Solana’s NFT sales soar 125%: Will this help SOL rise?

- Solana’s number of NFT buyers surged by more than 125%.

- Market indicators suggested a price increase for SOL.

Solana [SOL] reached a milestone last week in the NFT ecosystem, which looked optimistic. However, while the blockchain’s NFT ecosystem flourished, its native token’s price remained under bears’ control.

Let’s take a closer look at what’s going on with Solana.

Solana NFTs’ latest achievement

SolanaFloor, a popular X (formerly Twitter) handle that posts updates related to the blockchain’s ecosystem, recently posted a tweet highlighting an interesting development.

As per the tweet, Solana crossed over $100k SOL in terms of NFT trading volume in the last seven days.

AMBCrypto’s look at CRYPTOSLAM’s data revealed that the blockchain’s number of NFT buyers increased by 125% last week.

Similarly, Solana’s number of NFT sellers also spiked by more than 66% in the past seven days. DappRadar’s data revealed that MadLads was the top SOL NFT collection of the week.

Apart from MadLads, Famous Fox Federation and STEPN also made it to the top three on the same list.

However, it was surprising to note that despite the massive rise in the number of buyers and trading volume, Solana’s NFT sales volume dropped by over 4%.

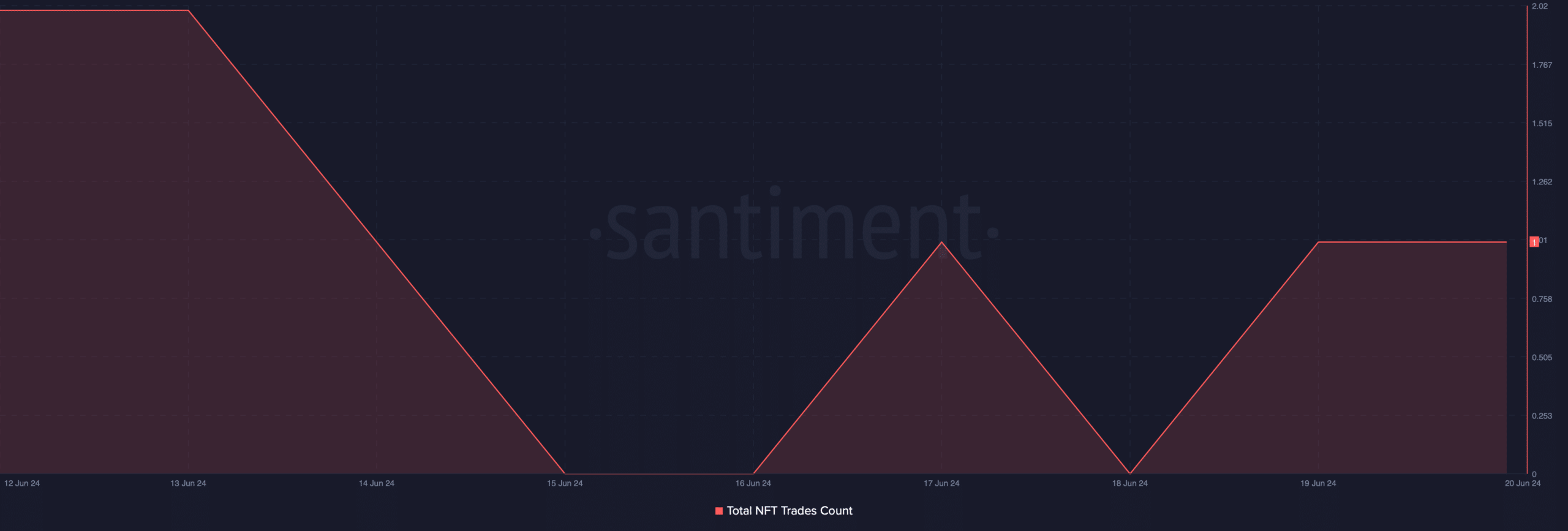

Our analysis of Santiment’s data also revealed that SOL’s NFT trade counts dropped last week.

