‘I don’t think Ethereum ETFs will match Bitcoin ETFs, but…’ – Exec

- SEC approved the 19b-4 listing for Ethereum ETFs, but S-1 approval is awaited

- Bitcoin ETFs have been seeing massive inflows, with Ethereum expected to attract millions too

After much speculation surrounding the approval of Spot Ethereum [ETH] ETFs, the SEC gave a green light to these financial products a few days ago.

However, what’s significant here is that they’ve only approved the 19b-4 listing requests for ETH ETFs, not the critical S-1 registration statements.

What’s behind the split?

This split approval raises questions, with some suggesting a potential political influence rather than a careful review of the ETF proposals. Sharing a similar line of thought, Matt Hougan, CIO at Bitwise, during a recent episode of the ‘Bankless’ podcast said,

“I haven’t seen an example of people having no expectation of approval and flipping to expecting approval so quickly on an effectively overnight basis. So, to the extent that this has never happened again, something was shocking at work here.”

Reiterating the same, James Seyffart, Research Analyst at Bloomberg Intelligence, added,

When asked about the next steps in terms of an ETF, Hougan noted,

“The process between sort of where we are and these ETFs listing is: Issuers have to go back and forth with the division of investment management around exactly what’s in this document.”

Here, he highlighted that while the SEC’s approval of the 19b-4s is a significant step forward, the full launch of ETH ETFs depends on the S-1 document approval. This could take weeks to months.

Impact on ETH’s price

Needless to say, these developments contributed to significant fluctuations in Ethereum’s market cap, initially leading to a decline on the charts. However, at press time, ETH had rebounded to $3,752, up 1.65% in the last 24 hours. The wider market sentiment, led by Bitcoin climbing past $69k, had turned bullish too.

Bitwise CIO lent some insights to this matter too by stating,

“There’s no new supply, net supply is effectively zero and what that means is that this new demand shock has to buy ethereum from people who don’t have to sell it and that’s just an extraordinarily bullish setup.”

BTC inflows vs. ETH inflows

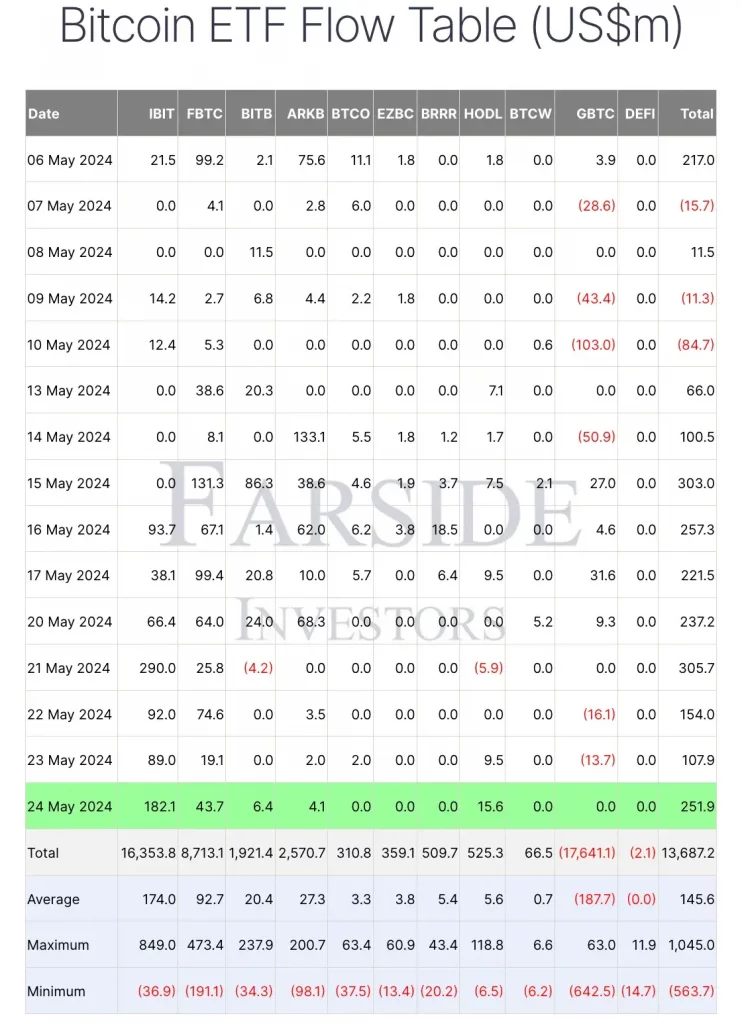

As far as spot Bitcoin [BTC] ETFs are concerned, since their debut on 11 January, the inflows have been phenomenal. In fact, recent data by Farside Investors revealed that on 24 May, Bitcoin ETFs saw total inflows of $251.9 million.

Will Ethereum see similar numbers though? According to Hougan, no. He went on to say,

“I don’t think Ethereum ETFs will match Bitcoin ETFs but I do think it will be measured in terms of many billions of dollars.”

The exec expanded on this point by emphasizing that Bitcoin’s simplicity as “digital gold” makes it easily understandable, while Ethereum’s role as a platform for decentralized applications is more complex.

Institutional investors, however, are likely to see the value of diversifying and diving into both BTC and ETH ETFs.