Litecoin price prediction: How miners might trigger a LTC drop

- Litecoin’s price might keep trading below $80 as Puell Multiple rose above $0.50.

- A rise in Bitcoin and Ethereum’s prices might not influence LTC.

The actions of Litecoin [LTC] miners typically affect the cryptocurrency’s price. In this piece AMBCrypto will disclose the recent developments and the potential impact on LTC’s value.

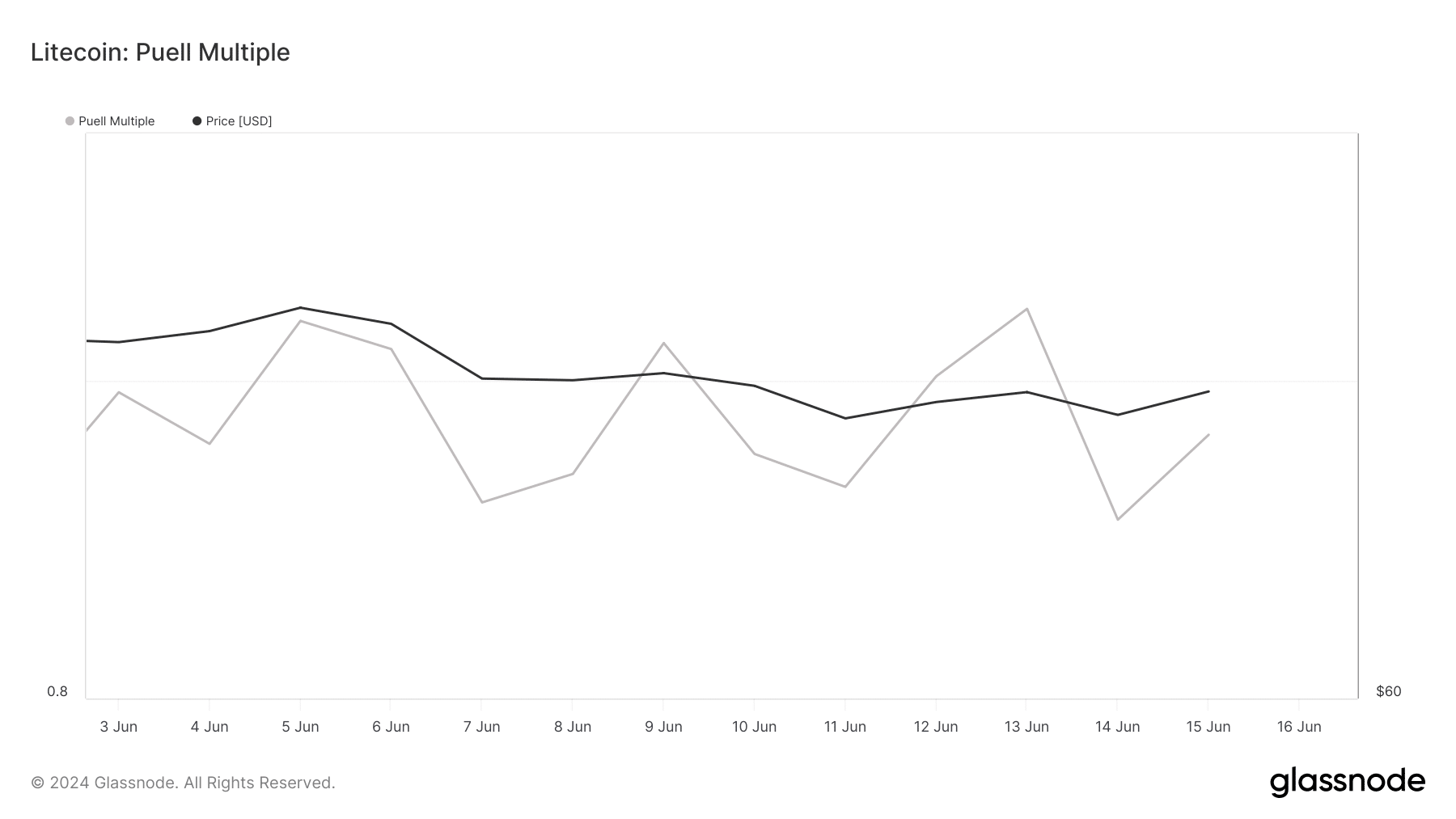

Starting, we looked at the Puell Multiple. In non-technical terms, the Puell Multiple compares the cost of mining relative to revenue.

