XRP’s weekend price action – Why long-term range’s breakdown could be key!

- Higher timeframe market structure was bearish, but XRP might see some gains in the next day or two

- Liquidation levels chart showcased two short-term price targets before the next downward move

XRP saw its whale cohort grow over the past two weeks, indicating accumulation. A recent AMBCrypto report observed a hike in the dormant circulation too, which indicated selling pressure was likely.

XRP’s price dropped to $0.382, but bounced to $0.43 over the last 24 hours. At press time, the price action remained bearishly biased on the higher timeframes. However, the lower timeframe liquidity charts indicated that a further price bounce was possible.

Here’s what XRP traders can be prepared for –

11-month-old range finally succumbed to selling pressure

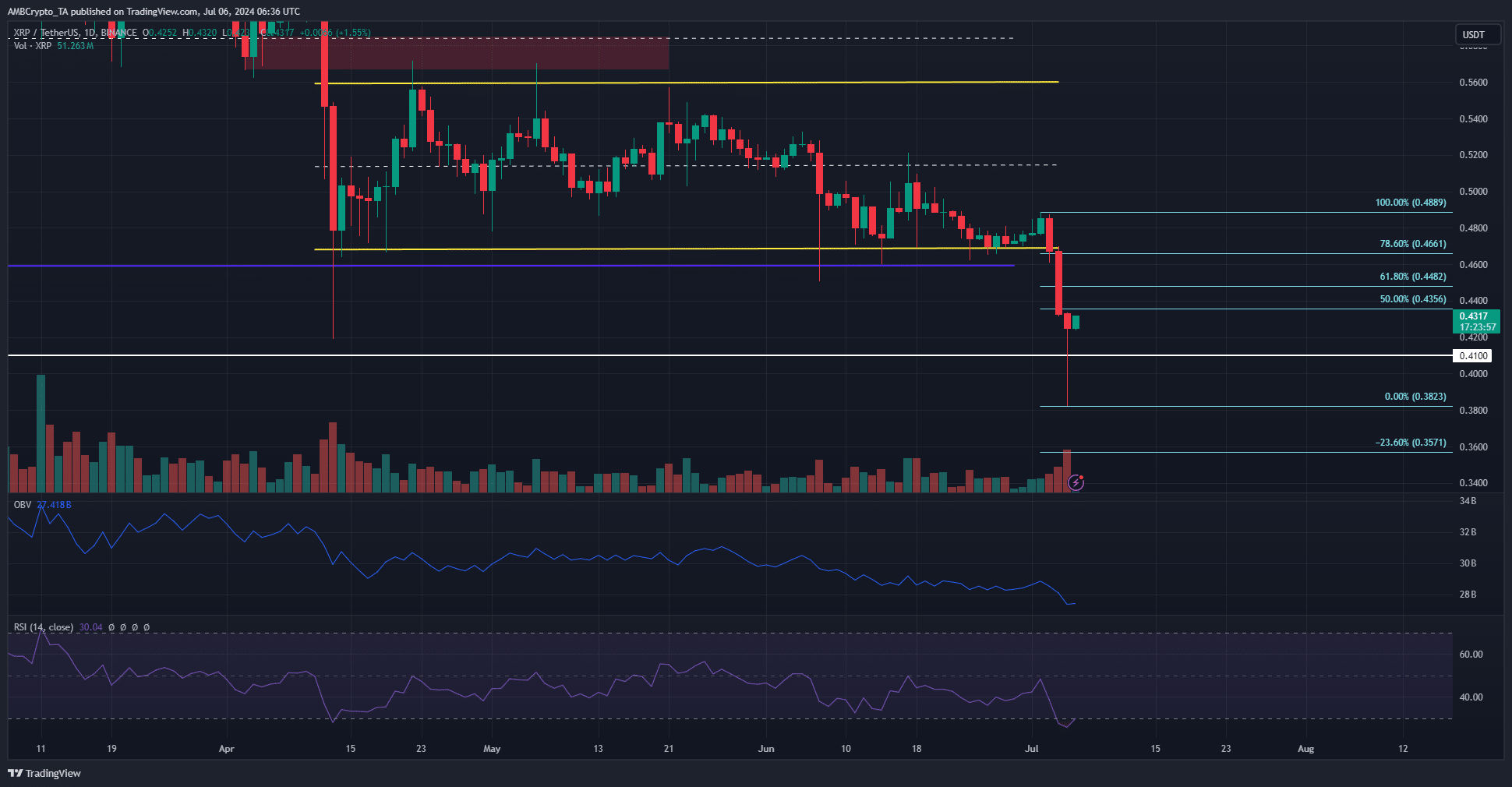

Marked in purple at the $0.46-level was the 11-month range low that XRP has traded within since August 2023. The smaller range that has been in play since mid-April was also broken. This swift decline meant that bears have been emphatic and further losses may be likely since the bulls were exhausted.

