Dogecoin: $0.25 is DOGE’s next target – This is why

- 81% of DOGE holders are in profit, indicating that the coin has not reached the top.

- Traders are betting on an increase, and other indicators suggest a run toward $0.25.

Dogecoin [DOGE] has lost 4.66% of its value in the last 24 hours. But AMBCrypto’s on-chain analysis suggests that the coin has not hit the top of this cycle.

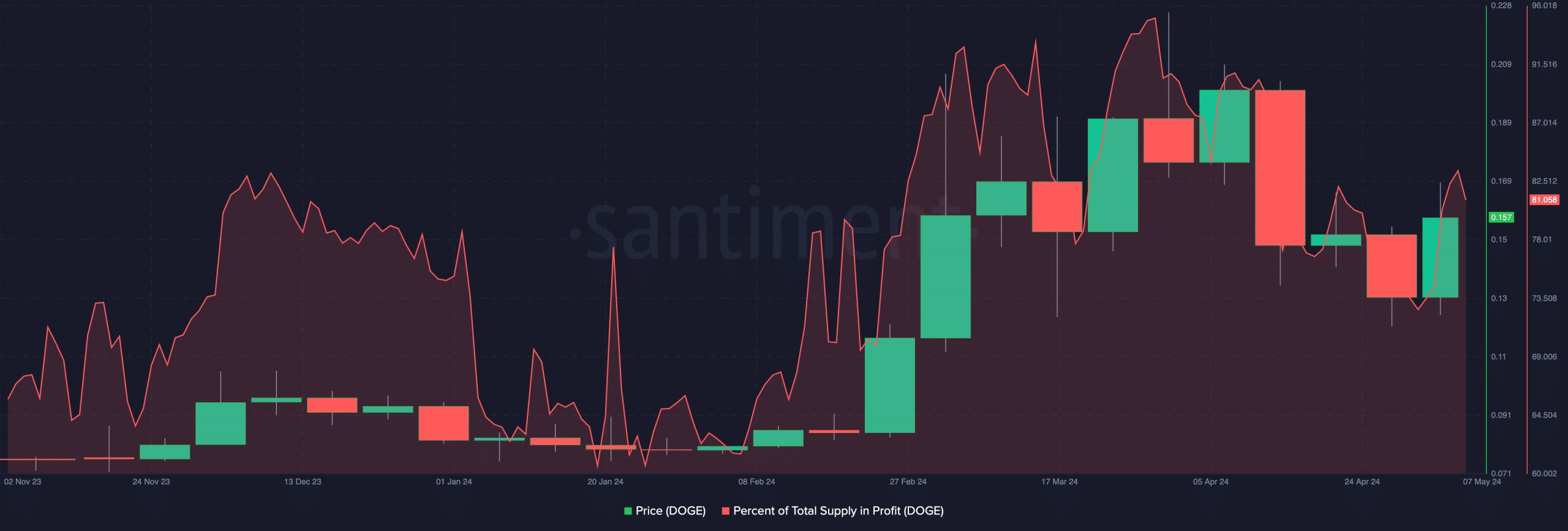

We found the Rationale for this in the total supply in profit. At press time, 81.05% of the total Dogecoin circulating supply was in profit.

Another 40% hike is on the table

Typically, such a high level of gains should trigger selling. Interestingly, this has been the case as DOGE, despite reaching $0.20 about 30 days back, changed hands at $0.15 at press time.

But for the coin to hit the top, at least 95% of holders have to be in the green zone. This inference was taken from the historical performance of DOGE.

However, it is important to note that history does not always repeat itself. But patterns tend to be similar. Therefore, going by past bull markets, Dogecoin might need to rise by another 40% for talks about the top to be valid.

If this is the case, the coin price should be trading at $0.25. Furthermore, DOGE might hit the price, and could still go higher considering the external factors that could drive the cryptocurrency to $1.

