the $58,500 level.

Despite strong resistance, the Relative Strength Index (RSI) is in an oversold area and forming a bullish divergence, which signals a potential sign of recovery.

There is a high chance that BTC will reach the $60,500 level if it gives a daily candle closing above the $58,000 level.

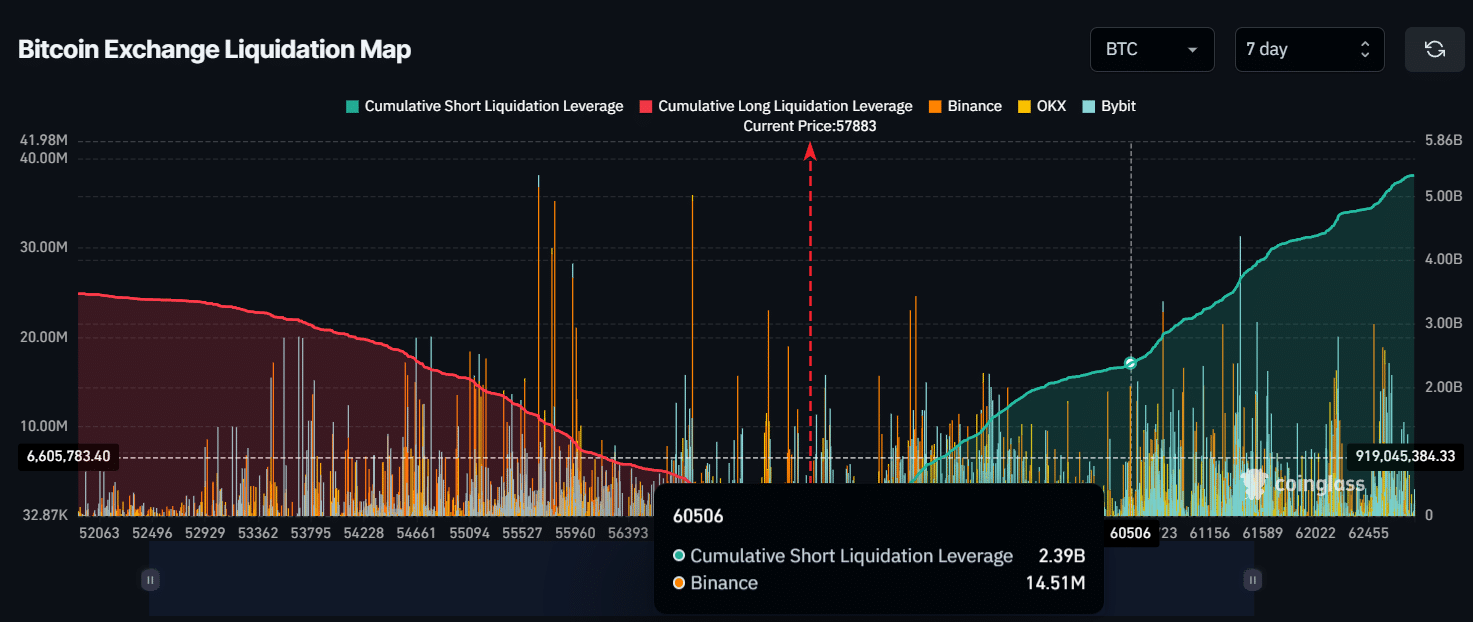

According to an on-chain analytic firm CoinGlass, if BTC reaches the $60,500 level, nearly $2.4 billion of short position will be liquidated.

Meanwhile, the open interest (OI) of Bitcoin has surged by 1.4% in the last 24 hours as per CoinGlass data. This surge in OI signals slight investor and trader interest in Bitcoin.

BTC price-performance analysis

As of writing, BTC is trading near the $57,800 level and it experienced a 2% upside momentum in the last 24 hours.

Read Bitcoin’s [BTC] Price Prediction 2024-25

However, the trading volume dropped by 37% in the same period, signaling a decrease in investor and trader participation over the last 24 hours.

If we look at the performance of BTC over a longer period, in the last 7 days it is down by 6%. Whereas, in the last 30 days, BTC has lost over 20% of its value, dropping from $71,300 to $57,800 level.