The Fibonacci levels (cyan) revealed that the 23.6% extension level at $0.357 was the next target for the bears. At press time, the 50% level at $0.435 served as resistance. Short sellers can look to enter trades in the $0.448-$0.466 zone.

The OBV continued its descent, highlighting steady selling volume in the market. The daily RSI was at 30 to denote oversold conditions. While a visit to the oversold zone might not guarantee a price bounce, it is something traders should be wary of.

Further proof that short-term price gains may be likely

Source: Hyblock

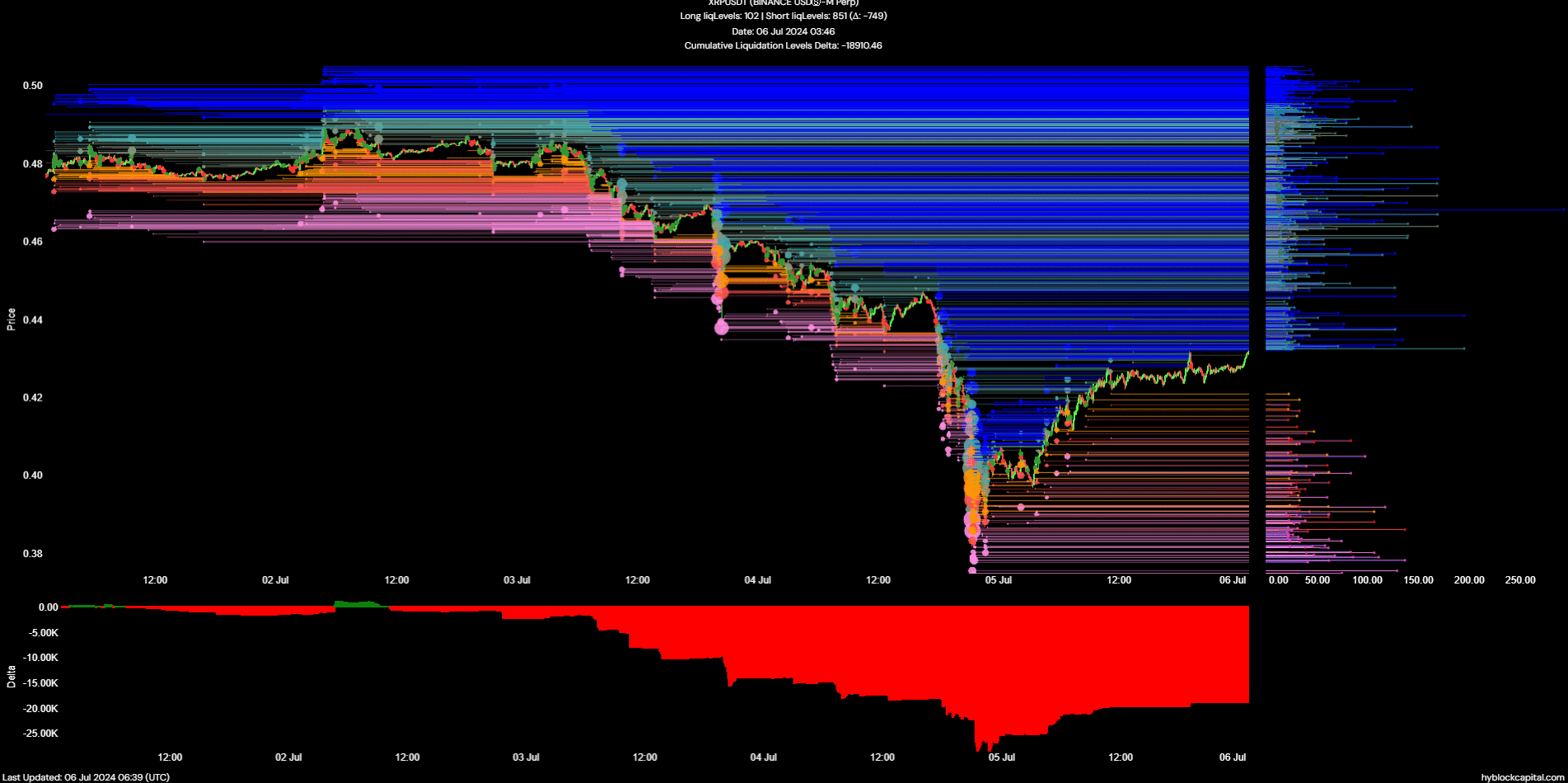

AMBCrypto’s data analysis of the liquidation levels found that the cumulative levels delta was negative. Simply put, short positions outnumbered the long ones, which could see a short squeeze in the form of a price hike to hit key liquidity clusters.

Read Ripple’s [XRP] Price Prediction 2024-25

There were high leverage short positions too that would be liquidated should XRP hit $0.461. The $0.47-level would also trigger sizeable short liquidations, marking the two levels as short-term targets before the next downturn.

Additionally, the $0.47-level seemed to be just above the 78.6% retracement level at $0.466, reinforcing the idea of a bearish reversal on the charts.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.