OpenSea’s NFT sales – Why April is seeing another low

- OpenSea NFT sales volume has dropped by over 40% since the beginning of April.

- Blur’s market share of NFT sales volume continues to spike.

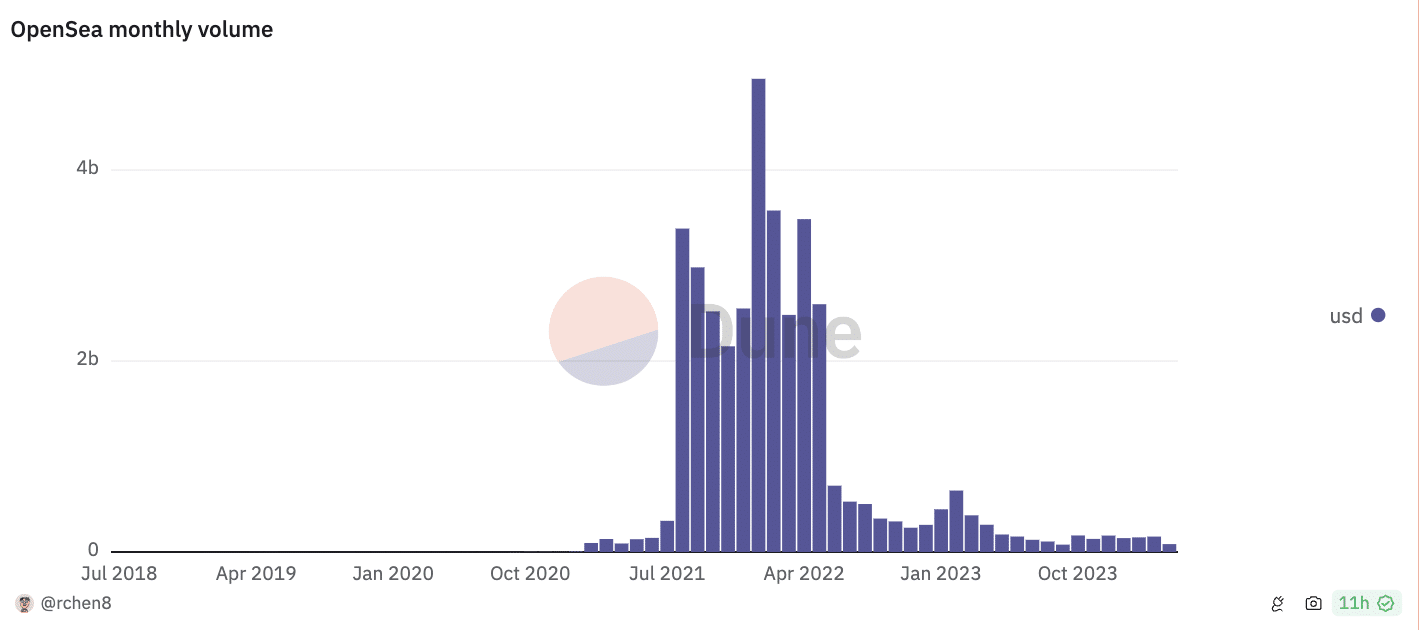

Leading non-fungible token (NFT) marketplace OpenSea is poised to close April with a record decline in monthly NFT sales volume.

According to data from a Dune Analytics dashboard prepared by Rchen8, this month, NFT sales on the marketplace have totaled $82 million, representing its lowest since September 2023.

Since the beginning of the year, monthly NFT sales activity on OpenSea has declined steadily. After witnessing a year-to-date (YTD) high of $153 million in monthly volume in February, OpenSea has since recorded a month-over-month decline in sales.

This fall is primarily attributable to the decline in user activity in the marketplace. So far this month, OpenSea’s active users have totaled 63,339. This marks a 22% fall from the 80,727 users who completed at least one transaction on the marketplace in March.

Assessed on a YTD basis, the number of monthly active users has fallen by 48%, according to the Dune Analytics dashboard.

Due to the fall in active user count on the marketplace in April, the monthly count of NFTs sold on OpenSea has plummeted to its lowest year-to-date.

In the last 25 days, 110,000 NFTs have been sold on Opensea, the lowest monthly number since June 2021.

With the low user activity and sales volume on OpenSea this month, the platform’s monthly fees derived from primary transactions and royalties have also declined.

In the last 25 days, primary transaction fees totaled $2.8 million, and those from royalties amounted to $1.9 million.

Blur takes lead

Despite having fewer users than OpenSea, NFT marketplace and aggregator Blur [BLUR] has continued to record a higher trading volume.

According to a Dune Analytics dashboard prepared by Hildoby, 79% of all NFT transactions completed in the last week alone were done on Blur. OpenSea trailed with a 21.3% market volume.

This occurred even though the count of OpenSea’s active users exceeded Blur’s by 24% during that period.

However, Blur’s traders could execute 56% of all NFT sales transactions, while OpenSea’s users could only account for 44.2% of all trades completed.