Bitcoin: ‘Be prepared for very boring price action for many more weeks’

- Bitcoin’s recent price recovery is technical, not fundamental, per analyst Willy Woo.

- Despite a temporary price increase, underlying market weaknesses and speculative pressures persist.

Despite a recent spike that saw Bitcoin [BTC] momentarily reach the $62k mark, the largest cryptocurrency by market capitalization continued to struggle under bearish pressures.

After achieving a high of over $73k in March, Bitcoin has since declined nearly 20%, trading below $61k with recent fluctuations dipping as low as $60,606 at press time.

This decline comes amid broader market challenges and reflects a significant retreat from earlier gains, hinting at underlying weaknesses in market fundamentals.

Assessing Bitcoin’s recent price increase

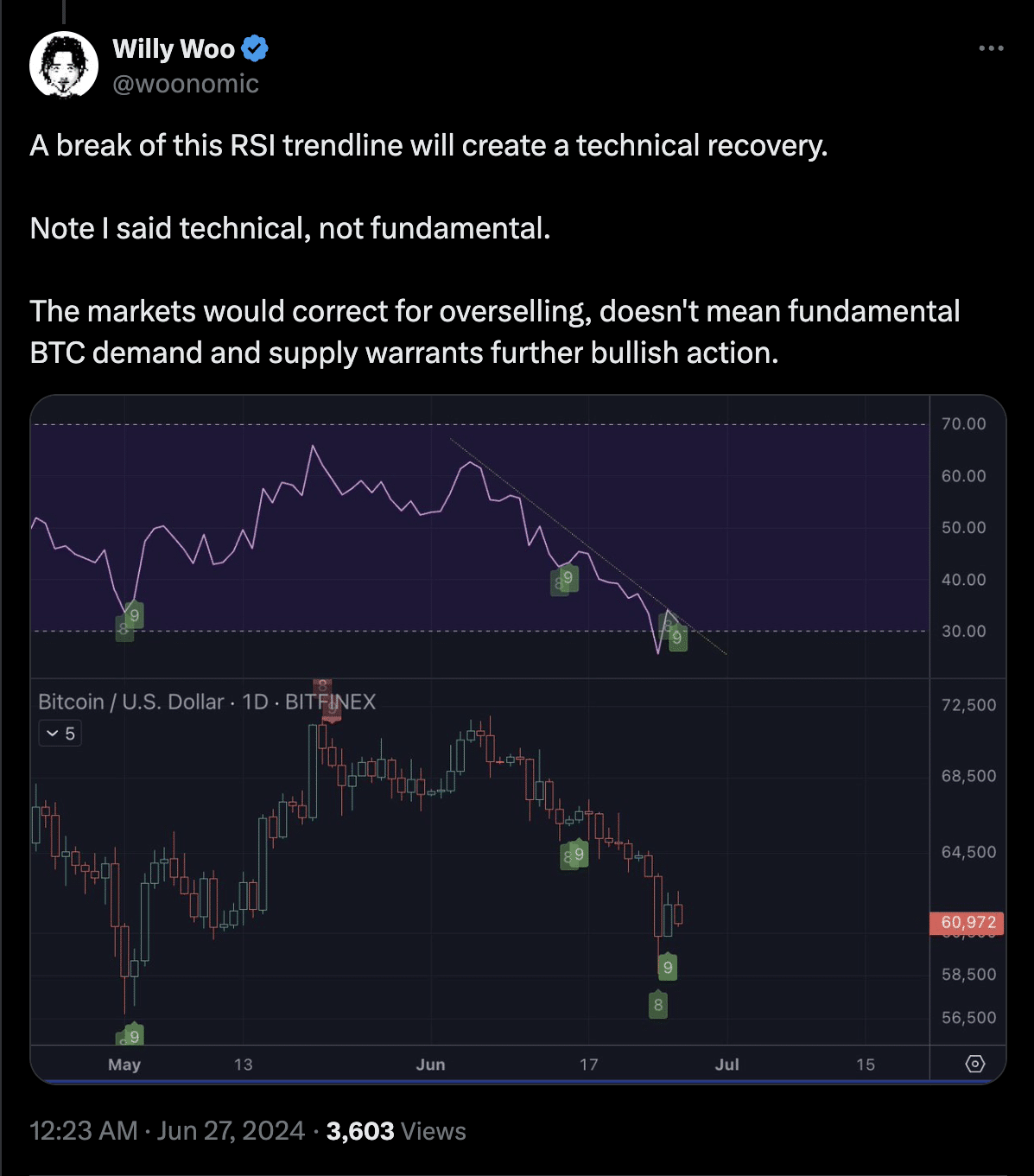

Crypto analyst Willy Woo has recently offered insights into BTC’s volatility, suggesting that while recent price corrections have alleviated some market over-leverage, a full recovery is far from imminent.

