Shiba Inu burns 798M tokens – Is this next for SHIB’s price now?

- SHIB’s weekly burn supply jumped by nearly 4x.

- SHIB’s on-chain activity plunged, with less influx of new users.

More than 24 million Shiba Inu [SHIB] coins were kicked out of circulation in the last 24 hours, as the second-largest meme coin continued to see high burn activity.

SHIB burns, but price goes the other way

The burned supply exceeded the previous day’s figures by more than 90%, as per a recent X (formerly Twitter) update. A whopping 798 million tokens went up in smoke over the week, a nearly fourfold jump from the previous week.

Token burning has caught the eye of crypto enthusiasts, as most projects look to remove coins out of circulation for long-term value appreciation.

The removal creates a supply shock, which when matched by robust demand, could boost prices.

However, SHIB was clearly not the beneficiary lately, as the coin plummeted 20% over the week, according to CoinMarketCap. This signaled that demand for the asset was not very strong as of this writing.

SHIB sees sharp fall in network activity

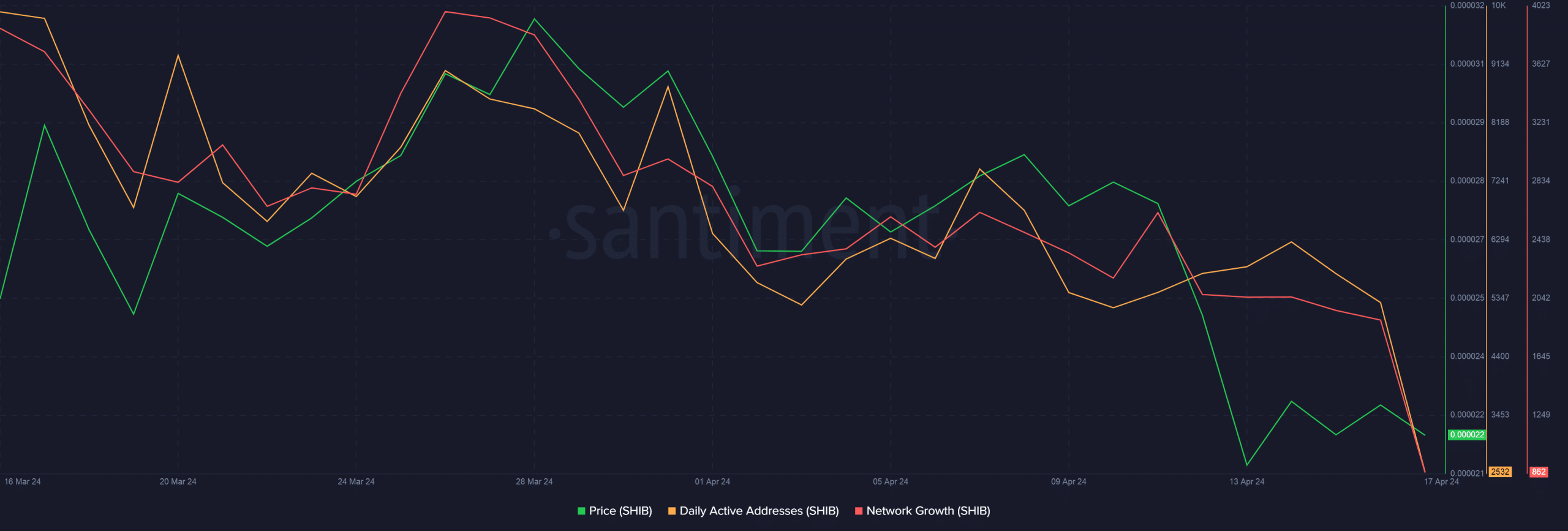

These deductions were supported by SHIB’s on-chain activity.

According to AMBCrypto’s examination of Santiment’s data, the daily count of unique addresses involved in SHIB transactions plunged more than 50% over the week.

Additionally, the rate at which new addresses were getting created slowed down considerably. Just about 862 new addresses were created on the 17th of April, less than half of the count seen a week ago.

The low rate of network growth meant that the coin wasn’t gaining enough traction.

SHIB in the derivatives markets

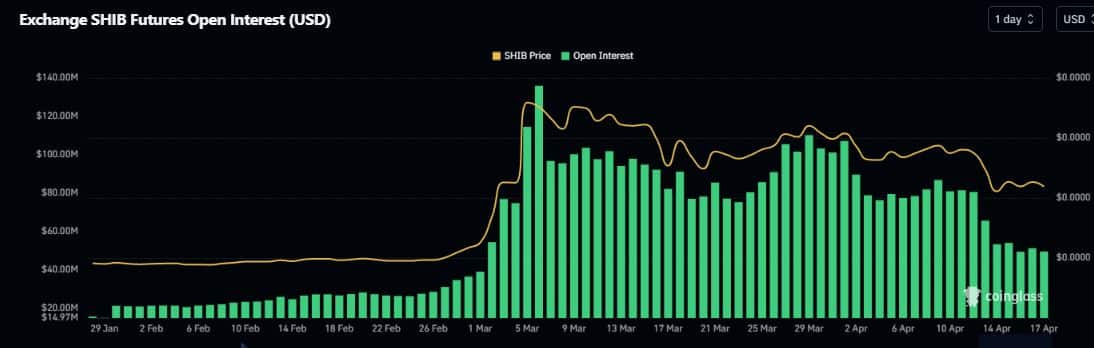

The price slump also dented speculative interest for the coin.

Read Shiba Inu’s [SHIB] Price Prediction 2024-25

The Open Interest (OI), or the money locked in outstanding SHIB futures contracts fell 38% over the week, and more than 55% since the month began, AMBCrypto noticed using Coinglass’ data.

That being said, most of the derivatives traders were bullishly positioned for SHIB, as the Longs/Shorts Ratio remained over 1 as of this writing.