Litecoin ‘beats’ Bitcoin – Here’s what it means for its $100 price target

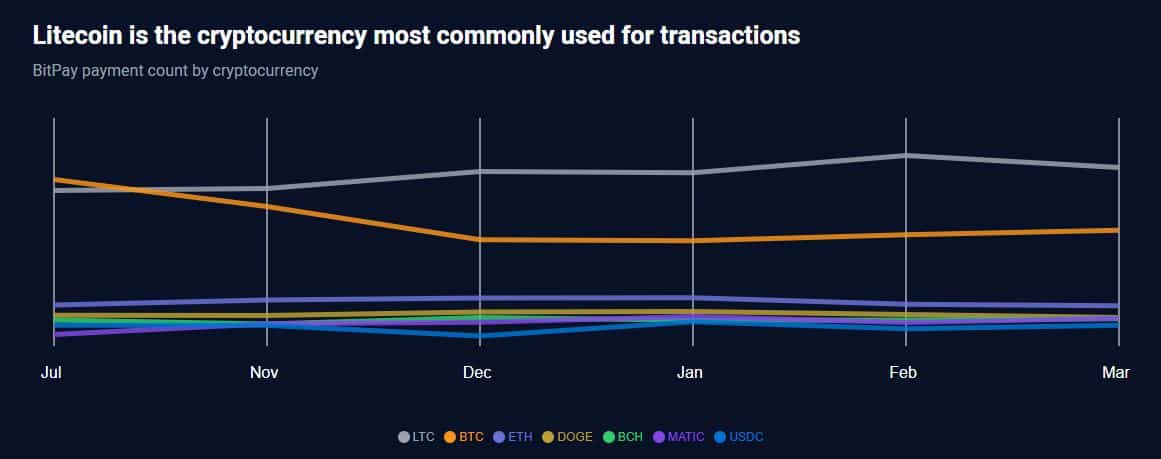

- LTC’s share of the global payments was 39% in March, followed by Bitcoin at 25%.

- LTC’s growth stagnated in the last month, causing a decline in its Open Interest.

Litecoin [LTC] remained the most-preferred cryptocurrency for payments in the month of March, outperforming all major assets, including Bitcoin [BTC].

Litecoin extends winning streak

As tracked by the world’s largest crypto payment service provider BitPay, LTC’s share of the global payments was 39% in March, marking a decline from 41% in February.

That being said, the digital silver has consistently ranked at the top of the charts, and March marked its third straight month of domination in 2024.

It was worth noting that LTC clocked more transactions than BTC and Ethereum [ETH] combined, both arguably being the two most recognizable cryptocurrencies in the world currently.

HODLing gains traction too

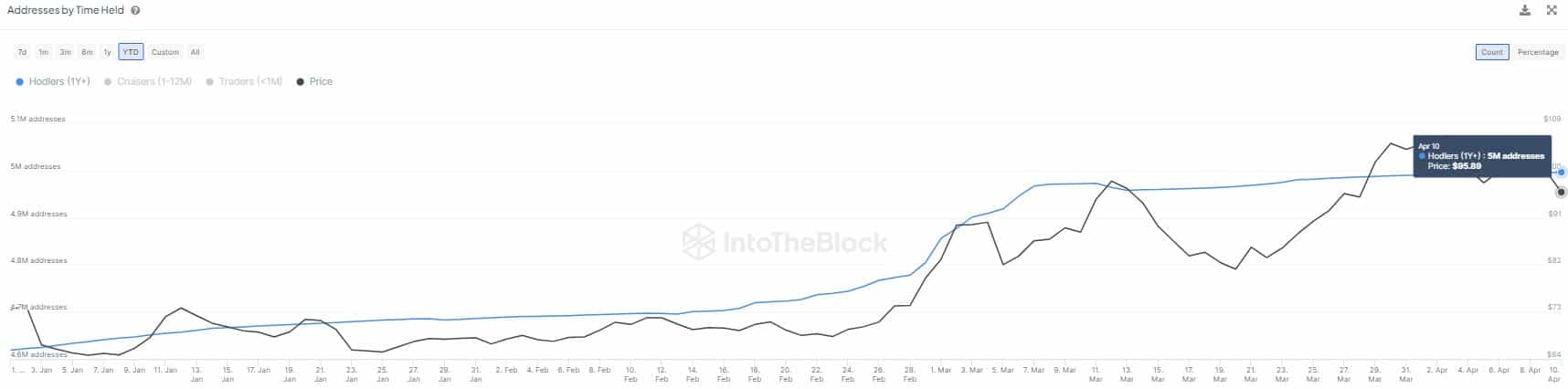

While LTC was gaining significance as a mode of payment, a different user cohort was trying to extract value by HODLing them for longer periods.

According to on-chain analytics firm IntoTheBlock, the number of long-term holders (LTH) of Litecoin surged above 5 million. The LTH here were users who have been in possession of the coin for a minimum period of 1 year.

Interestingly, the LTH cohort constituted more than 62% of all Litecoin addresses with a balance, suggesting a strong HODLing trend in the ecosystem.

LTC remains cold on the price charts

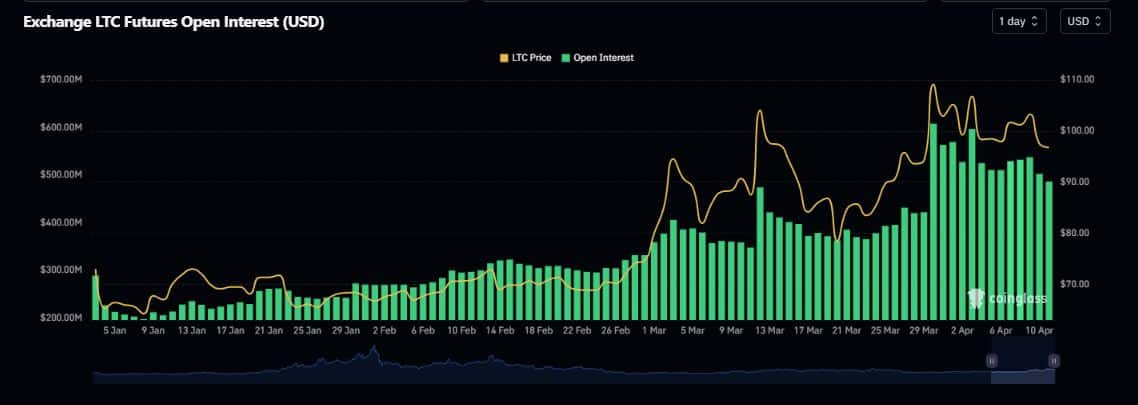

Well, one of the factors behind the long periods of HODLing could be low returns from the coin since initial acquisition. The cryptocurrency was currently trading at $97, 76% lower than its all-time high (ATH) of $412 in May 2021, according to CoinMarketCap.

In fact, LTC was trading cheaper than it had been in early 2022, encouraging holders to wait till the price recovers.

Is your portfolio green? Check out the LTC Profit Calculator

Over the last month, LTC has moved sideways, leaving very little for traders on either side to benefit from.

As a result, the money invested in speculative market dropped nearly 13% since the start of the month, according to AMBCrypto’s analysis of Coinglass’ data.