FLOKI’s trend reversal depends on THIS key factor panning out

- Positive sentiment and interactions around Floki Inu grew significantly over the last few days

- Despite the surge in price, however, holders remained unprofitable

Once upon a time, Floki Inu [FLOKI] was left behind as other memecoins entered the market and flooded social media platforms with hype. However, recent data suggests that this could finally be changing.

A rise in popularity

According to LunarCrush’s data, FLOKI has dominated the field in terms of social activity. Apart from Solana, the memecoin has outperformed all other coins in this space. Over the last 24 hours, the positive sentiment around the altcoin grew by 89%. Additionally, the number of interactions FLOKI was having across social media platforms also surged.

Because Floki is a memecoin, the success of the token depends on its popularity on social media.

Looking at the price

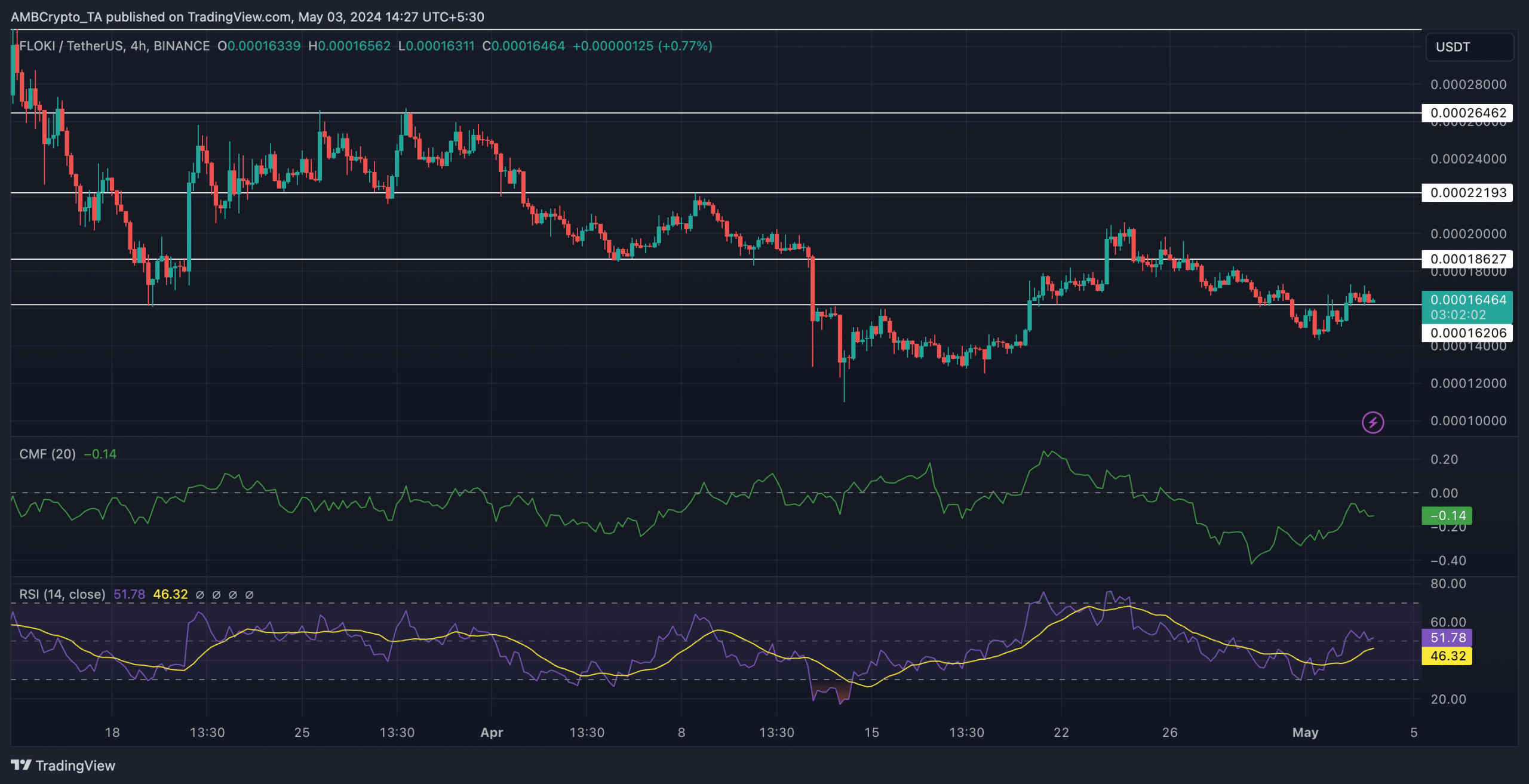

Due to the surge in activity on social media platforms, the price of FLOKI surged materially. In the last 24 hours alone, the price of FLOKI hiked by 6.19%. However, this surge in price did not translate to a bullish trend. In fact, since 28 March, the price of FLOKI has fallen on the charts. After the decline in price, FLOKI continued to hit lower lows and lower highs – Indicative of a bearish trend.

For FLOKI to reverse the trend and rally again, its price would have to break past the $0.00020873-level in the future. It would need massive bullish momentum to do the same. While the RSI (Relative Strength Index) for FLOKI hiked to 51.4, the uptick wasn’t significant enough for a big move.

Moreover, the CMF(Chaikin Money Flow) for the token also declined, pointing to heightened selling pressure on FLOKI’s markets. It remains to be seen whether the price of FLOKI succumbs to the selling pressure or not.

How are holders doing?

A massive factor that contributes to selling pressure of a token is the profitability of addresses. If holders become profitable in a very short span of time, they are much likely to sell their holdings. This was not the case with FLOKI.

AMBCrypto’s analysis of Santiment’s data revealed that the MVRV ratio of FLOKI declined, indicating that most holders are yet to see profits. This means that the price of FLOKI could surge further before holders indulge in profit taking, while subsequently causing a correction.

Realistic or not, here’s FLOKI market cap in BTC‘s terms