As Dogecoin large holders exit, THIS will be the effect on DOGE’s future

- Those who own about 0.1% of DOGE’s circulating supply are selling the cryptocurrency.

- Datasets indicated accumulation, something which could stop the price from plunging.

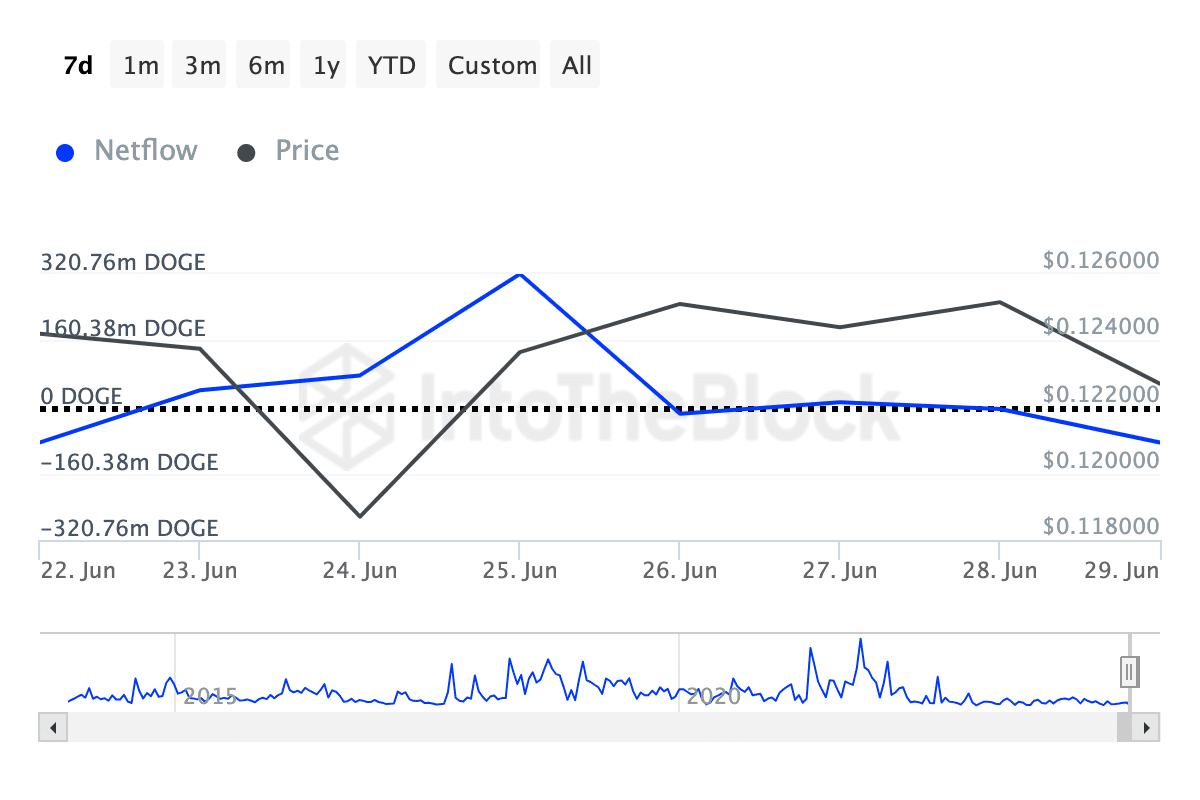

Dogecoin’s [DOGE] large holders netflow has decreased by a staggering 311% in the last seven days, indicating that pressure could be on the price.

For context, large holders are addresses holding about 0.1% of the total circulating supply.

Because this group owns a substantial amount of funds, they significantly impact price. Spikes in the metric indicate accumulation from large holders. If this is the case, the coin’s value is expected to increase.

DOGE large holders choose a different side

However, this recent drop indicated that these large players were selling their coins. As such, DOGE’s price might experience another decrease if the action continues.

At press time, Dogecoin changed hands at $0.12. This was a 23.74% decrease in the last 30 days. Considering the action mentioned above, it is possible to see the price decline toward $0.10

