Solana: What key indicator’s 47% slip means for SOL’s price and $130

- SOL’s Futures Open Interest sat at a two-month low.

- There is a possibility the coin slips under $130.

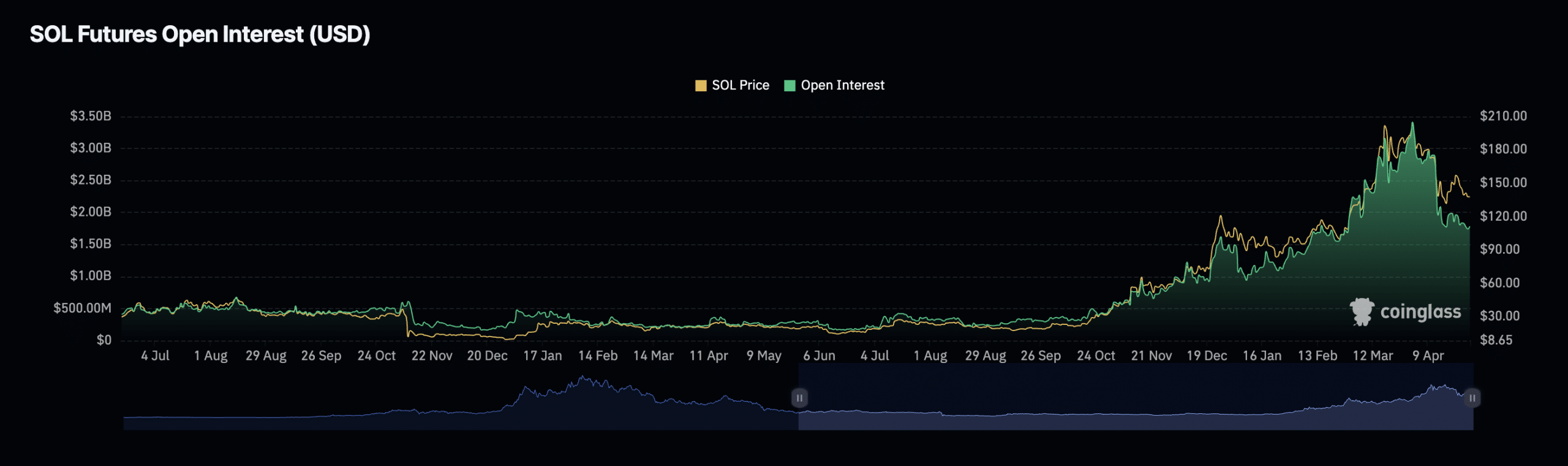

Solana’s [SOL] Futures Open Interest has cratered to its lowest level since the 27th of February, according to data from Coinglass.

An asset’s Futures interest tracks the total value of its Futures contracts that have yet to be settled or closed.

When it declines in this manner, it indicates a surge in the number of market participants closing their trade positions without opening new ones.

According to Coinglass’ data, the altcoin’s Futures Open Interest totaled $1.79 billion at press time. It began its decline on the 1st of April and has since fallen by 47%.

Solana saw a decline in April

An assessment of Solana’s performance revealed that the Layer 1 blockchain witnessed a decline in network activity in April.

According to The Block’s data dashboard, Solana witnessed a decrease in its monthly count of active addresses.

During the month, the number of unique addresses that signed transactions across Solana totaled 34 million. This represented an 11% drop in active Solana use during the month.

New demand for the blockchain also plummeted. On-chain data showed that in April, the number of unique first signers to transact on the Solana Network amounted to 25 million.

This marked an 11% drop from the 28 million new users that completed at least one transaction on Solana in March.

Due to low user activity on the network in April, Solana’s monthly transaction volume cratered significantly. Totaling $7.32 trillion, the network saw a 95% month-over-month decline in transaction volume.

For context, in March, Solana’s transaction volume was $148 trillion.

SOL has two options

At press time, SOL traded at $135.10. According to CoinMarketCap, its price has dropped by over 30% in the last week.

