Bitcoin’s fall to $60K will not stop BTC from skyrocketing to $90K: Analyst

- An analyst predicted a notable rise in Bitcoin’s price.

- Recent market indicators suggested an impending bullish surge.

Despite a recent downtrend in Bitcoin’s [BTC] price, falling to $60,790 after a brief peak above $63,000 earlier in the week, the market may be on the verge of a significant rally.

The past day’s 2.8% decline has not deterred market analysts from predicting an imminent surge.

In fact, renowned crypto analyst Lark Davis is at the forefront, suggesting that Bitcoin could be gearing up for a dramatic increase in value over the coming weeks.

A path to the rally

Lark Davis, a noted figure in the crypto community, has voiced optimism about Bitcoin’s near future, influenced by a wave of institutional investments poised to enter the market.

Davis aligned his predictions with Standard Chartered Bank’s projection of Bitcoin potentially reaching $100,000 by August.

Although, he adjusted expectations to a more conservative $90,000 by this year’s end.

Davis also disclosed that the anticipated influx of institutional money through Bitcoin exchange-traded funds (ETFs) could counterbalance any potential sell-off from significant Bitcoin releases or government acquisitions.

Davis underscores the necessity for Bitcoin to first overcome the $72,000 resistance level, which could catalyze a Q4 bull run.

This surge, he posited, could extend beyond Bitcoin, amplifying gains across the altcoin market.

Beyond Bitcoin, Davis extended his bullish outlook to Ethereum [ETH] and several altcoins.

He predicted a substantial influx of capital into Ethereum, particularly from upcoming spot ETFs, which could substantially drive up its price.

His enthusiasm doesn’t stop with Ethereum; Davis also highlighted the potential of Solana [SOL], which he saw as a leader in blockchain development and market momentum.

Further exploring the crypto ecosystem, Davis expressed confidence in Polkadot [DOT], Helium [HNT], and even lesser-followed projects like Arweave [AR] and Fetch.ai [ASA].

Each of these platforms offer unique solutions and innovations that could play significant roles in the broader crypto market’s growth, according to the analyst.

Is Bitcoin ready for the surge?

While Davis anticipated a significant uptick for Bitcoin in the upcoming weeks, a closer look at Bitcoin’s fundamentals was essential to gauge the asset’s readiness for such a bullish outcome.

AMBCrypto’s analysis of Glassnode’s data revealed an increase in BTC’s new addresses, with numbers jumping from below 250,000 in early June to a peak of 432,000 on the 1st of July.

Ali, a well-regarded crypto analyst, supported this perspective, noting that the old adage “Sell in May and go away” is now defunct, as retail investors make a strong return, marking a four-month high in new BTC addresses.

The trend was mirrored by a rising interest among Bitcoin whales.

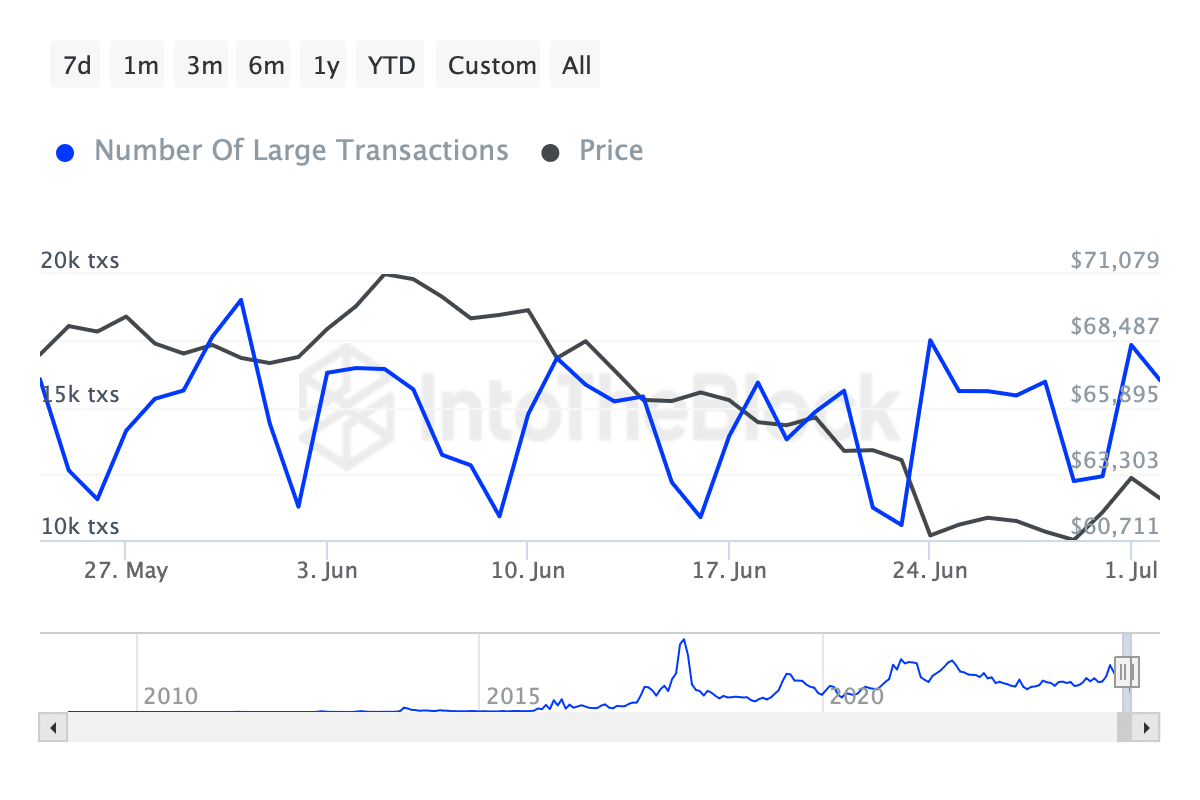

AMABCrypto’s look at data from IntoTheBlock showed that Bitcoin transactions exceeding $100,000 have risen from fewer than 12,000 transactions in early June to over 17,000 by the 1st of July.

Read Bitcoin’s [BTC] Price Prediction 2024-25

This indicated heightened market activity and potential accumulation by large-scale investors.

In contrast, AMBCrypto reported a notable decline in Bitcoin’s hash rate in recent days, potentially signaling an upcoming phase of miner capitulation.