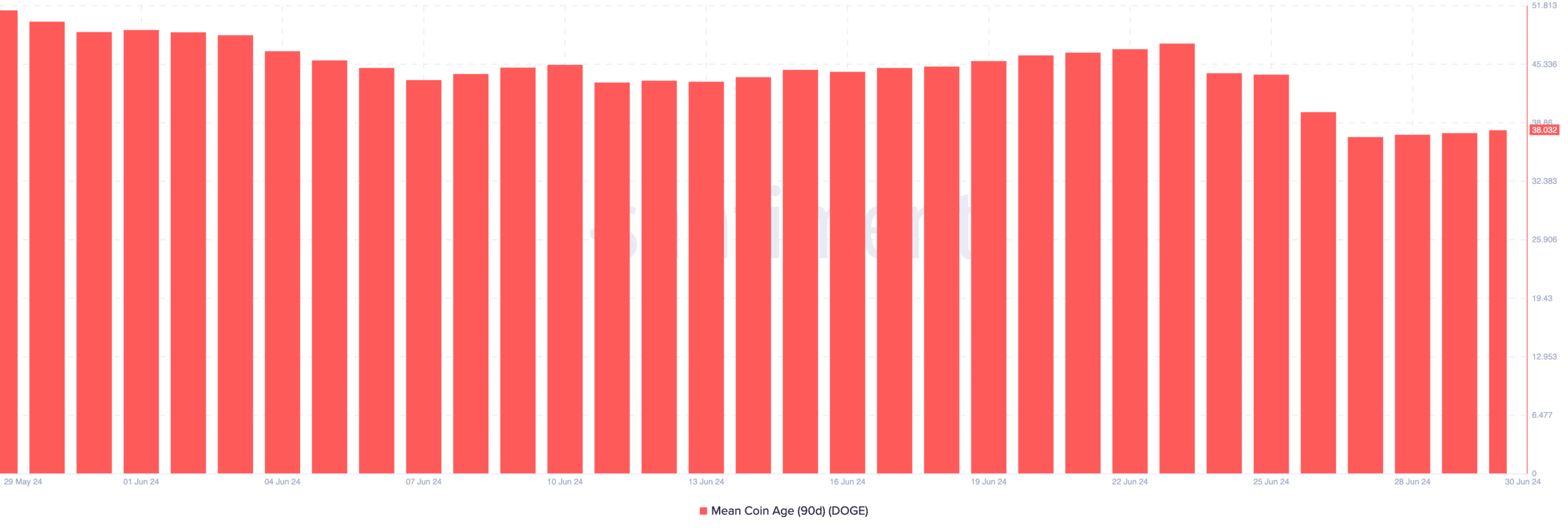

To confirm if the bearish trend will continue, AMBCrypto examined the Mean Coin Age (MCA). As the name implies, the MCA is the average age of all coins weighted by the purchase price.

However, it is important to note that the MCA specifically focuses on old coins. That means coins that have spent at least 155 days in the wallet of a particular holder.

When the MCA spikes, it means that the trading activity among old coins is increasing.

Most times, this movement ends up in exchanges, meaning that they are for sale. For Dogecoin, the 90-day MCA dropped. This has been happening since the 25th of June.

The decrease here implies that old coins are retiring their holdings into self-custody and not selling.

Therefore, it is likely that the large holders sell-offs were initiated by those who accumulated DOGE within the last few months.

Traders are waiting to buy at a discount

Comparing both metrics, and its effect on price, it is possible to see Dogecoin trade sideways. Per specific targets, the price of the cryptocurrency might move between $0.11 and $0.13 in the coming days.

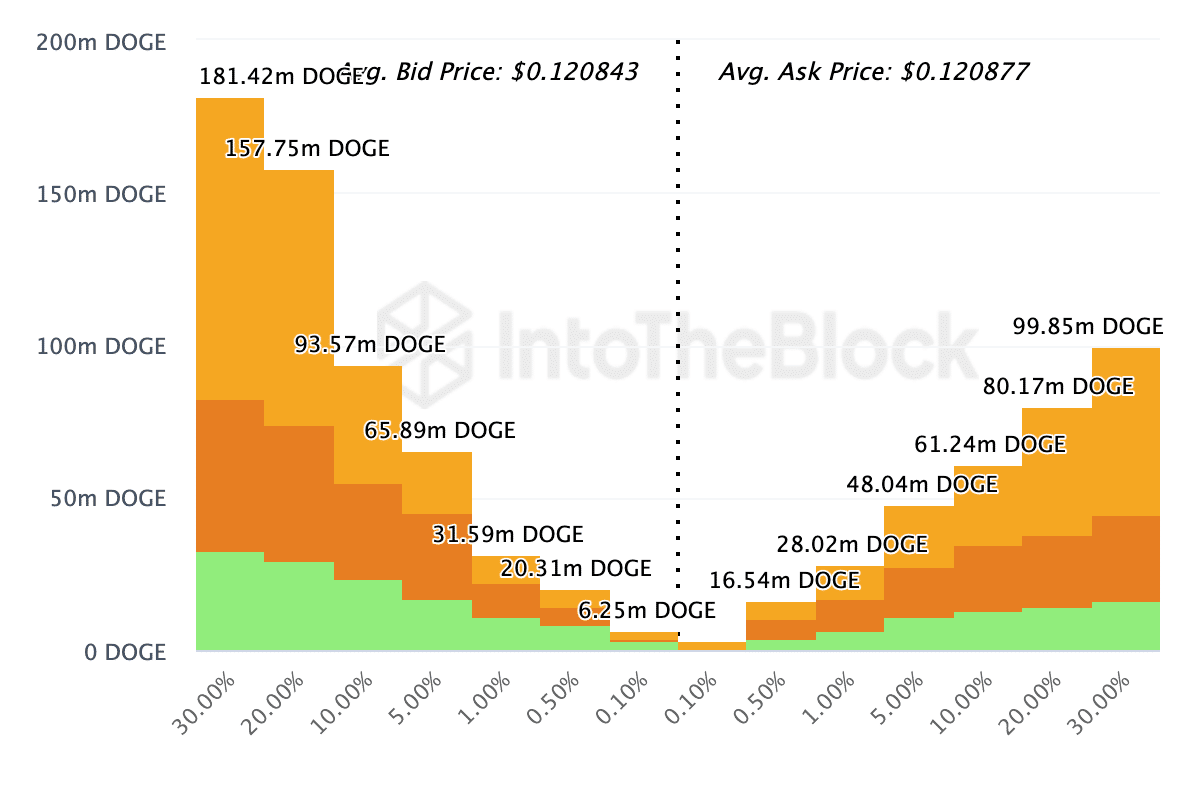

But what are other market participants doing? In this case, AMBCrypto analyzed the Exchange On-Chain Market Depth. This looks at how many traders are bidding or asking for a coin.

By bid, we mean traders waiting to buy a coin on the top 10 exchanges, and by sell, we imply those waiting to sell. If the ask side is more than the bid side, then a price decrease might occur days or weeks after.

However, a higher bid than ask favors the upside. According to IntoTheBlock, the number of coins on the bid side of Dogecoin outweighed the potential ask by a far number.

Is your portfolio green? Check out the DOGE Profit Calculator

Should the participants waiting to snipe DOGE at a lower price continue to increase, then a rally could be in the works. If this remains the case, DOGE could climb toward $0.15 in a matter of weeks.

However, the forecast will be invalidated if the value of traders bidding decrease.