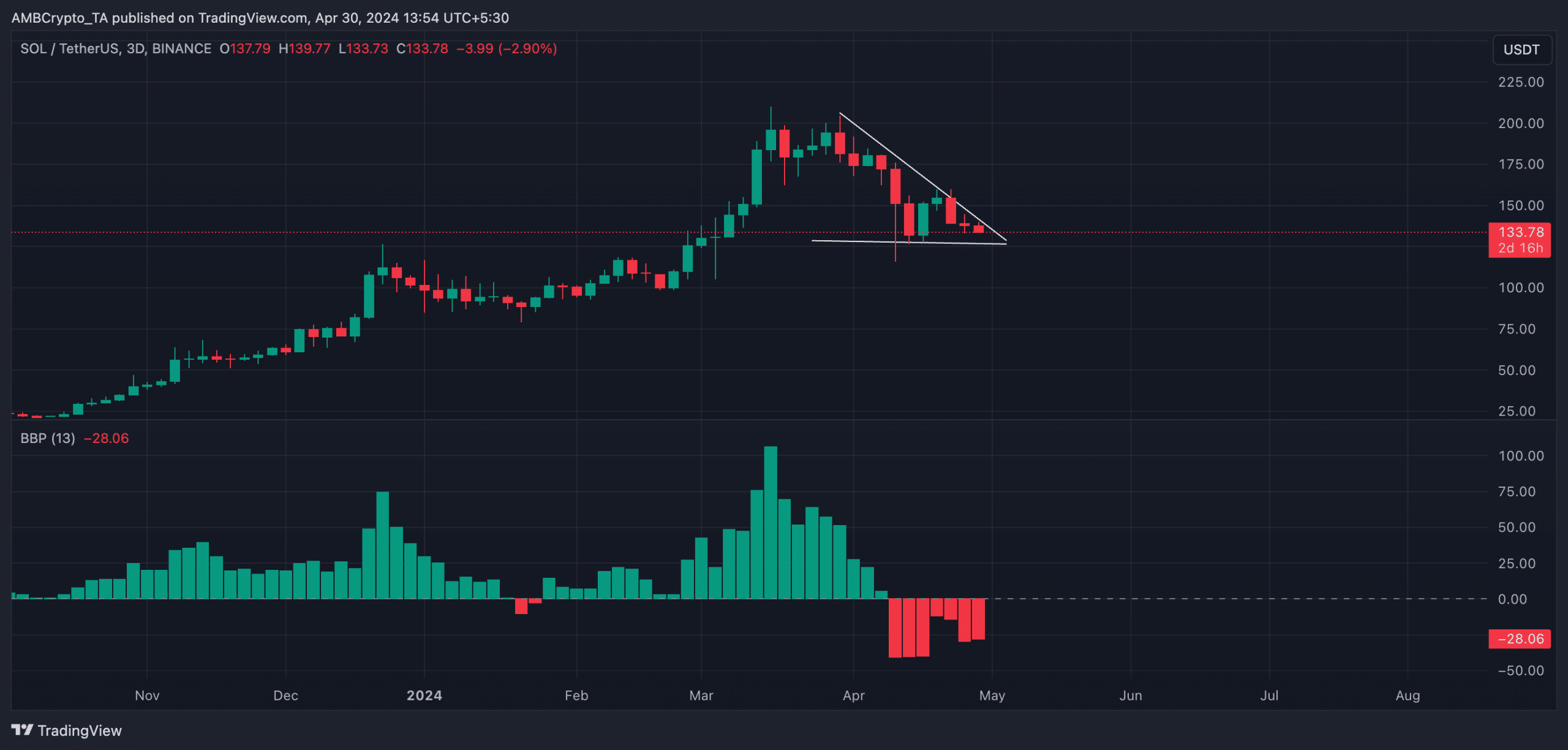

An assessment of the coin’s performance on a 3-day chart revealed the formation of a descending triangle, within which SOL’s price has found support at the $128 price level.

If sentiment grows poorer, the coin may retest support and fall below $130.

A quick look at the market’s sentiment showed that bearish activity superseded the bullish outlook amongst market participants.

For example, SOL’s Elder-Ray Index, which measures the relationship between the strength of the altcoin’s buyers and sellers in the market, was negative at the time of writing and has been negative since the 12th of April.

Read Solana’s [SOL] Price Prediction 2024-25

When this indicator is negative, it means that bear power is dominant in the market. As a result, SOL remains at risk of retesting support and even falling below it.

However, if market sentiment changes, the coin may break out of the triangle in an uptrend and trade at $195 and above.