If the metric decreases, it means that miners’ revenue has decreased compared to the cost of operation. However, an increase suggests that the revenue has exceeded the cost of mining.

Increasing revenue has opened the floor for selling

In a situation where the metric falls, Litecoin can be volatile. But at that point, the cryptocurrency is undervalued. At press time, Litecoin’s Puell Multiple had risen to 0.88.

This increase implies that LTC might be overvalued since the reading was above 0.50. It also suggests that miners might be moved to sell some of their holdings since they were running in profits.

Should this metric continue to rise, LTC’s price might drop. As of this writing, Litecoin’s price was $79.01. This was a 5.50% decrease in the last 24 hours.

Previously, AMBCrypto analyzed how Litecoin might trade under $80 for some time. If miners decide to sell some of their LTC, this prediction could be validated.

However, if they refrain from selling, it does not mean LTC would go on a long rally.

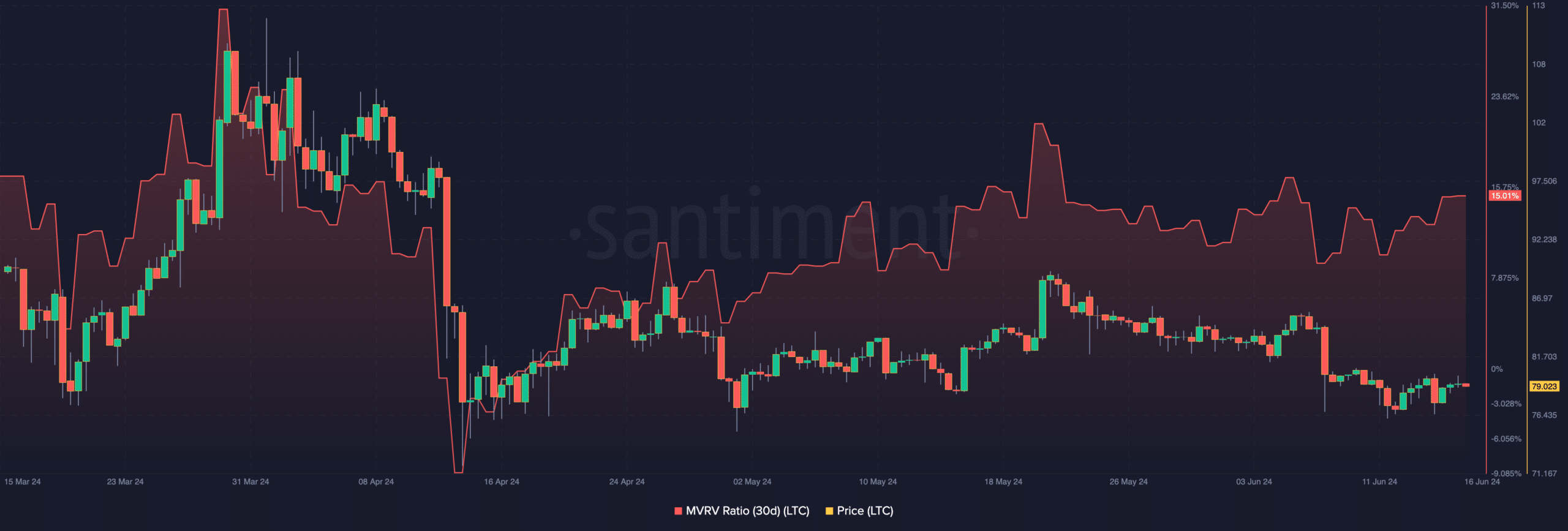

Instead, the price of the coin might change hands between $75 and a little over $80. Furthermore, the Market Value to Realized Value (MVRV) ratio was 15.01% at press time.

LTC at risk, can’t depend on BTC and ETH

The MVRV measures profitability of holder. It also serves as a way to check if a cryptocurrency is undervalued or not.