Should this be the circumstance, then 100% of the coins in circulation would be in profit. Furthermore, traders seemed to share the opinion that DOGE might be set to bounce.

Will bullish wagers be worth it?

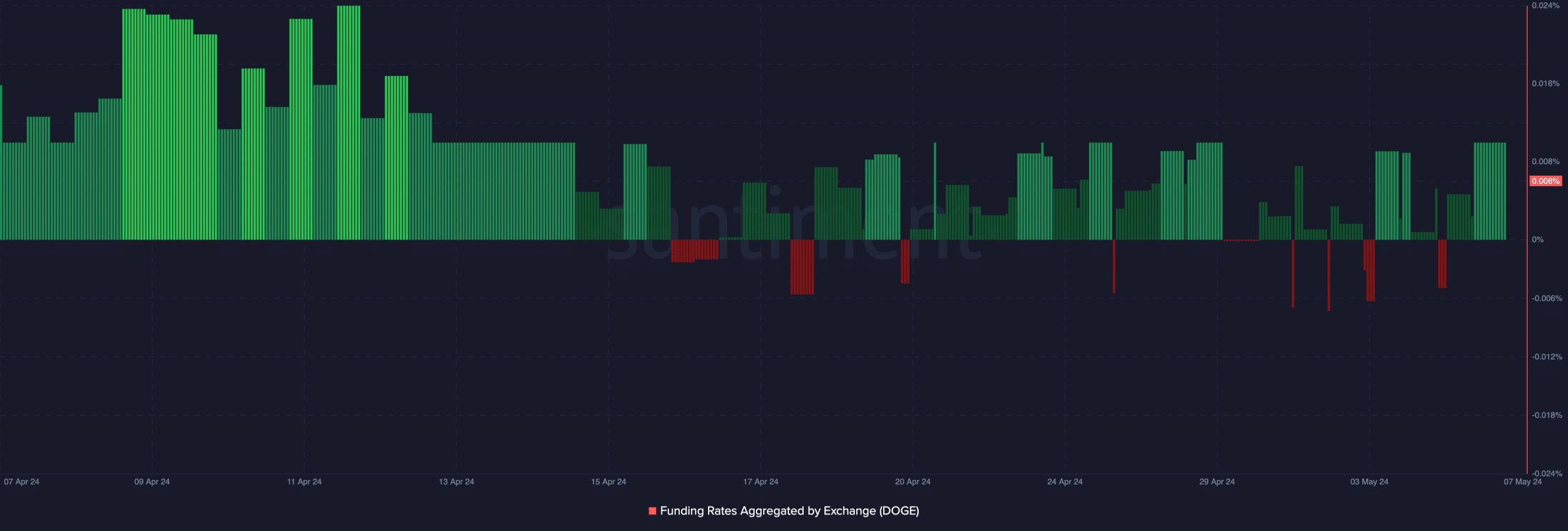

This was indicated by the Funding Rate. On the 5th of May, Dogecoin’s Funding Rate was negative, suggesting that shorts were paying longs a fee and bets in the market were mostly bearish.

But at press time, that was no longer the case, as the Funding Rate was positive. Positive values of the metric imply that DOGE was trading at a premium per price compared to the spot value.

However, the price decrease suggests that longs are not yet getting rewards for their positions. From a price perspective, this could be bearish for DOGE.

As such, the price might slide to $0.14. If it does, the rebound from this low could be hard, and a rally could occur in the midterm.