According to Woo, the market still harbors speculative excess that needs to be addressed to stabilize prices.

The recent uptick to $62k, as Woo pointed out, is more of a technical rebound than a fundamental recovery, indicating that deeper issues still plague the Bitcoin market.

Willy Woo described the latest increase in Bitcoin’s price as a technical rebound, attributing it to automatic responses within trading algorithms rather than a genuine increase in buyer demand.

He pointed out specific patterns, such as the TD9 reversal and hidden bullish divergence, which suggest a short-term recovery but do not necessarily indicate long-term health.

Woo stated,

“So far this technical reversal is playing out.”

However, Woo emphasized that this rebound does not reflect an underlying fundamental strength.

The market is merely correcting from its previous oversold condition, without any significant change in the real demand and supply dynamics of Bitcoin.

For a true bullish reversal in fundamentals, there needs to be an increase in spot buyers who are purchasing coins directly from exchanges, a trend which is not sufficiently pronounced at the moment.

Woo also noted that,

“We are still waiting for the hash rate to bounce, which is a leading sign that miners have stopped selling to fund hardware upgrades.”

He concluded,

“So be prepared for very boring price action for many more weeks. It’s not moon boy time. It’s time for speculators to liquidate themselves, or until they get bored and close positions. Then we can move on. Best path here is to stack spot and let degens die.”

Insights from market data

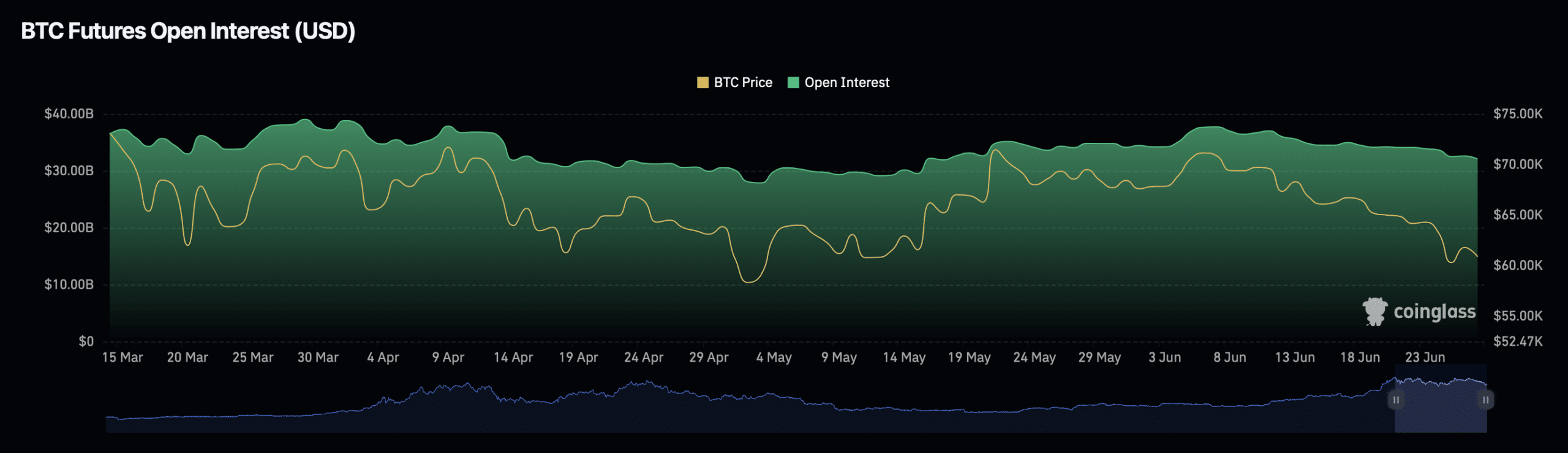

Further compounding the bearish outlook was the data on Bitcoin’s Open Interest and trading volumes.

AMBCrypto’s analysis of Coinglass’ data revealed a sharp 2.16% decrease in Open Interest and a 25% drop in Open Interest volume over the past day, indicating reduced trading activity and possibly a lower level of speculative interest.

Such declines can suggest that traders are less willing to take positions in Bitcoin, anticipating potential further drops in its price.