Bears are refusing to leave

While Solana’s NFT ecosystem managed to grow last week on a few fronts, the case was different for SOL. CoinMarketCap’s data revealed that SOL’s price declined by nearly 10% in the last seven days.

At the time of writing, Solana was trading at $137.34 with a market capitalization of over $62 billion, making it the fifth-largest crypto.

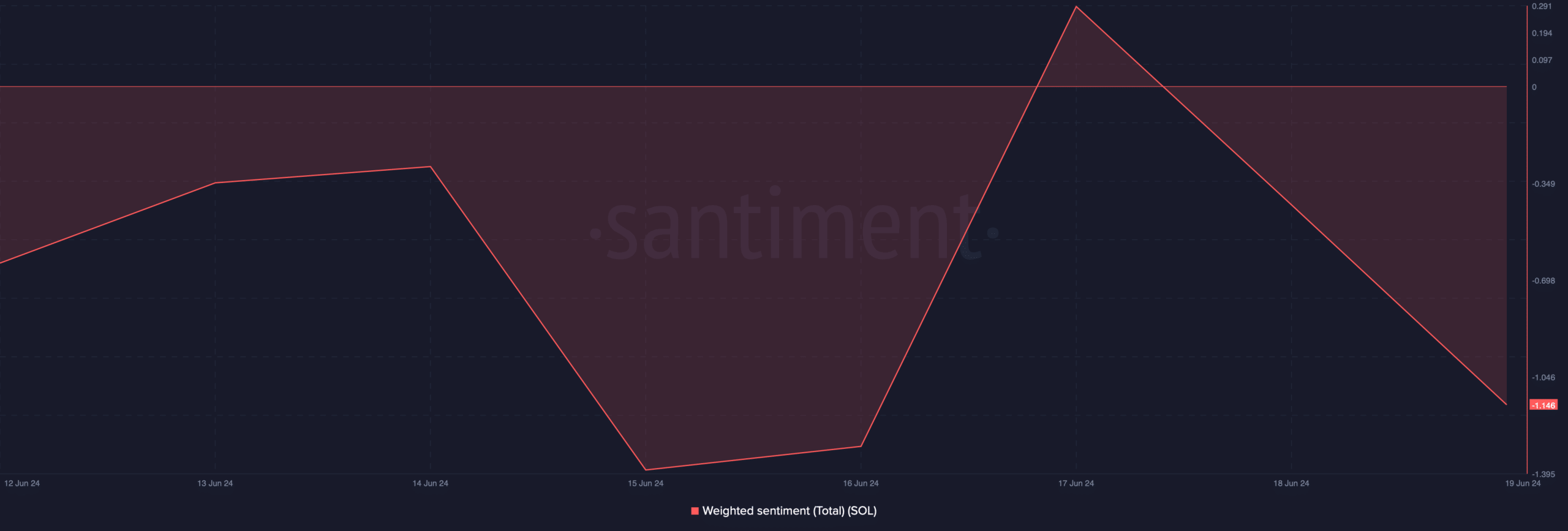

The massive price drop had a negative impact on SOL’s social metrics. Notably, the token’s Weighted Sentiment dropped sharply, meaning that bearish sentiment was dominant in the market.

However, there were chances for the bearish trend to change. AMBCrypto’s look at CFGI.io’s data revealed that at press time, SOL’s fear and greed index had a value of 30%, meaning that the market was in a “fear” phase.

Whenever the metric hits that level, it indicates a possible price increase.