Thus, the reading meant that if the average LTC holder sells off their holdings, the average return would be around 15%. Considering the current market condition, this could mean that Litecoin is undervalued.

If the price of the coin decreases, the ratio might also fall. However, in the long term, the price of Litecoin might trade higher.

Assuming the bull market condition experienced in market returns, the value of the coin might jump to $105.

As such, that could be a mid to long-term target. In addition, AMBCrypto checked if the price action of Bitcoin [BTC] or Ethereum [ETH] can impact Litecoin.

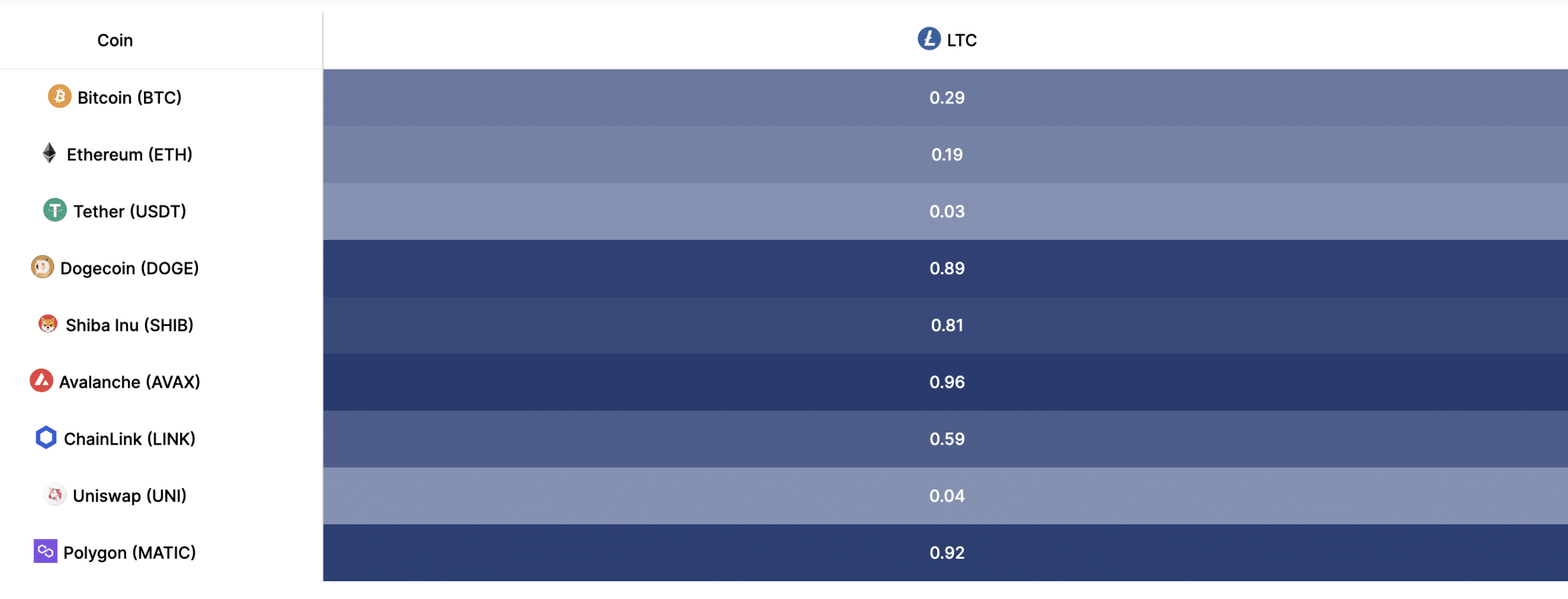

To do this, we evaluated the correlation indicator provided by IntoTheBlock. Values of this range from -1 to +1. When the value is close to +1, it indicates a strong correlation.

On the other hand, a value closer to the negative region suggest diverging performance. At press time, LTC’s correlation with Bitcoin was 0.29. With ETH, it was 0.19.

Realistic or not, here’s LTC’s market cap in BTC terms

Therefore, if Bitcoin or Ethereum’s price increases, it is no guarantee that Litecoin would follow.

Interestingly, memecoins and other large-cap altcoins seem to have a stronger correlation with LTC than the top two cryptocurrencies.