Checking Cardano’s strong link with AVAX, MATIC: Gains ahead?

- The correlation coefficients respectively indicate nearly parallel market movements.

- On-chain data suggested that holders should anticipate further gains in the future.

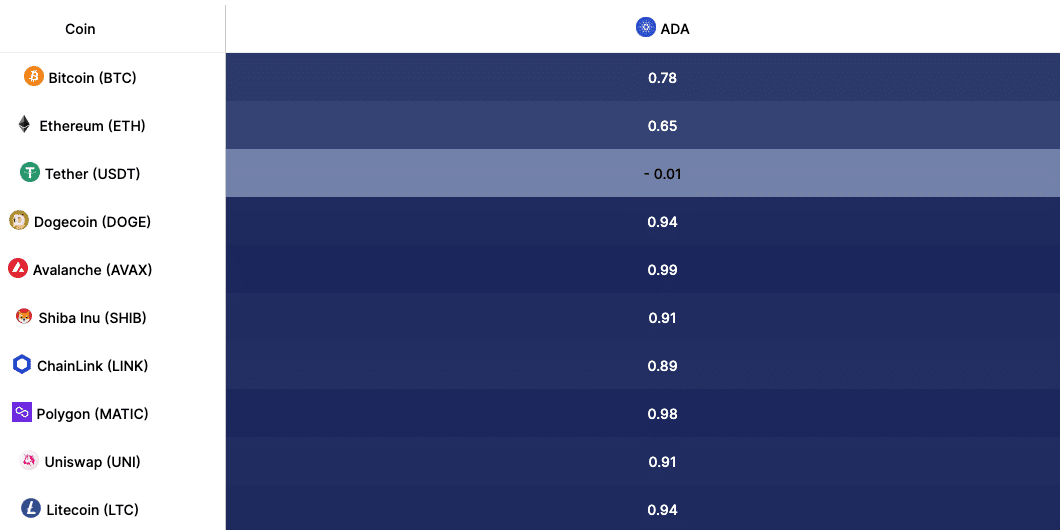

According to IntoTheBlock, Cardano [ADA] has a stronger correlation with Avalanche [AVAX] and Polygon [MATIC] than any other top cryptocurrencies.

At press time, the correlation between ADA and AVAX was 0.99. For MATIC, it was 0.98 on a 60-day basis. Values of the correlation coefficient range from -1 to +1 where the former implies significant divergence.

On the other hand, a reading close to +1 suggests strong direction movement which was the case with Cardano and the other two. As of this writing, ADA’s price was $0.45, which was a 26.40% decrease on a Year-To-Date (YTD) basis.

A trio in deep waters

For AVAX, its value was $36.94— a 11.73% decrease within the same period. Lastly, MATIC changed hands at $0.71, marking a 29.21% slide.

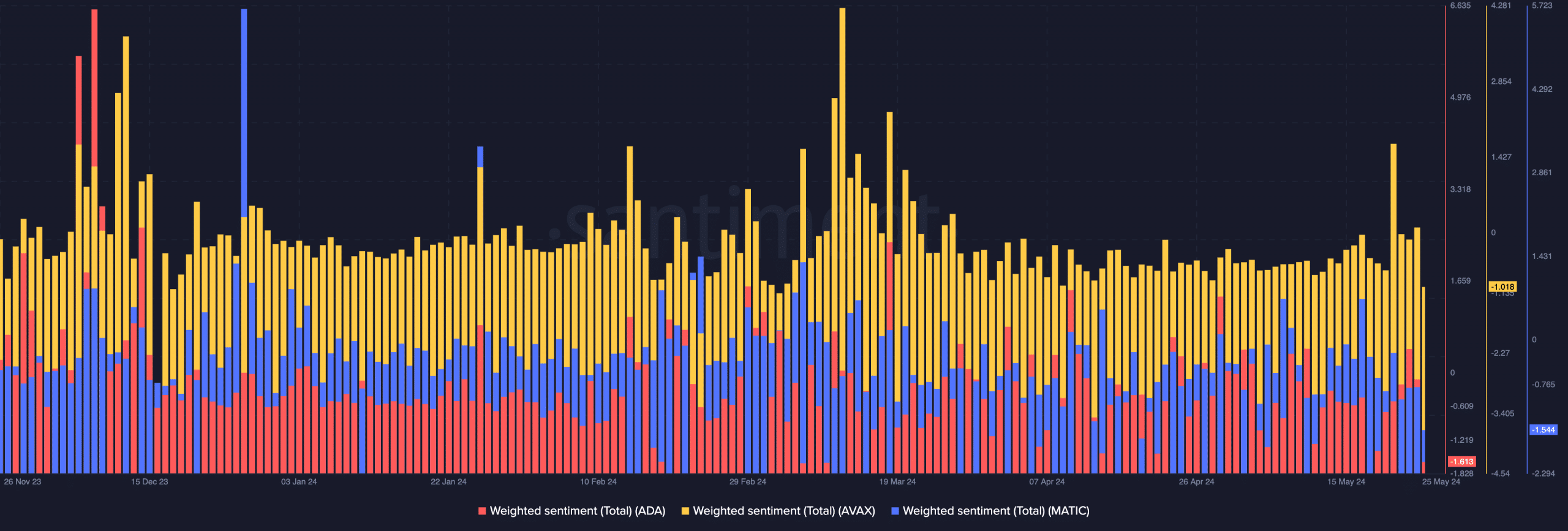

To ascertain if Cardano would continue to follow in the same direction as AVAX and MATIC, AMBCrypto looked at the sentiment around the projects.

