Bitcoin whales shrink assets- Here’s what to expect from BTC in March

- Some Bitcoin whales have reduced the number of coins they hold.

- A CryptoQuant analyst says the BTC price could trend lower in the short term.

The number of addresses holding 1000 Bitcoin [BTC] has continued to decrease according to a recent update from Santiment. The on-chain analytics platform tweeted on the first day of March that these whales who were instrumental to the BTC price jump in January and February were now only 2,011 in number.

As revealed by Santiment, this number represents the lowest in about three years. Usually, massive whale accumulation results in price increases.

However, dumps by this same group put cryptocurrencies like BTC at risk of decline. So, will BTC eventually succumb to the pressure from these whales?

Is your portfolio green? Check out the Bitcoin Profit Calculator

Investors remained skeptical

Since the last week of February, BTC had not made a significant move in the upward direction. According to CoinMarketCap, the seven-day performance of the king coin was a 4.73% decline, bringing the 30-day trend to a neutral halt.

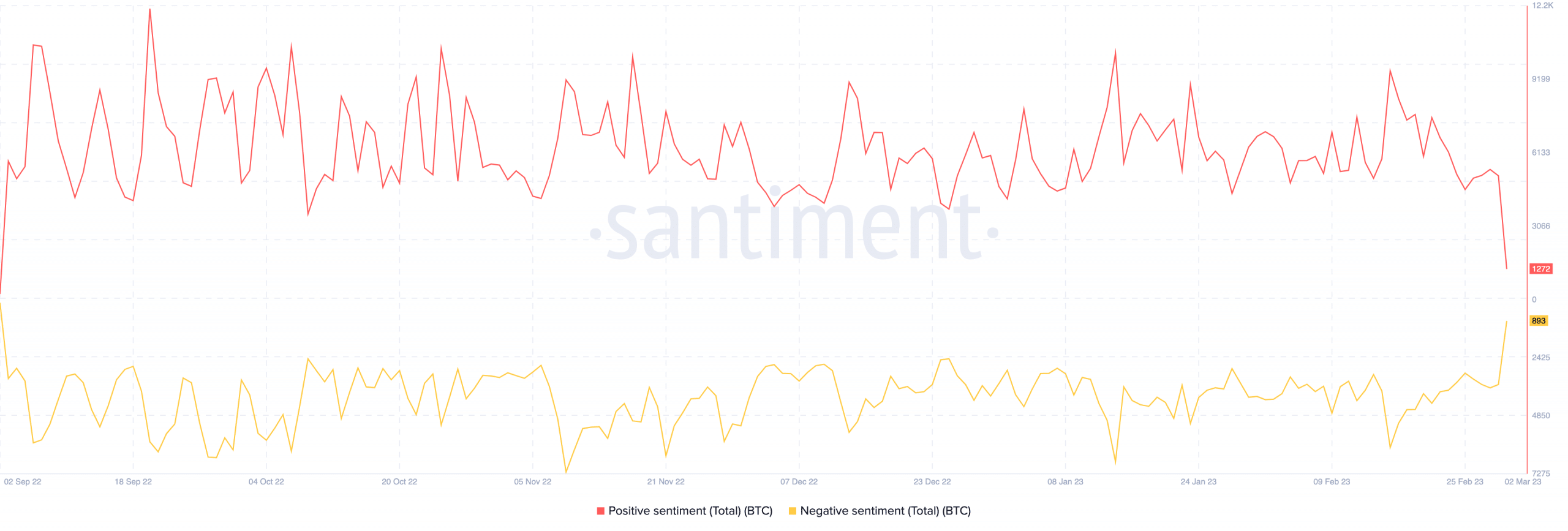

This decline means that BTC was already yielding to the impact of the top addresses’ exit. While the coin price still remained above $23,000, the viewpoint towards BTC was very utterly terrible. This was because the positive sentiment that hit a crest mid-last month, had decreased significantly. At press time, Santiment showed that the metric was 1245.

However, the negative sentiment painted a different scenario. At the time of writing, the metric had increased to 877. Interestingly, this has been the case since its opposite number was at this year’s highest.

Considering the trend, it implied that the wider market perception of a rally was massively truncated.