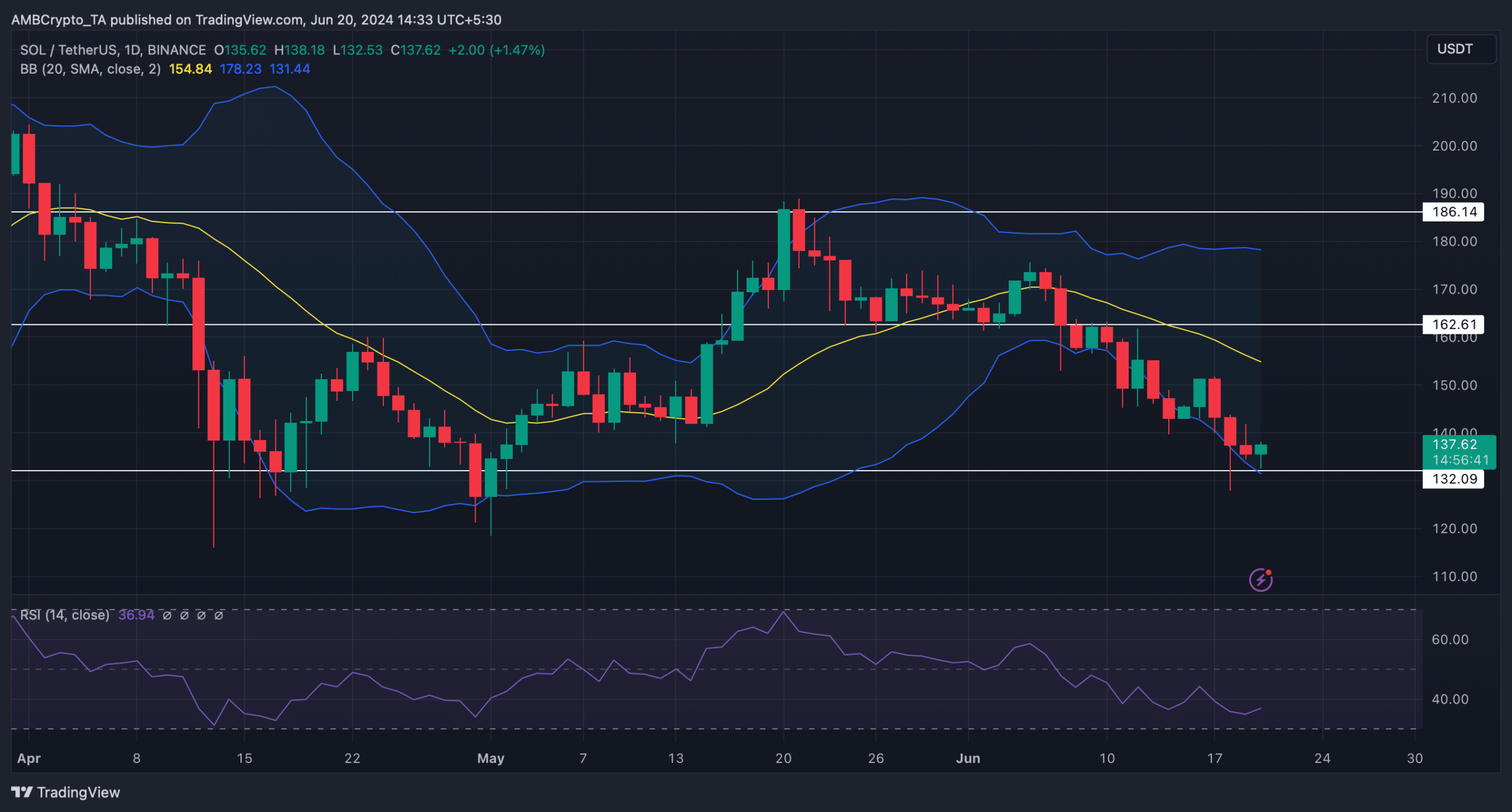

Therefore, to see whether a price increase is possible, AMBCrypto analyzed SOL’s daily chart. We found that Solana’s price touched the lower limit of the Bollinger Bands, which often results in a price rebound.

Read Ethereum’s [ETH] Price Prediction 2024-25

Additionally, the Relative Strength Index (RSI) also registered an uptick, further hinting at a price hike. If a trend reversal happens, then SOL might touch $162 in the coming days.

A successful breakout above that level might allow SOL to reclaim $186.