A look at the Weighted Sentiment metric provided by Santiment that the reading was -1.613 for ADA. In AVAX’s case, the reading was -1.018 while MATIC’s was -1.544.

Weighted Sentiment shows the unique social volume, measured by comments about an asset. If the metric is positive, it implies that market participants are bullish, and demand for the assets involved might increase.

However, since the reading was negative for all three, it indicates low confidence in the potential. With this trend, there is a chance that ADA, AVAX, and MATIC prices might decrease again.

At the same time, a highly negative sentiment of this nature could indicate a good period to accumulate before a major surge appears.

The tokens may soon get back to the bull phase

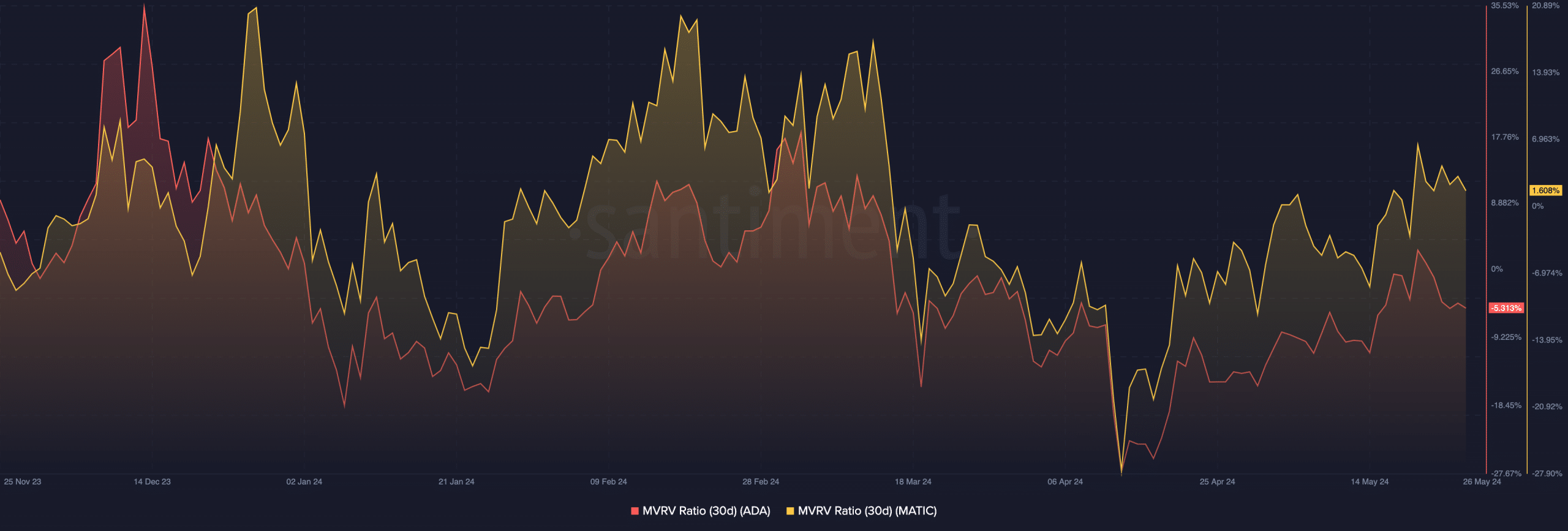

But to confirm that, we need to analyze the Market Value to Realize Value (MVRV) ratio. This metric tells if a cryptocurrency is undervalued or otherwise.

The more the MVRV ratio increases, the more profits holders have, and the more they are willing to sell. On the other hand, a decrease in the metric suggests that more holders are moving into unrealized losses.

In this case, most will decide to HODL. At press time, Cardano’s 30-day MVRV ratio was -5.313%. This means that if every ADA holder who accumulated within the last 30 days sold, they’d be making an unrealized loss.

In MATIC’s case, the metric was 1.608%. But one thing AMBCrypto noticed was that the ratios decreased. Therefore, one can assume that the tokens were undervalued in the context of the bull market.

Realistic or not, here’s AVAX’s market cap in ADA terms

Should the prices begin to recover, ADA could rally back to $0.67. If it is the same for AVAX, the token could make a move to $50.35.

In addition, a bounce for MATIC could send the price in the $1.06 direction.