Regardless of the perception, CryptoQuant analyst Achraf Elghemri opined that BTC could trade around $22,000 sooner than expected. Highlighting suspicious movements on the charts, Elghemri mentioned:

“Technically forming portfolios on an aggregate scale despite a low price, but there is still a target of 22,241, but in general to maintain a bottom above the bottom and top of the top”

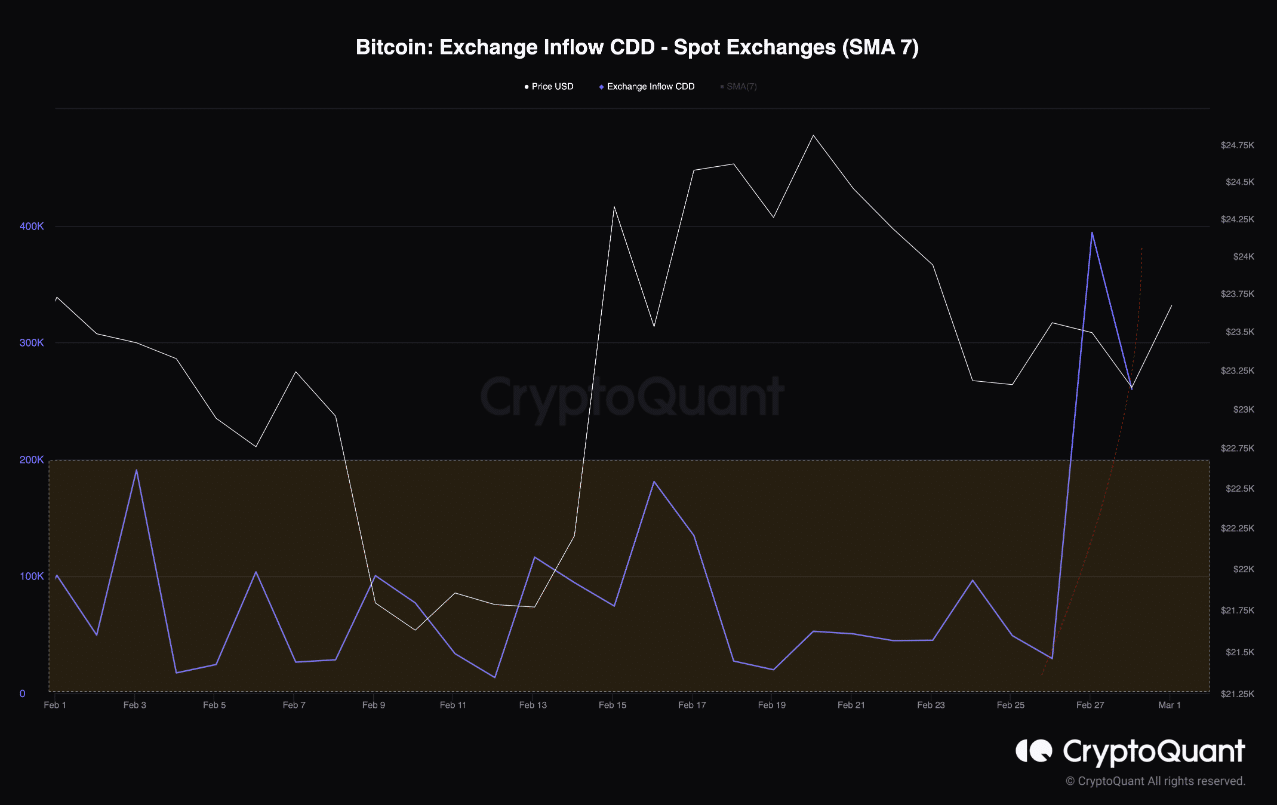

The analyst also referred to the Bitcoin deposits proportion and the exchange inflow Coin Days Destroyed (CDD). The CDD evaluated the number of coins that are not being spent. So, the increase in the image shown below meant that there was high volatility, a reversal risk, and possible selling pressure.

