Why Pi Network’s mainnet launch is crucial for Pi’s price

- Pi Network disclosed that it was putting finishing touches on the project.

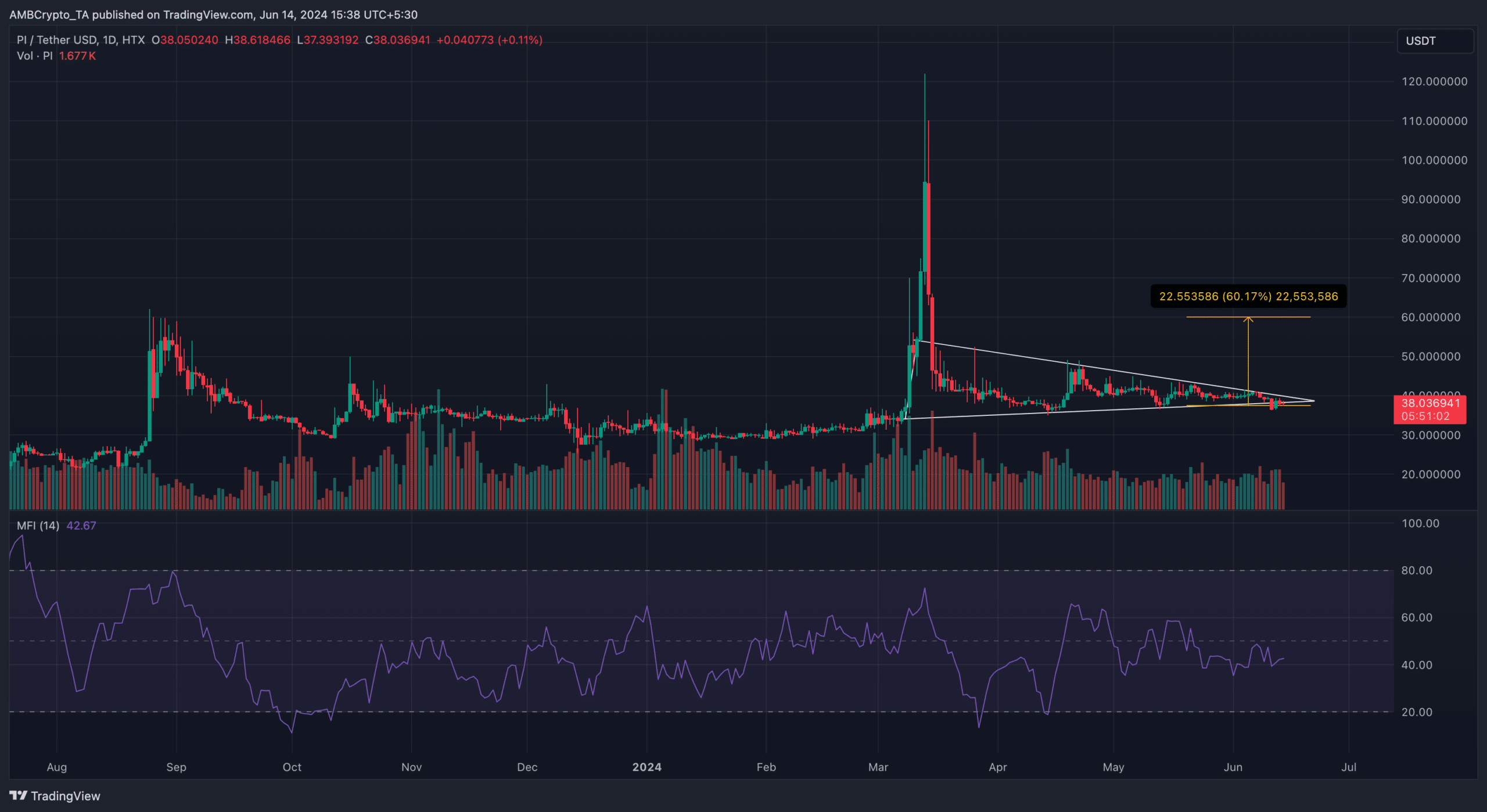

- Pi’s price decreased by 6.26% in the last seven days but might soon break out.

Pi Network has been in existence for some time. However, it has been a struggle for the project to launch on mainnet despite the active trading of Pi, its native token.

However, all that might soon change as the team revealed its plans on the 7th of June. According to Pi Network, all is set for the introduction of its Mainnet. While encouraging users to get ready, it noted that,

“The Mainnet Checklist has been optimized: all Pioneer-dependent steps have been clustered earlier in the list, allowing for smoother completion and reduced drop-offs.”

However, not everyone knows what Pi Network does. That is what AMBCrypto would explain in this article.

What is Pi Network?

Pi Network has two functions. One— it is a developer platform that allows developers to produce products for real-world application. Secondly, Pi is a cryptocurrency that allows users to mine coins without endangering the environment.

This activity takes place on the phone and rarely affect the battery of the mobile device. Currently, Pi Network claims to have over 35 million users who can access “untapped social capital.”

In terms of its consensus, Pi does not use the Proof-of-Work (PoW) like Bitcoin [BTC]. This is because the PoW has environmental costs which is not part of the project’s fundamentals.

Instead, it uses the Stellar Consensus Protocol (SCP) to validate transactions. Furthermore, since environmental impact is low, users can mine Pi on the App Engine which is similar to the Apple iOs operating system.

Despite the potential of the project, the cryptocurrency’s price has struggled to sustain positive returns for its holders.

According to CoinMarketCap, Pi’s price was $37.92 at press time. This value was a 57.19% increase within the last 365 days. However, the same price has decrease within the last week by 6.26%.

Is Pi ready to break out?

Like the price, CoinMarketCap showed that the trading volume fell in the last 24 hours as well. Volume is an indicator of interest. Hence, the decline implied that buying and selling of Pi had decreased.

However, a falling volume and decreasing price may lead to seller exhaustion, and this could trigger a bounce in Pi’s price. However, it is important to analyze the potential from a technical perspective.

On the daily chart, AMBCrypto observed that Pi had formed a symmetrical triangle. A symmetrical triangle appears when two converging lines of opposite slopes meet each other.

This could either lead to a break down or a break out. For Pi Network’s cryptocurrency, the token seem to be moving out of a depression phase. Also, the Money Flow Index (MFI) shows that capital is starting to move into the market.

Therefore, there is a chance for PI to breakout. However, this would also depend on the sentiment around the token as well as the project’s development plans.

Realistic or not, here’s Pi’s market cap in BTC terms

If Pi goes ahead with the Mainnet launch, it could cause euphoria in the market, and lead to the price toward the $60 upper resistance.

On the other hand, a bearish outlook might lead to another decline.