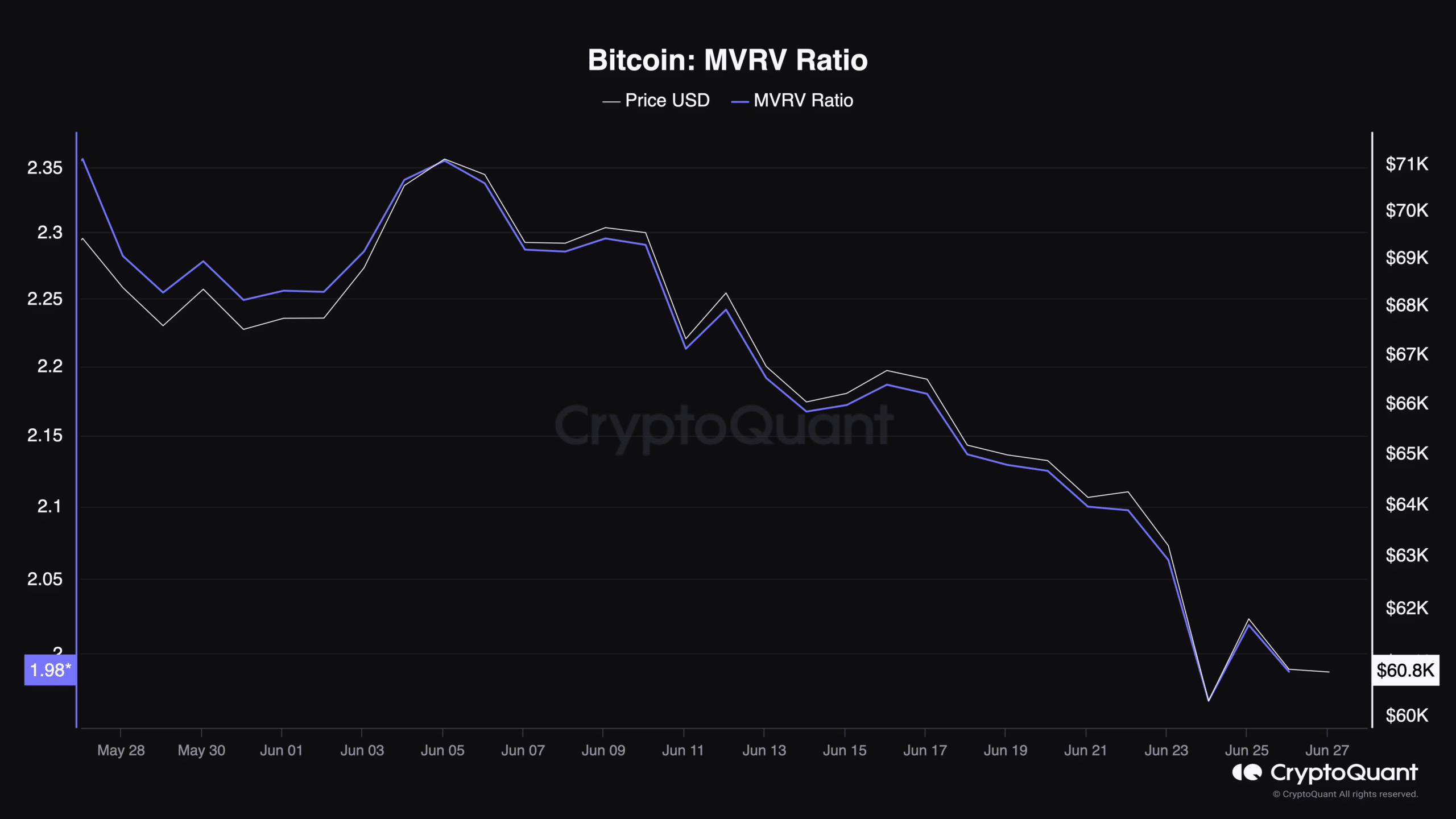

Moreover, the MVRV ratio, which compares the market value of Bitcoin to its realized value, was 1.98 at press time. This helps indicate whether Bitcoin is undervalued or overvalued compared to its historical price norms.

An MVRV ratio under 2 generally suggests that Bitcoin is undervalued, which might imply that the price could have room to grow if market sentiments change.

Read Bitcoin’s [BTC] Price Prediction 2024-25

However, given the current market conditions and broader economic uncertainties, this potential for growth must be viewed with caution.

Despite the bearish trends, some optimistic forecasts remain, such as predictions reported by AMBCrypto that foresee a surge to $250k based on the Bitcoin rainbow chart.