Realistic or not, here’s BTC’s market cap in ETH’s terms

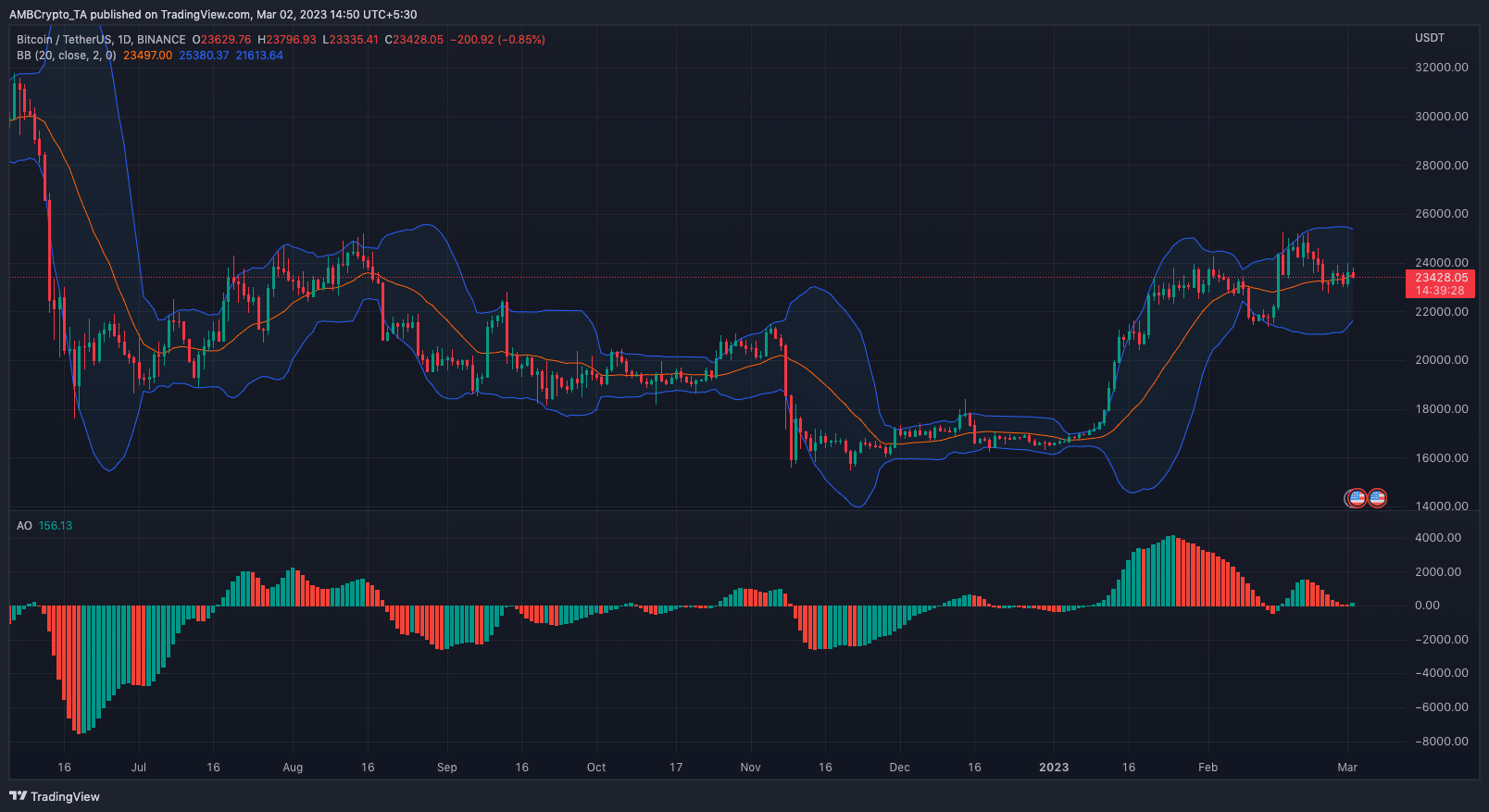

Furthermore, the technical outlook confirmed the analysis’ position because the Bollinger Bands (BB) indicated high volatility. However, BTC was in a more unbiased state since the price avoided touching any of the bands.

Regarding its momentum, the Awesome Oscillator (AO) indicated minute bullish traits. But a lot of the red bars above the midpoint bring a case to negate the bulls.