How Base’s 3M transactions can help it overtake Arbitrum, Optimism

- Base outperformed Arbitrum and Optimism on various aspects

- Memecoins played a huge role in Base’s popularity

Despite being relatively new to the Layer 2 (L2) sector, Base has outperformed other L2 chains in the crypto-market on several fronts. In fact, Base has kicked off the month in an absolutely fantastic manner, with daily transactions hitting new all-time highs and fees plummeting towards unprecedented lows.

New highs for Base

At press time, the network is processing over 3 million daily transactions – A remarkable milestone. Despite this surge in transaction volume, however, the average transaction fee, which includes priority transactions, fell significantly to just $0.13.

How did it fare against other L2s?

As far as the DeFi sector is concerned, the Base network has been performing relatively well. On 14 March, for instance, DEX (Decentralized Exchange) volumes on Base surpassed Optimism’s. A few weeks after that, DEX volumes on Base outperformed Arbitrum as well. Even though the dominance of Base was short-lived, it demonstrated how Base has been able to do so well in such a short time.

Owing to these factors, the revenue generated by Base soared. The daily revenue collected by the network grew from $135,000 to $405,000 over the last few weeks. Despite having a lower TVL (Total Value Locked) than Arbitrum, Base managed to do better in terms of collecting revenue than both Arbitrum and Optimism.

The significant revenue generated by Base, combined with the fact that it is being backed by Coinbase, can give the Layer 2 network a significant edge against its competitors.

Memecoin frenzy

One of the reasons for the heightened activity and revenue generated on Base has been memecoin activity on Base. Apart from the Solana ecosystem, the Base ecosystem has seen a massive uptick in the creation of memecoins too.

For example – Over the past month, the values of popular memecoins on the Base network have seen upticks ranging from 60.75% to 1776.36%. In fact, memecoins such as Brett and DEGEN have performed relatively well, compared to other memecoins in the space.

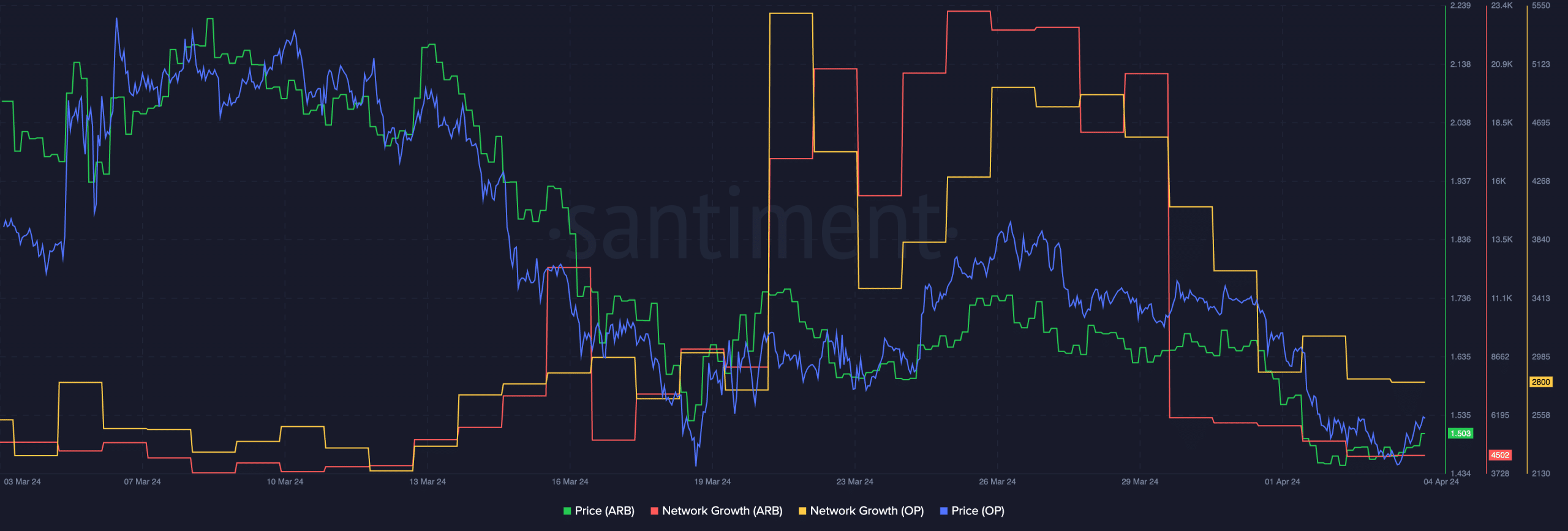

As far as ARB and OP are concerned, both tokens recorded a significant decline in terms of price. Moreover, network growth for these tokens also fell materially over the last few days.

This indicated that new users aren’t interested in these tokens. At least not in the short-term.

Realistic or not, here’s ARB’s market cap in BTC’s terms