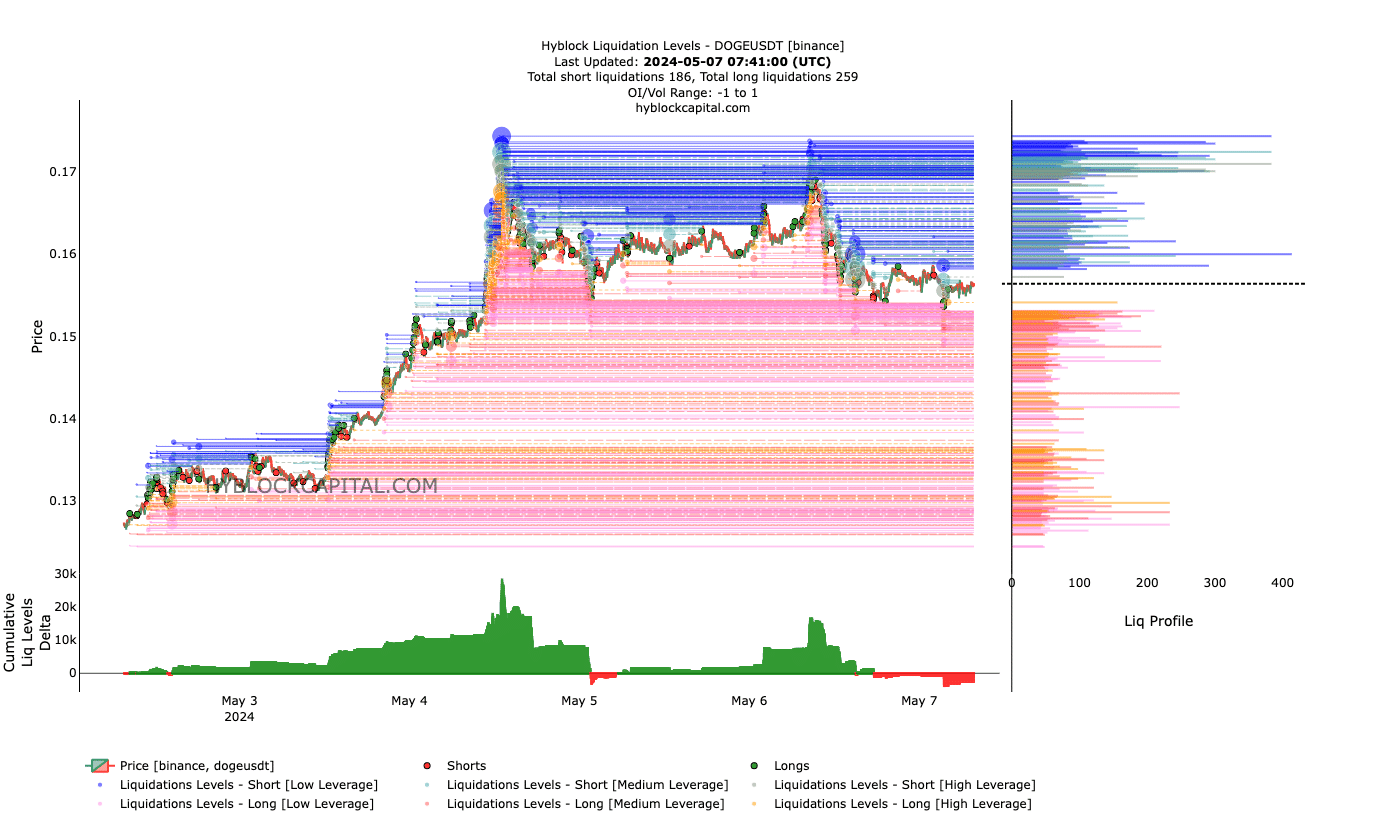

Another indicator AMBCrypto found fueling the prediction was the liquidation levels and the CLLD. CLLD is an acronym for Cumulative Liquidation Levels Delta.

When the CLLD is positive, it implies that there are more long liquidations. A negative reading, on the other hand, suggests more short liquidation.

From the chart above, a magnetic zone appeared between $0.16 and $0.20, indicating that Dogecoin’s price could rise in that direction.

Is your portfolio green? Check out the DOGE Profit Calculator

The negative value of the CLLD indicates that the slight price dip could leave late shorts trying to capitalize on the movement at risk.

While this could trigger a bullish bias, longs who are not getting rewards yet, might soon start to make profits.